All Forum Posts by: Ashlee Hutson

Ashlee Hutson has started 4 posts and replied 58 times.

Post: Sell or Hold Out Texas

Post: Sell or Hold Out Texas

- Real Estate Agent

- Pearland, TX

- Posts 59

- Votes 34

I agree with @Nathan Gesner I would hold onto it for the reasons he outlined. Also, if you don't have a specific use for the money, why sell and have it sit in a bank? What city is your duplex located in?

Post: suggestions for lockboxes or other system to secure keys?

Post: suggestions for lockboxes or other system to secure keys?

- Real Estate Agent

- Pearland, TX

- Posts 59

- Votes 34

I use a keyless entry at one of my rentals and a smart lockbox at another. Both allow access keys to be autogenerated. In addition, I also have a regular lockbox hidden on my property with a key in case the keyless entry devices fail. Here are the links to the ones I have:

https://www.igloohome.co/en-US...

https://www.schlage.com/en/hom...

https://www.amazon.com/Combina...

Feel free to reach out with any STR questions you may have!

Post: Is cashflow possible in a new duplex in greater Houston?

Post: Is cashflow possible in a new duplex in greater Houston?

- Real Estate Agent

- Pearland, TX

- Posts 59

- Votes 34

Quote from @Kenisha B.:

Quote from @Ashlee Hutson:

What's your price range? Also, if you are doing a 3.5% down FHA loan, you will typically have to pay mortgage insurance for either 11 years or the life of the loan.

the Cheapest duplex I've seen (new construction) is $330K. When I do the numbers on this property with 3.5% down I am not making any cash flow. So not sure if this would be a good investment?

Post: Is cashflow possible in a new duplex in greater Houston?

Post: Is cashflow possible in a new duplex in greater Houston?

- Real Estate Agent

- Pearland, TX

- Posts 59

- Votes 34

What's your price range? Also, if you are doing a 3.5% down FHA loan, you will typically have to pay mortgage insurance for either 11 years or the life of the loan.

Post: Aspiring REI doing my homework

Post: Aspiring REI doing my homework

- Real Estate Agent

- Pearland, TX

- Posts 59

- Votes 34

Quote from @Kenisha B.:

Quote from @Ashlee Hutson:

Welcome to the community! I think you’re headed in the right direction as Houston is a great place to begin your investing journey and house hacking in the easiest point of entry. Our job growth and appreciation is ideal for investing. If you haven’t already, I would suggest reaching out to an investor friendly realtor to help you in your search. Best of luck!

Hey Ashlee! Thanks for the advice. My bestie recommended his realtor. She's old school and has been in the business for 3 or 4 decades and owns a lot of investment property. However, she doesn't quite see my vision and isn't familiar with alot of the revitalization happening in houston. Additionally, she doesn't have answers to some of my investing questions. I don't wanna write her off, I mean I've never been to houston so I don't even know if my vision makes sense... not to mention I'm a professional in my field but every now and again I don't know an answer to a question (but I usually get back to people). That said, how would I know if I have a "good" investor friendly realtor? Like what are some things to look out for or to ask?

•Has investment properties themselves

•Has worked with other investors

•Is always learning. Keeping up with the current market trends and learning difference REI strategies.

•Is able to articulate why your approach may or may not work in that specific market.

Also, decades of experience doesn’t make automatically make someone an expert or an expert in what you need.

Post: Aspiring REI doing my homework

Post: Aspiring REI doing my homework

- Real Estate Agent

- Pearland, TX

- Posts 59

- Votes 34

Welcome to the community! I think you’re headed in the right direction as Houston is a great place to begin your investing journey and house hacking in the easiest point of entry. Our job growth and appreciation is ideal for investing. If you haven’t already, I would suggest reaching out to an investor friendly realtor to help you in your search. Best of luck!

Post: Best vacation rental market

Post: Best vacation rental market

- Real Estate Agent

- Pearland, TX

- Posts 59

- Votes 34

@Samuel Filter I wanted to reiterate what some of the other posters have said. Definitely read Short Term Rentals, Long Term Wealth. Also, you don't necessarily need to find something close to you but it is helpful for your first property. At the very least, I would find a realtor you trust in the area you would like to purchase in. That way you can reduce the learning curve somewhat in terms of learning the more desirable or tourist driven areas, the local regulations, and having access to their preferred vendor list of cleaners, handymen, electricians, etc. Also, I would specifically look for areas that already have STR regulations in place. I personally have two STRs in the Galveston area.

