All Forum Posts by: Seth Wilcock

Seth Wilcock has started 27 posts and replied 134 times.

Post: Number 10 - 3rd Quad

Post: Number 10 - 3rd Quad

- Lender

- Nashville, IN

- Posts 138

- Votes 84

Investment Info:

Small multi-family (2-4 units) buy & hold investment.

Purchase price: $249,000

Cash invested: $69,065

Contributors:

Mike Ernest

10th deal overall, 3rd quad purchased as part of a package deal with the same seller. This one had a few issues to overcome, but thankfully the sellers worked with us on getting to the finish line. Should be a strong performing property long-term and helped scale my portfolio quickly through "The Stack".

What made you interested in investing in this type of deal?

Quads and multi-family seem to perform better than SFR's. There seems to be less competition in this space since most of these properties are only attractive to real estate investors and house hackers. I also wanted to scale the portfolio a little faster, and this property helped me increase my door county quickly through "the stack".

How did you find this deal and how did you negotiate it?

This property hit the MLS at the same time as 2 other quads that I closed on. Realtor.com sent me an email every day with opportunities, and this one really appealed to me. It was part of a package deal offered by the sellers, and the fact that we were willing to buy all 3 quads so they could complete a 1031 exchange was attractive to the sellers.

How did you finance this deal?

The deal was financed with a 25% down traditional Fannie Mae/Freddie mac conventional loan.

How did you add value to the deal?

This property had a few issues that needed to be dealt with prior to closing. There were four underground storage tanks at the property (my first time dealing with that issue) and the roof definitely needed to be replaced. We negotiated with the sellers to remediate the UST's and replace the roof before closing. This wasn't much of a "value add", but it will decrease Capital Expenditures after closing.

What was the outcome?

After a few delays for the roof replacement, UST remediation, and an appraisal delay, we successfully closed on this property to allow the seller to complete their 1031 exchange.

Lessons learned? Challenges?

The underground storage tanks was definitely a new one for me to address. I had no clue what these were, or how to handle. Apparently, these are pretty severe/major issues. I can honestly say I would have terminated the transaction if the seller had been unwilling to remediate this. The sellers had no knowledge of the UST's, which means they probably bought these homes as a cash deal sight unseen, and probably without an inspection. It was a very costly fix that could have easily been more.

Did you work with any real estate professionals (agents, lenders, etc.) that you'd recommend to others?

Mike Ernest with Team Endicott is a rock star. I also highly endorse Jonathan Hoover with Aegis Environmental if you need help in Indy for underground storage tank remediation and for all of your other environmental cleanup needs.

Post: Number 9 - Second Quad

Post: Number 9 - Second Quad

- Lender

- Nashville, IN

- Posts 138

- Votes 84

Investment Info:

Small multi-family (2-4 units) buy & hold investment.

Purchase price: $238,900

Cash invested: $90,875

Contributors:

Mike Ernest

Long-term buy & hold property. 2nd quad. Purchased as part of a package deal with 2 other quads. Turnkey purchase.

What made you interested in investing in this type of deal?

I've been looking at Quad's in Indy for some time. In reading Brandon Turner's books and watching his YouTube videos, I really started to hone in on "The Stack" as a tool to scale and grow my portfolio faster. This deal was part of a set of 2 other quads, and it helped me double my previous door count very quickly.

How did you find this deal and how did you negotiate it?

The quad happened to pop up in my email from realtor.com along with two other quads. It just hit me at the right time, and the fact that it came as part of a package with the same seller, helped to put this deal under contract because we offered on all 3 at the same time.

How did you finance this deal?

Traditional Fannie Mae/Freddie Mac financing. Straight purchase with conventional financing.

How did you add value to the deal?

No value was added. This was a turnkey purchase.

What was the outcome?

We closed on this property at the same time as another quad that is literally 25 feet away. Very smooth and successful closing with minimal issues.

Lessons learned? Challenges?

The biggest challenge on this transaction was the appraisal that came in low. We were under contract for $238,900 with a full appraisal gap. The appraisal came in at $205,000 which increased my cash to close. While it was unfortunate, it didn't really change our cash-on-cash return much. While it wasn't ideal to dump more cash into the property, it did improve our monthly cash flow a little bit with a lower PI payment on the loan.

Did you work with any real estate professionals (agents, lenders, etc.) that you'd recommend to others?

Yes. Mike Ernest with Team Endicott at Keller Williams. He has been an essential power partner for me in Indy, and has helped me scale my portfolio while being a powerful ally. He is a vital member of my core four.

Post: Number 8 - First Quad

Post: Number 8 - First Quad

- Lender

- Nashville, IN

- Posts 138

- Votes 84

Investment Info:

Small multi-family (2-4 units) buy & hold investment.

Purchase price: $238,900

Cash invested: $83,503

Contributors:

Mike Ernest

My first quad, and 8th investment purchase. Long-term buy and hold. Property needed minimal repairs and is located in an up and coming neighborhood that should see some healthy appreciation in the years ahead. Property was part of a package deal purchased with 2 other simultaneous quads. This was 1 of the 3. Property was fully occupied with tenants at the time of purchase.

