All Forum Posts by: Account Closed

Account Closed has started 141 posts and replied 4068 times.

Post: Should I worry about hurricanes and natural disasters in Ohio?

Post: Should I worry about hurricanes and natural disasters in Ohio?

- Investor

- Scottsdale Austin Tuktoyaktuk

- Posts 4,205

- Votes 4,163

Originally posted by @Rodrigo Serzedello:

I currently have 4 properties in Cincinatti area, and as im expanding my portfolio, Im looking around other states and cities to don't "put all of my eggs in one basket". I'm specially concerned about natural disasters around Ohio area.

Is someone there from Ohio / Cinci that has the same concern like me?

Any ideas / suggestions for other cities that I could buy a <100k house and get a 1% rent?

Thanks!

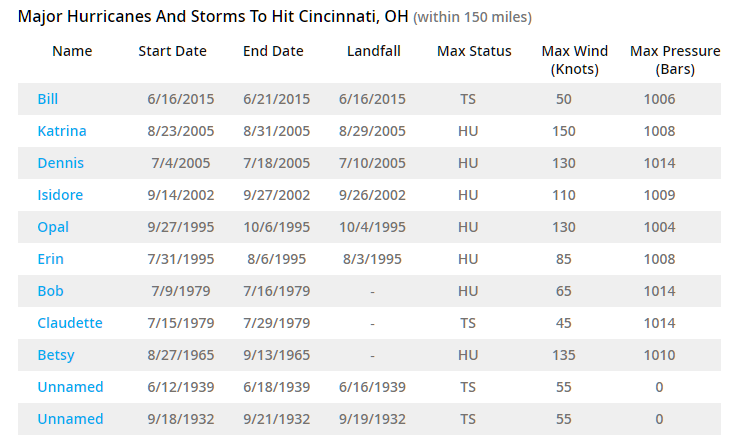

Ask your insurance agent, but is is the list

Post: China’s Largest Real Estate Developer About to Collapse

Post: China’s Largest Real Estate Developer About to Collapse

- Investor

- Scottsdale Austin Tuktoyaktuk

- Posts 4,205

- Votes 4,163

Things are about to get rocky in the world of real estate.

------------------------------

“There are more than 1.5 million Evergrande customers who put down payments on yet-to-be-completed condo building projects. “

China’s Evergrande Group customers and employees demonstrated this week as the world's largest developer faces soaring probabilities of default.

The developer is stuck between a rock and a hard place as it struggles to restart stalled construction work due to its whopping $148 billion owed in trade and other payables to suppliers as of June. The company has more than $300 billion in liabilities and has been dubbed "China's Lehman." However, Beijing gave the company a lifeline Thursday by renegotiating payment deadlines with banks and other creditors.

There are more than 1.5 million Evergrande customers who put down payments on yet-to-be-completed condo building projects.

This week's protest could be an ominous sign of more social unrest to come.

Post: What’s the deal with Opendoor?

Post: What’s the deal with Opendoor?

- Investor

- Scottsdale Austin Tuktoyaktuk

- Posts 4,205

- Votes 4,163

Originally posted by @Zak House:

What’s the deal with Opendoor in the Phx market? Seems to have bought a lot at premium price and trying to resell for break even or minimal profits….and they don’t seem to want to negotiate on anything.

Most likely they are simply trying to figure out what works. When they have money sitting around investors would ask why they are in cash instead of buying properties. It doesn't make sense to you and me but sometimes it isn't about profit, it's about appearances.

Post: Calling a STR a Bed & Breakfast: Ideas Needed!

Post: Calling a STR a Bed & Breakfast: Ideas Needed!

- Investor

- Scottsdale Austin Tuktoyaktuk

- Posts 4,205

- Votes 4,163

Originally posted by @Michael Glunk:

I'm looking for some creative, but ideally justifiable thinking on this topic. Thank in advance for any thoughts.

Here's the deal, I am evaluating a property that is in a commercial zone but can be used in a commercial or residential capacity. I think it would make a great STR. This area doesn't allow STRs unless it is permitted as a B&B. Any thoughts on how to structure it in order to run it as a traditional AirBnB type STR so it's more turn key and less labor intensive, but classified as a B&B?

B&B requires that you serve breakfast, thus B(ed) & B(reakfast). I guess you could leave a plate of croissants and strawberry jam out for them.

