All Forum Posts by: Corey M.

Corey M. has started 30 posts and replied 106 times.

Post: I have 100,000 and i dont know where to put it...

Post: I have 100,000 and i dont know where to put it...

- Posts 106

- Votes 32

Originally posted by @Jon Schwartz:

Originally posted by @Gavin D.:

@Jonathan Anderson

Ok. well since your entire argument, and the profitability of your plan, is based on one HUGE if.. which is if the owner of the property can rent the place for enough to cover ALL of the costs of ownership including, but not limited to

a 300k mortgage payment,

property taxes

scheduled maintenance

property management fees (as you stated)

misc repair costs

a quick check of the median listed price of a 2 bed condo in LA is, wouldn't you know 389,000.

So after 100k down, and the loan origination fees, looks like 400k total purchase is a great figure to go off of....

leaving us with roughly a 300k loan.

So, at 4% on a 30yr fixed = $1432.00/mo

property taxes escrow = $392/mo (random property listed at $379k)

property management = $100/mo (conservatively...)

scheduled maintenance = $100/mo (conservatively...)

1 repair per year ($480/yr) = $40/mo

Now, let's look at 2br SFR for rent. Im going to, for argument's sake, allow our 2br condo to be compared against 2br houses in terms of rental price, partially because it will still illustrate my point, and also, I did not feel like hunting through 1000 listings for apartment complex owned and managed studio-3br listings to find an example. We do have to count out apartment complex listings however, single unit privately owned condos, are in need of updating, and do not have the amenities that apartment complexes do for our 400k purchase price, unless there is a $200/mo HOA fee. Infact 400k +/- purchase price is the lowest anything is listed for in L.A.

So..while I would love to just assume avg median rent / avg media price, We can not. While the lowest we can find a condo for is 350k+, the avg median sales price is over 700k. So basically, at 400k, were looking at the low side of what is out there.

And just a quick glance at realtor.com, and we can see how this will play out...Keep in mind we are looking at 2br condos to purchase. And sure enough 2br houses are listed for rent all the way down to $1300/mo and 17 listed for less than $2k/mo.

So, did you do the math from above? our total (conservative) estimate for monthly costs came to $2064.00. Just to be safe, I repeated the search for rentals 2br+ in Los Angeles, SFR or Condos on zillow, and there are at least 30 listings for under $2k per month.

To be fair, I repeated the search for homes for sale for less than 400k on LA. I think we can both agree that mobile/manufactured housing should be removed as they are a depreciating asset which would invalidate the appreciation aspect of your argument. Zillow does have listings down to 320k. which would mean a lower monthly mortgage payment.

All in all, I'm still not seeing it actually work out. Looks to me like you can rent a place for less than the cost of ownership. (which is generally speaking the rule.... otherwise no one would ever rent.) which means that There is most likely going to be at least a little negative cash flow at 100k down.

But let's say we break even. Every day that property sits empty adds to negative cash flow.

I do not believe that investing in property is a bad idea at all. Your suggestion lumps in all of the possible rewards and disregards any risk. I believe that attempting to invest with the same monetary plan as one would purchase a primary residence is not investing at all. It is simply buying another liability that someone else is going to live in.

You want a great return on 100k. Buy a 100k house. Rent it for $500/mo. Let it appreciate 2% per year. Pay your property taxes, do your scheduled maintenance, and repairs, and walk with 5% per year, with almost no risk.

Or buy a house in LA....maybe break even on cash flow... and at the end of 7 years... maybe..maybe break even on house value.

Oh... forgot to mention forbes reported in december 2019 on L.A. awwww...no appreciation in 2019 for LA homes...

https://www.forbes.com/sites/johnwake/2020/12/31/no-house-price-appreciation-in-new-york-los-angeles-chicago-or-san-francisco/#cffec8f1af84

If you invested in L.A. with the 100k down strategy in 2019.... there goes that whole year of profit.

Gavin, Gavin, Gavin...

