All Forum Posts by: Steve Meyers

Steve Meyers has started 19 posts and replied 175 times.

Post: Taxes on selling primary property

Post: Taxes on selling primary property

- Real Estate Agent

- San Diego, CA

- Posts 190

- Votes 77

Quote from @PK Adi:

Hi,

I bought a house in 2018 in San Diego and then moved out of state for job reasons in 2022. So basically, I will complete the 2 out of 5 rule in 2025. Can someone help me understand the tax implications if I sell the property before completing the 5 years and after 5 years.

My tax status is married and joint filing.

Thanks in advance.

https://www.investopedia.com/ask/answers/06/capitalgainhomes....

Link above explains it. $500K is exempt from cap gains if you're married the remaining is what you pay cap gains on.

Post: Hold and Rent OR Sell and Invest Out of State

Post: Hold and Rent OR Sell and Invest Out of State

- Real Estate Agent

- San Diego, CA

- Posts 190

- Votes 77

Quote from @Forrest Brown:

Purchased in 2021 and finished rehab January 1 of 2022. The rental market is okay, just very saturated due to the limited supply of homes for sale. I've been told by other investors in San Diego that there will be a correction soon to come and the market is insanely inflated. Also, overall population is decreasing.

If you need a good 1031 accomedator which you will if you want to do a 1031 I'd be happy to connect you with my guy Brandon. Since you've owned it for more than a year you would be able to do a 1031 exchange. A lot of investors are looking outside of CA. It comes down to what's important to you, appreciation or cash flow. SD is not a cash flow market but you get the appreciation over time. You could easily cash out and go purchase some section 8 rentals in Kansas City, St. Louis or Cleveland and cash flow a lot more than you are currently making. I would look into furnished finder and rent to a travel nurse. North Park is a highly desirable area for a lot of travel nurses and they will pay more typically because they get an allowance for housing from the hospital.

Post: Best lead generation sites

Post: Best lead generation sites

- Real Estate Agent

- San Diego, CA

- Posts 190

- Votes 77

@Jaudon Smith how has real geeks worked out for you so far?

Post: Had anyone heard of Cogo Capital?

Post: Had anyone heard of Cogo Capital?

- Real Estate Agent

- San Diego, CA

- Posts 190

- Votes 77

@Kenneth T. if you're investing in San Diego, I've had good experiences with easy street capital and aqua funding.

Post: Need a real estate CPA? Attorney? to sell a house

Post: Need a real estate CPA? Attorney? to sell a house

- Real Estate Agent

- San Diego, CA

- Posts 190

- Votes 77

@Jen Breysler sent you a PM.

Post: What should I do with the NAR Settlement if I'm selling before July

Post: What should I do with the NAR Settlement if I'm selling before July

- Real Estate Agent

- San Diego, CA

- Posts 190

- Votes 77

@Gregory Saysset commissions have always been negotiable on both sides. You don't need to wait until July if you do not want to offer a commission percentage to the buyer's agent. What I will say is by not offering one you are esstentially hurting your property and the number of offers you will get because you are diminishing your buyer pool to just those that are willing and able to pay their buyer's agent. So most VA and FHA buyers won't have extra money to pay a buyer's agent commission when they are coming up with a down payment and closing costs. Just my two cents.

Post: Set to Inherit San Diego property: Build, Rent, or Sell?

Post: Set to Inherit San Diego property: Build, Rent, or Sell?

- Real Estate Agent

- San Diego, CA

- Posts 190

- Votes 77

@Lauren L. the first thing I would do is get a feasibility study done on your lot to decide what can be built on it to determine highest and best use of your lot and the cost that is associated with that. There are a lot of developers in SD that will partner with you on something like this and help out with the capital. It's ideal that you own the property outright because the holding costs on a hard money loan a lot of time is what kills development deals. You can find a couple of capital partners to come in and help out with cost for permits, plans etc.

I'm not a developer myself but I know a few who are doing these types of projects throughout SD and would be interested in partnering with you. Send me a PM if you want to chat about this further.

Post: San Diego Market Recap - Jan 2024

Post: San Diego Market Recap - Jan 2024

- Real Estate Agent

- San Diego, CA

- Posts 190

- Votes 77

Two full months into 2024 and things are picking right back up where they left off in 2023. With many buyers tired of waiting on the sidelines for interest rates to drop, we've seen an uptick in activity in the first couple of months of 2024.

Below is a recap of last month's market stats in comparison to the prior year regarding new listings, median sales price, days on market, pending sales and closed sales.

New Listings for Detached Single Family Houses

Jan 2024 - 1,484 compared to 1,425 last January, up about 4.1%

Feb 2024 - 1,345 compared to 1,334 last February, pretty much the same level of supply as last year.

