All Forum Posts by: David Kelly

David Kelly has started 4 posts and replied 349 times.

Post: Refi attempted but ran into Safe Harbor Law

Post: Refi attempted but ran into Safe Harbor Law

- Lender

- Nationwide Lender

- Posts 391

- Votes 140

Hello, can you explain the Safe Harbor Law? I haven't ran into this before and I am curious if this is a fannie/freddie guideline or if it is just the lender that wont proceed.

Post: Fannie Mae tightens lending standards on Investment Homes

Post: Fannie Mae tightens lending standards on Investment Homes

- Lender

- Nationwide Lender

- Posts 391

- Votes 140

My interpretation is that there is an Increased risk and that is why they are doing it. If they start making more money on the interest then they can more easily handle a potential change in that market in the future. Just as the info I have read states, they are limiting their portfolio to 7% being second homes and investment properties. I wonder what their current holdings of this is? If you remember, several months ago they put an extra .5% charge (adverse market refinance fee) on specific refinances, including cash out refinances. That is still in place to this day when I am running rates.

Post: HELOC VS CASHOUT REFI ? (BRRRR)

Post: HELOC VS CASHOUT REFI ? (BRRRR)

- Lender

- Nationwide Lender

- Posts 391

- Votes 140

If you pay cash for the next property then you will not have to wait the 6 months to refinance it. If you pay cash and there is borrowed money to aquire that cash, then that needs to be paid off before you get any additional cash against the property.

Post: First time home buyer program in FL

Post: First time home buyer program in FL

- Lender

- Nationwide Lender

- Posts 391

- Votes 140

Post: Cash out refinance in an LLC

Post: Cash out refinance in an LLC

- Lender

- Nationwide Lender

- Posts 391

- Votes 140

Hi Jeff,

To get the best terms typically you will want to go conventional financing. Doing this you will need to get the property back into your personal name by doing a quit claim deed. Its a simple document and is very inexpensive. Once the refinance is done you have the freedom to put the property back into the LLC with another quit claim deed. This is a very common practice and is not hard to do, typically a lender can help you facilitate it. Hope this helps, let me know if you have any other questions.

Post: 17 and want to prepare to get my first rental property

Post: 17 and want to prepare to get my first rental property

- Lender

- Nationwide Lender

- Posts 391

- Votes 140

Hi Tucker,

The first thing as a lender I would ask is how long of a work history do you have? Lenders typically need 2 years if you want to go the conventional financing route. You'll want to see what you can qualify for as well by having a lender do an income calculation. Once they have that established they will run credit and figure out your DTI.

Post: Looking for some advice here

Post: Looking for some advice here

- Lender

- Nationwide Lender

- Posts 391

- Votes 140

There are programs available to lenders like myself that are able to run a credit simulator. This will show you what needs to be done to get your score up quickly, with the available amount of money that you currently have. You would be surprised how quickly a fico score can jump by 50-100 points if done correctly. Have you ran rates yet with any lenders to see what is available to you with that credit score?

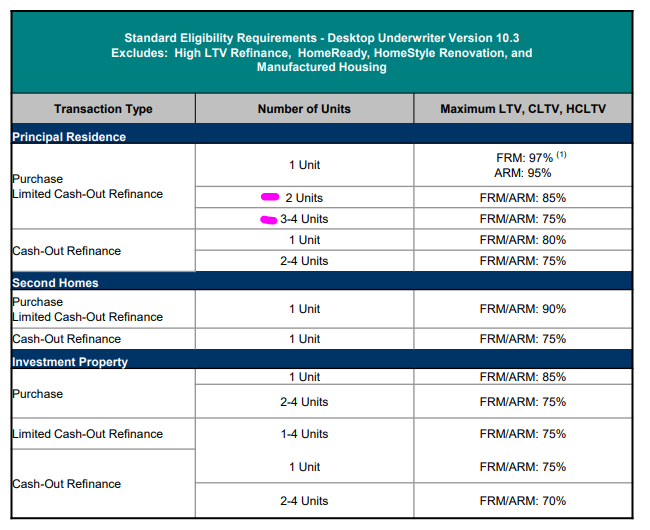

Post: 80% LTV Refinance on 3 family

Post: 80% LTV Refinance on 3 family

- Lender

- Nationwide Lender

- Posts 391

- Votes 140

Post: Can I do 2 refi's at the same time? Rental property & Home Jumbo?

Post: Can I do 2 refi's at the same time? Rental property & Home Jumbo?

- Lender

- Nationwide Lender

- Posts 391

- Votes 140

@Joseph James

Doing both at once is not an issue. And actually I would recommend closing on both at the same time to make it easier. Your best bet is to get this quoted out from a few lenders to make sure that everyone’s closing costs and rates are in line. Some will want to charge for a rate and some may not. Ask about turn times as well because there is a range of time frames with different lenders right now. Feel free to reach out with any questions.

Post: 75% + LTV Lenders in Norfolk area

Post: 75% + LTV Lenders in Norfolk area

- Lender

- Nationwide Lender

- Posts 391

- Votes 140