All Forum Posts by: Aaron Taylor

Aaron Taylor has started 3 posts and replied 148 times.

Post: Is the real estate bubble burst soon?

Post: Is the real estate bubble burst soon?

- Olathe, KS

- Posts 148

- Votes 207

I don't know if a correction is coming or not, but I do wonder longer term about the housing market. For the last 40 years the market has been propelled by lower and lower interest rates...what happens when rates can go no lower like we are now? About the only way to move things higher is through inflation. The market is being juiced right now because rates on houses are at all time lows near 3%, what happens if rates go up 1% to 4%? That's going to be a major drag going forward then. Are they going to move to 40 year amortization or interest only to keep things moving? That seems like the next logical step.

It just seems like there's a lot of dislocation in the market. The fed pumped so much money into the system that price discovery is non-existent currently. I frankly see prices going higher at least for the next 6 to 12 months until that money has distressed assets to go after (like hotels, office, etc...there's too much money available and no deals, so that money is just inflating everything currently). It needs someplace to flow to besides like tech stocks.

Post: Anyone else feel like the forums are losing value?

Post: Anyone else feel like the forums are losing value?

- Olathe, KS

- Posts 148

- Votes 207

I've been on here 2 1/2 years, so neither a newbie nor someone with overwhelming experience. I've noticed a change, not necessarily with the forum itself but the biggerpockets organization and frankly the real estate education space in general. Things that I've noticed in the past year:

Deals started become tighter, so sponsors started ramping up their education instead

To sell education and what limited deals they had, everyone started having each other on each other's podcasts to sell more and more

BP expanded from two podcasts to four, started bpcon, lot more books, etc...basically more and more information with a lot of the cross pollination between podcasts.

I think in general it's more and more people chasing fewer and fewer deals, so the same information is being repeated a lot more often trying to reel in more new people. Everyone is trying to get their slice of the education pie which driving down the value somewhat. BP isn't trying to chase deals but they've transitioned into a 'business' type mode this past year, you can tell, making the needle swing towards 'too much'.

Also the fact that the pandemic happened made the deal flow even worse, which has made some people lean into the education selling portion even more. It's information overload. BP has 4 podcasts, Jake and gino has 4, etc.

I like Biggerpockets a lot. But the lines between honest advice, selling you something, etc are being blurred more and more. This forum is different than every other one I'm on because 99% of the users in those forums have no financial reason to be on the forum. This one is almost all financial, so sometimes I think what people really think isn't seen because it would be bad for business.

Post: Will people leave cities post COVID 19?

Post: Will people leave cities post COVID 19?

- Olathe, KS

- Posts 148

- Votes 207

Working from home does not take great internet. If you're doing remote desktop, even like 1.5 meg connection will work, which beyond bad (I know because I used to use that at one point for a little bit). The only thing that would take more is if you're doing huge file transfers or zoom calls, but even then 10 meg should work fine.

I don't even know if the question is will people leave cities, but more "Will people still move to cities from their college towns?". So now you have a company like Facebook who wants to move 50% of the their workforce remote eventually. Previously, college grads had to pick from San Fran, New York, or Seattle, increasing the population and inflation in those cities. Now, those people may not even come because it will save Facebook a ton of money to have them just stay where they're at. No office to maintain, way smaller salary, etc. So that alone will make a big difference over time. If I would have been offered the chance to work remotely while still living in my college town I would have taken that option in a heartbeat.

As far as the cities themselves, I'm guessing that the major difference is that places that were previously "too far to commute from" are now possibilities. So the suburbs may see price appreciation whereas the the more condensed locations may not.

Post: Facebook will now let some employees work from anywhere

Post: Facebook will now let some employees work from anywhere

- Olathe, KS

- Posts 148

- Votes 207

Originally posted by @Amit M.:

I think the recent work from home hysteria is a fallacy. Conceptually, working from home has NOTHING to due with covid 19. If it’s so awesome, why wasn’t it adapted en mass years ago? Yahoo a couple years back even rolled back WFH. It’s a trend that will have some effect yes, but it’s being way over hyped. For two main reasons: 1- I’m not sure it will really provide long term benefits to the tech firms jumping on the bandwagon now 2- I’m not sure how many employees will ultimately like it, after the forced-Covid-novelty wears off. i.e. it’s hard to get all those cool tech co benefits like free gourmet food, gyms, awesome office spaces, etc., etc. piped over a zoom meeting.

As for WFH effect on the Bay Area, keep in mind that when people work from home, their direct environment becomes MORE, not less important. Would you rather be home based in the Bay Area with tons of things to do nearby, good weather, lots of nature, etc. or someplace with little culture, extreme temperatures, bland immediate environment, etc., etc. There is a reason many people, who can afford to do so, aspire to live in CA and especially the Bay Area. Working from home isn’t going to radically change those aspirations.

You're right that it has nothing to do with Covid-19. However, the biggest problem is that there was this HUGE management mindset that "work from home doesn't work" and "how can I trust my remote employees" and "we're going to work from the office because that's the way my dad did it, and his dad before him, and his dad before him...". That mindset suddenly has huge holes in it because things just got done without a hitch. Frankly I think our productivity at my work has gone up even more (although my work is one that will not be allowing remote work in future).

