All Forum Posts by: Ben Leybovich

Ben Leybovich has started 96 posts and replied 4169 times.

Post: Track Record Pre-2018 vs New Normal- Syndicator Vetting

Post: Track Record Pre-2018 vs New Normal- Syndicator Vetting

- Rental Property Investor

- Phoenix/Lima, Arizona/OH

- Posts 4,456

- Votes 4,295

Originally posted by @John Blanton:

Thanks for the response @Ben Leybovich and opinion.

I guess my question is meant specifically around a few sponsors who have been sitting on the 'sidelines' since 2018 or even before saying the market has gotten too 'hot.'

If managing investor money or investing in general is looking to predict the future...how confident can you feel in their ability to predict the future of investments/ valuations if they have chosen to not buy in two years while values have continued to climb?

What would have changed in their investment thesis that makes me believe they are any better at predicting today than they were in 2018/2019?

I would personally be more hesitant to invest with them as I feel there are some differences between their thesis and the market

But I am by no means an expert!

Your analysis of such folks aside, I guess I am a bit confused. Why would you be worried about investing with someone who's been on the sidelines since before 2018? They are on the sidelines...lol It ain't like they are offering you any opportunities, unless it is to buy a training program from them which will teach you all about being patient and waiting for a crash...:)

Post: Track Record Pre-2018 vs New Normal- Syndicator Vetting

Post: Track Record Pre-2018 vs New Normal- Syndicator Vetting

- Rental Property Investor

- Phoenix/Lima, Arizona/OH

- Posts 4,456

- Votes 4,295

Interesting question. Insightful.

People saying they can't predict the future - that's neither here nor there. If you are buying/investing, this means you are bullish on the outcome. By definition, therefore, you are predicting the future. So not sure how to interpret someone saying - I'm not in the business of predicting the future. Seems to me that's precisely the business we are in. We've got to take a stand if we are going to accept investments from folks...

So - what's the final answer to the question?

Post: Ditch Arizona and invest in Ohio?

Post: Ditch Arizona and invest in Ohio?

- Rental Property Investor

- Phoenix/Lima, Arizona/OH

- Posts 4,456

- Votes 4,295

Well, I moved from OH to Phoenix about 4 years ago, and since then have bought about $80M of property in Phoenix. Different folks, different strokes, I guess...

Good luck!

Post: Physician looking to get started in REI

Post: Physician looking to get started in REI

- Rental Property Investor

- Phoenix/Lima, Arizona/OH

- Posts 4,456

- Votes 4,295

@William White This is a conversation I have with folks in the medical field several times each week. I won't give you advice, but I'll offer a bit of perspective...

First, whatever you do, do not read that book by that guy, @Brian Burke. He knows absolutely nothing, I tell you. Not a thing!

Now, I am not old yet, though some days it feels like it, but in my 45 years I did discover one thing - to win we must be focused on our unfair competitive advantage. Unfair being the operative word.

If you dwell on this, things will become very clear very quickly. Be honest with yourself.

Brian has an unfair competitive advantage. I have an unfair competitive advantage. You have an unfair competitive advantage. All of us must play into our unfair competitive advantage. And, if we are smart, we might even put them together, and the synergy can be a situation where 1+1=4.

That's the game. Good luck!

Post: Class A vs. Workforce and Affordable Housing

Post: Class A vs. Workforce and Affordable Housing

- Rental Property Investor

- Phoenix/Lima, Arizona/OH

- Posts 4,456

- Votes 4,295

Think of it this way. The concept of "light value add" - what does it really do? This is where you put a little lipstick on the thing, without improving much of anything, and then you stretch the existing tenant profile $100. You are not upgrading the tenant profile, but asking for more money from the current tenant profile without giving them much value in return.

Tell me - in 2020 - is this a good idea?

So, there goes the idea of "light value add". Talk about dangerous. If you are going to do value add this late in the cycle, specifically during COVID, you have to go heavy and truly re-position the asset and the tenant base. A lot of value there.

Class A, by definition, is preservation. It's a coupon. Unless you've made all of the money and now the concern is to store it, I don't see how Class A makes sense. You are not creating value in a meaningful way in Class A.

Thus, I would go with Option 3.

Post: 100K to Invest, What Would You Do?

Post: 100K to Invest, What Would You Do?

- Rental Property Investor

- Phoenix/Lima, Arizona/OH

- Posts 4,456

- Votes 4,295

Well, here's the thing:

If you have to ask the question, you are not ready to deploy. It's a cliche but you just need to focus on learning ****.

Separately, knowing that you need to ask the question, I or any other syndicator of note on BP, would not accept the investment from you. Last thing we need is to have to spend time babysitting people. We're plenty busy as is...

Study!

Post: $150k into $6k/month in passive cash flow

Post: $150k into $6k/month in passive cash flow

- Rental Property Investor

- Phoenix/Lima, Arizona/OH

- Posts 4,456

- Votes 4,295

Originally posted by @Jake Grenier:

What's up BP community! I'm wanting to hear your strategies for turning roughly $150k of savings into $6k/month in passive cash flow through real estate. Don't consider anything off-limits, as I'm hoping some of these ideas can not only help me but many others that have similar goals. However I'll give my personal situation below so that you have a real world case study to analyze.

