All Forum Posts by: James Park

James Park has started 152 posts and replied 856 times.

Post: What does the top ten % of the top 1% net worth look like?

Post: What does the top ten % of the top 1% net worth look like?

- Real Estate Broker

- Johns Creek, GA

- Posts 870

- Votes 664

That book actually had a big influence in my decision to move to Atlanta over Irvine, California. Not because the author is from Atlanta, but Tom Stanley states that once the purchase price of your primary residence goes above $500,000, due to higher overhead and carrying costs, the wealth building process goes against you. Back in 2010, my plans were to move to Irvine and I only wanted to spend in the mid $400s, but I quickly realized that $400k would only buy my family a two bedroom condo there. I ended up building a lovely home on a foreclosed lot in a golf course community with 10 rated schools in Atlanta for mid $400s in 2011. Looking back, I am extremely happy with my decision and thankful to Tom Stanley.

Page 8 in the book Millionaire Mind.

"About 12 years ago we purchased our current homes for home for an average price of $558,718. The median price was $435k. We have enjoyed reasonably good appreciation on our home. On average, it is currently worth $1,381,729. The current median value is approximately $750,000. Thus, we have benefited financially and added to our net worth by the appreciation of our homes.

Post: What does the top ten % of the top 1% net worth look like?

Post: What does the top ten % of the top 1% net worth look like?

- Real Estate Broker

- Johns Creek, GA

- Posts 870

- Votes 664

Those are excellent books that i still have in my library and refer to time to time. I read Millionaire Next Door as senior in college and Millionaire Mind two years out of college when I was consulting in the bay area. There are so many golden nuggets and financial wisdom in the Millionaire Mind book.

Another stat that you may find interesting from Tom Stanley is that the value of the primary residence of a millionaire is less than 25% of his or her networth and scales up as the networth increases.

Avg. Networth Personal Residence Value value of home % Net worth

$1,493,804 $404,240 27.1%

$3,416,267 $620,779 18.2%

$6,859,864 $1,034,411 15.1%

$13,687,961 $1,818,699 13.3%

$59,919,891 $2,735,436 4.6%

Even though I firmly believe that real estate buy and holds should be the foundation of your wealth managment process / portfolio, what I believe is even more important is to find a business that you are absolutely passionate about, a vocation of love, a lifetime career.

Post: What does the top ten % of the top 1% net worth look like?

Post: What does the top ten % of the top 1% net worth look like?

- Real Estate Broker

- Johns Creek, GA

- Posts 870

- Votes 664

@Bryan Hancock:

Many of us have not experience an interest rising environment like 1941 (ten year was 1.95%) - 1982 (ten year reached 14.59%) and the investment strategy will change when the interest rates rises in the years ahead.

I believe 5% is a yield one can achieve without take much risk of their captial and I believe that wealth preservation is important to a multi-millionaire.

Percentile of Networth:

99.90 % $30,644,280.00

99.50 % $11,898,128.00

99.00 % $7,869,549.00

98.00 % $4,640,000.00

97.00 % $3,180,000.00

96.00 % $2,400,000.00

95.00 % $1,868,640.00

Originally posted by @Bryan Hancock:

Why an estimate of 5% passive income?

Post: REAL ESTATE PROFESSIONAL-TAX BENEFITS

Post: REAL ESTATE PROFESSIONAL-TAX BENEFITS

- Real Estate Broker

- Johns Creek, GA

- Posts 870

- Votes 664

One thing I noticed as a great benefit when I became a real estate professional, is that my passive losses from my schedule E became active losses which seemed to off set my earned income 1 to 1 ratio. If you were operating a software company as an S Corporation, you would not be able to do that since the owner would not be classifed as a real estate professional and earned income would not be able to offset passive income 1 to 1.

If a real estate agent list his clients' homes for a commission and also flips 3 houses a year, both Income from flipping and commissions from transactions would be considered ordinary income subject to income tax which would offset rental properties passive losses 1 to 1. As a real estate professional, I can exceed the $25k maximum cap on rental losses whether I make $20k/year or $250k/year. For an engineer, doctor, any other profession, the rental loss cap will completely phase out at an AGI of $150k and will be carried over to the next year.

Disclosure: I am not a CPA, but my wife is.

Post: What does the top ten % of the top 1% net worth look like?

Post: What does the top ten % of the top 1% net worth look like?

