All Forum Posts by: Eric Veronica

Eric Veronica has started 9 posts and replied 578 times.

Post: Refinancing Rental Properties

Post: Refinancing Rental Properties

- Lender

- Cleveland, OH

- Posts 585

- Votes 434

@Martin Nowak When shopping with different lender you will want to make sure you provide consistent information about your situation. This is important because investment properties have a lot of different pricing adjustments. You want to make sure the quotes that you are comparing are apples to apples

- Credit Score (above 740 will give you the best rates)

- Property type (single family? 2-4 unit? condo?)

- Estimated loan to value

- Pulling cash out or just getting lower rate

I would ask each lender for the interest rate, does that rate include any points, and what are the total origination fees.

Post: Modular Homes Financing

Post: Modular Homes Financing

- Lender

- Cleveland, OH

- Posts 585

- Votes 434

@Scott Baker unfortunately I do not have any contacts in Alabama. As I mentioned previously, if the home is truly a modular then lenders should not have an issue. I understand that this may be easier said than done.

You might want to ask local modular dealers for a referral. At least that way you can be sure that the lender understands the difference.

Post: Modular Homes Financing

Post: Modular Homes Financing

- Lender

- Cleveland, OH

- Posts 585

- Votes 434

@Scott Baker What state are you looking at?

Post: Have 10 loans through brrr, how do I finance more?

Post: Have 10 loans through brrr, how do I finance more?

- Lender

- Cleveland, OH

- Posts 585

- Votes 434

@Michael Fagan This is a hyper local question. A local REIA group or the local forums may be a good place to search as well. We have a program to finance property 11-15 but it is limited to OH and MI. Looks like you are a Badger!

Post: Modular Homes Financing

Post: Modular Homes Financing

- Lender

- Cleveland, OH

- Posts 585

- Votes 434

@Scott Baker Modular home is treated exactly the same as a single family home. Period.

Manufactured homes are a different story. They can be more difficult to finance. Typically you can identify a manufactured home if you recognize the following

- there is a HUD tag similar to a license plate affixed to the home. Usually there is a tag on the exterior of the home and the interior. Usually in a closet or cabinet

- There is skirting around the bottom of home's exterior

- Typically manufactured homes are built on a steel chasis

- Often times at the purchase you will pay sales tax

The confusion arises because consumers and a lot of folks in real estate use these terms interchangeably. An appraiser disclosing that a home was a modular should not disqualify you for conventional financing.

Post: Closing Costs on Residential Cash Out Finance

Post: Closing Costs on Residential Cash Out Finance

- Lender

- Cleveland, OH

- Posts 585

- Votes 434

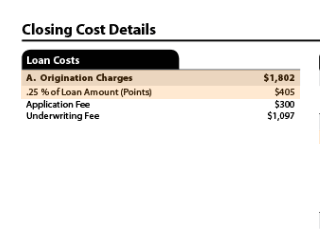

@Scott Donahue The devil is in the details with this type of question because the term "closing costs" can include a lot of different things. Escrow? Home insurance premiums? tax pro-rations? Also the specific state can have a big impact on closing costs as well. Purchasing a $100,000 home in Ohio can cost $1,000 more than the same $100,000 home in Indiana.

Are you able to attach the closing disclosure to help breakdown the closing costs. If you cannot attach, what are the lender origination charges? They will be listed on page 2 of the closing disclosure in the upper left hand corner.

Post: Is it possible to get 80% LTV on a Triplex Investment Property?

Post: Is it possible to get 80% LTV on a Triplex Investment Property?

- Lender

- Cleveland, OH

- Posts 585

- Votes 434

@Matt Crusinberry I never like to speak for what other lending institutions can or cannot do because I truly do not know. What I can say is that conventional/Fannie/Freddie loans will not allow 80% LTV On 2-4 unit investment properties (unless there is some special exception program that I am not familiar with)

If the banks that you are mentioning can offer 80% on 2-4 investment they must have a pretty competitive portfolio loan program. Sounds like you have done your research and found a couple aggressive lenders!

Post: Is it possible to get 80% LTV on a Triplex Investment Property?

Post: Is it possible to get 80% LTV on a Triplex Investment Property?

- Lender

- Cleveland, OH

- Posts 585

- Votes 434

@CJ M. I can understand what you are saying but I guess I have a different take. As a mortgage loan officer I live off of referrals from past customers. I have had situations where past customers have referred me clients who are unqualified, or pushy or rude. Even in those situations I am incredibly grateful when my name is passed on and I cant understand why anyone in real estate would not want their name mentioned.

Post: Loan officers southern Ca...?

Post: Loan officers southern Ca...?

- Lender

- Cleveland, OH

- Posts 585

- Votes 434

Co-sign @Brian G. mention of @Chris Mason

Guy knows his stuff

Post: Should I worry about a hard pull on my credit?

Post: Should I worry about a hard pull on my credit?

- Lender

- Cleveland, OH

- Posts 585

- Votes 434

@Mohamed Mahmoud One of most common statements I hear from my customers is "My credit score use to be X but now it has dropped to X because I have had so many credit inquiries. I havent had any late payments or anything else negative so it must have been the credit pulls"

This is almost NEVER the case. In almost every scenario the borrower's credit score has gone down because their credit card utilization ratio has increased (credit card balances / credit card high limit).

With that being said, you should be able to have a conversation with a lender without the first step being a credit pull. Especially if you have a pretty solid idea about your current debts and your current credit score. Typically you should shop lenders but in my opinion you do not need to get preapproved by every lender you speak with.