All Forum Categories

Market News & Data

General Info

Real Estate Strategies

Landlording & Rental Properties

Real Estate Professionals

Financial, Tax, & Legal

Real Estate Classifieds

Reviews & Feedback

All Forum Posts by: AJ Wong

AJ Wong has started 241 posts and replied 657 times.

Post: Are Property values appreciating or is USD buying power decreasing?

Post: Are Property values appreciating or is USD buying power decreasing?

- Real Estate Broker

- Oregon & California Coasts

- Posts 676

- Votes 537

Recently I've continued to get positive feedback on my posts so I'll keep it up until the comments turn negative..

For those that follow me, they will sense my bullish tendency towards real assets. For the record during the past twelve months I've been aggressively acquiring gold, silver, rare colored diamonds and working on a redevelopment rental in Mexico as I felt the dollar had peaked. I also have extensive individual experience with these commodities and realize I take more 'risk' than most..or do I?

Additionally my work with investors in Oregon and California has quadrupled and most of my recent clients have in retrospect secured very favorable terms on both the purchase and sale side.

This is not a pat on the back, but just to provide some context for why I think inflation is here to stay and that there is the potential that despite the challenges in the housing market, there could be more incentives to invest capital and reserves than disincentives.

Most obviously banks are failing. I saw a graphic that said the total failures are GREATER than 2008. If not for government backstops depositors could lose their entire savings above $250k! We are in a banking crisis, that is a financial crisis by another name.

The only solution is for the government to print more money. That's what they doing. This will continue to devalue to purchasing power of dollars. To reiterate I'm not an alarmist, but the threat of hyper inflation is growing and it is a known fact that if we used the same CPI from the 1980's and 1970's we currently have double digit inflation.

Inaction is not a solution, it is a risk. The risk of already invested time losing value and risking your future.

I am not advocating to act recklessly, in fact quite the opposite. I'm advocating putting your 'money' to work and in more challenging times that is going to require working for your money.

For the first time this generation, passive investing could be disastrous. When deposits at the bank aren't safe, what is?

You as your own bank. A portfolio of hard, tangible, real assets and real estate.

Currencies have come and gone but empires have been transferred and sustained on land and real estate.

It is the first and most essential asset. In my humble opinion, the more quality property you control, the more safe, secure and dependable your investment portfolio.

Sure rates are higher and valuations are up, but what if property valuations (and everything else) for that matter are rising because the value of the dollar is falling?

$20 sure doesn't go as far as it used to, does $50k even buy a new car nowadays? In comparison a recent client secured a Triplex for $50k out of pocket on a cash flow positive property. That was six months ago..that same $50k couldn't even purchase the same things today.

There are new investment intangibles to be considered when evaluating the investment potential of a property, including the declining value of the proposed capital by not being utilized.

Silver was $17-18 not so long ago. Today it's $26 but in my opinion still considerably undervalued. The same argument could be made for real estate, but either way I think dollars will continue to purchase fewer commodities.

Is real estate a commodity?

What are your thoughts, are values too high or do dollars not go as far as they should?

Post: When there is blood in the banks buy Real Estate

Post: When there is blood in the banks buy Real Estate

- Real Estate Broker

- Oregon & California Coasts

- Posts 676

- Votes 537

Quote from @Jay Hinrichs:

Quote from @AJ Wong:

Isn't it ironic how the one time borrowers got a 'leg up' in the form ridiculously low interest rate mortgages that those same 'assets' are partially what is behind the collapse of several significant US banks and beyond?

I just find it hilarious that these financial geniuses couldn't see that 2-3% loans for 30 years were not great returns. What is not as funny is how perilous, shaky and scary the entire financial system looks. If not for government guarantees and back stops where would the markets and depositors' deposits be? I'll tell you where they are not, in the accounts that you deposited them in.

The same way inflation is taxing consumers, bank revenue is declining and their deposits are shrinking in part to flight, but also because the proportion of individuals and businesses savings are being eroded by higher costs and declining purchasing power.

I won't go into length here about the decline of USD, it's purchasing power and the correlation to increased asset prices including housing, but I will say that if you have been considering investing in real estate I think the time to act is sooner than later.

In fact I would go so far as to re-evaluate my entire investment portfolio. I am not a financial advisor but conventional equities and stocks are down roughly 20-30% in the past 12-18 months, certainly off peak and I think we're only half way there. (My personal call is to reach March/April 2020 levels or Pre Pandemic stimulus/QE.) Equities are in some cases still 15-20X earnings. There is all risk and little reward. Anyone with a significant equity position likely could have purchased a cash flowing or dream property with the value they 'lost.'

