All Forum Posts by: Eric Veronica

Eric Veronica has started 9 posts and replied 578 times.

Post: Banks doing 75% LTV?

Post: Banks doing 75% LTV?

- Lender

- Cleveland, OH

- Posts 585

- Votes 434

Thats an overlay. You should still be able to find plenty of banks offering 75% LTV cash out.

Post: Seeking Advice - Conventional Financing for Self Employed

Post: Seeking Advice - Conventional Financing for Self Employed

- Lender

- Cleveland, OH

- Posts 585

- Votes 434

I would ask for 2018 and 2019 personal and business tax returns along with a YTD P&L.

Audited P&L are not very common.

The 12 months of reserves is not something that I have heard most lenders requiring however many lenders are adding overlays (additional rules) for self employed and investment property income.

Post: Seeking Advice - Conventional Financing for Self Employed

Post: Seeking Advice - Conventional Financing for Self Employed

- Lender

- Cleveland, OH

- Posts 585

- Votes 434

Ill push back on a couple things you said.

Self employed W-2 income - Whether you are S-Corp self employed with a W-2, or without a W-2 there isnt much of a difference. If every year your business pays you a 100k W-2 and your business income breaks even then you as a borrower make 100k per year . If your business pays you zero W-2 income but your business net income is 100k with a k-1 reflecting a 100k distribution then you still make 100k per year. (assuming you own 100% of your s-corp)

Impossible to get loans as a self employed borrower - it is definitely more challenging to get a loan as a self employed borrower than is was 6 months ago however it is definitely not impossible. If your self employed revenue and income has been negatively impacted by Covid-19 then it may be very challenging to get a loan. If your business has not been negatively impacted by Covid-19 and you can prove this with a P&L and corresponding bank statements then I am not sure what the issue is.

Post: Pre-Approval w/o a Credit Check?

Post: Pre-Approval w/o a Credit Check?

- Lender

- Cleveland, OH

- Posts 585

- Votes 434

Preapproval without a credit inquiry is not a thorough preapproval. The credit score impact of a hard inquiry is very overstated, especially if your score is in the 800's.

Once your score is above 740 you will qualify for the best the rate/points combination (conventional Fannie/Freddie mortgage)

Post: Know of a 5% Down Conventional Loan Product?

Post: Know of a 5% Down Conventional Loan Product?

- Lender

- Cleveland, OH

- Posts 585

- Votes 434

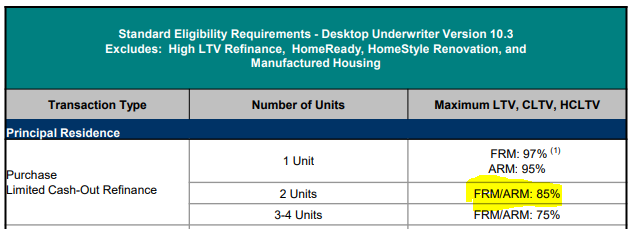

@David M. The duplex changes everything. Below is a snip from the Fannie Mae eligiblity matrix.

Post: Im having issues with BRRRR strategy

Post: Im having issues with BRRRR strategy

- Lender

- Cleveland, OH

- Posts 585

- Votes 434

Have the lenders told you why you are unable to qualify for cash out refinances?

Post: Know of a 5% Down Conventional Loan Product?

Post: Know of a 5% Down Conventional Loan Product?

- Lender

- Cleveland, OH

- Posts 585

- Votes 434

Probably unlikely for a conventional loan. How long ago did you check the county income limits? The maximum income limits just increased around 4%-5%. Maybe if you were just over the income limit for homepossible, this could get you back under.

Good luck!

Post: Lender changing down payment to 30% 3 days before clos

Post: Lender changing down payment to 30% 3 days before clos

- Lender

- Cleveland, OH

- Posts 585

- Votes 434

@Kevin Lisewski that does seem a little odd that your lender would order the condo questionnaire 6 days before closing. Typically that one one of the first things I do as a lender.

What I can tell you is that gathering condo questionniares, by laws, and budgets from management companies that facilitate the delivery of these documents is one of the biggest headaches I encounter. A lot of management companies take FOREVER to complete the questionnaire. Then once they do complete the questionnaire there are often mistakes. Many management companies will refuse to complete the standard Fannie questionnaires and instead will only send their company proprietary questionnaires. These questionnaires often do not answer the necessary questions. Other times the proprietary questionnaires will answer extra unnecessary questions which the underwriter never asked for, but if they are voluntarily disclosed, the underwriter often cannot pretend they dont see it. For example, One time I did a loan in condo complex near a very large automotive plant. Many of the condo owners worked at the auto plant. A month earlier the auto company announced that a lot of layoffs would be coming throughout the company. For some reason the gal at the management company added a note to the questionnaire stating "There are currently no delinquencies on monthly HOA fees however the impending layoffs could create future problems. I think half the owners might go late" She had no inside information and was purely speculating but when the management company is told that they are expecting a 50% HOA delinquency default rate the underwriters are going to ask questions. Ultimately we did the loan but that definitely created additional steps to get the loan close.

And heaven help you if there are inconsistencies with a budget. Trying to get to the person who can actually clarify budget questions can be a needle in a haystack.

The lender may or may not have dropped the ball. My humble opinion is that when a seller or seller's realtor is selling a condo, they should be providing the buyer and their lender with all necessary condo docs UP FRONT as part of the purchase contract and disclsoures. Why this isnt a customary practice baffles me. If the current owner and their realtor were proactive in providing you this information up front, your lender should have been able to tell you a 30% down payment was required up front when you were in contract negotiation. Before you give an earnest money deposit. Before you pay for an inspection. Before you pay for an appraisal.

Hopefully this doesnt kill the deal for you.

Post: Where to find good lenders

Post: Where to find good lenders

- Lender

- Cleveland, OH

- Posts 585

- Votes 434

I would add one to Chris's list. There seem to be a lot of value in local investor facebook groups. I konw there are Indy and Cleveland groups that are very active. Sure there are some in your areas as well.

Post: Gift of Equity for Investment Property

Post: Gift of Equity for Investment Property

- Lender

- Cleveland, OH

- Posts 585

- Votes 434

Conventional investment property purchases do not allow gift funds to be used as down payment. I cant speak for every lender in the world but I do not think there is much flexibility on this topic.