All Forum Posts by: Anthony Angotti

Anthony Angotti has started 64 posts and replied 1482 times.

Post: Should we flip it ourselves or sell for cash?

Post: Should we flip it ourselves or sell for cash?

- Real Estate Agent

- Pittsburgh, PA

- Posts 1,538

- Votes 845

Originally posted by @Brendan August:

My dad owns a home in Pittsburgh that is too big for just him and needs a lot of work (roof, water heater, HVAC). He has spoken with a local investor that wants to purchase the property from him for 100k. My dad owes about 30k on it so he would walk away with about 70k and not have to deal with the stress and hassle of hiring contractors to fix the place up himself.

The homes on the street have been selling for 225k - 245k. The exact home next door just sold for 225k all fixed up (without central air)

I'm trying to convince my dad to fix up the property himself with the help of my uncle and with about 20k that I could invest.

The house needs at least 50-70k to get it retail ready and probably 30-40k to get it rental ready.

Ideally my dad would keep it as a rental property. However he does not have the extra money to cover any additional repairs. Would it make sense for him to take out a HELOC on the home to cover the rest of the renovations and then use the BRRRR strategy (minus the B) to pay off the HELOC, pay me back and use as a down payment on another property?

Or should my dad, my uncle and I work out a partnership to just flip the property and sell it retail. We are having a tough time figuring out the terms of this one though. My dad brings the house and money from the HELOC, my uncle does the work and I bring 20k - not sure how we go about splitting the profits?

Sorry for the long post but any advice would be great - even if it is just to sell it the investor for a 70k profit.

Thanks!

Flip and sell and then invest the profits in a higher cash flow type building.

If you only stand to make 70-90k on it as a flip then it makes sense to sell to the investor, however keep in mind if they are offering you that much then there's still a good bit of meat on the bone for them, meaning there is basically a whole steak for you most likely

Post: Newbie from San Francisco, California

Post: Newbie from San Francisco, California

- Real Estate Agent

- Pittsburgh, PA

- Posts 1,538

- Votes 845

Originally posted by @Evan Chen:

Hey all,

My name is Evan. I'm 28 and I live in San Francisco, California. I've been a Bay Area resident for most of my life.

I'm a Software Engineer and recently have been interested in Real Estate Investing. I just finished Buy, Rehab, Rent, Refinance, Repeat and started reading Long-Distance Real Estate Investing.

I'm looking to invest out of state for cash flow since home prices around the Bay Area are expensive. I've been looking into West markets like Arizona and Nevada since they're close to me and the Mid-West/South markets since I've heard that they're great for cash flow but have been having trouble figuring out which city I'd like to start in.

I look forward to talking to ya'll soon.

Thanks!

Welcome to the community! I have a lot of out of state customers from the bay area that invest in Pittsburgh, but as you mentioned there are a number of areas that may work for you.

Most important step is to build a team. The Long Distance Real Estate Investing Book has some great topics that detail just how to do that.

Best of luck!

Post: New investors in the house!

Post: New investors in the house!

- Real Estate Agent

- Pittsburgh, PA

- Posts 1,538

- Votes 845

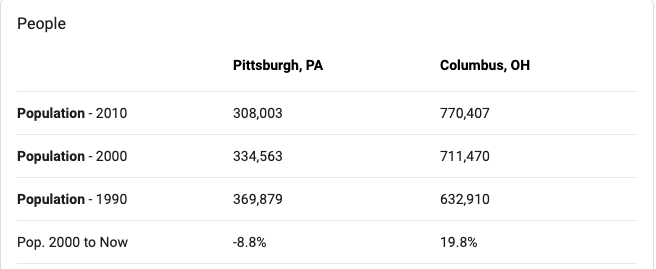

I know the population trend in my own market yes.

However the demographics of job type are changing as evidenced by the growth in per capita income. Population trend isn't the only factor involved in picking a market. . . .

Additionally investing in your own backyard is much easier to have higher return than investing remotely. Which is why I mentioned anything in the first place.

Post: New investors in the house!

Post: New investors in the house!

- Real Estate Agent

- Pittsburgh, PA

- Posts 1,538

- Votes 845

Originally posted by @Alex Ciuca:

Hey everyone,

Want to reach out to the BP community and introduce myself and my wife who are eager to get started investing in SFHs and Multi-Unit rental properties. We are located in Pittsburgh, and while we are interested in our local market (if the right deals come up), we are more interested in out-of-state investing; namely Columbus, OH or similar. Our goal is to build long-term wealth through equity while maintaining positive cash-flow through our properties. (Yes, we realize that is "well, duh, who doesn't?" statement.)

We are trying to do this the right way from the ground up and want to make the right connections before we move forward with our first purchase.

We welcome any constructive feedback, pointers, advice, etc.. on getting started. Love the content on BP, it's been a huge help in gathering knowledge from so many POVs.

Thanks!

Hey Alex,

Just curious, Pittsburgh is a good market to invest in. Why look in Columbus at all to get started?

Post: First BRRRR deal in Pittsburgh

Post: First BRRRR deal in Pittsburgh

- Real Estate Agent

- Pittsburgh, PA

- Posts 1,538

- Votes 845

Originally posted by @Camden Kelly:

Investment Info:

Single-family residence buy & hold investment.