So keep it in cash right? Well, yes if it wasn't buying less by the moment. Whatever their 'CPI' index is, is grossly under calculated and still you're losing 5%+ per year, on top of the already increased prices of everything else. Just wait until fuel prices really begin to rise and reflect..

Inflation destroys savings. The most responsible have the most to lose. The only way to outpace inflation is to increase your income, and/or reallocate to cash flowing assets, potentially utilizing debt that actually benefits from inflation. In other words the value of the debt goes down as inflation goes up.

Historically mortgage rates are still reasonable and extremely available. We're working with several investors on a 10% down program with no PMI 1-4 units up to $1.3-1.4M. This often enables cash on cash returns of 1-2-3 years for high grossing rentals.

$25-$50-$70-$100k down and a positively cash flowing asset as opposed to losing .5% per month for the luxury of keeping it in risky banks, stocks or bonds. Doesn't sound so bad? Getting nothing for my hard earned money certainly does..I mean at least you'll know where your down payment or money went?

Should and when rates drop expect an even greater flurry of purchase activity, or worse should banks and the debt crisis spiral into a dollar death debt cycle you could see a huge move of money into real estate as it is the most efficient way to convert significant capital into tangible hard assets.

I cannot speak for all markets but the OR Coast and I5 Eugene corridor are incredibly strong at the moment yet still offers some exceptional growth opportunity and value.

For example an Oceanfront updated estate on acreage or in a premier community for $1M +/- ? Bonus when world ends you're at least in paradise enjoying what you worked for.. lol

I'm not an alarmist but I am a realist. The financial system is not healthy and the same financial game plan of equities and tech stocks are not going to yield the same type of passive returns generations have become accustomed to. The time to adapt is now, real estate is the first and most essential asset class. I firmly believe it's place in portfolios should be prioritized more than ever. When it comes to inflation and the risks associated with the USD there could be more lost by indecision than bad decision.

What are your thoughts? Are the rules of investing and retirement strategies changing?

Which is funny until they stop buying those notes because they keep getting burned. lol

Post: Las Vegas/Henderson Market Shift

Post: Las Vegas/Henderson Market Shift

- Real Estate Broker

- Oregon & California Coasts

- Posts 676

- Votes 537

Quote from @Robert Adams:

The buzz around the country right now is the shifting economy and that is no different in the real estate sector. With the Fed raising the overnight interest rates and implementing Quantitative Tightening (QT) to combat the hyper inflation we are seeing across industries as it hits inflation rates we have not seen since the 80's, the ripple effects are reaching everyone. Due to the pandemic the Fed pumped money into the system that drove the demand of goods and services through the roof. This has put the reputation and value of the dollar as the world currency at risk. Below is a chart of the inflation rates since we started tracking them in the 60's.

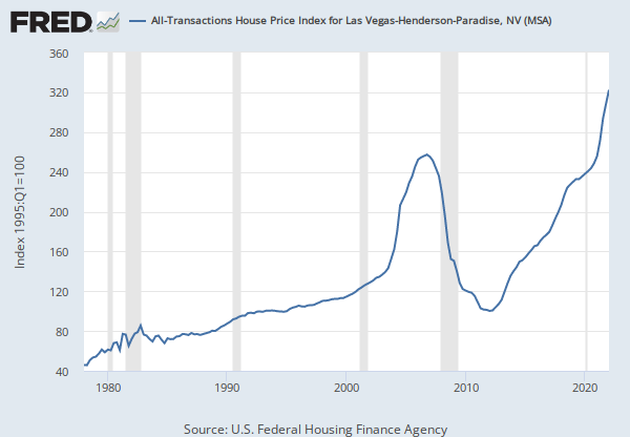

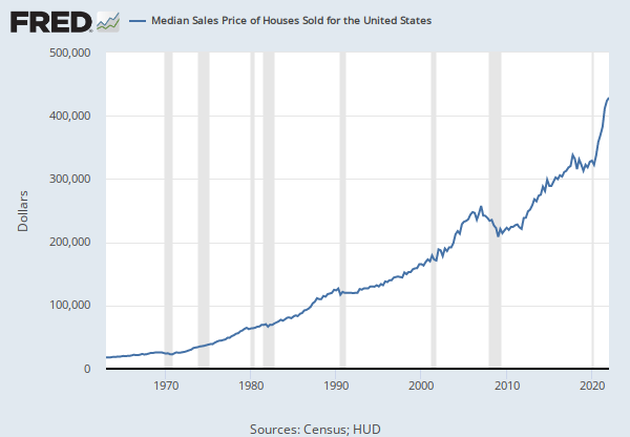

With this being said, many are asking themselves if a housing crash like 2008 is headed our way. This is a very logical question given the fact that inflation is still very high despite rate hikes, stocks are plummeting, crypto currency is down, supply issues are still affecting the world as a whole, fuel prices are at all time highs, and the political climate across the globe is tense with the Russia / Ukraine conflict. Below is chart of historic housing prices.