Post: Financing issue debt to income ratio

Post: Financing issue debt to income ratio

- Real Estate Agent

- Pearland, TX

- Posts 59

- Votes 34

You could potentially get a DSCR loan for the third but the interest rate will be a little higher and you usually need to put down 25-30%. You can also talk with a lender about utilizing some of the projected long term rental income on the property to qualify. As @Ryan Howell said, lenders will typically use 75% of the projected long term income.

Post: Do you follow 1 percent rule

Post: Do you follow 1 percent rule

- Real Estate Agent

- Pearland, TX

- Posts 59

- Votes 34

Quote from @Michele Velazquez:

Quote from @Wale Lawal:

Quote from @Michele Velazquez:

Quote from @Wale Lawal:

You should have your own investment goals and look for multifamily deals that fits in your investment goals.

Multifamily deals can be analyzed through various matrix like NOI, Cap rates, IRR etc.

Each investor looks for specific matrix depending on their investment goals.

I suggest that you clearly define your criteria and what you are looking for.

Based on the area you choose, a local Investor-Agent can help shorten your learning curve and save you a lot of headaches as they tend to understand the market better.

All the best!

Totally agree. And I do have my investment goals determined. Just had this question. I am still narrowing down the city I am interested in but then of course will be building my core 4

I recommend you look into Houston, TX.

The income and appreciation in Houston are growing at a steady pace.

I personally have rentals in Houston, and the surrounding areas of Spring and Conroe.

Good luck!

That is on my list. Well the last guy said im nutz to do a multi unti, do you think so too? I am new to all this so I am just trying to get cash flow and appreciation but certainly don't have to do mfh if im nuts for it lol

I don't think you're nuts. Especially starting with a small multifamily (2-4 units). It's obviously more challenging to find home run deals right now but that doesn't mean there aren't profitable ones out there.

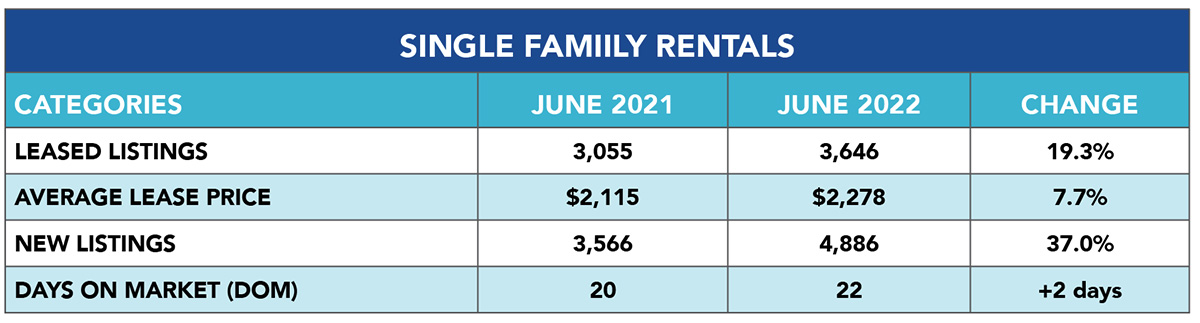

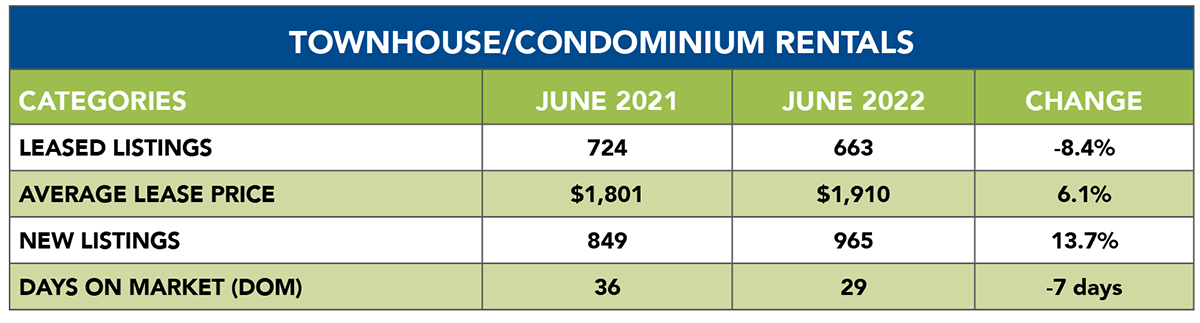

Post: Houston's June Rental Market Update

Post: Houston's June Rental Market Update

- Real Estate Agent

- Pearland, TX

- Posts 59

- Votes 34