All Forum Posts by: Joseph Snyder

Joseph Snyder has started 5 posts and replied 25 times.

Post: Rent Cheap to Invest More… or Buy Your Own Home Now?

Post: Rent Cheap to Invest More… or Buy Your Own Home Now?

- Posts 25

- Votes 10

When you’re single, the math is pretty easy. You can live in a duplex or fourplex. Keep your costs low and build equity. Even if you don’t house hack, renting a small one-bedroom or studio can be an obvious win because your living expenses stay low and you can throw more money into investments.

Once you have a family, kids, and a couple of pets, it’s not as simple. Most of the rentals that really save you money aren’t in areas you’d want to live with your family.

Here’s the situation I keep thinking about.

The kind of home most people would want for their family is in a safe neighborhood with good schools and a nice community. That could easily cost over $4,000 a month with a small down payment. Inflation is making it harder for people to save that down payment in the first place. You could rent something smaller or in a less “perfect” spot for around $2,400 and save about $1,600 a month. As a renter, you’re also not paying for big repairs or maintenance, which means even more savings. If it’s a condo or townhouse, you might get a gym or pool included. That could save money there too.

The question is: in today’s economy, is saving $1,600+ each month enough reason to hold off on buying your own place? Or does inflation wipe out the advantage so fast that you’re better off buying now?

And if we do see a market correction, would that change your answer?

Post: When Is It Actually a Good Time to Sell Real Estate?

Post: When Is It Actually a Good Time to Sell Real Estate?

- Posts 25

- Votes 10

Quote from @Basit Siddiqi:

It is a good time to sell real estate when you think there is another property / investment that will out perform your current property net over a 5 year period and cover your fees and taxes(assuming you are not doing a 1031 exchange).

Post: When Is It Actually a Good Time to Sell Real Estate?

Post: When Is It Actually a Good Time to Sell Real Estate?

- Posts 25

- Votes 10

Quote from @James Hamling:

"When is it actually a good time to sell real estate?"

When you say "Wait, what, you'll pay me how much?"

Post: When Is It Actually a Good Time to Sell Real Estate?

Post: When Is It Actually a Good Time to Sell Real Estate?

- Posts 25

- Votes 10

Quote from @Eric Fernwood:

Hello @Joseph Snyder,

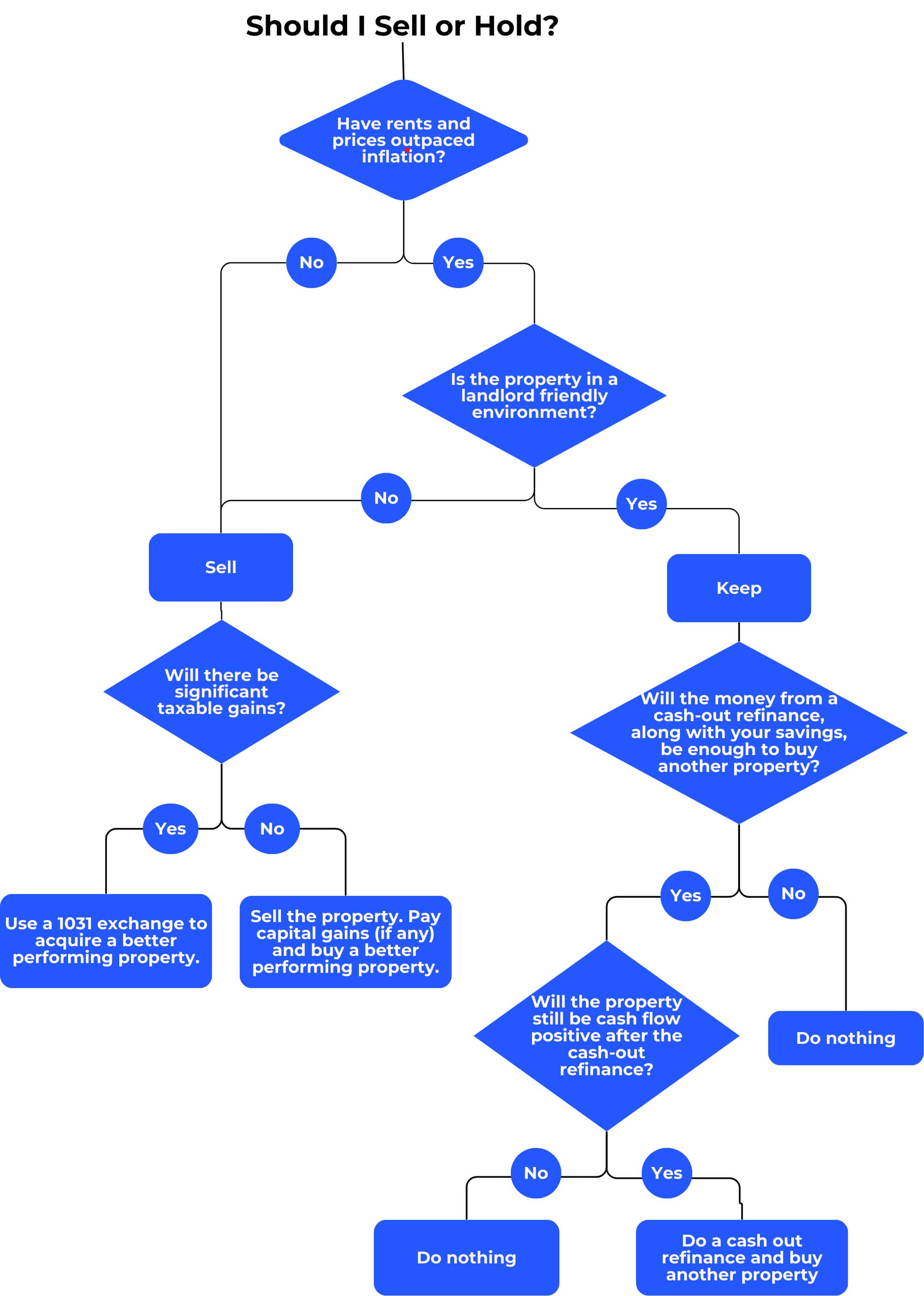

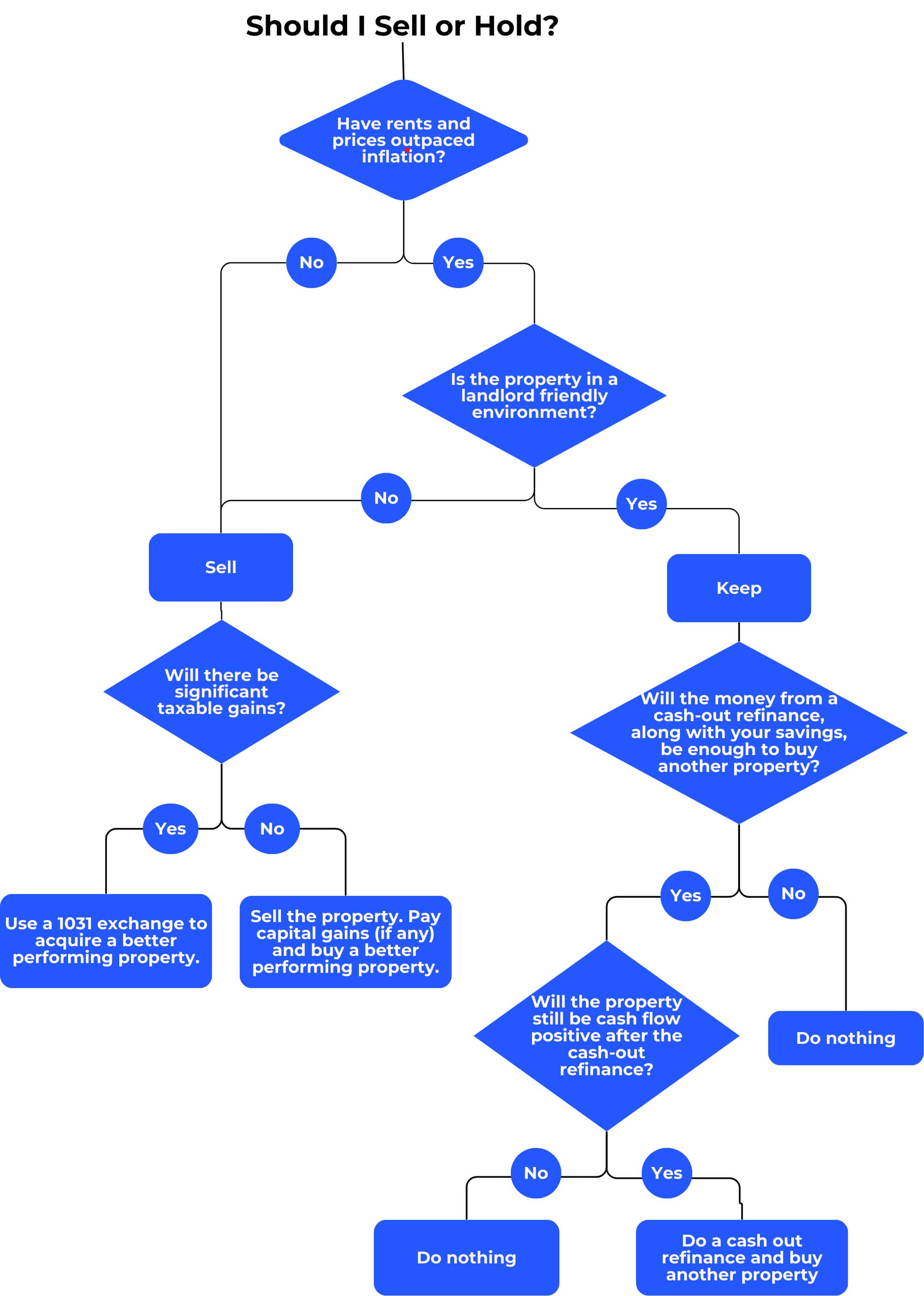

When it is a good time to sell depends on your financial goals. If your goal is financial independence, the decision process is relatively straightforward. I created the following decision tree which I hope you find useful.

In summary, there is no fixed date when you should sell. What you should do depends on the property's performance and your goals. If your goal is lifelong financial independence, then rents increasing faster than inflation is essential. Let the property’s performance and your goals make the sell/refinance/1031 decision.

Post: When Is It Actually a Good Time to Sell Real Estate?

Post: When Is It Actually a Good Time to Sell Real Estate?

- Posts 25

- Votes 10

Quote from @Eric Fernwood:

Hello @Joseph Snyder,

When it is a good time to sell depends on your financial goals. If your goal is financial independence, the decision process is relatively straightforward. I created the following decision tree which I hope you find useful.

In summary, there is no fixed date when you should sell. What you should do depends on the property's performance and your goals. If your goal is lifelong financial independence, then rents increasing faster than inflation is essential. Let the property’s performance and your goals make the sell/refinance/1031 decision.

This is great and really easy to follow. How do you usually calculate if rents have outpaced inflation? I know you just compare rent growth over time to the inflation rate for the same period, but I would love to hear how you approach it. Also, you might not need to sell at all. If you can add value with a few small changes under $10k in renovations, like adding a bedroom or doing minor upgrades such as light fixtures, paint, furniture, or converting to mid-term or short-term rental, you could see rents jump by several hundred dollars. That increase could bring you right back in line with inflation, even if it means spending a little more up front. I am definitely using this in my listing consultations. Nice work.