I'm in tech, and frankly those perks you see in the movies are overblown. Sure, you have ping pong and foosball tables, cafeteria, etc but once you get a little older and have kids family just trumps all of that into the ground. Basically, it's great for people for their first 5 years out of college, but as you settle down then space, schools, other family, etc become more important.

Until this year, I actually worked remotely more in 2005 and 2006 than I had in the past 13 years. The technology has been there forever, the trust factor wasn't though. Sometimes things don't happen either unless there's a herd moving towards it either, all these corporations just copy each other for the most part with the same 401k, medical, vacation, etc. So if the big tech companies make this standard, it will probably flow to all the rest just to compete for college students. I could actually see this being a longer term plus for towns that have major colleges, as instead of having to move to their job (the traditional thing that happens after college where everyone goes their separate ways) a lot of them can just stay put if they want. I can tell you for certain that I wouldn't have moved had I been given the option after college.

Post: Facebook Shifting Many Employees to Permanent Remote Work

Post: Facebook Shifting Many Employees to Permanent Remote Work

- Olathe, KS

- Posts 148

- Votes 207

Originally posted by @Casey Powers:

So there is the fact that many people have kids and remote work is much harder with kids at home, especially small kids who aren’t in school. Some stay at home parents go back to work just to get a break. LOL

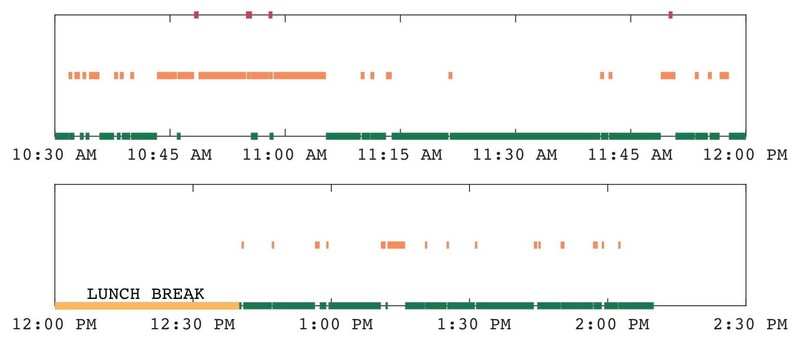

A dad documented his interruptions just with watching his kids for 3 hours. It’s pretty telling, of what (mostly female of course) parents may have to deal with.

This dad apparently did not document the time it took to refocus on the task at hand, just the actual time of interruption. Studies show that it takes extra time to remember what you were doing and get back to it after an interruption.

Work at home may not necessarily be all it’s cracked up to be.

It really depends on your situation, if you have kids under 5 without daycare it really wouldn't work that well. I don't think anyone would expect it would either. But normally those kids wouldn't be there if they're that young, they'd be at daycare if you were at work, and I don't think working from home would change that (unless your daycare was closed like it might be now). I think a lot of families where one parent stays at home while the other works, well in that situation I think most of those working parents can't wait to get back to the office, lol.

I can just give myself as an example. I started working remotely occasionally back in 2005. Technology is still the same, it hasn't really gotten any better or worse ironically. When I first had kids, working remotely would not have been ideal for sure for the 3 months of maternity leave. After that though, with daycare, it would have been fine. My wife and I both work, so working from home or office would have been pretty much identical. Neither of us had remote work though, so we've been going into the office for the past 20 years.

As I've gotten older though, the time commitments from kid activities though really start to crunch your time. I was averaging 100 miles a day driving I think when this hit, driving to work and back, then to a soccer/basketball practice and back, getting home late almost every night. Then work out, hopefully get into bed by 11 to midnight.

But if you really break down the time, work related stuff was eating like an hour to an hour and a half a day. Of course the driving (40 minutes total) but there are other things you kind of forget like getting ready for work (10 extra minutes). My work requires a mandatory 1/2 hour lunch break. At work, I honestly don't have a single thing to do during that time so I basically just waste it. At home, I can work out, it's such a nice break. But I'm wasting 30 minutes there as well when I drive in. So 80 minutes a day that I get back from working from home, that's huge when your time is so limited like mine.

I get to work remotely for a little bit longer, then I'll be back in the office permanently again. And frankly it's really going to bum me out when I have to go back because I was so much happier remote (and frankly I'm getting even more done).

It's not for everyone for sure, I can tell some of my coworkers can't wait to get back in the office. I notice it mainly in the younger group and people with small kids. They're trying to climb the corporate ladder and haven't figured out that the only thing that matters for a promotion is that your boss likes you. :)

I'm happy to see though that some corporations are finally warming up to the idea. It's been long overdue. It's kind of ironic though, a lot of these web based businesses spend their whole existence trying to make brick and mortar obsolete but then require you to show up for work in one everyday. The irony.

