All Forum Posts by: David Kelly

David Kelly has started 4 posts and replied 349 times.

Post: FHA Refinance To A Conventional Loan ?

Post: FHA Refinance To A Conventional Loan ?

- Lender

- Nationwide Lender

- Posts 391

- Votes 140

Hi Kyle,

That's a fantastic rate, I assume you bought it down? What do you think the property is worth now vs what you owe? You can possibly remove mortgage insurance, but you would want to take a look at the differences in the interest savings vs how much MI you would remove.

Post: What kind of loan should I look for

Post: What kind of loan should I look for

- Lender

- Nationwide Lender

- Posts 391

- Votes 140

Is this an investment property? @John Shea

Post: Lenders! Share with us those magic numbers!

Post: Lenders! Share with us those magic numbers!

- Lender

- Nationwide Lender

- Posts 391

- Votes 140

I suggest looking at a few different lenders based on the same numbers. Give the same info to the lenders and let the quotes tell all... You will want to get a breakdown of the closing costs as well. If someone has lower closing costs, then this would allow you to buy down the rate further with the additional money.

Not all of this may be needed, but some of this information is asked for. There are different investors that will pop up if I enter all of the information.

- Property type/number of units/zip code

- Loan amount

- Property value

- Fico score

- Self employed? Or not.

- Will you be escrowing for taxes and insurance?

- DTI ratio? You probably don't know this number unless you have been qualified already

Post: I have refinanced wrong any suggestions?

Post: I have refinanced wrong any suggestions?

- Lender

- Nationwide Lender

- Posts 391

- Votes 140

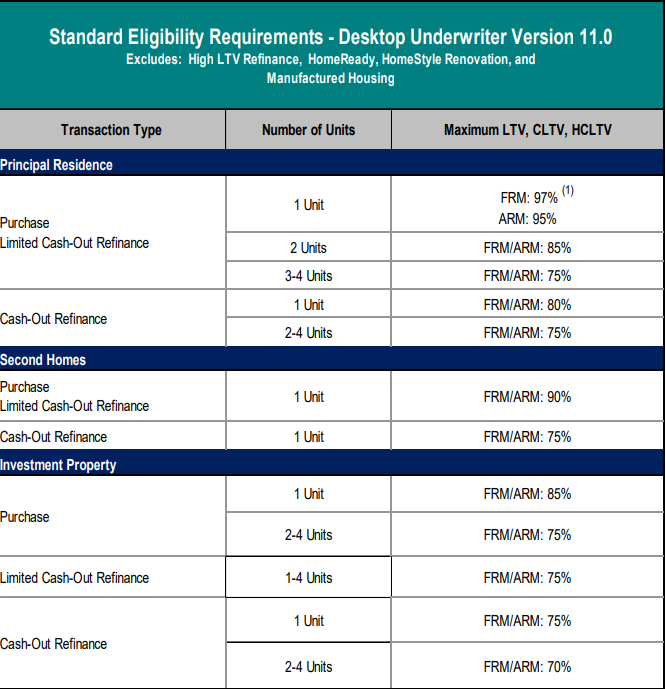

Is your next purchase going to be an investment property? How many units? If you were trying to get 10% down, there may be an option for a second home, but this would only work if it was a 1 unit.

Post: Minimum down payment for multifamily

Post: Minimum down payment for multifamily

- Lender

- Nationwide Lender

- Posts 391

- Votes 140

Post: Any recommendations on bank to use for cash out refi?

Post: Any recommendations on bank to use for cash out refi?

- Lender

- Nationwide Lender

- Posts 391

- Votes 140

Hi @Isaac Lopez I will PM you.

Post: Investment Property Financing right at 50% DTI

Post: Investment Property Financing right at 50% DTI

- Lender

- Nationwide Lender

- Posts 391

- Votes 140

Is your primary residence a 2-4 unit property? Or is it classified as a 1 unit? 1 unit properties would only qualify for "boarder income" (google "boarder income fannie mae"). Also, with short term rental income you would need to show at least 1 years worth of income to be able to use it if it was on an approved property. Since you bought in May, then you would not qualify with that.

Post: Partnership - Financing Issues?

Post: Partnership - Financing Issues?

- Lender

- Nationwide Lender

- Posts 391

- Votes 140

There is no way to tell without a lender running the numbers for you and doing income calculations based off of the numbers you are looking at with the purchase. Both borrowers dont need to supply income info if just one of the borrowers has enough to cover the DTI requirements. As far as credit goes, one borrower can hurt the approval by having a low score. I suggest having someone take a look at everything so you know for sure you would need to look at alternative options.

Post: What are the rules for using other's money in a down payment?

Post: What are the rules for using other's money in a down payment?

- Lender

- Nationwide Lender

- Posts 391

- Votes 140

Seller concessions - Assuming the appraisal will support a higher purchase price, you can offer more and have them give you seller credits towards the closing costs.

Gift funds - a relative, defined as the borrower’s spouse, child, or other dependent, or by any other individual who is related to the borrower by blood, marriage, adoption, or legal guardianship. Or your fiancé is eligible as well.

Borrowed money is not allowed for the down payment with conventional financing.

Post: Refinancing our Home

Post: Refinancing our Home

- Lender

- Nationwide Lender

- Posts 391

- Votes 140

Hi David,

One big factor in this would be what current LTV you are at. The max LTV with conventional financing would be 80% on a cash out. What do you owe vs the homes value?