All Forum Posts by: Stephanie Medellin

Stephanie Medellin has started 18 posts and replied 1149 times.

Post: Refinancing out of a 30 year fix hard money loan

Post: Refinancing out of a 30 year fix hard money loan

- Mortgage Broker

- California

- Posts 1,176

- Votes 628

@Oscar Hernandez If you're using hard money to purchase the property, not only due to the condition of the property but also because you've found you can't qualify for a conventional loan, you will have the same qualification issues when you try to refinance. The income / asset / credit requirements are going to be the same.

There are investor loan programs that don't require tax returns or pay stubs, but they typically have minimum loan amounts and credit requirements. You will also need enough equity in the property. I would recommend making sure you can qualify for one of these loans before getting into a hard money loan. What state are you buying in?

Post: DSCR loan work for STR?

Post: DSCR loan work for STR?

- Mortgage Broker

- California

- Posts 1,176

- Votes 628

@Chris K. Yes, but rents will still only be based on market rent, not short term rental rates. There are programs that will allow DSCR < 1 (when rental income does not cover the monthly payment).

Post: New Fannie Rules for SFH investment Help

Post: New Fannie Rules for SFH investment Help

- Mortgage Broker

- California

- Posts 1,176

- Votes 628

It sounds like your lender added their own requirements. Conventional down payment requirements have not changed, but investment property loans have gotten more expensive. You should still be able to find 20 - 25% down to purchase another.

Post: Looking for small loan

Post: Looking for small loan

- Mortgage Broker

- California

- Posts 1,176

- Votes 628

@Melissa McConnell You may want to try posting this in the marketplace.

Post: First Time Investor: Owner Financing

Post: First Time Investor: Owner Financing

- Mortgage Broker

- California

- Posts 1,176

- Votes 628

@Matt Duckworth I agree with @Brent Coombs - are you sure you're paying a fair market value for the home? Just because the seller (as your lender) is not requiring an appraisal, you can always choose to pay for your own appraisal. You don't have to, of course, if you know it's a great deal, but you do have the option to include an appraisal contingency in your contract as extra protection.

Post: Lender vs Lender, what do I do?

Post: Lender vs Lender, what do I do?

- Mortgage Broker

- California

- Posts 1,176

- Votes 628

@Ryan Copeland You can always ask your current lender how much it would cost to buy down your rate, even if you're already locked. You will get the pricing from the day you locked, but you do have the option to choose a higher or lower interest rate.

Quicken does have a reputation for quoting low rates with high points, so you always want to find out the real cost behind the rate being offered.

Post: Residential Lot Loan

Post: Residential Lot Loan

- Mortgage Broker

- California

- Posts 1,176

- Votes 628

@Matthew Tyson Are you looking for a construction loan?

Post: Hitting walls. Any suggestions on financing 25 unit + rehab

Post: Hitting walls. Any suggestions on financing 25 unit + rehab

- Mortgage Broker

- California

- Posts 1,176

- Votes 628

@Russell Beach That sounds like it could be a headache. I came across a loan program yesterday that will finance 50% with a 50% seller carryback. Hard money, very high rates, but essentially no down payment from the buyer needed, leaving your funds for the rehab.

Post: My lender didn’t rate lock on time and rates went up

Post: My lender didn’t rate lock on time and rates went up

- Mortgage Broker

- California

- Posts 1,176

- Votes 628

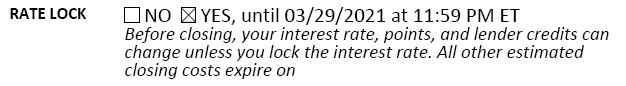

@Evelina Khaimova When you receive a loan estimate, in the top right corner it will indicate whether the interest rate is locked, and if locked, the date when the lock will expire. The lender has 3 days to send you an updated loan estimate after locking your rate. If you have not received an updated loan estimate, you can assume your rate has not been locked.

Post: Lender pulled plug on conventional refis for rentals as of monday

Post: Lender pulled plug on conventional refis for rentals as of monday

- Mortgage Broker

- California

- Posts 1,176

- Votes 628

@Michael H. Lenders are slightly more limited in how many investment property loans they can offer. Some are just raising rates on these, rather than eliminating the loans entirely, so it's definitely still possible. If you already own the property though, most lenders will want a lease in place rather than 75% of the market rent.