Post: Facebook Shifting Many Employees to Permanent Remote Work

Post: Facebook Shifting Many Employees to Permanent Remote Work

- Olathe, KS

- Posts 148

- Votes 207

One of the articles I read on the Facebook thing is that it wasn't just moving to another place with your same salary, they were going to reduce your pay accordingly. To me, that is crappy. So if the guy stays remote in SF, he keeps his salary, but if he moves to Vegas he'll take a 20% hit or so (or more)?

Now there's some that would say that makes sense, but what if the opposite occurred, and a company in Vegas allowed remote work and someone moved to SF, you think they should pay them 20% more then for moving to an expensive area? I don't, for same reason I don't think they should doc you for moving to a cheaper area.

Remote work is going to be a game changer, I think the biggest thing is that it may smooth out the differences between sections of the county to some degree. So instead of SF being twice the midwest, maybe it will only be 50% more now (with SF decreasing some and the midwest increasing some). I could see Texas, Arizona, Florida, and Nevada being big winners with this.

Commercial office space is going to get crushed in my opinion longer term. It hasn't made sense for at least 15 years, but companies kept doing it because of lack of trust and fear of change. Well now they were all forced into it, and guess what, it actually works. Maybe a main headquarters makes sense, but so many of these companies have 30 to 40 dinky remote offices of 10 to 50 people for no apparent reason other than "we've always had an office and we have a policy of no remote work, so let's spend a ton of money on an office" without ever asking the question "does this actually make any financial sense"?

There's a lot of savings and employee happiness gains to be made if people/companies desire it. I'm a software engineer, there's actually zero reason I need to be in the office on a daily basis. In fact I've been getting way more done due to less meetings and interruptions. Way happier than I've been in a while.

Post: If the Market is Crashing, Then Why Aren't You Selling?

Post: If the Market is Crashing, Then Why Aren't You Selling?

- Olathe, KS

- Posts 148

- Votes 207

Single family isn't going to drop anytime soon as that's too long of a drawn out process. Even if 10% of the US homes went into foreclosure tomorrow, there really wouldn't be any effect on the market until next year sometime at the earliest. The last one took 4 or 5 years to bottom, from 06/07 to 2011.

Now multifamily, there's already been a correction because of the lending standards changing. Underwriter on a podcast today said 10% lower already just because of that and ranging between 10% to 15% lower. It's all about the financing/laws, the single family moves in a slow motion wave whereas other things can be changed overnight.

However, if Freddie/Fannie suddenly stopped single family mortgage purchases for a while (super unlikely) that would be something that could have an immediate impact on housing prices, for example.

Post: Housing Market Crash?

Post: Housing Market Crash?

- Olathe, KS

- Posts 148

- Votes 207

I would think for the next few months, nothing will really happen. The people that can't pay will be in forbearance, and the people who were going to buy would have already had the money ready to go before this started. So you're going to have a drop in inventory by probably 10% (the amount in forbearance) and the available buyers will probably be reduced by an equal amount, leading to a standstill.

It won't be until this winter/next year that there would be any possibility of lower prices in my opinion. The other guys are right, not enough inventory. If leading standards reduce buyers and job losses increase inventory, then that would be where you might see things swinging the other way.

I also wonder if the issues in commercial real estate will spill over to other sectors. Lots of losses by banks, and then investors rotating to that sector for deals possibly.

Post: Who is doubling down, who is backing off?

Post: Who is doubling down, who is backing off?

- Olathe, KS

- Posts 148

- Votes 207

I feel like right now, there's really no reason to buy unless you're getting a really good deal. Most of the people that are saying it's going to blow over in this thread are realtors. :)

8% of FHA loans are now in forbearance

The average number of loans in forbearance is 5.95%

At the beginning of March, only .25% were. It doubled week over week.

Lending standards have gone way up. Minimums and credit scores have gone way up. Jumbo loans are getting harder to get.

So you have less buyers and sellers who are increasingly in trouble. And historically this has taken quite a while to play out. Nobody is going into foreclosure now. But they might next year or the year after.

It's area by area, but you'd have to have a smoking deal right now as an investment to protect to the downside. Sure, it could blow over and everything goes back to normal in 3 months. But what about the flip side, an 18 month slog of distancing and closures? You've got to account for that.

For context, the foreclosure rate in like 2009 and 2010 was around 2% when it peaked.

Post: Will COVID-19 Cause a Recession?

Post: Will COVID-19 Cause a Recession?

- Olathe, KS

- Posts 148

- Votes 207

We're already in one. No stopping that now. The only question is how far down will we go, and how long will it take to climb out?

Commercial real estate is going to take a long time to come back from this. You've got:

small businesses that aren't going to survive even with loans

large businesses (JC Penney, etc) that were already close to the edge and this might push them over

malls that may not make it out

businesses that instead of opening multiple locations are just going to have people work from home

It's 10 years worth of change smashed into a 2 or 3 month span. Businesses that were going to be around in 10 years will be fine probably. Things that were operating close the edge and could go under anytime probably won't make it.

A lot of those jobs may not come back either, or may be radically different. Food delivery just got supercharged.