What made you interested in investing in this type of deal?

I've been looking for a cash-flow positive quad in Indy for years. This one happened to come on the market and it caught my eye. It's in a good neighborhood and needed minimal repairs.

How did you find this deal and how did you negotiate it?

The property popped up in my email one morning. I believe I first saw it on Realtor.com. It was part of a package deal. The sellers had 2 other quads they were selling. We put this one under contract at the same time as the other two.

How did you finance this deal?

Traditional Fannie Mae/Freddie Mac financing. The appraisal came in low on this one, so we had to increase our down payment to bridge the appraisal gap. It worked out because even though the cash to close increased, the loan amount and PI payment decreased, which pretty much kept the same cash-on-cash return while improving monthly cash flow.

How did you add value to the deal?

Not much in value was really added on this. It was turnkey.

What was the outcome?

We closed on this property smoothly and seamlessly with the help of my Realtor and the sellers. Quick and painless transaction. Property is separately metered for utilities. We didn't even submit an inspection objection on this one because it was so clean.

Lessons learned? Challenges?

The sellers were utilizing a 1031 exchange to upgrade to a small commercial apartment building. Our offer was attractive to them because we bought it as part of a package deal, which helped them sell all 3 buildings at the same time so they could complete their 1031 exchange. I also learned that the appraiser didn't know how to value quads. It's tough to buy a duplex in this neighborhood for under $250K, and I just can't imagine the quad is worth $205K in it's current condition.

Did you work with any real estate professionals (agents, lenders, etc.) that you'd recommend to others?

Yes. Mike Ernest with Team Endicott at Keller Williams. He has been an essential power partner for me in Indy, and has helped me scale my portfolio while being a powerful ally. He is a vital member of my core four.

Post: Long Term Buy & Hold Duplex

Post: Long Term Buy & Hold Duplex

- Lender

- Nashville, IN

- Posts 138

- Votes 84

Investment Info:

Small multi-family (2-4 units) buy & hold investment.

Purchase price: $139,900

Cash invested: $32,188

Contributors:

Mike Ernest

Long-term buy and hold in an up an area of revitalization in Indy. 2-unit duplex.

What made you interested in investing in this type of deal?

The cash flow this property generated was one of the best I've seen. Since this was a turnkey property, it was an easy decision to add this one to my portfolio.

How did you find this deal and how did you negotiate it?

I found it on the MLS. I received a notification and once I dove into the numbers, it just made sense.

How did you finance this deal?

I funded this with a conventional Fannie/Freddie loan. I put 25% down.

How did you add value to the deal?

The property was tenant occupied at the time of purchase, and we negotiated a slew of repairs with the seller prior to closing. I'll be replacing the roof after closing to lower insurance costs and further improve cash flow. I will likely be replacing the A/C at some point as well.

What was the outcome?

We ended up closing on the property after about 3 months. There were a lot of repairs we asked the seller to fix prior to closing and it took some time to work through all of that.

Lessons learned? Challenges?

A big lesson learned was to be patient and to stick to your guns during negotiations. Never in my wildest dreams did we think the seller would agree to fix the laundry list of repair items we sent over, but they were amenable to do everything and wanted to close. The numbers have to make sense for you as an investor. If they don't work out, don't be afraid to speak up and walk away from the deal if that's what it takes.

Did you work with any real estate professionals (agents, lenders, etc.) that you'd recommend to others?

Yes. I worked with Mike Ernest at Team Endicott as my agent. I've worked with him several times over the years, and he's phenomenal. A great guy that I highly recommend. I also worked with my company Draper & Kramer Mortgage for the loan, and everything went off without a hitch.

Post: Where to Invest with $50K in cash?

Post: Where to Invest with $50K in cash?

- Lender

- Nashville, IN

- Posts 138

- Votes 84

@Amit Desai - I recommend looking into a long term rental in Indianapolis, IN. It's been a fantastic market for me. Very landlord friendly, low vacancy, lot's of population & job growth, good rent to price ratios, 20% avg appreciation rates on 2021 and projecting 20% again 2022. Let me know if you have any questions on the market/area.

Post: What would you do in this situation?

Post: What would you do in this situation?

- Lender

- Nashville, IN

- Posts 138

- Votes 84

Hi @Andrew Delgado,

There's certainly nothing wrong with buying in an appreciating market. In one of his recent YouTube videos/podcasts, David Greene stated that cash flow buys you time/freedom, but it's really the market appreciation that makes you wealthy. Since this would be a house hack scenario, I don't think there would be any problem with purchasing a multi-family in Colorado Springs. In fact, I think it would be a fantastic decision as you would be able to capitalize on future appreciation grains, and Co Springs is growing rapidly. You could do this while having a large portion of your housing expense paid by tenants in the other units. After enough time, you could move out of the MFH and rent out the final unit. During that time, rents are sure to go up as well, especially during inflationary periods like the current environment we are experiencing. Give it enough time, and you'll realize passive positive cash flow as well as appreciation. You could (at the same time) look at investing in markets out of state as well if you're chasing cash flow, but I would definitely give Colorado Springs a look from a house hack perspective.

