Correct way to evaluate a 4-plex?

I purchased my first properties off market not too long ago and pretty much made up my own way to evaluate them. Probably not the best decision as a newbie, but I think I did OK. I made a spreadsheet that subtracts my desired cash flow from the NOI to give me a mortgage payment. It then calculates an offer price based on that mortgage payment instead of using the cap rate method.

Since 4-plexes are right on that border of residential and commercial, I wanted to see if I did the correct thing by basing my offer price off of the income of the property or if market value should have played more into the equation.

I got excited to buy the first time, but I will reach out for help BEFORE next time. Thanks, everyone!

@Austin Davis In my experience when appraised for financing purposes the appraiser will a large majority of the time use the Sales Comparison Approach (sold comps) when evaluating a 4-unit.

Around here the income of the property is considered more and more as you get above 6-units.

As far as your offer goes, ultimately whatever you end up buying it for it is going to need to appraise in order for you to get financing. So, I would consider both. Obviously even though the appraisal will most likely not be based on the income of the property you will want to consider it heavily when making an offer.

Thanks for the feedback @Michael Noto. The appraiser that worked with the bank for my properties was very interested in the income of the properties. Is this not the norm?

Would you say that getting a realtor or an appraiser that is familiar with experience with 4 plexus would be best if I would want to pursue more off market 4 places?

Well @Austin Davis, that is a kind of wild way to come up with a valuation of a property. The biggest wildcard in your own formula is the NOI. Where did you get it from and what was it as a percentage of gross rents?

With 4-plexes, it is more market specific on the weight given to comps or income. If you are in a market or submarket (part of town) where there is an abundance of 4-plexes, comps will most likely be given more weight in determining valuation for an appraisal. If they are scarce, the income approach is probably your best approach to determine value. Sometimes, an appraiser who does lots of residential appraisals will use comps when they should use the income approach too.

As an investor, you need to be aware of market values (cap rates, comps), but have a better understanding of investment value (ROI, income & expenses) IMO.

Thanks for the reply, @Robert Leonard.

NOI came from the income and expenses that the owner reported, which were confirmed to be pretty darn close in due diligence. NOI ended up being about 54% of gross rents, which I initially thought was kind of high, but I see some opportunities to bring down expenses, so I thought that would be OK. Where would you want this number?

I personally couldn't find any good comps in the side of town that I purchased, but that is probably where I should have brought in a professional (realtor or appraiser) to help me out. I met my minimum thresholds for cashflow and ROI, but I definitely could have overpaid based on the market value. The lack of competition was what I was excited about in doing the off market deal, but it sounds like the disadvantage is having to work a little harder to find that market value.

How would you approach a realtor that wouldn't be getting any commissions to help you on a deal like this? Can you just pay them to run comps for you or do they always need to sell to make money? Or would you just pursue an appraiser for this type of help?

Thanks again!

You'll hear people talk about the 50% rule, it's a rule of thumb, that suggests you should expect expenses to be in the ball park of 50% over the long term on residential properties, whether single family (SF) or multi-family (MF). And often with MF when you are paying for some things like water and utilities in common areas, expenses can be expected to be in the 60% range. Those are all generalizations that you have to prove or disprove in your due diligence process. What you have sounds like it is probably in the ball park of a property that is being maintained and you weren't given some rosy low figures on expenses.

A good real estate professional can help you in a lot of ways and as an investor who is ready willing and able to buy, you can certainly help them. IMO such a Realtor will also be an investor who will be an opportunist who buys great off market deals when they get a chance and won't mind helping you, to a reasonable extent, without charging a fee for everything they offer you. If you are someone who is in contact and actually has a relationship with them, they know you will buy or send some other business their way that will generate commissions or other opportunities for their business. When you get ready to sell, you will probably want to sell for top dollar and get full exposure to the market by listing it on the MLS, right? Who can list that property for you? Your friend the Realtor.