Post: WA Tenants Protected from Discrimination BasedOn Source of Income

Post: WA Tenants Protected from Discrimination BasedOn Source of Income

- Investor

- Scottsdale Austin Tuktoyaktuk

- Posts 4,205

- Votes 4,163

Originally posted by @Bruce Woodruff:

Originally posted by @John Boire:

I know rules and laws change all the time. I'm curious how other Washington landlords are approaching this situation?

I bet a lot are just leaving..... :-)

Roger that. We did.

Post: How many bathrooms are needed in an short-term rental/STR/AirBnb?

Post: How many bathrooms are needed in an short-term rental/STR/AirBnb?

- Investor

- Scottsdale Austin Tuktoyaktuk

- Posts 4,205

- Votes 4,163

Originally posted by @Richard Davis:

How many bathrooms do you think are optimal for a given number of bedrooms in an STR intended to be advertised primarily through VRBO and AirBnb? I recently spoke to a STR manager who cautioned me against a 6/2, saying that having just two bedrooms for 12 guests would lead to bad reviews and plumbing problems. But Rentalizer seems to PREFER 6/2's over 6/4's in some cases. I've seen Rentalizer's revenue prediction for the same property jump from $101k to $181k when I changed the data from 6/4 to 6/2 (yes, HIGHER revenue for fewer bathrooms).

Puzzled! Perplexed! Flummoxed! Do renters not like bathrooms?

What's Rentalizer?

We stayed in a nice VRBO cabin for a week at Christmas in Ashville in a 6 bed 2 bath for seven of us and it worked fine. No one was doing the pee pee dance for very long.

Post: Loan Modification AFTER Forbearance

Post: Loan Modification AFTER Forbearance

- Investor

- Scottsdale Austin Tuktoyaktuk

- Posts 4,205

- Votes 4,163

Originally posted by @Shawn M.:

@Account Closed

This is not very informative advice. Whats a big hit mean? like having a bankruptcy?

I asnwered the question you asked. Your comment: "does your credit take a big hit?"

Yes, it's like a foreclosure or a bankruptcy. It shows you don't have control of your finances and that it would be a big mistake to lend money to you. Is that clear enough? Just curious since you made a big deal out of a word you failed to define. But, yes, you are in the stinky poo when you do one of those. Life moves on though.

Post: Anyone know where to find cash buyers?

Post: Anyone know where to find cash buyers?

- Investor

- Scottsdale Austin Tuktoyaktuk

- Posts 4,205

- Votes 4,163

Originally posted by @Gabriella McClellan:

Originally posted by @Account Closed:

Originally posted by @Gabriella McClellan:

Then it's the wrong house.

It doesn't matter what someone will sell for. What matters is how much the investor will make when it's all done and said.

You have to estimate how much money it will take a fix & flip investor to fix it up. Usually it's about $10k to $80k depending on the deal. You have to add in carrying costs - usually $2000 a month for 6 months. You have to add in the costs the investor incurs to sell, usually about 8%. and so on and on. You have to add in your fee. If there isn't any profit left after taking that risk and doing all of the work, why would an investor want it?

Well yes, but we have a contractor who does all of those estimates for us and the numbers showed this property would be a great investment for a buyer... It definitely is one of my less exciting deals, but I trust a contractor to be upfront with me about ARV and such

You're spinning your wheels with the wrong contractor. He either has never done a flip or doesn't understand what you are asking of him. But, it's your call. If you want to learn how to do things correctly PM me.

Post: Loan Modification AFTER Forbearance

Post: Loan Modification AFTER Forbearance

- Investor

- Scottsdale Austin Tuktoyaktuk

- Posts 4,205

- Votes 4,163

Originally posted by @Shawn M.:

Has anyone done this? what is the process and was it worth it? does your credit take a big hit? What other pitfalls would I need to be aware of? I know with regular Forbearance you can't apply for a new loan for 3 or 6 months. Any guidance on whether this is a good route to lower your rate is appreciated.

Sure, it's whatever you work out with the bank. Yes, your credit takes a big hit.

Post: HOA Foreclosure without mortgage

Post: HOA Foreclosure without mortgage

- Investor

- Scottsdale Austin Tuktoyaktuk

- Posts 4,205

- Votes 4,163

Originally posted by @Amanda Seth:

Hello all,

Has anyone bought a HOA foreclosure property without any mortgage on it? I want to know how does it work? Do you legally get the ownership and title after the sale if you are the winning bidder?

Any feedback would be helpful.

Thanks,

Amanda

Foreclosure laws vary from state to state, but generally yes. If there is no mortgage you would get the property subject to any underlying liens. There may be a redemption period depending on the state.