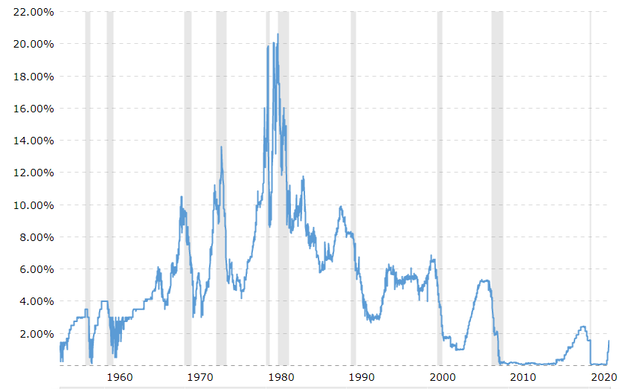

To get this in check the Fed has raised rates multiple times and are expected to raise rates several more times throughout 2022 and into 2023. With that being said rates are still historically low and at this time are still lower than the inflation rate. These are not mortgage rates but rather the overnight Fed rate at which banks lend amongst themselves. Think of it as wholesale rates between banks in the back end. Mortgage rates are more like retail rates to consumers. While the Fed rates do play a part in mortgage rates they are not directly tied to one another. The Fed rate also plays a role in other types of loans like credit cards, HELOC's, auto loans, business loans, etc. See the chart below for the historic Fed rate.

To further cool the supply of money for lenders in the housing sector they lowered the amount of mortgage backed securities (MBS) the government is buying to further lower liquidity in the market. As we all know basic economics with less supply of money the cost of the money/loans will increase. During the pandemic the government drastically increased the volume of MBS to add liquidity to the market to help keep rates low to stabilize the economy as we battled covid's impact on our economy. As the MBS's volume is decreased it will further affect affordability and the costs of financing for homes. See the historic chart for Mortgage Backed Securities (MBS) below.

So you ask, WHAT DOES THIS MEAN FOR THE REAL ESTATE MARKET??? This means lenders will have less liquidity meaning they will have less money to lend (lowering the supply side of money to lend will cause the cost to borrow money to increase). You combine that with the higher Fed rates and lenders are forced to increase their mortgage rates to consumers. These higher mortgage rates combined with higher home prices that we have seen in recent years due to the hyper appreciation caused by the low housing inventory over the past several years and inflation costs, this will create affordability issues for many first time home buyers and financed buyers in general.