First, to quickly address your counter example: A $100K house bought in cash and rented for $500/month is going to generate $6000/year in cashflow max. You're talking about a 5% return with almost no risk. You're saying that this $100K house has "almost no risk" of incurring more than $1000/year in maintenance and vacancy. Sure!

Now on to your gripping takedown of investing in LA:

Firstly, you don't make money in LA buying a condo. Secondly, you don't make money in LA by doing ten minutes of research and buying anything anywhere. The Los Angeles MSA has over twice the population of your entire state. A little more effort is required to invest here.

Let's take this listing as an example:

https://www.redfin.com/CA/Los-...

I know, the purchase price is $459K, which puts us over the $400K limit. My original post was demonstrating simple math between appreciation and cashflow, and this price point is in the ballpark of a $100K down payment, so let's proceed.

What numbers do you run on this listing? Here's what I get:

Rental Income: $2865

PITI (at 4% interest): $2206

Maint & Capex (10%): $287

Prop Mgmt (5%): $143

Vacancy (4%): $115

CASHFLOW: $114

PITI includes property taxes (1.27% annually in LA) and insurance. We don't mess around with escrowed taxes or insurance when we put 25% down, my friend.

So this inexpensive LA property cashflows. But we're not buying for cashflow, right? We're buying for appreciation. This property is just below downtown LA, an area which was been massively gentrified over the last decade. Nowhere in LA is growing faster (and becoming expensive faster) than downtown LA. (Obviously, yes, COVID will put a slowdown on that growth, but I think we'll be back in track in 12-18 months.)

Let's look at some maps!

