All Forum Posts by: Clint Dorris

Clint Dorris has started 5 posts and replied 77 times.

Post: Correct way to evaluate a 4-plex?

Post: Correct way to evaluate a 4-plex?

- Jackson, TN

- Posts 79

- Votes 21

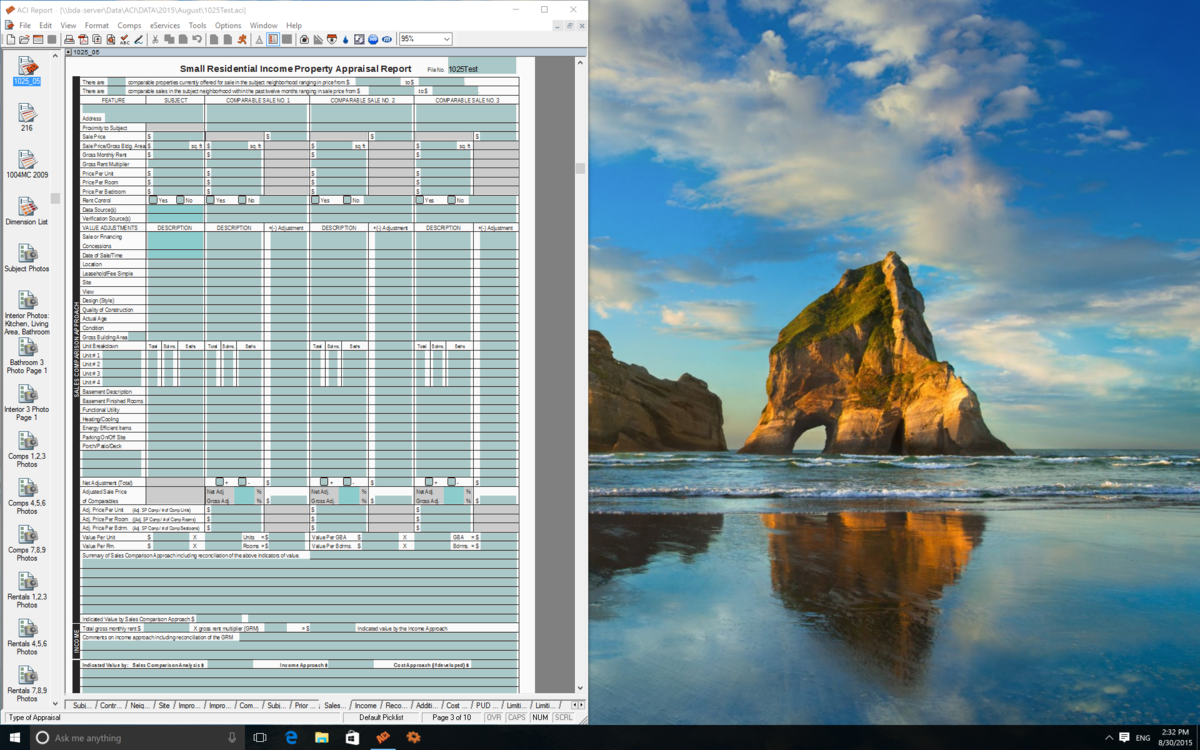

I hope you can read this. This is the main page of the basic appraisal form we used for 2-4 family properties.

The answer is, it depends on your market. Yes, you can figure GRM and Cap Rates, but is that how your market buys? In most markets, yes. But anyone can manipulate any numbers, and GRMs and Cap Rates can be manipulated to make values seem higher. I'm not saying everyone cheats, but that you need to know these numbers for real, not just for hoping your property appears to be worth more. The plus side of a commercial appraisal, is you can control the value by controlling your rents or expenses, thus controlling value based on cap rate. However, in my market people mostly buy 2-4 family based on what other ones are selling for. In a perfect world, all these numbers work together. The GRM or Cap Rate are both numbers that include Sales Price (or value) in the equation, so really even commercial property is based off of sales prices or sales comparison. The Cap Rate is established off of prices (or value, which is where it gets hairy).

The answer is, it depends on your market. Yes, you can figure GRM and Cap Rates, but is that how your market buys? In most markets, yes. But anyone can manipulate any numbers, and GRMs and Cap Rates can be manipulated to make values seem higher. I'm not saying everyone cheats, but that you need to know these numbers for real, not just for hoping your property appears to be worth more. The plus side of a commercial appraisal, is you can control the value by controlling your rents or expenses, thus controlling value based on cap rate. However, in my market people mostly buy 2-4 family based on what other ones are selling for. In a perfect world, all these numbers work together. The GRM or Cap Rate are both numbers that include Sales Price (or value) in the equation, so really even commercial property is based off of sales prices or sales comparison. The Cap Rate is established off of prices (or value, which is where it gets hairy).

Many people think appraisers use one method for residential and one for commercial, but we are actually required to consider all three methods in every appraisal: sales comparison, cost approach, and income approach.