New Listings for Condos/Townhomes

Jan 2024 - 933 compared to 811 last January, up about 15%

Feb 2024 - 851 compared to 735 last February, up about 15%

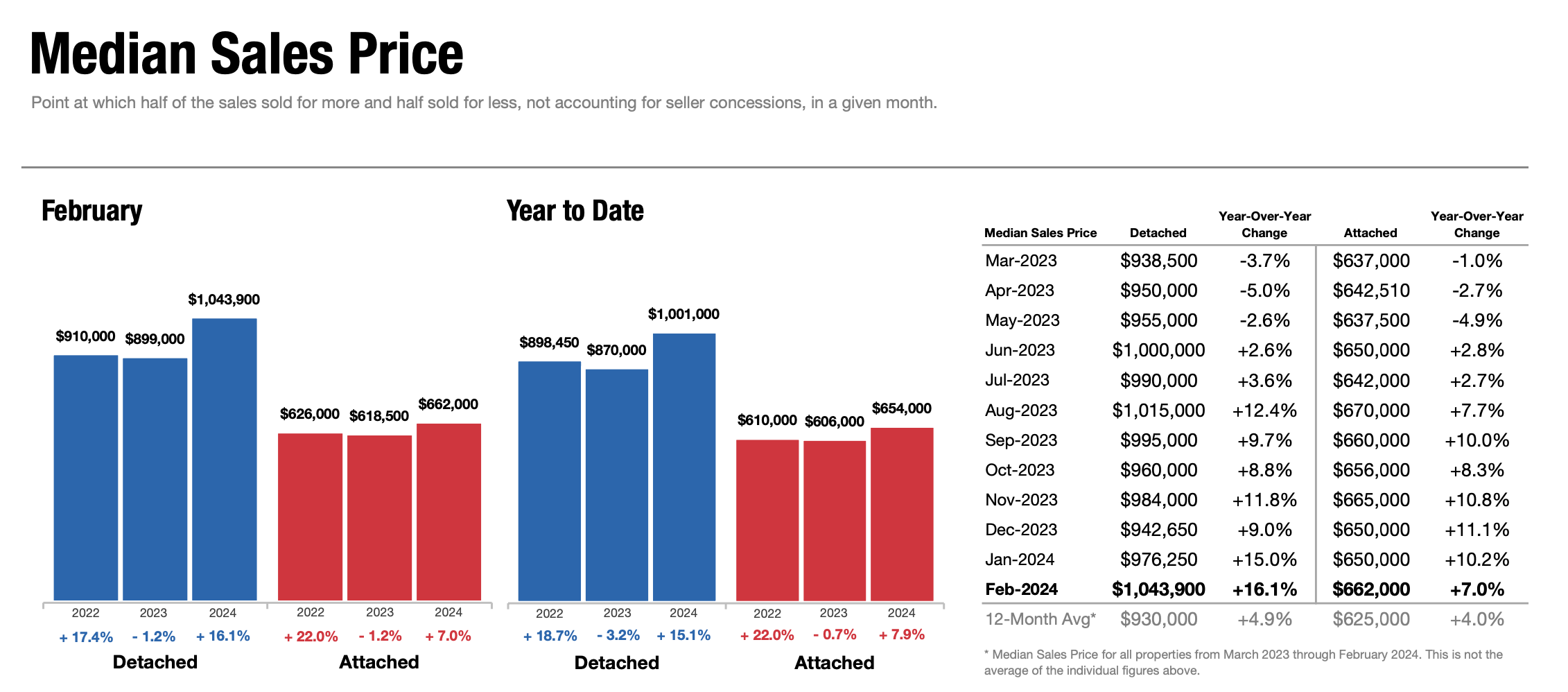

Median Sales Price for Detached Single Family Houses

January 2024: $980,000

February 2024: $1,043,900 is the current median sales price last month for a house. Up about 6.5% from last month.

Median Sales Price for Condos/Townhomes

January 2024: $650,000

February 2024: $662,000 is the current median sales price last month for a condo/townhome. Up about 2% from last month.