- Real Estate Broker

- Johns Creek, GA

- Posts 870

- Votes 664

% Networth Estimated 5% passive income (Annual basis)

99.90 % $30,644,280.00 $1,532,214

99.50 % $11,898,128.00 $594,906

99.00 % $7,869,549.00 $393,477

95.00 % $1,868,640.00 $93,432

90.00 % $943,656.00 $47,182

80.00% $428,540.00

70.00% $247,026.00

60.00% $147,732.00

50.00% $81,456.00

40.00% $38,322.00

30.00% $14,840.00

20.00% $4,314.00

10.00% -$2,066.00

Household Annual Income

99.00 % $521,411

95.00 % $208,810

90.00 % $148,688

80.00 % $107,628

Post: Does a W2 from your own corporation count?

Post: Does a W2 from your own corporation count?

- Real Estate Broker

- Johns Creek, GA

- Posts 870

- Votes 664

Yes,

J Scott is correct that you need to 2 years of tax returns. The lender will count both your W2 and your K1 (net profit) as your income.

Post: North Atlanta Real Estate Market Update

Post: North Atlanta Real Estate Market Update

- Real Estate Broker

- Johns Creek, GA

- Posts 870

- Votes 664

When we see the data and chart for Forsyth County, the numbers are very interesting. Forsyth is a more affluent County than Gwinnett where the per capital income is higher and schools are rated mostly in the 9s and 10s. We can see that the peak median home price value took place on May 2007 at $295,000 in Forsyth County. Unlike Gwinnett County which corrected more than 50% from 2007 - 2012, Forsyth County only corrected 35.6%. If you had bought in Forsyth County at the bottom in Feb 2011, today your property value would have appreciated 59% vs 100+% had you bought in Gwinnett County. Gwinnett County's median home price is current at the peak level of 2007 whereas Forsyth County's median home prices are starting to make new highs surpassing the 2007 peak price level before the crash.

Forsyth County Median Home Price Data

Forsyth County Median Home Price Chart

Post: North Atlanta Real Estate Market Update

Post: North Atlanta Real Estate Market Update

- Real Estate Broker

- Johns Creek, GA

- Posts 870

- Votes 664

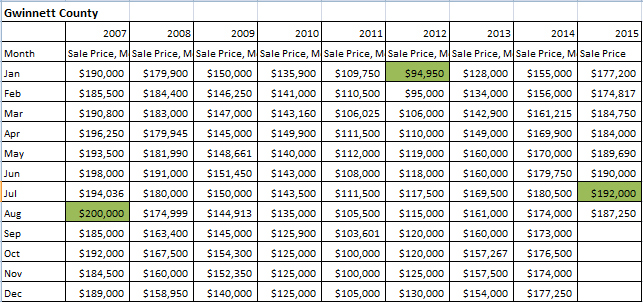

Now we can see some historical data as a buy and hold investor in Gwinnett vs Forsyth County. Gwinnett's housing peaked in August 2007 where the median sales price hit $200k. Prices dropped 52.5% down to $94,950 in January 2012. If you were one of those investors who bought back then and held on for three years, your property value would have more than doubled today. Data and Chart of Gwinnett County is Shown below.

Gwinnett County Median Home Price Data

Post: North Atlanta Real Estate Market Update

Post: North Atlanta Real Estate Market Update

- Real Estate Broker

- Johns Creek, GA

- Posts 870

- Votes 664

Case Shiller data is updated. As of June 30th, 2015, both Atlanta and Los Angeles metro markets have appreciated 5.08%.

Below is a chart for Peak to Trough Values for Atlanta, Chicago, Los Angeles, and San Francisco.

Post: Certified Investor Agent Specialist™ (CIAS) Designation

Post: Certified Investor Agent Specialist™ (CIAS) Designation

- Real Estate Broker

- Johns Creek, GA

- Posts 870

- Votes 664

I am assuming you are a licensed agent looking to specialize in investment properties for your cilents. If this is the route you want to go in your career and want to build your credentials, I would probably get your broker license, then get the CCIM designation rather than CIAS. Although I don't believe a degree or designation is requirement to be successful as a broker, it does your show the clients you have made a commitment to this business. I plan to pursue my CCIM designation.

Real Estate Brokers: Credential Path

Sales License (level 1)

Broker License (level 2)

CCIM, MBA (level 3 -optional)

Financial Advisors : Credential Path

Series 6,7, & 65 (level 1)

CFP (level 2),

CFA, MBA (level 3 - optional)

Salary Comparison:

Median Income for a CCIM designee $132,000

Median income for Harvard Business School : $135,000

Median Income for Stanford MBA : $130,000