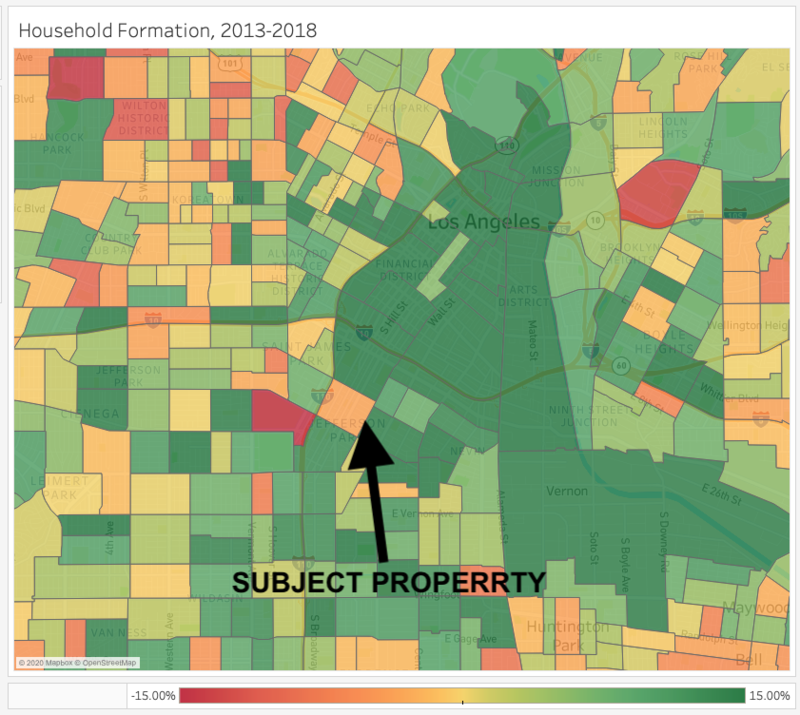

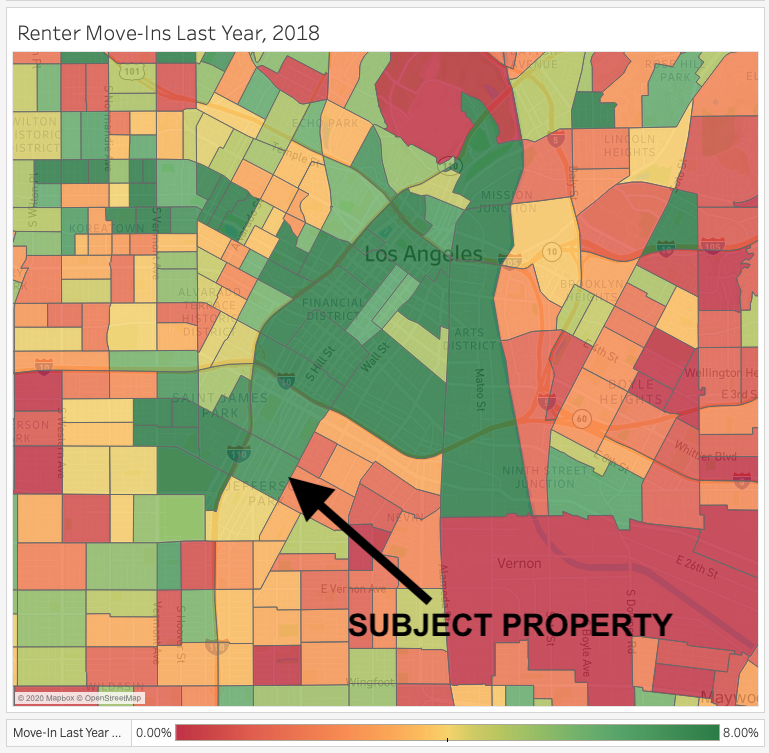

All of the below maps were made with Census Bureau data, which you can download yourself at data.census.gov. I use Tableau to make my maps. The most recent annual data from the Census Bureau reflects 2018's data collection, so the range we're looking at is 2013-2018 (numbers reflecting 2019 will be published in October, and I can't wait to update these maps!). All of these maps represent census tracts in Los Angeles; census tracts are the smaller geographically area that the Census Bureau tracks.

Here's household formation 2013-2018:

The bright green areas to the north of the subject property are downtown LA. Lots of people moving in! The subject property's census tract is a spot of orange surrounded by green. That's a good thing! Because look at this map of renters who have moved in within the last one year:

As you can see, now the green area extends down to our subject property. New renter households abound! And this is what we want -- more renters moving in means more demand means higher rents means more expensive buildings.

What's interesting, though, is that prices are lagging move-ins. Here's median home price growth, 2013-2018:

As you can see, at the very top of the map, the northern area of downtown LA has already seen robust home price appreciation. Our little census tract and the areas around it have not. Fantastic! We've identified the cusp, the edge of the path of progress. We're right on target!

That's the kind of analysis required to make money in LA real estate, and it's this kind of analysis that mitigates the risk such that one is not playing roulette.

@Todd Pultz, gotta ask, is this still speculation at best?

Thanks guys!

All the best,

Jon

Curious how you came to 2200ish with insurance and taxes at 4%. That's not right. The p+I would be about 1900 alone. A 500k house would have about 6000 in taxes per year (500/mo). Insurance is easily $1500/yr ($125/mo) and probably more since you need eq insurance.

So just loan, insurance and taxes are much more like $2500.

Also a 500k condo would be garbage in LA. A SFV house would be in a D neighborhood. I don't disagree with you on the potential appreciation, but if this guy has $100k to invest, he better be prepared to take on $6k+ of negative cash flow annually. This isn't necessarily a bad bet, it's just one that inherently involves risk. Now, if I knew I had a guaranteed income of $200k year at my regular job, then I'd definitely take a $6k hit/yr and bet on LA long term appreciation. But you have to be able to hold for a long time to increase the odds of getting the appreciation you cite.

Post: I have 100,000 and i dont know where to put it...

Post: I have 100,000 and i dont know where to put it...

- Posts 106

- Votes 32

Originally posted by @Jon Schwartz:

Originally posted by @Etienne Dubois:

If money was not an issue and i had 100,000 USD on the side to put for down payments, would investing in expensive cities like los angeles be a good idea because of the rental occupancy rate there, or would it be wiser to invest it in somewhere that has a lower occupancy rate but i can buy more with 100,000 in down payments.

Etienne, I'd invest for appreciation in a market like Los Angeles. If money's not an issue at present, and you want your money put to best use, invest in a place like LA (and I vote specifically for LA).