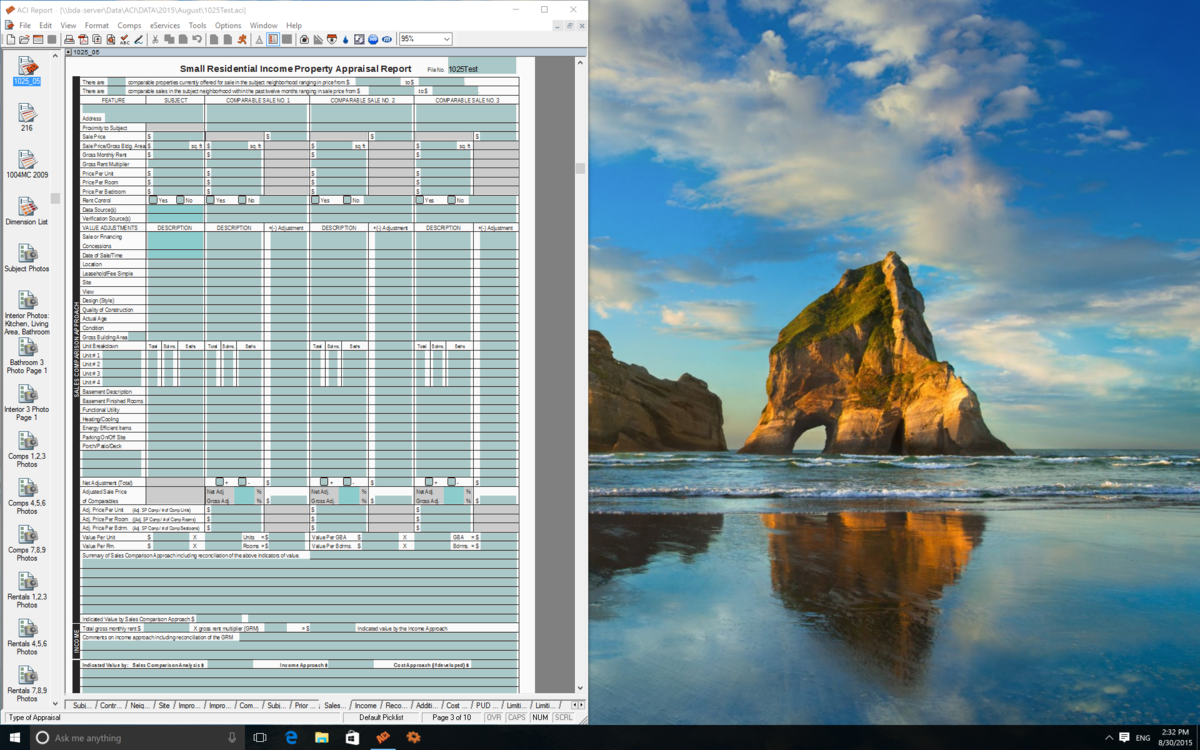

I hope you can read this. This is the main page of the basic appraisal form we used for 2-4 family properties.

The answer is, it depends on your market. Yes, you can figure GRM and Cap Rates, but is that how your market buys? In most markets, yes. But anyone can manipulate any numbers, and GRMs and Cap Rates can be manipulated to make values seem higher. I'm not saying everyone cheats, but that you need to know these numbers for real, not just for hoping your property appears to be worth more. The plus side of a commercial appraisal, is you can control the value by controlling your rents or expenses, thus controlling value based on cap rate. However, in my market people mostly buy 2-4 family based on what other ones are selling for. In a perfect world, all these numbers work together. The GRM or Cap Rate are both numbers that include Sales Price (or value) in the equation, so really even commercial property is based off of sales prices or sales comparison. The Cap Rate is established off of prices (or value, which is where it gets hairy).

