All Forum Posts by: David Kelly

David Kelly has started 4 posts and replied 349 times.

Post: Is a Cash Out Refinance the same thing as Delayed Financing?

Post: Is a Cash Out Refinance the same thing as Delayed Financing?

- Lender

- Nationwide Lender

- Posts 391

- Votes 140

Another note to add, delayed financing with fannie/freddie only allow you to get your purchase price plus closing costs. You cannot get any more than that. Also, if you plan to use delayed financing and you had recieved some of that cash to buy the home from a HELOC, or some sort of other loan that is not attached to the property, that has to be paid back first, and the remaining cash is then available to you. This can all be done within the loan. You need to source where the cash payment was from, which is why borrowed money from somewhere else will come to light.

for example:

50k cash

100k heloc funds used

bought the home for 150k plus 5k in closing costs - total of 155k

You would only be able to receive 55k cash back. But the heloc would be paid off during the process as well.

Post: C/O Refi or Refi/HELOC

Post: C/O Refi or Refi/HELOC

- Lender

- Nationwide Lender

- Posts 391

- Votes 140

How much cash will the c/o refinance net you at closing? You also need to look at total costs to do the loan beyond the points you are paying for the rate.

Post: Info needed for duplexes

Post: Info needed for duplexes

- Lender

- Nationwide Lender

- Posts 391

- Votes 140

Lets take a look at the property, please PM me the address and I can help determine if it is FHA approved.

Post: BRRRR vs Using Loan without refinance

Post: BRRRR vs Using Loan without refinance

- Lender

- Nationwide Lender

- Posts 391

- Votes 140

From a lenders eyes the first thing I would make sure you are doing is figuring out where your current DTI is and making sure there is room to add additional mortgages with or without renters in that property.

Post: Cash out refi on 20 year fixed for investment property?

Post: Cash out refi on 20 year fixed for investment property?

- Lender

- Nationwide Lender

- Posts 391

- Votes 140

20 yr and 30 yr rates usually are not to far off from each other. If you can afford the 20 year payment, even with an unforeseen financial hardship then it may make sense to save on the interest. Depending on how long you will keep the property will determine if the cost to buy down the rate will make sense. You need to look at how much you will save vs the time it will take to recoup that money. That all ties in to your financial status and what else you might want to do with that money.

Post: Owner Occupy with Lowest Down Payment

Post: Owner Occupy with Lowest Down Payment

- Lender

- Nationwide Lender

- Posts 391

- Votes 140

Post: first time homebuyer soon

Post: first time homebuyer soon

- Lender

- Nationwide Lender

- Posts 391

- Votes 140

You do not need 20% down for a duplex. FHA will allow you to purchase up to 4 units with only 3.5% down and rent out the other side. You must however live in one of the units for a minimum of 1 year. Reach out if you have any other questions.

Post: I need a conventional loan using my IRA funds

Post: I need a conventional loan using my IRA funds

- Lender

- Nationwide Lender

- Posts 391

- Votes 140

@Brian Eastman I may have read that wrong as he stated

"I plan to use some of my IRA funds as a down payment".

Either way, maybe the information will help someone that reads this. Thank you.

Post: I need a conventional loan using my IRA funds

Post: I need a conventional loan using my IRA funds

- Lender

- Nationwide Lender

- Posts 391

- Votes 140

Vested funds from individual retirement accounts (IRA/SEP/Keogh accounts) and tax-favored retirement savings accounts (401(k) accounts) are acceptable sources of funds for the down payment, closing costs, and reserves. The lender must verify the ownership of the account and confirm that the account is vested and allows withdrawals regardless of current employment status.

Post: Cash out REFI new construction

Post: Cash out REFI new construction

- Lender

- Nationwide Lender

- Posts 391

- Votes 140

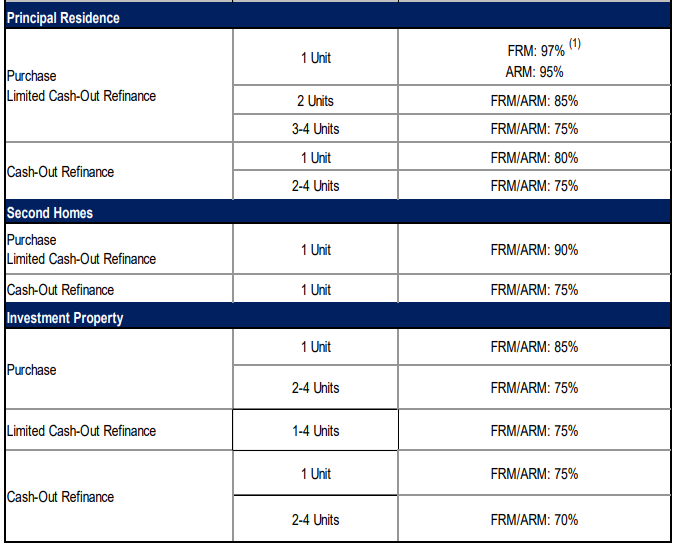

There will need to be an appraisal to determine the value of the home. Once that is done, the cash out amount will be determined by the LTV guidelines with the type of financing you use.