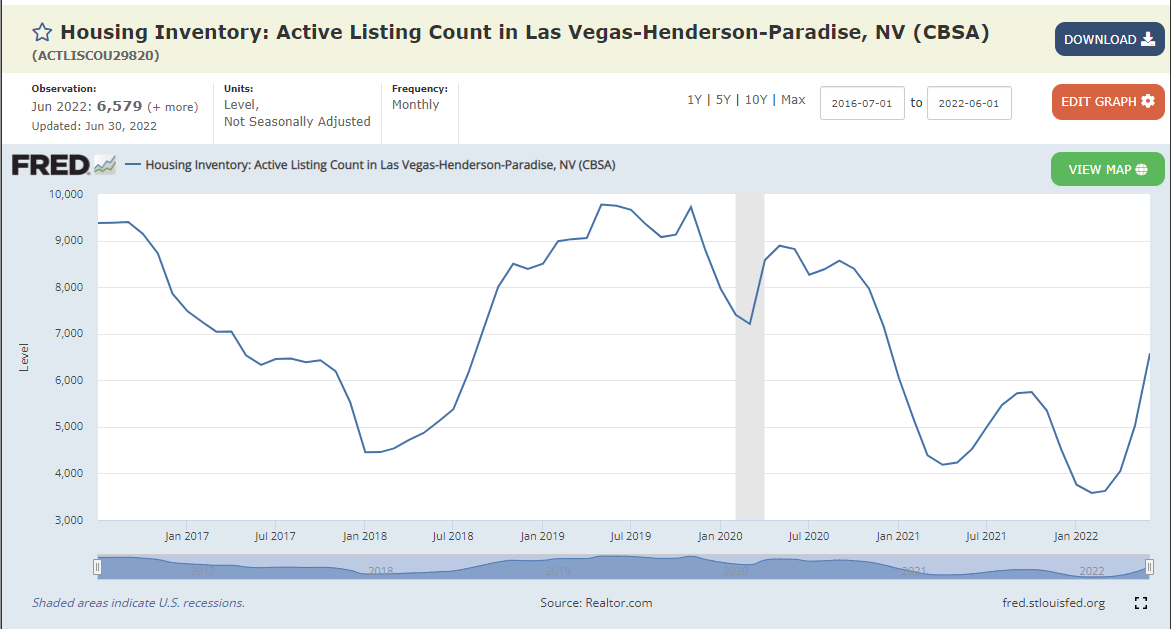

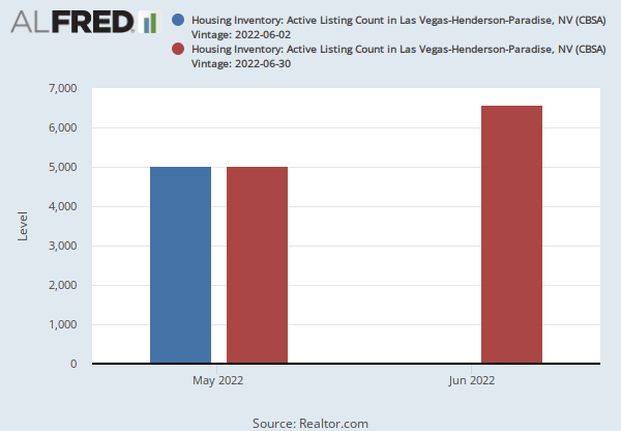

So far the real estate market has had a knee jerk reaction to the monetary changes and demand has slowed dramatically. You combine this with many sellers panicking and putting their properties on the market to sell in fear of a crash and you see the significant increase in housing inventory. At the lowest point here in the Las Vegas / Henderson market we only had 2 weeks supply with less than 2,000 listings. Over the past few months we have seen month after month increases in inventory and locally we now are sitting just shy of 2.5 months supply with almost 7,000 listings. While relative to the inventory we did have this is a major increase, to put it into perspective we would need 4 month to 6 month supply to reach a balanced market (not a buyer or sellers market). If we rise to above 6 months supply you can expect prices to start decreasing. To put things into perspective, after the 2008 crash we had over 15,000 homes for sale here in Vegas with 5,000 foreclosures every month. We are no where near those numbers right now and foreclosures make up less than 1% of the available homes for sale. See the local Las Vegas/Henderson inventory charts below.

Despite all of these factors we have not seen home values decrease yet other than the latest median home price report that says here locally our median home price dropped from $482k to $480k last month (June 2022) for the first time since April 2020 when the media home price was only $310k. This $2k median value decrease is such a minor change it barely qualifies as a value decrease. We are feeling the shift as active agents and investors with boots on the ground that submit offers every single day. Rather than there being 30+ offers on a property and the property selling for $50k+ over appraisal value we are seeing most properties sell at value. If the home is distressed or a dime a dozen type of property we are seeing those sell slightly below value, or perhaps at value with some seller concessions included. If the property is remodeled, unique in some way, or a niche product we are still seeing those sell for slight over value. Believe it or not this is actually how homes sell in a healthy market. The 20%-30% appreciation that we saw last year is not healthy nor sustainable. The housing market needed to cool and that is what we are seeing. See historic housing prices for the country below.

In summary, we do not have a crystal ball to tell you exactly how this will all play out but I can tell you that the changes in housing and lending that were implemented after the 2008 housing crash have protected homeownership and made housing a much safer investment than back then. 30% of homes locally have been being bought with cash in recent years. Predatory and subprime lending like "no doc" loans are no longer available. Most loans have been taken out with down payments, very low fixed 30 year principal and interest payments, and have had to prove how the loan will be repaid. Adjustable rate mortgages (ARM's) while recently being reintroduced to the market are a very small percentage of loans that have been taken out.

Another huge factor that is new to our current market that was not around prior to the 2008 crash is the institutional buyers. Hedge funds with billions of dollars that have bought around 280,000 homes across the country. Most of which are not being resold. They are being held as long term rentals for cash flow for the hedge fund shareholders profits. As affordability becomes an issue for financed buyer, these hedge funds will likely continue to buy just with less competition from the financed buyers.

