1. Here is the answer to your first one:

- LLC Distribution

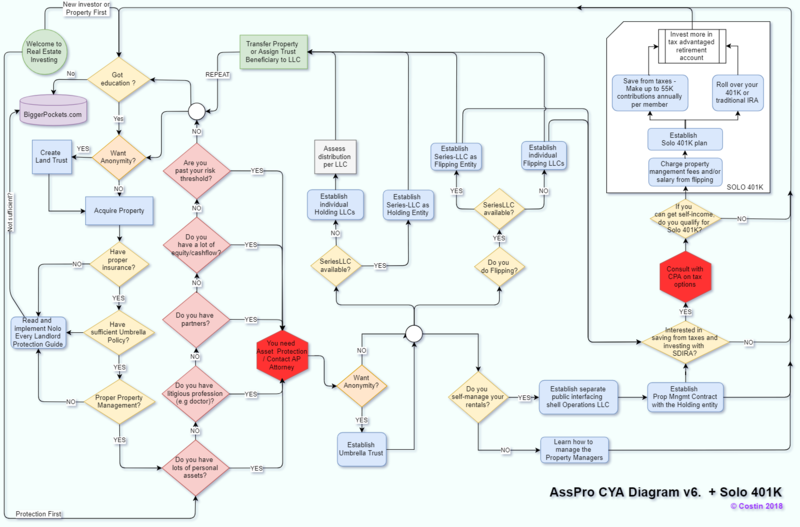

You should look into Series-LLC and see if that's an option for you - then you don't need to worry about this question, as you can place a property in its own children Series-LLC that you can form when needed.

As for distribution, you can have one or more per LLC, and that depends on multiple factors:

- property class - you might not want to mix A class property with a D class property in the same LLC, due to different tenant level

- cash flow - you might want to keep your cash flow cow separate from the ones that barely produce

- equity - you might want to keep the one with large equity in its own LLC while you can group the ones with little equity in another LLC (let's say you have one with 50K equity in its own LLC and 3 other each with only 10K in another LLC, till their equity grows to your risk threshold when you move them out in their own LLC).

- number of units (in the case of MF)

- location of real estate

The investor has to decide what mix is optimal for their situation.

You should also look into these threads:

how-many-properties-do-you-have-in-your-llc

separate-llc-vs-one-llc

break-portfolio-into-mltiple-llcs

llc-for-each-individual-rental-property

But before answering the "per LLC distribution" question you should ask yourself "do you need an LLC?" - in most cases, as a new investor you should concentrate on accumulating the wealth worth protecting first and answer that question later.

2. Here is a short answer to your 2nd question: Get a line of credit, not a home equity loan. Read David Green BRRRR book.

3. General advice for taking the leap?

My favorite: "Ignorance is bliss. Knowledge is power, but also a burden, leading to analysis paralysis. The cure for both: action, progress(ion), not perfection."

Want more general advice to answer a general question?

MOTIVATION

Know why you're doing everything you're doing.. AKA Know your WHY..

Good things may come to those who wait, but only the things left by those who hustle.. -Abraham Lincoln (?)

Some people want it to happen.. Some wish it would happen.. Others make it happen.- Michael Jordan

"Things don't happen to you, they happen because of you."- Grant Cardone.

The only way things will change for you is if YOU change !

"Fortune Favors The Bold."

YOUR NETWORTH IS YOUR NETWORK

The richest people in the world look for and build networks.. Everyone else looks for a job.

You are the average of the 5 people you spend the most time with.. If you want to elevate your life, improve on who you spend most of your time with.

"If you are the smartest one in the room, you are in the wrong room."

"People don't care what you think until they know how much you care."

"50 percent of a deal is better than 100 percent of no deal."

ACTION, PROGRESS, NOT PERFECTION

"The best time to start was yesterday.. The next best time is now."

"You should have started many years earlier."