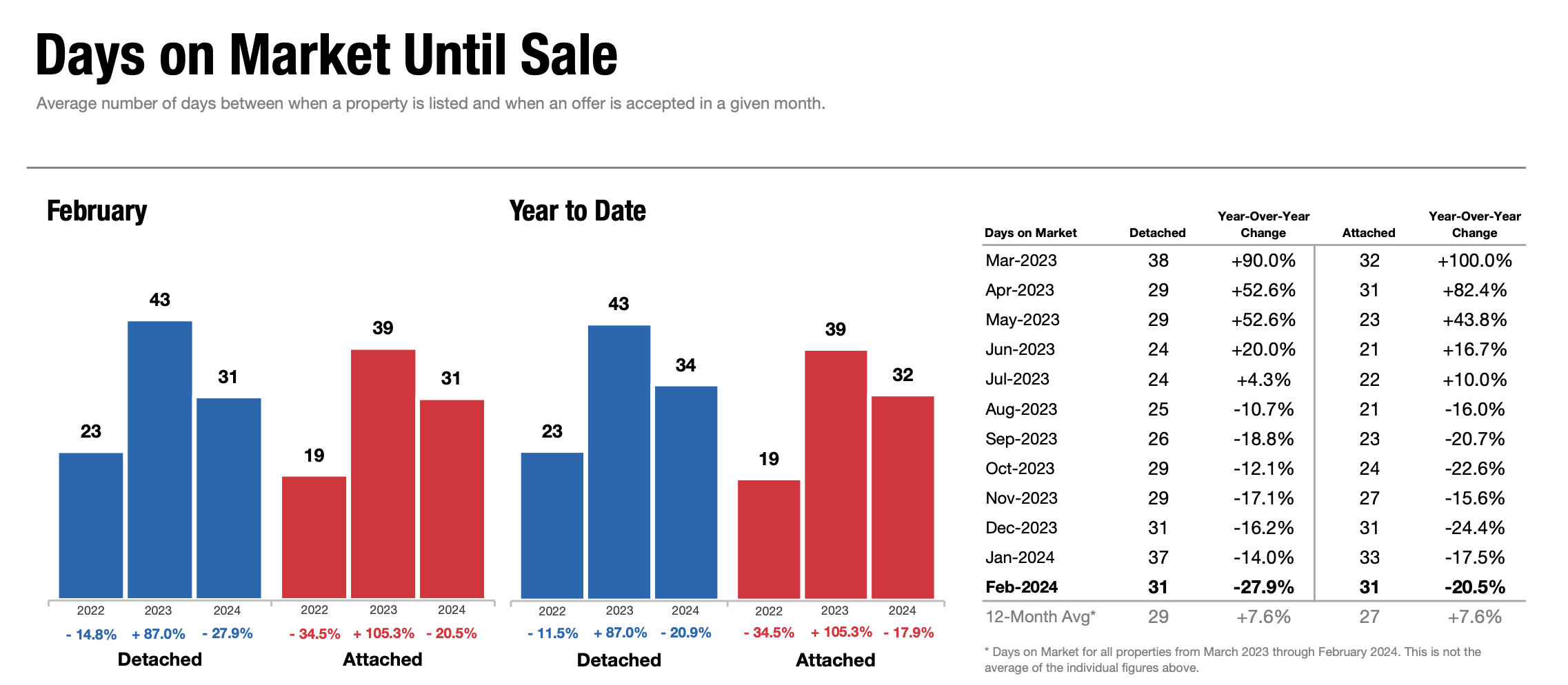

Days On Market for Detached Single Family Houses

Feb 2024: 31 compared to 43 this time last year.

Days On Market for Condo/Townhomes

Feb 2024: 31 compared to 39 this time last year.

Pending (Under Contract) for Detached Single Family Houses

Feb 2024: 1,209 compared to 1,197 this time last year about the same amount of buyer demand.

Pending (Under Contract) for Condos/Townhomes

Feb 2024: 707 compared to 690 this time last year. Condo and townhome sales are up about 2.5% from this time last year.

Closed Sales for Detached Single Family Houses

Feb 2024: 1,049 compared to 1,025 this time last year. Number of sold are up about 2%

Closed Sales for Condos/Townhomes

Feb 2024: 664 compared to 581 this time last year. Number of sold are up about 12.5%

Today's Rates

Looking Ahead:

As we head into the Spring market, I predict more buyers will begin entering the market, especially once tax season is over with come April. Inventory continues to be the biggest factor in keeping prices high throughout San Diego county.

If you are one of the many buyers on hold due to interest rates, a good alternative is asking the seller to credit you for a 3-2-1 or 2-1 rate buy down. This will help get you a lower payment for the first 2-3 years of ownership and allow you to refiance when rates come back down.

Show as urlRemove

|

Warm regards,

Post: New to bigger pockets and excited to start investing save

Post: New to bigger pockets and excited to start investing save

- Real Estate Agent

- San Diego, CA

- Posts 190

- Votes 77

I would look into a DSCR loan option it will require 15-25% down depending on the lender but it's based off the asset and if it debt services rather than based off the individual. Stash the extra money you can save in an index fund like VTI or something that is getting you a good ROI while you build up your equity for your HELOC, this way you're saving up some down payment money while your equity in your home builds. That's what I would do

Post: New to bigger pockets and excited to start investing save

Post: New to bigger pockets and excited to start investing save

- Real Estate Agent

- San Diego, CA

- Posts 190

- Votes 77

@Tiffany Sorocco if you want to invest out of state I would look at what area you want to invest in, ideally something that is not too far away in case you need to go there, but a lot of ppl in CA are investing in the midwest areas and renting to sec 8 tenants. You can get higher rents with this strategy and the government is paying most of your tenants rent money directly to you. You can look up FMR - fair market rents on the HUD site to see what areas are paying what for 3 bedrooms homes. Good luck

:max_bytes(150000):strip_icc()/3-2-1_buydown.asp-Final-fa9d408b7f784938979231ce2d84ca58.jpg)