We now also have iBuyers such as Opendoor, Offerpad etc that have billions of dollars to buy homes cash like a trade-in and then resell them to a retail end-buyer.

After considering ALL of these factors we are expecting the market to continue to soften in the short term. We are hoping we see a flat market but there may be a 5% to 10% decrease in values until buyers gain confidence in the market again, higher interest rates normalize in the minds of consumers, and inventory flattens. Once this happens we are projecting the market will stabilize and we will see healthier 3% to 5% annual appreciation for the next few years. I am also expecting interest rates to continue to go up to the 8% to 10% range before inflation will get under control. At which time we will likely still be in a recession and then the Fed will most likely have to lower rates back down to help pull us out of the recession.

I personally am continuing to buy and invest in the local real estate market but I have adjusted my formula to match the current and projected market conditions. You can no longer bank on aggressive appreciation when calculating your After Repair Value (ARV). Be conservative and calculated with your formula, don't be emotional, and if the numbers work then buy smart. It is also wise to have a Plan B should your exit strategy not work out. I recommend making sure the property is also a good "buy and hold" property for cash flow as a worse case scenario so you can wait out the storm should it get unexpectedly worse.

GREAT STUFF HERE!!

Post: When there is blood in the banks buy Real Estate

Post: When there is blood in the banks buy Real Estate

- Real Estate Broker

- Oregon & California Coasts

- Posts 676

- Votes 537

Isn't it ironic how the one time borrowers got a 'leg up' in the form ridiculously low interest rate mortgages that those same 'assets' are partially what is behind the collapse of several significant US banks and beyond?

I just find it hilarious that these financial geniuses couldn't see that 2-3% loans for 30 years were not great returns. What is not as funny is how perilous, shaky and scary the entire financial system looks. If not for government guarantees and back stops where would the markets and depositors' deposits be? I'll tell you where they are not, in the accounts that you deposited them in.

The same way inflation is taxing consumers, bank revenue is declining and their deposits are shrinking in part to flight, but also because the proportion of individuals and businesses savings are being eroded by higher costs and declining purchasing power.

I won't go into length here about the decline of USD, it's purchasing power and the correlation to increased asset prices including housing, but I will say that if you have been considering investing in real estate I think the time to act is sooner than later.

In fact I would go so far as to re-evaluate my entire investment portfolio. I am not a financial advisor but conventional equities and stocks are down roughly 20-30% in the past 12-18 months, certainly off peak and I think we're only half way there. (My personal call is to reach March/April 2020 levels or Pre Pandemic stimulus/QE.) Equities are in some cases still 15-20X earnings. There is all risk and little reward. Anyone with a significant equity position likely could have purchased a cash flowing or dream property with the value they 'lost.'

So keep it in cash right? Well, yes if it wasn't buying less by the moment. Whatever their 'CPI' index is, is grossly under calculated and still you're losing 5%+ per year, on top of the already increased prices of everything else. Just wait until fuel prices really begin to rise and reflect..

Inflation destroys savings. The most responsible have the most to lose. The only way to outpace inflation is to increase your income, and/or reallocate to cash flowing assets, potentially utilizing debt that actually benefits from inflation. In other words the value of the debt goes down as inflation goes up.

Historically mortgage rates are still reasonable and extremely available. We're working with several investors on a 10% down program with no PMI 1-4 units up to $1.3-1.4M. This often enables cash on cash returns of 1-2-3 years for high grossing rentals.

$25-$50-$70-$100k down and a positively cash flowing asset as opposed to losing .5% per month for the luxury of keeping it in risky banks, stocks or bonds. Doesn't sound so bad? Getting nothing for my hard earned money certainly does..I mean at least you'll know where your down payment or money went?

Should and when rates drop expect an even greater flurry of purchase activity, or worse should banks and the debt crisis spiral into a dollar death debt cycle you could see a huge move of money into real estate as it is the most efficient way to convert significant capital into tangible hard assets.

I cannot speak for all markets but the OR Coast and I5 Eugene corridor are incredibly strong at the moment yet still offers some exceptional growth opportunity and value.