Post: When Is It Actually a Good Time to Sell Real Estate?

Post: When Is It Actually a Good Time to Sell Real Estate?

- Posts 25

- Votes 10

Quote from @Greg Scott:

Quote from @Ken M.:

Quote from @Greg Scott:

I try to stay out of situations where I "need to sell". I want to be in situations where I choose to sell. Why would I choose to sell? The reasons are many, but usually they involve improving my total dollar returns or my return on time.

"Never Sell" is a very simplistic strategy. Because of that, it is also a dumb one.

Why do I call "never sell" a dumb strategy? Let's just look at one factor, depreciation. The moment you have owned a residential property for more than 27.5 years, you have used up all your depreciation expense. Your cashflow is now 100% exposed to ordinary income tax unless you have other offsets. You would be much better off swapping that house for another just like it and resetting the depreciation.

Now let's say you use accelerated depreciation. (You should.) If you do the math on that, somewhere around year 10-15 it stops making sense to continue owning that property. The math will tell you that simply swapping out that property for one just like it would improve your returns. I recently learned of a pair of brothers that would sell their houses to each other every so often for this very reason.

That is just one of many reasons why "never sell" is a bad strategy.

Don't forget that you "recapture" that depreciation, it's a delay not a gift.

What Is Depreciation Recapture?

https://www.investopedia.com/terms/d/depreciationrecapture.a...

Usually a 1031 exchange is beneficial. The best, in my opinion, is generational transfer done properly.