The answer is, it depends on your market. Yes, you can figure GRM and Cap Rates, but is that how your market buys? In most markets, yes. But anyone can manipulate any numbers, and GRMs and Cap Rates can be manipulated to make values seem higher. I'm not saying everyone cheats, but that you need to know these numbers for real, not just for hoping your property appears to be worth more. The plus side of a commercial appraisal, is you can control the value by controlling your rents or expenses, thus controlling value based on cap rate. However, in my market people mostly buy 2-4 family based on what other ones are selling for. In a perfect world, all these numbers work together. The GRM or Cap Rate are both numbers that include Sales Price (or value) in the equation, so really even commercial property is based off of sales prices or sales comparison. The Cap Rate is established off of prices (or value, which is where it gets hairy).

Many people think appraisers use one method for residential and one for commercial, but we are actually required to consider all three methods in every appraisal: sales comparison, cost approach, and income approach.

You can see on the attached sheet, the main "grid" is devoted to the sales comparison approach. At the top you see the Gross Rent Multiplier. At the top and bottom, you see price/room, price/bedroom, price/unit, as well as value/room, price/room and even value per Gross Building Area. It is our job as appraisers to determine which one of those is most relevant for each individual appraisal, and that number can help us decide our sales comparison approach. Below that you can see the Gross Monthly Rent X Gross Rent Multiplier. The rent can be the actual or market rent, and there is another page or form where we typically look at that as well as expenses and maintenance. You will also see the cost approach. Typically, this won't matter on residential or commercial rentals, but it i

s slightly possible. Once I have the Income Approach and the Sale Comparison Approach, I do the Reconciliation. This is the part of the appraisal where I decide and explain how I came up with my value. Again, in a perfect world, these number support each other. But we all know real estate is not perfect.

Hopefully this is helpful. Let me know if you have questions.

Looks like that isn't very readable w/o zooming in. I can upload a pdf if I knew how/where.

@Robert Leonard-Yes, I am familiar with the 50% rule and actually rounded it up to the 55% rule in this case and it still seemed to check out OK with pretty conservative numbers. Management fees, maintenance, CapEx were included in this initial evaluation. Anything I am missing?

Great advice on getting a Realtor's help on this too! That makes a ton of sense.

@Konstantinos Zaferatos-Thanks for the comment! I am glad I asked this question. From what I am gathering, it seems like 4-plexes are one of the more complex things to evaluate. Sounds like it also gives the buyers and sellers more factors to leverage in the negotiation process, which sounds kind of fun!

@Clint Dorris- Thank you for the very detailed explanation of the appraisal process! I opened your screen shot in another window and can read it perfectly.

I agree that GRMs and Cap rates can easily be manipulated to make your rents higher, which is why I made my own calculator that is more black and white based on my own goals of cash flow. If a property isn't going to perform how I want it to with the current market cap rate or GRM, I don't want it anyway. However, they could give me a better offer price if I did look at them, so I should probably start considering them for the future. As you said, market price value, cap rates and GRM's should give you about the same offer price, but the more information you have, the better in my opinion.

As an appraiser, do you just have GRM's and Cap rates spit out to you in the systems you use from previous sales? As an investor doing my own assessment of value, how would I you recommend acquiring the most up to date cap rates and GRMs to punch into a spreadsheet? If I am working with a realtor for comps, should they be able to give me a pretty good idea of these or would you go right to an appraiser?

@Austin DavisYes, we keep a list of rentals, but not necessarily GRMS. It can actually be a bit difficult to tell. I work for a good bit of investors, and I also use a management company for my personal stuff. Finding rents is the easy part. However, the investors I work for, who tell me rents, those aren't recent sales. So we normally update our GRMS base on current sales. We pull recent sales in the areas where we have our rent rates.

I don't know much about CAP rates because I deal with them so little doing mostly residential work.

However, the easiest way to get rents is to just drop by a management company and pick up their sheet of available rentals. They usually rent for what they are advertised at. Many of them keep them online now, too.