Purchase price: $53,000

Cash invested: $36,000

This was my first experience with BRRRR. I secured a line of credit against my primary residence for $85,000. I took the full amount out and purchased a single family home for $53,000 and rehabbed the whole thing top to bottom. This included, plumbing, electrical, a retaining wall, HVAC, flooring, kitchen, bathroom, paint, fixtures, ETC. My total invest in the property, including holding costs, is just north of $88,000. The house recently appraised for $140,000.

What made you interested in investing in this type of deal?

The numbers made sense. I had looked at and analyzed over 50 deals. This one fell into my lap (the seller had reached out to me). I was able to get the property at a premium do to the scope of work (80% of which I could do myself).

How did you find this deal and how did you negotiate it?

My father-in-law is a contractor. He was working on the house across the street when the seller approached him and asked if he wanted to take a look. He called me to let me know it could be a pretty quick turn around (2 months).

How did you finance this deal?

HELOC

How did you add value to the deal?

I updated everything in the house. Although I ended up spending a little more than I had originally wanted to, I feel that the extra money spent allowed me to ask for a little more in rent.

What was the outcome?

Felt like a fairly successful BRRRR. I didn't have to leave any money in the deal and I now have the capital to inject into the next deal.

Lessons learned? Challenges?

Finding the right tenant is a process. We had 75 applications come in when we posted the property. It took an extensive amount of time showing the property, vetting potential tenants, and drafting the lease (thank you BP for the PA lease package!).

Did you work with any real estate professionals (agents, lenders, etc.) that you'd recommend to others?

Anjelica Kopsahilis. Would highly recommend her to anyone who is getting started.

Congrats on the deal! Doing all the work yourself probably taught you a lot that will help you in the future when dealing with contractors yourself

Post: Are remote property inspections a thing?

Post: Are remote property inspections a thing?

- Real Estate Agent

- Pittsburgh, PA

- Posts 1,538

- Votes 845

Originally posted by @Dugan O'Donnell:

Question for you all. If I want to keep an eye on my property can I ask the tenants to send through pictures? Can I also ask them to check fire alarms? Rather than visiting the property myself. Thanks for the help.

You can, but I don't think this will be an effective strategy. Someone should be doing at least a yearly inspection on your places, and it should really be more often than that (twice per year is what I do)

Post: Starting Rental Investing Pittsburgh

Post: Starting Rental Investing Pittsburgh

- Real Estate Agent

- Pittsburgh, PA

- Posts 1,538

- Votes 845

Originally posted by @Ken George:

The only issue is where does it stop? Pittsburgh was known for its areas of separation. Now that it's expanding so fast will there be a crash when it's not affordable anymore? I believe that will happen eventually especially with so many investors and REIT's entering the market. Prices are so high they are unaffordable and the rentals are going to be pure speculation soon. I think we will see a boom on the outskirts of town in the next few years since downtown will be too expensive.

The prices are not unaffordable right now.

The Median Sale Price in 2019 was $177,500

The Median Sale Price in 2020 so far is $195,500

Median household income for Pittsburgh Metro was reported as roughly $63,000. A couple with modest debt and goodcredit can still pretty easily get approved for well above a $200,000 sale price.

Furthermore rents still have some upward mobility as well since the average price of rent is $1,250 per month and to afford that you need to make $3,750 per month and that's below the median household income ($5,250/mo).

It's common for people that have lived in Pittsburgh for a long time to say that prices are getting too high and unaffordable and a local crash is coming, that may happen, but it won't be because housing is unaffordable. It will be because external pressure (interest rates, job loss, etc.) reduced people's ability to afford homes compared to today. Or prices exceed the affordability of the average person.

Post: Starting Rental Investing Pittsburgh

Post: Starting Rental Investing Pittsburgh

- Real Estate Agent

- Pittsburgh, PA

- Posts 1,538

- Votes 845

Originally posted by @Keelee Moseley:

@Andrew J Betzold Hi what's spreadsheet magic?

Basically that when you plug the numbers into a spreadsheet they look like the property will perform great! However when you invest in D/C class neighborhoods a lot of factors can make the building perform a lot worse than anticipated if you don't manage the property properly or if you have not accounted for expenses properly.

Post: Switching to Electric from Gas

Post: Switching to Electric from Gas

- Real Estate Agent

- Pittsburgh, PA

- Posts 1,538

- Votes 845

Originally posted by @Nicholas Pelletier:

Hey Everyone question, renovating property in NH and we have the option on switching from gas to electric and was curious if this would be a smart move?

Thank you

What is being switched. Assume your moving the heat of the building.

Electric can be more expensive, but it depends what kind of unit you install. It may be less maintenance.

Post: HELOC needed- I'll appreciate any help!

Post: HELOC needed- I'll appreciate any help!

- Real Estate Agent

- Pittsburgh, PA

- Posts 1,538

- Votes 845

Originally posted by @Shai Flax:

HI BP!

I'm OOC REI and since I don't have a credit score yet it's really difficult for me to get any loan that is not from HML.

Does anyone has an experiance with getting an HELOC without any credit on their exiting properties (bought in cash). I'm investing in Pittsburgh PA.

Any lead will be appreciated. Thanks!

You're going to have a hard time getting a HELOC on a rental property in general, and then to get it on a property if you have no credit and are Out of Country.

You may just need to find someone that will do a cash out refi with you. Which will also be challenging, but probably more likely than a line of credit in this scenario.