All Forum Posts by: Justin Gottuso

Justin Gottuso has started 18 posts and replied 182 times.

Post: How are people scaling so quickly

Post: How are people scaling so quickly

- Rental Property Investor

- Columbus, OH

- Posts 184

- Votes 162

@Ian Stuart

So what do YOU do with YOUR investments?

Post: How are people scaling so quickly

Post: How are people scaling so quickly

- Rental Property Investor

- Columbus, OH

- Posts 184

- Votes 162

@Andrew Syrios

I do not include capex in my cash floe numbers because I don’t save $100 per month for big repairs and renovations that will cost thousands of dollars. I have a savings/emergency fund of thousands of dollars for my properties for that.

Post: Why am I having such a hard time with HM lenders? Unrealistic?

Post: Why am I having such a hard time with HM lenders? Unrealistic?

- Rental Property Investor

- Columbus, OH

- Posts 184

- Votes 162

@Pat Mulligan how is your investing going now? I’m in a similar boat as you with a property under contract and seeking best terms for the financing (the seller is a friend of mine whose flexible on closing date but I don’t want to keep him waiting either).

I'm also realizing HML is just as much work and hoops than a local bank with higher rates. I've gotten some individual private lenders reaching out to me but they seem like scams. I really need to establish relationships with some people with cash who could loan me money with flexible terms and ideally around 6%.

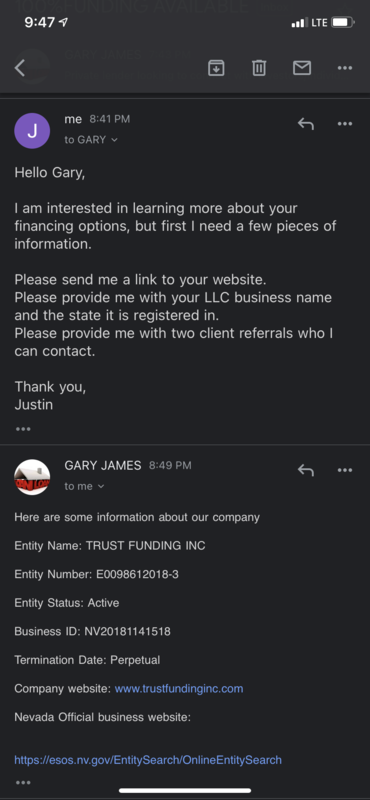

Post: Anyone have experience with Trust Funding Inc

Post: Anyone have experience with Trust Funding Inc

- Rental Property Investor

- Columbus, OH

- Posts 184

- Votes 162

Post: Private money lenders advice please!

Post: Private money lenders advice please!

- Rental Property Investor

- Columbus, OH

- Posts 184

- Votes 162

Hey 👋 I’m looking into private Monday lending options. The rates on being quoted are 5% interest. Seems like a much quicker process than conventional loans since funding is in 3 to 5 days. No property appraisals required that slow things down. No down payment requires so can fund 100% of the deal.

I am also in the process of also getting a credit line on my existing properties to cover earnest money deposit, repairs and emergency fund. It’s a process of using credit line to lock up a property. Private lending for the cash to close and rehab funds, close in about seven days total. Then already have funds for rehab to get started immediately, no draws from the contractor to the lender, just have the cash ready to go. Credit line can also help cover the gaps in monthly payments for the private lender while property/unit is being rehabbed. My properties were paid for in cash and have great cash flow so they can cover the credit line payments.

Also larger institutional private lenders like Lending One has rates in the 8-9% interest range for more short term loans and a lot more requirements and hoops to jump through. The rates are a little lower for longer fixed rate loans but not by much, mid 4% range. So that small difference in interest-rate percentage between individual vs institutional private lenders is a small difference but I think the speed of the individual private lenders is a BIG advantage for me since I want to scale quickly and get lots of great deals coming my way from my network.

A downside at this point for the individual private lenders is not having pre-existing relationships with them. More risk sense they might not have a website or the basic business kind of things that build trust with clients. Don’t wanna get scammed LOL What do you think about this strategy and the points I’ve laid out? Thanks so much!

Post: Anyone on track to quit their 9to5 in < 5 yrs from rental income?

Post: Anyone on track to quit their 9to5 in < 5 yrs from rental income?

- Rental Property Investor

- Columbus, OH

- Posts 184

- Votes 162

@Isabelle Chapman

What are you afraid of?

Why are you afraid of that?

Where do you want to be in 5 years financially? Why?

What is a ‘great’ deal to you?

Post: Best use of large amount of cash

Post: Best use of large amount of cash

- Rental Property Investor

- Columbus, OH

- Posts 184

- Votes 162

@Mark Seery

Things are about 35k to 70k per door for multi family properties. This includes property management. More of a mentality where in CA you can buy a few properties with terrible to zero cash flow, or in the Midwest you can buy 50-100 units that have great cash flow. Or a mixture of both. We own a condo in Los Angeles still too. No wrong way to start. You’ll learn a lot along the way whatever you choose to do!

Post: Anyone on track to quit their 9to5 in < 5 yrs from rental income?

Post: Anyone on track to quit their 9to5 in < 5 yrs from rental income?

- Rental Property Investor

- Columbus, OH

- Posts 184

- Votes 162

@Isabelle Chapman

If it's your third priority behind work and school, don't worry about how much time you're investing into real estate (I.e guilt trip of ‘ugh I'm not devoting enough time to this I need to do more!). Rather, focus on the next task to be done. If it's a big one like gathering all your financial docs for a loan, don't think you'll get it done in one weekend- it might take two months! Be patient and persistent and don't beat yourself up. Celebrate all the little wins along the way. Connect with others who are interested in REI as well as REI mentors with experience.

Post: Anyone on track to quit their 9to5 in < 5 yrs from rental income?

Post: Anyone on track to quit their 9to5 in < 5 yrs from rental income?

- Rental Property Investor

- Columbus, OH

- Posts 184

- Votes 162

@Cruz Gartner

Yes from real estate investing

From this thread there were about 5 people I noticed who said they were either working on it or had already accomplished that goal. Many more are out there I’m sure.

Post: Anyone on track to quit their 9to5 in < 5 yrs from rental income?

Post: Anyone on track to quit their 9to5 in < 5 yrs from rental income?

- Rental Property Investor

- Columbus, OH

- Posts 184

- Votes 162

@Cruz Gartner

Great thread. I’m also on the FI in 5 years or less pack. Also with a goal of $10k per mo of pure cash flow. After one year I am up to $2.5k per month on average.

I’ve thought it would be great to have a group of people who have the same goal of FI in 5 years to support each other. BP and FI forums and FB groups are great for general things and posting questions but I’ve been wanting more like minded people to connect with. Even thought of it being a future book and/or podcast focusing on people who are trying to as well as those who have already achieved FI in 5 years or less and earning $10k per month or more of income.