You can see on the attached sheet, the main "grid" is devoted to the sales comparison approach. At the top you see the Gross Rent Multiplier. At the top and bottom, you see price/room, price/bedroom, price/unit, as well as value/room, price/room and even value per Gross Building Area. It is our job as appraisers to determine which one of those is most relevant for each individual appraisal, and that number can help us decide our sales comparison approach. Below that you can see the Gross Monthly Rent X Gross Rent Multiplier. The rent can be the actual or market rent, and there is another page or form where we typically look at that as well as expenses and maintenance. You will also see the cost approach. Typically, this won't matter on residential or commercial rentals, but it i

s slightly possible. Once I have the Income Approach and the Sale Comparison Approach, I do the Reconciliation. This is the part of the appraisal where I decide and explain how I came up with my value. Again, in a perfect world, these number support each other. But we all know real estate is not perfect.

Hopefully this is helpful. Let me know if you have questions.

Post: Broker, Appraiser, Investor

Post: Broker, Appraiser, Investor

- Jackson, TN

- Posts 79

- Votes 21

Hey Brian, I'm an appraiser and investor just north of you. I do some work in the Pickwick area, and I know some North Mississippi appraisers go there to. Let me know if you ever want to talk, or if I can ever help you.

Hey @Konstantinos Zaferatos. I'm also an appraiser and investor. Let me know if you ever need anything.

Post: Refinishing Concrete Floors - Concrete Foundation

Post: Refinishing Concrete Floors - Concrete Foundation

- Jackson, TN

- Posts 79

- Votes 21

Post: Re-learning Investor moving to Jackson, TN

Post: Re-learning Investor moving to Jackson, TN

- Jackson, TN

- Posts 79

- Votes 21

Phoenix Management/Investments owns a bunch of them, and I know those guys. Actually, only a handful are out of town, but I've failed getting in touch with them. All the local owners are some of the main investors in the area, and all but possibly one are willing to do something.

Its interesting because I don't think most of the tenants are that bad. The crime seems to be done by non residents, possibly companions or boyfriends of tenants. There were just a few crime stories, and it made me want to change it. It is right in the middle of town, and there is no reason it should be rough.

Post: Re-learning Investor moving to Jackson, TN

Post: Re-learning Investor moving to Jackson, TN

- Jackson, TN

- Posts 79

- Votes 21

I like that HOA. I own one on Brianfield. The rents are actually similar, but no HOA and worse cooperation makes the area look worse and be worse. I'm attempting to get all the owners together to do something, but I've hit a standstill.

Post: Re-learning Investor moving to Jackson, TN

Post: Re-learning Investor moving to Jackson, TN

- Jackson, TN

- Posts 79

- Votes 21

I agree with @David Cook

The 2% stuff can be good if you absolutely must have cash flow now. But it will still need repairs, and other stuff can be better long term.

Some guys have just started a local investment group called JAREIA. You should be able to find it on Facebook or Google. I'm an appraiser and an investor in this area. David is an investor, too. You should be in good hands. Jackson is a great place to live and invest inexpensively.

Post: Investors in TN - may need your help on a deal

Post: Investors in TN - may need your help on a deal

- Jackson, TN

- Posts 79

- Votes 21

I do appraisals in Trenton and in Gibson County. I'm in the neighboring county (Madison).

Also, I know @Blake Garcia is from that area. Let me know if I can help you.

I'm leaving town for the weekend in the morning, but I'll be on the road all day. You can get my info from my website on my profile.

I can put you in touch with all the local closing attorneys.

Post: 4plex for $50k - total monthly rents $2200 - whose lending?

Post: 4plex for $50k - total monthly rents $2200 - whose lending?

- Jackson, TN

- Posts 79

- Votes 21

Sounds like a great plan. After refi, you can have the property with equity and no real skin in the game.

I would also consider permits and codes, and give yourself a couple of months to get it rented. Things come up, so make sure you can cover the vacancy, holding costs, insurance, utilities for a while.

Also, I would have a sign, or at least some cards over there as you get working. So many people we see you are working on it and come in and ask the workers. They need to know who to tell them to call.

Post: Do investors have a need for this service?

Post: Do investors have a need for this service?

- Jackson, TN

- Posts 79

- Votes 21

Most appraisers would kill me for saying this, but here goes.

If she's looking to grow her business, particularly with investors, I suggest she become a sounding board for investors. I'm not talking about doing appraisals or CMAs. I'm talking about getting to know these people, they can call her, and she can pull comps and give them her opinion for no charge (not an official appraisal).

It seems that many investors look down on appraisers, but like investors, some appraisers deserve their rep and some don't. I can't figure out why an investor wouldn't want someone they can call for a second opinion. I look at houses and comps all day, every day.

Now, I know you are looking for immediate money, but for long term business this could really help. All investors in my area know they can call me when they have a question. I had 2 guys last years buy a package of houses, and they requested to use me. I got 10 appraisals in one week because of this. Despite what many say, banks working with investors can sometimes send an appraisal to the appraiser they want.

Also, this could help you on investing deals in the future. It is really a win-win-win. Plus, if she could feel out some paperwork based on these conversations, she might could find a way to get experience hours for it.