To Avoid Criticism: Say Nothing, Do Nothing, Be Nothing + You miss 100% of the shots you never take.

"Learn to forgive yourself for the things you didn't know before you knew them."

Don’t wish it was easier .... wish you were better! + "If it was easy, everyone would do it."

"On paper every strategy is easy, in the real world every strategy is hard"

"What you know is your greatest wealth... What you don't know is your greatest risk... There is always risk, so learn to manage risk instead of avoiding it"

“Action beats preparation, and over preparation is the Achilles heel to success”.. + Luck is what happens when preparation meets opportunity... + The harder you work the luckier you get!

LONG TERM VISION & DELAYED GRATIFICATION

I skate to where the puck is going to be, not where it has been.. - Wayne Gretzky

The day you plant the seed is not the day you get the fruit.

Discipline is choosing between what you want now, and what you want most.. - Abraham Lincoln

Discipline equals freedom - Jocko Willink

BUYING and SELLING

When’s the best time to plant a tree? 25 years ago... When’s the second best time? Today!

Don't wait to buy real estate, buy real estate and wait.

"Buy at the funeral, sell at the wedding" + When investing, pessimism is your friend, euphoria the enemy... - Warren Buffett

"Fearful when others are greedy and greedy when others are fearful" - Warren Buffet

The Best time to buy real estate is NOW... The Best Time to sell real estate is NEVER.

"Never ever sell real estate.. Ever.. [but never say never, so...] Unless it's to buy better real estate"

You make your money when you buy a deal.

Know when to walk away - the numbers don't lie! + If it’s not a Heck Yeah, then it’s a No! (keeps me from jumping in on so-so deals/properties/etc)

This holds especially true when starting out: The best deal you can do is the one you decide to walk away from.

First three rules of real estate investing: location, location, location.. + Location: the only thing about a house you can't change.

If your offer has a bunch of zeroes in it, it will be shot down like the balloon it appears to be.. Make it at least appear like you did a detailed analysis.

It’s not the quantity that matters it’s the quality! And due diligence for the latest deal is more important than the deal itself!

FAILURES / MISTAKES

Over-improving rentals and replacing things too soon (I like nice things – but my rentals don’t need them!).

Failure to properly vet contractors.

Failure to conduct proper background checks on tenants.

Two quickest ways to lose money in real estate:

- Overpay for a crappy property

- Overpay for an awesome property

"A rising tide lifts all boats... You can't tell who's lucky and who's good, unless you watch what happens when the tide is receding."

BUSINESS

Being an entrepreneur and starting up a business is like diving off a cliff and building an airplane on the way down.

"Look at dollars, not dimes" --- in reference to spending money/paying fees to grow

Identify what you do best, and hire the rest.. [Do your best, forget the rest]

"Learn to work on your business, not in your business"

Don’t do business with people you can’t sue” ..... different way of saying “don’t do business with friends and family”.

"Sophisticated investors get 12% at least... Average range of stable returns are 12-20%...once you fall below that, you reposition/sell/refi."

"ABC...... Always Be Closing"

“Speak softly, and carry a big portfolio!”

After Years of Real Estate Investing, THIS is What I Regret or Would Do Differently

0.. I Regret Not Starting My Real Estate Business Earlier

0.. I Regret Not Delegating Tasks Sooner

0.. I Regret Not Using Leverage in a Bigger Way

1.. Seek OPK (Other People’s Knowledge) sooner.

2.. Get serious about investing in real estate sooner.

3.. Let go of wrong assumptions.

4.. Learn more about the possibilities.

5.. Be wary of the naysayers.

6.. Surround myself with positive people, doing positive things with their lives, for the right reasons.

7.. Trust in God, trust in yourself, and trust in your partner more (your life and business partner).

8.. Create a strong team and delegate more.

9.. Review and reflect more often.

Nothing is impossible, the word itself says "I'm possible"

"Stop talking and just go make some offers... There's saying and then there's doing.. Luck takes action!"