All Forum Posts by: Shawn-Karisa Shaffer

Shawn-Karisa Shaffer has started 3 posts and replied 10 times.

Post: 100 Rentals, Success Or Fraud?

Post: 100 Rentals, Success Or Fraud?

- Colorado Springs, CO

- Posts 10

- Votes 3

It's interesting how your story's focus is the "why" you invested, yet many of the comments ask you about the "how". My comment to the "why" you invested, and the "reason" you wrote this article is..."well said friend."

Post: New member with 20k capital looking to invest out of state

Post: New member with 20k capital looking to invest out of state

- Colorado Springs, CO

- Posts 10

- Votes 3

@Vuthy Seang

I have a possible deal you could team up with us on. PM me if you want to hear more.

Post: Is my property commercial or residential?

Post: Is my property commercial or residential?

- Colorado Springs, CO

- Posts 10

- Votes 3

Post: Is my property commercial or residential?

Post: Is my property commercial or residential?

- Colorado Springs, CO

- Posts 10

- Votes 3

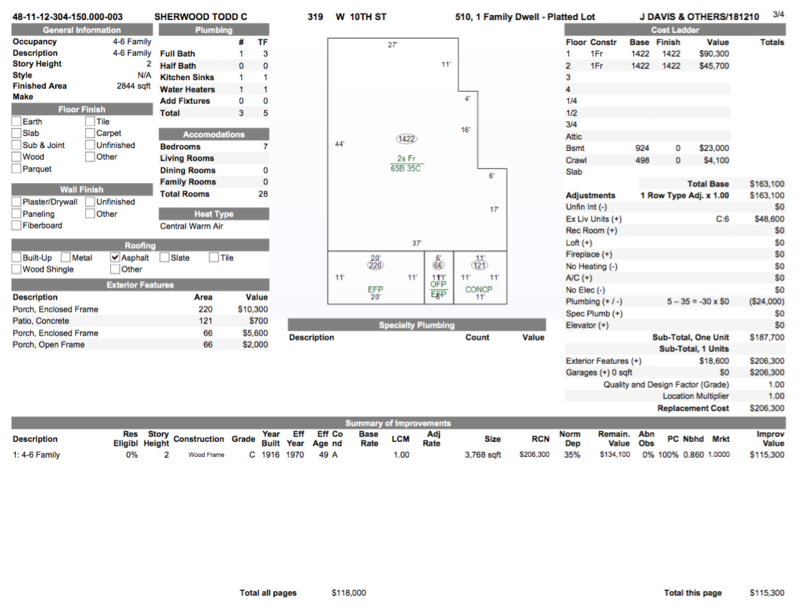

I partnered on a deal we found outside of Indianapolis. It's a small 6 unit apartment building with 1 bed 1 bath units, just down the road from a university. It needs a tremendous amount of work. We paid $30k for it, probably going to take $100k to put it back into shape. But then it'll bring in $3000 in gross rents per month ($300 is conservative, probably more like $3500). So if we're in it for $130k, heck, even $150k, I think it'll be a good deal, but I have a dilemma. The local county assessor classifies it as SFR, not commercial. The property card states the zoning is SFR, but then also labels it 4-6 units on the second page. Currently, the building is even sub metered for 6 units. And the local building official called it commercial.

I think we can secure some rehab financing, but we'd like to do a long term commercial loan once we have it repaired and rented. I know in the lending world, they want 5 or more units to be considered for a commercial loan, but what do they do in this case? Does FHA/ HUD determine the number is 5? If we have the zoning changed or updated to the correct zoning, will we fall in that commercial classification?

Any ideas or thoughts? Who determines whether the property is commercial or residential? The local building authority? Or does FHA? Or?

Post: 25 Years old with 44 units (187 bedrooms)....... Here's my story

Post: 25 Years old with 44 units (187 bedrooms)....... Here's my story

- Colorado Springs, CO

- Posts 10

- Votes 3

Aggressive...I like that.

Post: Short sale/ DIL/ Foreclosure

Post: Short sale/ DIL/ Foreclosure

- Colorado Springs, CO

- Posts 10

- Votes 3

I still own my first home, that I bought in 2007 with my first wife, just before the bubble burst. It's now an out of state rental property. It's about $300 per month in negative cash flow (split 50/50 with ex wife, $150 a piece). I don't think I can increase rent enough to break even. I owe 205k, it's worth between $135-$165k, depending on who you talk to. In my opinion, if I put another $5k into it, I might be able to sell it for $165-175k.

Kicker is this: all payments are up to date. It's owned with my ex-wife (both of us wanted to keep our credit), so we kept paying. I would have let it go to foreclosure about 3-4 years ago, but she did not want the credit hit.

Now that I am trying to expand my RE business, it really puts a damper on my ability to get new loans for properties from most lenders, because they apply the whole debt of this house to my name. Everyone I talk to whether bank/broker/portfolio lenders, they all cringe at this property's numbers.

Any ideas on how to get rid of it?

Thanks in advance...

Shawn

Post: New Personal Best on Buy, Full Rehab, Sell- 3 months 1 week

Post: New Personal Best on Buy, Full Rehab, Sell- 3 months 1 week

- Colorado Springs, CO

- Posts 10

- Votes 3

That a boy!

Post: Can your Tax Return limit your borrowing power?

Post: Can your Tax Return limit your borrowing power?

- Colorado Springs, CO

- Posts 10

- Votes 3

BTW, thanks for the info!

Post: Can your Tax Return limit your borrowing power?

Post: Can your Tax Return limit your borrowing power?

- Colorado Springs, CO

- Posts 10

- Votes 3

@Mark F

@Travis Sperr

I have filled out another application with a different lender. I'll see what they say, and if they give me the same results, I guess I'll have to amend my return --pay Uncle Sam more, and try again.

You lenders out there...are you looking for taxable income that has increased from the prior year? Or just "profits" instead of "losses" on paper?

Post: Can your Tax Return limit your borrowing power?

Post: Can your Tax Return limit your borrowing power?

- Colorado Springs, CO

- Posts 10

- Votes 3

Hey BP community...

I'm fairly new to the site, but been part-time investing for a few years. I have always done my taxes on my own (via TurboTax), and never seemed to be a problem. I admit I am not an accountant, but I was a finance major and keep good records of expenses, etc. As my deals have increased, and my time has decreased, I'm feeling the urge to hand this task over to a CPA.

Of course, I completed 2014 on my own just like normal. But I think I have run into a snag...and the reason for this post. The last two years I have been able to show losses on my RE deals (flips/rentals), but yesterday I started questioning my tax entries when I went to refinance my 2nd rental (that I have free and clear), and the broker told me that because my returns show losses from my real estate, they would not be able to fund a loan. Basically my taxable income had dropped from the prior year, and though they knew I would be able to make the mortgage payments, they weren't able to lend to me.

Granted, I'd never used him before, but it made me question myself and my tax abilities. I'd like to cash-out refi on my rental, to buy another, but I need to secure a mortgage for the additional cash. Do I need to amend my return? Or just check with another lender?

Thanks in advance!

Shawn