Buying & Selling Real Estate

Market News & Data

General Info

Real Estate Strategies

Landlording & Rental Properties

Real Estate Professionals

Financial, Tax, & Legal

Real Estate Classifieds

Reviews & Feedback

Updated over 2 years ago on . Most recent reply

Las Vegas Market and investor minded Agent

Like to know recent Las Vegas Market. Also want to find an agent who has his/her own SFH invest in Las Vegas.

Most Popular Reply

Hello @Jim G.

Below is from my monthly market update (on Las Vegas) for my newsletter readers. Some background.

Investment real estate is all we do. So far, we’ve delivered over 470 properties.

Our client's goal is passive income streams that rise faster than inflation and are reliable through market ups and downs. Their goal defined our target tenant pool segment, which defined the properties we selected.

Las Vegas, like every other market, is transitioning back from COVID. This, plus high-interest rates, financial market turbulence, and normal seasonal trends, reduced sales volume. However, the current slowdown presents good opportunities. I will talk about this later.

Market Update

The data below is only for single-family properties that meet all our requirements; the information includes no other property types.

Sales - $/SF by Month

High-interest rates and such cooled the market starting mid-year.

Sales - Median List to Contract Days

The days on market decreased in October.

Sales - Months of Supply

Supply is a little over three months, still a seller’s market. Six months of supply is considered a balanced market.

Rentals - Median $/SF

YoY rents are up 5%. With high-interest rates, more people are forced to rent.

Rentals - Median List to Contract Days

Days on market are still below pre-COVID.

Rentals - Months of Supply

Just a little over one month of supply, indicating demand is still greater than supply, which will push up the rents.

Where do I see the market going from here?

Below is a chart from the MLS showing the number of new listings by month for all single family homes. It's been dropping rapidly since June.

Inventory is leveling off at around 3.5 months, as I expected.

I see no reason why more sellers would be compelled to sell their homes in the coming months, especially when their current mortgage interest rates are in the 3’s or 4’s. Also, only a small percentage (<1%) of homes in Las Vegas are underwater, so there will be few distressed sales. This is why I believe inventory will stabilize at 2-3 months of supply. This was the state before COVID. Before COVID (2018 and 2019), prices and rents increased by about +5% per year; supply ranged between 2 and 3 months.

Why do I believe prices will continue to increase?

The market drivers for Las Vegas haven’t changed.

- Population growth - Population increases by 2.5% to 3% per year.

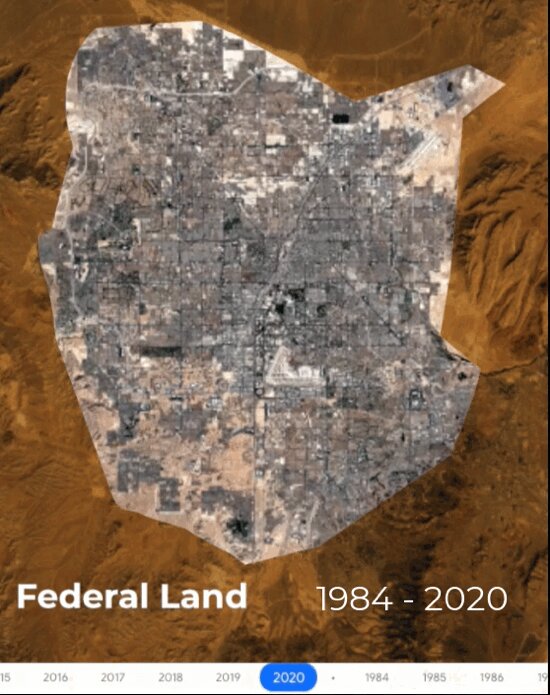

- Land shortage - At the end of 2019, there were about 26,000 undeveloped acres. About 5,000 or 6,000 is not suitable for residential construction. Las Vegas consumes about 5,000 acres per year in new development.

- Jobs - Jobs bring people. Today, there are between 26,000 and 31,000 available jobs in Las Vegas, depending on which job board you check. And over $22B is under development. These developments will create thousands more jobs.

Opportunity

As we search properties for clients, we are seeing more good opportunities. Some sellers are willing to contribute thousands to buyers’ closing costs. These funds could buy down the interest rate or reduce your closing costs. I can certainly resonate with Warren Buffett’s famous quote, “(be) greedy when others are fearful”, as long as you pick the right properties.

Jim, hope this helps. Let me know if you have any questions.

- Eric Fernwood

- [email protected]

- 702-358-8884