Post: What would you do in this situation?

Post: What would you do in this situation?

- Lender

- Nashville, IN

- Posts 138

- Votes 84

Hi @Andrew Delgado,

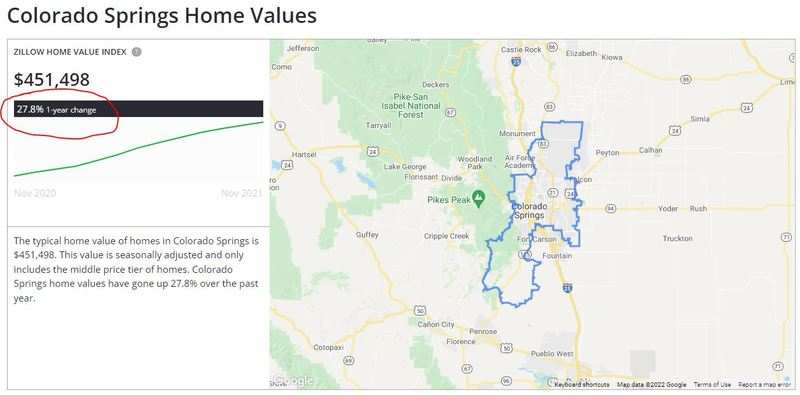

What's wrong with the Springs market? Colorado Springs has been appreciating and growing at a record pace for a few years now. Look at the snippet below for what happened in 2021. I would definitely consider house hacking in Colorado Springs, especially on multi-family. I'm curious to know what your concerns are before advising further.

Post: Deal With Foundation Issues

Post: Deal With Foundation Issues

- Lender

- Nashville, IN

- Posts 138

- Votes 84

Hi @Caleb Brown - I really appreciate your response. I know my description isn't much to go on. I'll see if I can obtain some photos/videos. The property is out of state and it's right before the holiday weekend so maybe I can get some more info by next week. I do have a GC in the market I could reach out to. Maybe he can swing by the property for me and give me a ballpark idea. I'll reach out to him and I appreciate the suggestion!

Post: Deal With Foundation Issues

Post: Deal With Foundation Issues

- Lender

- Nashville, IN

- Posts 138

- Votes 84

I'm looking at a potential BRRRR for a duplex in a fantastic area. It's priced right and there is some room to build in a repair budget.

My agent sent me the following broker remarks when he was taking a look at the property:

*** AS-IS SELLER TO DO NO REPAIRS! *** Inspection shows some settlement of foundation block in a couple areas and a split floor joist _ Still Sold AS-IS *** HIGHEST AND BEST OFFER DUE BY 5:00 P.M. FRIDAY 11/26/2021!!!

I've done some rehabs and a BRRRR before, but I've not had much experience with foundation repairs. I know they can be costly. Based on the description, can anyone give me an indication of the severity of these repairs and how much it might cost to fix?

Post: Colorado Springs Market Investing

Post: Colorado Springs Market Investing

- Lender

- Nashville, IN

- Posts 138

- Votes 84

Hi @Brock Fica,

I just found your post on the forums and wanted to chime in as I'm not sure what kind of guidance you've received yet. First and foremost, thank you for your service to our country!

I'm not sure if you've completed a loan application with a lender yet, but one of the things we look at with your pre-approval on a VA loan is your residual income (not just your debt-to-income ratio). Essentially, after paying the mortgage payment, all of your consumer debt payments, maintenance on the home, state/federal taxes, etc. we want to see how much money you have leftover each month to pay for living expenses. If it's just you in the home, you'll need at least $491 leftover after all these expenses. Don't worry, you don't need to know how to calculate all of this, but the point of this is to show you that VA has a different way of calculating your income than other types of financing options.

It sounds like you're active duty? If that's the case, we can use your BAH pay on your LES in addition to your regular pay to help you qualify. Again, you would need to submit a loan application to see how much you can qualify for based on the VA residual income calculation.

One area where I see a lot of first time home buyers get stuck, is they want to buy their "forever home" on their first home purchase. In real estate, it doesn't always work this way. You should see your first home acquisition as a stepping stone towards creating long-term wealth, and eventually moving up in price as time goes on. With homes appreciating at an average rate of 8%-10% over the past decade in Colorado Springs, a $200,000 home today will be worth about $220,000 this time next year. After about 3 years, that same house would be worth around $260K. Assuming you took out a $200K loan when you bought, that same loan would be paid down to around $187K leaving you with about $79K in equity after about 3 years. After you pay closing costs from a sale, you would net around $60K which could be used to fund a down payment on the next house, or to even tackle some consumer debts and improve your cash-flow position. You should view the home purchase today as a place to start building equity towards a future acquisition down the line.

The best time to buy a house was 10 years ago, but the next best time to buy is right now. The sooner you get started in real estate, the sooner you can start building wealth for your future.