Let's just do some quick math:

Let's say $100K is going to be 25% down payment on one or several properties. In your appreciation market, you'll receive no cashflow, but the building will appreciate 5% per year. In the cashflow market, you'll earn a fantastic 15% cash-on-cash return but no appreciation. All financing terms are identical. Let's remove costs associated by buying and selling. To further simplify, let's say there's no principal paydown (since it will be equivalent in both examples).

What's your investment horizon? Let's say seven years...

In seven years, in your appreciation market, you'll own a property worth $562,840. You borrowed $300k to buy it, so you profit in year 7 is $262,840.

In the cashflow market, after seven years, you will have made $105,000 in cashflow. You'll have no profit in the sale of the building because it didn't appreciate.

Now, cashflow-lovers are going to make the following argument: cashflow is money-in-hand whereas appreciation is speculative.

They would be right that cashflow is money-in-hand in that you get it regularly, not as a big lump sum at the end. This makes the early cashflow payments more valuable than the later appreciation harvesting. However, if money is not a current concern, as is the case in this example, the actual value of those earlier payments is lower. To be really nerdy and mathy about it, you can use a much lower discount rate when analyzing the value of future earnings.

However, is appreciation speculative? In the Midwest, yes. In cities that have populations under 1M and might or might not be ascendant, absolutely. But in an international gateway city with a longterm average appreciation rate of 6.7% going back to 1975 -- meaning this longterm average incorporates the five recessions that have occurred since? Appreciation is far less speculative than Midwestern investors make it out to be, and to the extent that it is more speculative, the reward is much greater.

So, buy LA, my friend!

Best,

Jon

You're not taking into account mortgage paydown on the non-speculative, non-LA property. That adds to the ROI. Also where is one getting a 400k rental property in LA that is neutral cash flow after all expenses (10% management, 5% Capex, 5% maintence, 5% vacancy, 2%+ insurance (eq insurance is necessary, HOA fees since 400k definitely won't buy a house). So if you can find a $400k condo with 25% down and rent it for $2k/mo, you'd get crushed.

300k mortgage at 3.25% would be $1306/mo, leaving you $694/mo for expenses. Well, expenses would be:

HOA: about $400 (maybe more)

Management: $200

Capex: $100

Maint: $100

Insurance+eq insurance: $ 150/mo

Vacancy: $100

So $1050 in expenses.

So cash flow would be about $400 negative a month, and I think these numbers are ambitious. Anyone investing in LA needs to be making enough to cover thousands in negative cash per year. It may be worth it for appreciation, but remember back in 2006 when LA real estate was a sport, but then dropped 30%? That could be a killer if you can't hold on for a long time.

Just my two cents...

Post: Renting out Primary residence - tax implications

Post: Renting out Primary residence - tax implications

- Posts 106

- Votes 32

Originally posted by @Account Closed:

@Corey M.

See bullet 3 below

Source: https://www.nerdwallet.com/art... $250,000 or $500,000 exclusion typically goes out the window, which means you pay tax on the whole gain, if any of these factors are true:

- The house wasn’t your principal residence.

- You owned the property for less than two years in the five-year period before you sold it.

- You didn’t live in the house for at least two years in the five-year period before you sold it. (People who are disabled, and people in the military, Foreign Service or intelligence community can get a break on this part, though; see IRS Publication 523 for details.)

You already claimed the $250,000 or $500,000 exclusion on another home in the two-year period before the sale of this home.

- You bought the house through a like-kind exchange (basically swapping one investment property for another, also known as a 1031 exchange) in the past five years.

You are subject to expatriate tax.

Post: Renting out Primary residence - tax implications

Post: Renting out Primary residence - tax implications

- Posts 106

- Votes 32

Originally posted by @Wayne Brooks:

No, you can’t keep the $250k exclusion if you rent it for more than 3 years. You cloud however, move back into it for 2 years sometime in the future...this wouldn’t give you the full exclusion, but it would be a pro data share exclusion based on the years occupied verses the years as a rental. So how long you’ve already owned it would help determine if this would makes sense. This assumes the 121 rules don’t change between now and then.