Over the past couple years I've been reading a lot of books and listening to a lot of podcasts, and you could say I've been stuck in analysis paralysis. Although I've gathered a lot of knowledge and ideas, I'm still searching for me and my fiance's direct path to early retirement. We both have full time jobs that we enjoy in Costa Mesa, CA and are looking to start a family in the next year or two. So neither of us feel the need to quit our jobs right away, but I have aspirations of replacing my W-2 income with passive cash flow sometime in the next 10 years to be more available for my family and to pursue more interesting endeavors.

Because we live in a very expensive area, it's hard to come up with a realistic plan that creates loads of cash flow locally. We also have full time jobs, so we need an efficient strategy that isn't just another full time job. We would be able to consistently add capital to our investment portfolio yearly, let's say $10k per year.

Some strategies that have peaked my interests are SFH or small multi-family BRRRRs, short term rentals, trade up into large multi-family, rental debt snowball, etc. But as you can see, I need to pick one and go for it! What's the one thing??

Thanks in advance for your ideas, looking forward to hearing them!

Some of us know how to turn $150,000 into $1M, which kinda makes $6,000 a silly thing. Are you sure you are asking the right question?

Post: 117-Unit Value-add in Phoenix Closed Today

Post: 117-Unit Value-add in Phoenix Closed Today

- Rental Property Investor

- Phoenix/Lima, Arizona/OH

- Posts 4,456

- Votes 4,295

Well, we've just sold this property. Once the final accounting is done I am sure we will have a more in-depth conversation. But, this was a 20-month hold and it looks like the investors will net about 1.8x and 40%+ IRR.

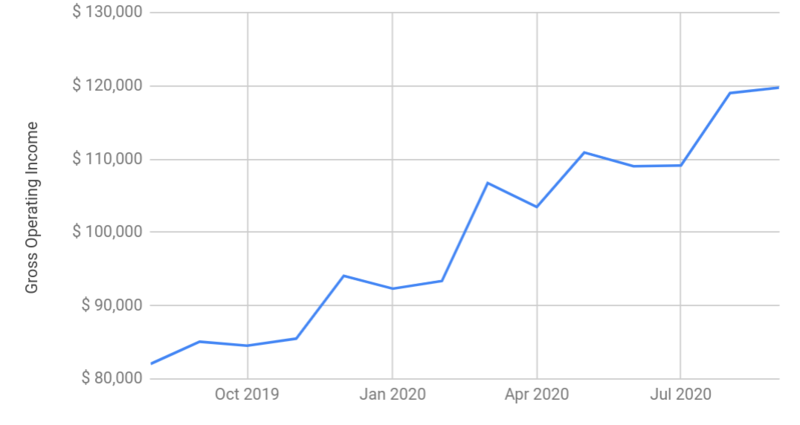

As you can see in the image, we improved the revenue from about $82,000 to $120,000, and there was still more value-add left. But, we couldn't say no to the offer - too good.

Feel free to reach out with questions and comments.

Post: Which Metrics are you using?

Post: Which Metrics are you using?

- Rental Property Investor

- Phoenix/Lima, Arizona/OH

- Posts 4,456

- Votes 4,295

Originally posted by @Andrew Syrios:

For houses, by far our most important is ARV, or more accurately All in Cost / ARV. (We aim for 75%.) We also look at Rent to Cost and Projected (and real after owning it for a while) cash flow. With apartments, it's the cap rate. We project ROI and IRR as well, but we aren't as good as we should be. I know Ben Leybovich would be mad at me about that.

I am furious!

Actually, ARV is the most important metric in apartments as well. The mechanics of getting there are very different, but the concept is the same. Cap rate is not a metric of return. It's used as a multiplier for means other than return.

Post: Why are people buying at these prices?

Post: Why are people buying at these prices?

- Rental Property Investor

- Phoenix/Lima, Arizona/OH

- Posts 4,456

- Votes 4,295

Originally posted by @Josephine Wilson:

Newbie question here: I'm looking to buy a Class A triplex or quad within 10 minutes of my house and doing property management and maintenance myself. I live close to a large university. Of the 20 recently-sold small multis I've analyzed, nearly all have little to no cash flow and cap rates averaging 4.6%. (2048/2050 E 6th St, Tucson, AZ 85719 is one example.) Some even have substantial negative cash flow. Everything I'm reading says these cap rates are not favorable. So why are people buying these properties?

I'm thinking the buyers are A) hoping for appreciation and don't mind no cash flow, B) planning to increase NOI or hoping that market rents will rise, C) wealthy parents buying a place for Johnny/Susie to live for four years or D) house hacking. Can folks offer their insights into why buy properties with negative cash flow and low cap rates?

For anyone interested, here are my estimates for my example property: 2048/2050 E 6th St, 85719

Price: $245,500, two 1BR units, 1219 sq ft total

Rent: $1454

Maintenance: $205

P&I: $938

Taxes: $195

Cash flow: -$39

Cash on cash: -0.7%

Cap rate: 4.4%

What would this investment look like, relative to projections of returns, if you could renovate the units and increase rents $350 per unit per month? Would it be more attractive to you?