All Forum Posts by: Amit M.

Amit M. has started 18 posts and replied 1537 times.

Post: House Hack - House with unpermitted rooms but cash flows well

Post: House Hack - House with unpermitted rooms but cash flows well

- Rental Property Investor

- San Francisco, CA

- Posts 1,589

- Votes 1,631

I agree with Brian. In the marketplace you’ll usually see 2/1’s being illegally changed to 3/2s, which still has risk, but at least is a more common occurrence. But taking a 2/1 and adding 8 illegal bedrooms and 6 illegal baths!?! That’s seriously No Bueño!

That could lead to ALOT of trouble. It’s a serious habitability and fire hazard (google Oakland ghost ship). city could easily construe this as an illegal attempt to make a boarding home, etc. which can definitely lead to big fines, and having to dismantle everything.

I’d run away!

Post: Purchase A Home in CA or Invest Out-of-State?!

Post: Purchase A Home in CA or Invest Out-of-State?!

- Rental Property Investor

- San Francisco, CA

- Posts 1,589

- Votes 1,631

Post: Remodel Bathroom in a Rental - Preventing Mold and Water Damage

Post: Remodel Bathroom in a Rental - Preventing Mold and Water Damage

- Rental Property Investor

- San Francisco, CA

- Posts 1,589

- Votes 1,631

^ nailed it...no pun intended

Post: Purchase A Home in CA or Invest Out-of-State?!

Post: Purchase A Home in CA or Invest Out-of-State?!

- Rental Property Investor

- San Francisco, CA

- Posts 1,589

- Votes 1,631

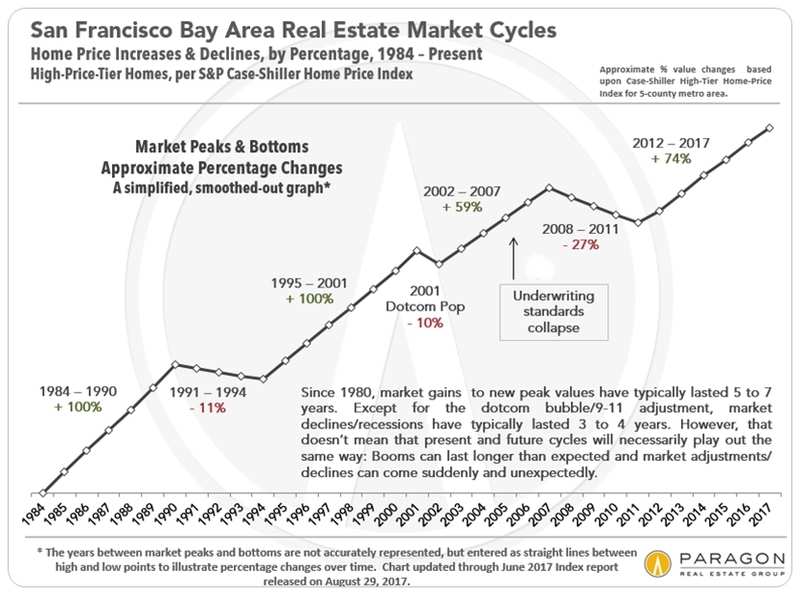

Amit: 3words/1chart

Carlos: thousand words/7posts

Same conclusion 😅😂🤣

Post: Purchase A Home in CA or Invest Out-of-State?!

Post: Purchase A Home in CA or Invest Out-of-State?!

- Rental Property Investor

- San Francisco, CA

- Posts 1,589

- Votes 1,631

Post: Markets with Most Appreciation

Post: Markets with Most Appreciation

- Rental Property Investor

- San Francisco, CA

- Posts 1,589

- Votes 1,631

Post: Where to put my 1031 exchange money. What would you do?

Post: Where to put my 1031 exchange money. What would you do?

- Rental Property Investor

- San Francisco, CA

- Posts 1,589

- Votes 1,631

At this point (since you already sold/triggered your 45 day ID window) STNL NNN is probably your easiest and safest option. Do you have a reputable broker working for you to review deals?

Joel Owens is a NNN broker who frequently posts here, who may be a good contact for you.

Post: 3 trillion dollar printed in 2020 so far - effect on house price

Post: 3 trillion dollar printed in 2020 so far - effect on house price

- Rental Property Investor

- San Francisco, CA

- Posts 1,589

- Votes 1,631

@David Song It’s hard to predict the sequence of events because every economic cycle is different. But I think that high inflation will tend to effect real estate in a positive way more towards the end rather than the start of that phase. I think interest rates going up can happen quickly (set by the Fed), and that will have an immediate downward effect on RE values. It will take more time for inflation to effect everything else like increased salaries, higher consumer goods prices, higher rents, etc.

As for being bullish on Bay Area RE now, I think it highly depends on the property type and location, though I personally am not as optimistic as you (but that’s what makes the world go round :) At least for San Francisco and possibly other prime core Bay Area towns, I think multi family will be challenged as rents have dropped and it will be several years before we reach 2015-2019 rent levels. And office and retail have a lot of challenges. Maybe bold moves (i.e. property repositioning) with a 5-7 year time horizon, if you bet well, will be big winners.

I know outlying areas have done well with SFH price increases, but as core Bay Area softens more people will look again to staying central. So I don't think places like Sacramento, Tracy, etc. will have a long unimpeded runway as pricing naturally balances out.

I agree that increased stimulus spending, and large capital projects the Biden administration hopes to roll out will drive inflation rates higher at some point. And I think good RE locations with good long term financing will likely get an accentuated appreciation lift. So with Biden in, I’m biding (sic) my time and waiting for some iteration of that ;)

Post: 3 trillion dollar printed in 2020 so far - effect on house price

Post: 3 trillion dollar printed in 2020 so far - effect on house price

- Rental Property Investor

- San Francisco, CA

- Posts 1,589

- Votes 1,631

@David Song I think the primary effects of inflation on housing have two opposing forces: 1- higher interest rates put downward pressure on values. 2- but eventually inflation effects everything like salaries and rents, so then the asset values inflate along as well. It’s not really predictable the sequence and timing of events, so as usual, the best scenario is to be able to hold assets through these unpredictable iterations, because eventually the effects of elevated inflation will lead to higher real asset values.

Post: Investment property in San Francisco

Post: Investment property in San Francisco

- Rental Property Investor

- San Francisco, CA

- Posts 1,589

- Votes 1,631

think

value

add

———-

3words