Post: Calculating ROI (specific scenario)

Post: Calculating ROI (specific scenario)

- Posts 106

- Votes 32

Bump. Hoping someone can help me with this.

Post: Renting out Primary residence - tax implications

Post: Renting out Primary residence - tax implications

- Posts 106

- Votes 32

As noted in another post, I'm considering renting out my LA condo, which will be cash flow negative in the range of $500/mo. I bought the house for $320k with 20% down, did a cash out refi recently and got a new $420k loan. That means there's about $230k in equity left in the home.

If I rent it out, it'll be at around $3k/mo, but with all expenses, it'll cost me $500/mo, so I'll be losing $6k year in cash. Assuming the property conservatively appreciates by 3%/yr, does this move make sense over a turnkey (not that I only want a passive investment) with an ROI of about 17% (including cash flow, appreciation, and house paydown)?

My understanding is that I can no longer get the $250k cap gains exclusion if I move out and don't live in the place in three years. But what if I want to keep this as a long term rental property and sell it in a decade? Am I out of luck and have to pay taxes on what would've been a $250k exclusion? To me, renting out the primary residence only makes sense if I can do it for the long term, especially when housing prices could drop 10-20%+ in one year (like they did around 2007 in LA).

Assuming I can afford to lose $6k/yr on the negative cash flow, is turning this into a longterm rental going to be a bad decision if I don't plan on selling it within three years? Is there any way to hold onto that $250k exclusion if it's a long term rental?

Post: Renting out Primary residence or Turnkeys in CA

Post: Renting out Primary residence or Turnkeys in CA

- Posts 106

- Votes 32

Originally posted by @Lee Ripma:

I like to decouple living in real estate from investing in real estate. Then you can think of RE purely as an investment.

The issue I have with turnkeys is that they are often sold at or above market value in C to D areas. These areas may provide cashflow but they won't provide market appreciation and the turnkey company has already taken all the forced appreciation.

There is a company that master leases SFH and uses that as a platform for a coliving company. The reason I like the model is that you are in A and B areas which actually have market appreciation. You also don't have the hassle and risk that you have with the traditional turnkey route with the master lease.

If you're looking at overall ROI it can be hard to beat CA. If you are wanting cash flow then you won't get it when you buy in CA (but will after time). I was very sold on cash flow by BP starting out. I now look at IRRs not cash flow and invest in CA. I also still hold a rental portfolio out of state.

Cash flow makes you free and appreciation makes you rich. What do you care about?

I'm curious how you cash flow in LA? My home has nearly doubled in value and when I take into account management, insurance, vacancy, cap ex, etc, it still ends up as a monthly loss of around $500 (possibly more). Also, it's very hard to guarantee appreciation in CA. As I recall, houses fell around 30+% around 2007 in LA and it took years to gain that equity back. So just because you buy in CA doesn't mean there is a huge appreciation upside. But generally speaking, I don't think most people want to be cash flow negative. And if I were to rent out my primary residence, I'd have to find a new place, at market rate, which would be at or above the value of my current house. Is there any way to make passive income in LA on a 20% down loan, even with low interest rates?

Post: Renting out Primary residence or Turnkeys in CA

Post: Renting out Primary residence or Turnkeys in CA

- Posts 106

- Votes 32

Originally posted by @Charles Cooper:

Hey @Corey M..

The $750 a month seems kind of high, is it a condo, newer built? Even if you can make some income in LA, thats a good start. The most important thing is that you do buy another property and build your empire of properties. Like @Jon Schwartz mentioned, buying a duple or triplex would be a great investment. There are other areas in Valley that could offer this.

It's likely more than $750. If I can rent it for $3k, management would be $300/mo, Capex plus maint would be $300, insurance would be about $175/ mo (w eq insurance). Vacancy would be another $150. So actually, I think it's more like $925/mo in expenses. I suspect I'd be, at a min, negative cash flowing $250-300/mo. The question is, is that worth it?

