All Forum Posts by: Eric Veronica

Eric Veronica has started 9 posts and replied 578 times.

Post: Will utilizing seller financing show up on my future DTI?

Post: Will utilizing seller financing show up on my future DTI?

- Lender

- Cleveland, OH

- Posts 585

- Votes 434

The seller financing will count against your debt to income ratio for future purchases. Even if you don't disclose the debt there are quite a few ways that the lender will know.

1. Whether you file your income taxes on a personal schedule E, a partnership 1065, or a 1120S Corp, the interest expense will show up as a deduction. Any underwriter with half a brain is going to question how you are deducting interest from a property that you are stating is free and clear.

2. Lenders run a public record search that picks up a lot of things beyond what you will see on a credit report. If the seller providing financing is correctly filing a mortgage on the property then that mortgage should be recorded with the county recorder/register of deeds.

3. If the underwriter sees a consistent monthly deduction coming out of your bank statements then they could ask for an explanation.

The good news is that if you are investing in Ohio then it is very likely that you will be cash flowing so hopefully the rent will more than cover the monthly debt.

Post: HELOC on an investment property?

Post: HELOC on an investment property?

- Lender

- Cleveland, OH

- Posts 585

- Votes 434

You may want to look through the local message board of bigger pockets. You are correct that HELOC on investment properties are not super common. Often times you can find local smaller credit unions or banks that will offer HELOC financing on investment properties.

Post: Interest Rate and Annual Percentage Rate Question

Post: Interest Rate and Annual Percentage Rate Question

- Lender

- Cleveland, OH

- Posts 585

- Votes 434

The APR also includes an up front one time PMI equaling 1.75% of the loan amount. FHA loans do offer pretty awesome rates but in most cases there are fees that will make the FHA option more expensive in the long run. The is especially true if you are a person who has has credit scores north of 740.

Have you researched the conventional renovation program called Homestyle? May be worth your time.

Post: Can lenders remove late payments from your credit history?

Post: Can lenders remove late payments from your credit history?

- Lender

- Cleveland, OH

- Posts 585

- Votes 434

If you can prove that the payments were not actually late then you have the ability to formally dispute those late payments with the credit bureaus. Unfortunately, it sounds this may not be the case. Time is likely your only remedy.

Post: Which Closing Costs Can I Contest / Reduce?

Post: Which Closing Costs Can I Contest / Reduce?

- Lender

- Cleveland, OH

- Posts 585

- Votes 434

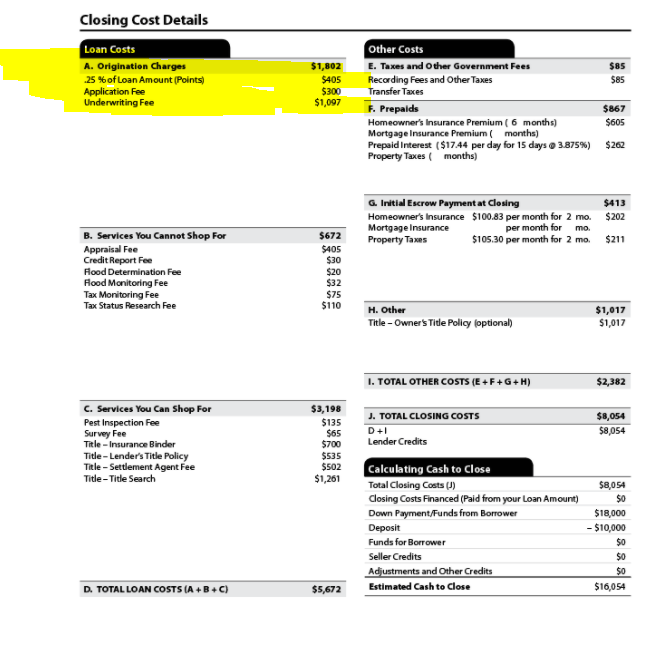

Ask for a loan estimate. Make sure to compare the costs that the lender can control which is actually far fewer than you may think. The lender controls the rate, term, and origination charges. These costs should be on page 2 of the loan estimate under "origination charges". I included a snip of a sample loan estimate or "LE" below. I also included a link to the CFPB which provides some detail about how to read a loan estimate.

https://www.consumerfinance.gov/owning-a-home/loan-estimate/

Post: Can't Get Any financing

Post: Can't Get Any financing

- Lender

- Cleveland, OH

- Posts 585

- Votes 434

Please dont take offense to this... but I am going to be blunt. A 611 credit score is very bad.

Try 100 lenders.... Try 1000 lenders.... Try 1 Million lenders. You can call every bank, credit union, co-op, and broker in every state in the US. 99% of them will not have any types of financing. The 1% of lenders that might have a program for you are likely to be very expensive and will cut deeply into your profit margin.

Your next investment should be in yourself and your credit score. Fix that that and your financing world should open up some. Stay away from all the free online scores. Start with https://www.annualcreditreport.com/index.action

This site allows you to pull your credit report once per year directly from the three bureaus that mortgage lenders use.

Good luck!

Post: How to use a Fannie Mae loan

Post: How to use a Fannie Mae loan

- Lender

- Cleveland, OH

- Posts 585

- Votes 434

You are not required to apply jointly with a spouse. If you and your spouse apply individually then you could both obtain 10 Fannie Mae loans each.

Post: Refinance While I have a HELOC

Post: Refinance While I have a HELOC

- Lender

- Cleveland, OH

- Posts 585

- Votes 434

Couple things to consider

- if you are getting a new conventional loan and subordinating the existing HELOC then the interest rate you are getting on the new 1st mortgage will be higher than it would be if the HELOC didnt exist. Fannie/Freddie charges pricing adjustments to 1st loans when there is a 2nd lien. The actual adjustments vary depending on the LTV

- 4% on an investment property isnt a bad rate at all

- At the time you initially opened the HELOC was the home a primary or an investment property? If the home was initially a primary when you opened the HELOC and then you converted the home into an investment at a later date, the lender may deny the subordination request and also close it entirely. If the home was used as an investment at the time you originated the HELOC then I think you should be ok.

Post: Seller Contributions on Investment Properties

Post: Seller Contributions on Investment Properties

- Lender

- Cleveland, OH

- Posts 585

- Votes 434

2%

Post: Banks doing 75% LTV?

Post: Banks doing 75% LTV?

- Lender

- Cleveland, OH

- Posts 585

- Votes 434

Sorry, overlay means additional, more restrictive rules imposed by a bank bank beyond standard Fannie Mae Conventional guidelines. Conventional Fannie Mae guidelines still allow for 75% cash out on investment properties.