For example an Oceanfront updated estate on acreage or in a premier community for $1M +/- ? Bonus when world ends you're at least in paradise enjoying what you worked for.. lol

I'm not an alarmist but I am a realist. The financial system is not healthy and the same financial game plan of equities and tech stocks are not going to yield the same type of passive returns generations have become accustomed to. The time to adapt is now, real estate is the first and most essential asset class. I firmly believe it's place in portfolios should be prioritized more than ever. When it comes to inflation and the risks associated with the USD there could be more lost by indecision than bad decision.

What are your thoughts? Are the rules of investing and retirement strategies changing?

Post: Is Eugene the next Boulder?

Post: Is Eugene the next Boulder?

- Real Estate Broker

- Oregon & California Coasts

- Posts 676

- Votes 537

If I was a betting man my money would be on Eugene and the I-5 corridor of Oregon becoming the new hot spot for the Pacific Northwest.

I have seen first hand the explosion of growth and missed a few opportunities in the Friendly Area of Eugene in the past 5 years. Notably that in that area particularly there are larger or quality homes often on very large lots (.25 acres of larger) within walking distance to coffee, markets and a community that is well...friendly.

It reminds me most of visiting Boulder in 2015 and saying to myself, 'This place is going to blow up...'

Fast forward nearly 10 years later and I get the same impression with areas of Eugene, Corvallis and Salem.

The reality is that affordable homes in the Pacific Northwest are becoming increasingly unaffordable. Younger investors and generations are looking for an active lifestyle and few areas can compete with the outdoor amenities and facilities of Eugene and the Willamette Valley. It is very centrally located, incredibly accessible (Check out Avelo airlines) I recently took a flight from LA (Burbank) to Eugene direct, non-stop, $100 round trip.

Average home prices have skyrocketed but in my humble opinion there is still considerable value. SFR in prime areas with potential for ADU's or other expansion can still be found in the $350k-400k range. Multi unit properties can still be acquired in the $150-200k/door range and rents are rising.

The University of Oregon has committed hundreds of millions to the future and the 'downtown' has seen recently improvements and investment by national hotels and a new Nike store.

A quick drive around will show you things are happening and the official statistics show tremendous growth with very little developable land to accommodate the population influx. So much so that the State of Oregon has essentially rubber stamped ADU's in cities of sizable populations and the city of Eugene even offers 'pre approved' ADU designs for permitting and construction.

I'm not saying that Eugene offers the same Boulder or Seattle suburb, but the properties are eerily similar for a fraction of the current price points. My sister lives in Bothell and purchased a home 5-6 years ago for roughly $500k, a client made an offer on a beautiful Eugene property last week in the same price range that was superior in every conceivable metric. Her home is likely worth $750-850k present day, I could easily envision this Eugene property being equivalent in value one day.

I am currently working with no less than five buyers from out of state seeking to relocate or invest in Eugene or just beyond.

Affordable homes are seeing multiple offers within days and in comparison to the areas buyers are migrating from (Los Angeles, San Francisco and Seattle) there is a lot of growth potential and value.

I was surprised to learn that the average home price in Boulder is now nearly $1M!? (Boy did I miss that boat..lol)

The average sales price in Eugene is roughly $485k..

Post: Could De-Dollarization accelerate US RE?

Post: Could De-Dollarization accelerate US RE?

- Real Estate Broker

- Oregon & California Coasts

- Posts 676

- Votes 537

The rules of investment of changed. The US dollar is at risk and the element of cash reserves essentially losing value should be beginning to factor into long term investment strategies. News and political affiliations aside, this topic has reached the 'mainstream' and when Mr. Carlson and I agree, it's definitely time to pay attention. For what it's worth this is excellent and accurate reporting... USD

On several occasions this week clients have either jokingly or seriously mentioned redirecting or reallocating their equity portfolios into real estate. Why wouldn't they?

I am NOT a financial advisor, but therein lies some of the value and perspectives of this post, very few financial experts are advising to diversify into hard, tangible assets like precious metals, real estate and commodities.

As real estate valuations have risen dramatically the past several years, there is concern that the real estate market as become 'overvalued' or 'overheated.' I certainly have several significant real estate investors and clients that have temporarily 'paused' their searches in observance of economic conditions, but most of my mentors and $100M+ developer friends are forging ahead.

Obviously I'm a real estate investor/broker/developer and so I also tend to be optimistically conservative in my assessment of real estate markets and opportunities in spite of my memory of 2008 (which feels all too familiar at the moment.) Yet my perspective is that although real estate valuations are increasing, it is at least partially contributed to by the same loss in purchasing power effecting consumers and investors in the grocery aisle.