Where in Valley can one get a cash flowing duplex? Why would anyone invest out of state if that existed and you could not only cash flow but also get CA appreciation?

Post: Calculating ROI (specific scenario)

Post: Calculating ROI (specific scenario)

- Posts 106

- Votes 32

Purchased primary residence for $320k with $60k down.

House appraises 7 years later at $650k . I Cash out refi with a $420k new loan. Remaining $230k equity kept in the house.

Now I decide to move out and rent it: Including all cash flow, appreciation, house paydown, I make $32k in year one. What is my ROI?

I'm struggling with what number determines my "initial investment" once it's been turned into a rental. Is it the original 60k? Is it the remaining 230k equity?

Post: Renting out Primary residence or Turnkeys in CA

Post: Renting out Primary residence or Turnkeys in CA

- Posts 106

- Votes 32

Originally posted by @Jon Schwartz:

Originally posted by @Corey M.:

I live in CA where rents typically don't cover the price of a house/mortgage. I've lived in my place for 8 years and after a recent cash out refi, I pay about $2250/mo for my mortgage + taxes. If I rented it out, I could get about $3k per month. However, my expenses are another $750 or so (management, Capex, maintenence, insurance, eq insurance, hoa). Essentially I'd breakeven if I rented it. I'd also have to buy a new place at a cost of about $800k (160k down) @ 3% interest, and that new place would have all the typical tax breaks associated with a primary residence. Los Angeles property has been appreciating at about 8%/yr, and because of that, I'm trying to choose between renting out my residence and moving into a new one, or doing a passive investment in a turnkey. I have a f/t job and can't be active.

The turnkeys I've been looking at average about 18% IRR, and that includes appreciation, equity via house paydown, and net cash flow. Most of the places I'm looking at have about 2-3% annual appreciation. This IRR doesn't include depreciation.

So, with that $160k that I could use as a down payment on a new residence while renting out my current one, would it be better to do that or buy 800k worth of turnkeys with that $160k (~5 sfhs)?

My concern with renting my current house and buying a new one is that the cash flow could easily be negative on any given month AND I'd be taking on a new mortgage that is 50% higher than my current one. On the other hand, I'd be making LA level appreciation on both of them, which could be lucrative.

Thoughts?

Yo Corey,

Fellow Californian here. (Don't listen to advice from out-of-staters. They don't know what they're talking about vis-a-vis CA!)

It's a bummer that the cashflow on your current place would be so thin. What are you calculating for property management? I'd forego property management entirely if it's one home with one tenant. I'm currently househacking a duplex with a tenant in the other unit; I work full-time, and managing the property is no problem at all.

Where are you finding turnkeys that have an 18% IRR? I wouldn't believe those numbers, man! Turnkeys are notorious under-performers. I'd think you'd have more luck breaking even on your LA home than on a Midwest or Southeast turnkey.

One thing to keep in mind: if you do rent your house, you can sell it anytime in the next three years and still take the capital gains exemption. So there's not much risk in renting it. If it's cashflow negative for a year, sell it. I bet anything you lose in cashflow will be made up for with a year's appreciation.

Have you considered buying and moving into a duplex? It's a really powerful way to supercharge CA appreciation and build equity. I'm sooo glad I made the move last year.

Best,

Hey Jon,

I realized I actually miscalculated and I'd be cash flow negative about $8k/yr. Given LA appreciation, I think I'd still offset that on a 650k house with appreciation, even if it was 2%. But I'm not sure if this is a great way to invest.

Re the ROI, most turnkeys can easily do 15%, I believe. REI Nation, for example, which uses pretty conservative numbers and sometimes above-market pricing can still do so. The combination of cash flow, appreciation, house paydown equity, and depreciation makes it pretty hard to go below 15%, even with a yearly appreciation of 1 or 2%.

Re house hacking a duplex, I never really thought about that, but in the area I'd want to live (studio city/Sherman oaks), I think a duplex would run at least $1.4mm. And I definitely don't want to manage my own properties. I can't be taking calls in the middle of the day to deal with a broken toilet. So even if I had a duplex I'd probably hire someone.