3 Ways To Transfer Real Estate To Future Generationshttps://www.forbes.com/sites/whittiertrust/2019/04/02/3-ways...

The real issue is hanging onto the property long enough for that to happen. It costs money to hang onto a property.

Over a long period of time, depreciation recapture becomes less important because so much appreciation has happened. The math remains correct.

Over the last 25 years, retail homes have gone up in value 181%. To simplify the math, that $100K home you bought 25 years ago is now worth $281K. The depreciation recapture on the $100K home might be something like $80K. Bonus depreciation on the $281K house could easily wipe out the depreciation recapture and leave you with residual depreciation for the next 27.5 years

Even better, remember you now have tons of equity you are pulling out at sale. Go buy two or three houses at $281K. You can easily wipe out any tax generated from depreciation recapture and have more savings going forward.

Over a 15 year time frame, US house prices have roughly doubled. The same sort of math applies. Do the math and the math will tell you what to do.

Post: When Is It Actually a Good Time to Sell Real Estate?

Post: When Is It Actually a Good Time to Sell Real Estate?

- Posts 25

- Votes 10

Quote from @Sarah McLaulin:

It was the right call. We are debating selling a duplex now due to the increase equity over the last 5 years. Lots of equity locked in one property that we could use to buy several more properties with growth potential. Such hard decisions!

Thank you for sharing, and I’m truly sorry for your loss. I know that’s a situation many people face, and it’s never easy. I’d love to hear where your thoughts are right now with the way market rates are, and whether you feel putting that money into another asset class might be the best move for you.

Post: When Is It Actually a Good Time to Sell Real Estate?

Post: When Is It Actually a Good Time to Sell Real Estate?

- Posts 25

- Votes 10

Quote from @Nick Wu:

I started investing two years ago and obviously not at a stage where I would consider selling. But I also ask my the same question all the time as well.

I invest for cash flow with a goal of continuing to grow asset base and passive income and the way I think about it is my Return on Equity. If my deal has grew so much appreciation, I would definitely consider cashing out (either selling or refinance it). If the home appreciation (my equity gain) is growing in parallel to the rent increase, I'd consider keeping it and refinance, that way my equity left in the deal is still generating me ideal return. But if my equity gain significantly outpaced the rent growth, that means my equity is not working for me efficiently (ROE is lower than what I would get from a new deal after subtracting all potential costs), I may consider sell and exploring a new market / property where I can get even an even higher cash flow (of course, not a simple rent/price ratio consideration when choosing a market/property)..

Would be happy to hear your thoughts too!

Thanks for sharing! You’re balancing cash flow and appreciation to build long-term wealth. I’ve always been more of a “if the cash flow looks good, I’m in” type. $600 a month minimum has been my buy signal.

I stick to Class C properties trending toward Class B, mostly small multifamily. Lately I’ve been focused on building more Section 8 cash flow. My best stretch was 10 by-the-room rentals for travel nurses at $1,000–$1,400 each, plus my long-term rentals. Cash flow far outpaced my cost of living and life was pretty dang fun.

For me, the balancing act is portfolio-based. I want enough cash-flowing deals to comfortably carry an appreciation play - maybe even a small hotel.

Post: Rental Arbitrage... Smart Play or Short-Term Win?

Post: Rental Arbitrage... Smart Play or Short-Term Win?

- Posts 25

- Votes 10

I wanted to get everyone’s thoughts on rental arbitrage.

It can be a quick way to get into the short-term rental game without tying up capital in a purchase. With mortgage rates as high as they are right now, rents in many markets are still lower than a new mortgage payment. In some cases, that makes arbitrage a smarter short-term play.

The trade-off is that you are not building long-term wealth through equity. Think about McDonald’s. It’s not just a fast-food company. It’s a massive real estate company. Even in times of low net income, equity and appreciation still build wealth over time.

Some operators do find ways to sell their arbitrage portfolios like a business, creating a payout at the end. You might also be able to lock in a longer lease, like 5 years or more, which gives more stability and cost control.

Another thing to consider is what happens at the end of the lease. If you’ve furnished the property, you’ll have to remove everything you bought. That can be a major logistical and financial challenge.

I learned this the hard way. I ran a short-term rental in a property I didn’t own, and everything was fine until the city changed the rules on who could operate STRs. Overnight, the model no longer worked.

So I’m curious…

Do you think rental arbitrage is worth it in today’s market? Or is it better to stick with properties you own and control?

Follow me and let’s go down the rabbit hole