The risks of investment inactivity have multiplied considerably. Imagine if the government did not step in to bail out SVB and the associated speculative VC company deposits? Those reserves would have been lost and in a free market the repercussions of the implosion would naturally be deflationary. Instead, the decision was made to replace the lost capital and indirectly but not explicitly guarantee all US Bank deposits.

This is obviously not feasible, sustainable or deflationary and creates a further risk escalation in the intensity of a subsequent decline in confidence or ramifications. Furthermore, if those depositors did lose their reserves, hypothetically would any have wondered what if? What if they they had diversified a portion or entirety of those same funds into hard tangible real estate?

That certainly isn't going to disappear, and if the current risk of fiat and equity 'assets' is a 100% loss, is that justifiable? Take a look at your equities performance the past 18-24 months, could those 'returns' errr... loses have been better utilized?

For well qualified borrowers there are some very favorable financing terms available..for example a client recently secured a turn-key Triplex that should return at least $15-20k NET annually with a TOTAL of $50k down payment. Even if those reserves were in a savings account, the presumed interest earned would be roughly .25% and more importantly the buying power of that capital has literally declined since the property was purchased.

When we look closely at the real rates of return of real estate, gold or other 'non-risk' assets over let's say the past 20-30 years we discover extremely marginal differences in yields, but disconcerting volatility in equities.

My point of emphasis is that the same strategies of wealth creation and preservation are rapidly evolving and real estate as part of an investment or retirement portfolio might be more intelligent and essential than ever. The Boomer generation is retiring at unprecedented rates and for the past two decades speculative growth equities have enjoyed a prophetic boom, which many of those same retirees are now utilizing to meet retirement and/or rising cost of living standards. Where will the stock market and other paper assets get the investment capital to support and justify the historic earnings and ridiculous profit to earnings multipliers?

Nearly 15% of the S&P500's value is now concentrated in Apple & Microsoft stock. Why? It's a flight to quality..for safety.

The elephant in the room is that the it's not just equities that are overvalued, it's the currency that all other assets, products and services are priced in. The risk to the US dollar is increasing and the value declining as the de-dollarization of the global economy accelerates.

How else can one explain the unprecedented depreciation in the buying power of their dollars and reserves? A $100 bill doesn't last nearly as long as it used to....last year. Why would $100k or $10M?

If inflation (money supply) continues to increase, or worse, a more rapid decline in the dollar's valuation, where can investors safely invest large quantities of legal capital rapidly? Hmmm...

Since I wasn't around during previous inflationary cycles, anyone with more tenure or experience have any real world input?

I'll have more on specific de-dollarization forces next time..in the meantime we're experiencing extremely strong interest and sales activity of investment properties on the Oregon and California Coasts and silver is up 25% this month.

Post: Total MFR listings on OR Coast is less than 50 - Opportunity or Restriction?

Post: Total MFR listings on OR Coast is less than 50 - Opportunity or Restriction?

- Real Estate Broker

- Oregon & California Coasts

- Posts 676

- Votes 537

Well the secret is out on the Oregon Coast and in my five years in the market there has never been more demand for multi family property investments.

The challenge is that inventory is extremely limited and quality investments with potential are even rare. At present there are roughly 50 active listings from border to border and 5-10% of those have realistic investment potential at their current valuations.

Rental incomes are typically lower than market rent as Oregon's tenant laws were previously quit fairly restrictive for new owners to raise rents (more on that later) and the quality of housing is generally fair at best.

My thesis for the market is that the previous generation of property owners had little or no incentive to modernize or significantly upgrade the housing as demand for higher quality units was more limited in the previous 1-2 decades.

With remote workers, retirees and a general preference for a more abundant lifestyle, those that want to move to the coast are often met with very limited worthwhile options or available lease options in general.

The challenge for investors (and RE Brokers) is the patience and perseverance to continually assess investment potential and the preparation to execute when the proverbial 'opportunity knocks.'

The best investment results for myself and clients have been with creating value by essentially updating dwellings to a superior condition to alternatives. Often the rental returns on both short, medium and long term have been worth the capital investment and result in double or triple the historical income dependent on usage.

Now getting a reliable contractor or team to perform QUALITY work? That's another post entirely..

I think the lack of inventory highlights both a barrier to entry but also a worthwhile mountain to climb.

If the demographic, climate and economic trends that are forecaster the area continue, long term investors could be rewarded in a huge way.

Dollar for US dollar I'll bet the long term value and upside of OR Coast investment compared to other Pacific Northwest markets is at least on parity, assuming you can break into the market.

