Updated 6 months ago on . Most recent reply

- Investor

- Zero Down Specialist

- 1,071

- Votes |

- 1,945

- Posts

Are We In a bubble? Will It Correct or Just Continue To Always Rise (Musical Chairs?)

Oh? It's different this time? Lol

*******************

Major repairs can now cost what previous generations paid for an entire house, and no, this isn't just inflation; it's the result of the decline of quality across the board and the gutting of labor skills to cut costs.

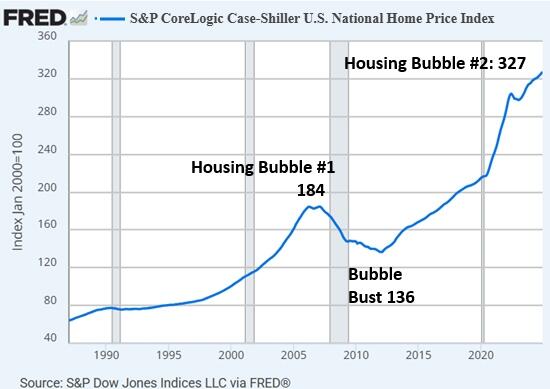

Here's the Case-Shiller Index of national housing prices. Housing Bubble #2 far exceeds the extremes of unaffordability reached in Housing Bubble #1:

Most Popular Reply

One could argue "Yes" to both of the questions in your title.

Near-term, prices do appear higher than normal and affordability is low. Prices may come down.

Long-term, the US government keeps debasing its currency, so it isn't difficult to forecast that 10 years from now, home prices will almost certainly be much higher than they are today. The chart below is useful for discussing both points.

How the near-term and long-term issues play out is less clear.