Anyone else having difficulty finding deals for clients or themselves? I think I know the answer..

Post: Never. Stop. Learning. 20 years around mortgages and just discovered 2x1 Buydowns!

Post: Never. Stop. Learning. 20 years around mortgages and just discovered 2x1 Buydowns!

- Real Estate Broker

- Oregon & California Coasts

- Posts 676

- Votes 537

As primarily a buyer's broker the increase in mortgage rates has clearly made some investments and property purchases prohibitive.

One part of the solution could be a 2x1 mortgage buy down. As I understand it, buyer's can pre pay interest (often with a seller's credit) to obtain an interest rate and mortgage payment that is a full 2%! lower(than the qualifying rate) for the first year and a full 1% lower for the second year. So for example a 6.75% 30 year mortgage would be based on 4.75% for the first year and 5.75% the second often at a cost of 1%ish of the loan amount. Generally these programs are without pre payment penalties and any unused portion during the first 24 months will be reduced off the principal balance if refinanced.

When used in combination with a seller's concession this seems like a very effective way to reduce costs and improve cash flow for the next two years, while optimally inflation settles and interest rates come down. Buyer's can then hypothetically either refinance or keep their 6.75% rate often with a marginal increase in total loan balance.

WIth inventory rising and sellers seeing less activity intensity there is often ample room for concession negotiation. We recently helped a BP investor get a full 3% on a Triplex, no issues with the appraisal.

Although I've been around mortgages since 2004 I was still unfamiliar to the types of buy downs available. Anyone else only aware of the conventional permanent buy down (which is often not worthwhile in the current rate environment)? And often only yields a 1/8 or 3/8 less rate?

Anyone utilizing this for personal or client investment or property purchases?

Other lender tidbits or niche programs that others are seeing utilized more frequently?

Post: New Member Intro from SoCal

Post: New Member Intro from SoCal

- Real Estate Broker

- Oregon & California Coasts

- Posts 676

- Votes 537

Quote from @Jeanelle Ignacio:

Hi everyone! I am so impressed by the wealth of information on this site. I wanted to introduce myself, share my story and hope to network and learn from many of you in this group.

Professionally, I've been a Registered Nurse since 2001. I have focused my career in critical care and enjoy teaching and mentoring future nurses. I currently work full time in the medical device industry but looking forward to my next phase. My husband and I have been involved in several businesses in health care and currently own "The Press" in Pomona, CA which is a screen printing and embroidery business specializing in graduation stoles/sashes.

I consider myself a REI newbie but have always had an interest in this subject. When I was a broke nursing student searching for ways to fund my college and support my child (I was a young mom), I read this book Deals on Wheels by Lonnie Scruggs about flipping mobile homes. Long story short, I was able to purchase a mobile home repo in a great area for 17K and was able to see it at double the price with only a deep clean and interior paint job. That's where I was able to secure my down payment on my first home not too long after finishing nursing school. Granted that was 20 years ago but I decided to focus on my nursing career. Between my husband and I, outside of our primary home in San Dimas, CA we also have 3 SFR rentals. Our best cash flowing rental is a 5 bedroom home we rent by room. Our other rental is with college students, and the third with a family. We've been blessed to really not having any vacancy. Some folks do not like renting to college students, but we've had great success with that. Our business in Pomona also deals primarily with colleges, so we always have so many students looking for housing in our area.

Future goal is to grow our real estate assets. I'd like to retire from my job but be able to just teach part time in a nursing college and help my husband build our businesses. I'd like to focus on increasing cash flow from real estate to eventually retire from my 9-5. I'd like to purchase a 4-plex next but also open to short-term rentals in the Oregon coast area. I look forward to meeting and learning with you all!

Hi Jeanelle,

I'm hyper focused on vacation rentals and investment properties on the OR coast, we keep an up to date list of all eligible/permittable rentals from Brookings North as well as multi units. We helped a BP investor recently close on a six plex in Newport. Astounding property and deal. Feel free to connect for some insight and a few we have on our radar. Cheers.

Post: 30 TOTAL Active Oceanfront Listings in OR - Listing Strategies that actually work?

Post: 30 TOTAL Active Oceanfront Listings in OR - Listing Strategies that actually work?

- Real Estate Broker

- Oregon & California Coasts

- Posts 676

- Votes 537

Hi there,

I'm an active broker on the Oregon Coast that covers a large geographic territory because well...the Coast is basically one 'typical' territory.

Any brokers or developers have listing farming strategies they're willing to share that work?

My experience with mailers isn't the greatest..