All Forum Posts by: Thomas Rutkowski

Thomas Rutkowski has started 20 posts and replied 801 times.

Post: Evaluating my current property

Post: Evaluating my current property

- Financial Advisor

- Boynton Beach, FL

- Posts 819

- Votes 791

There is no such thing as "investing in equity". You have a great thing going with your zero down VA loan. You are fully leveraged with none of your own money in the deal. If the property were actually cash flowing, you would have the dream scenario.

Equity is not an investment. It offers zero return. IF your property were generating cash flow, the return would not change one bit by increasing the investment in the property.

You would be much better off by looking for new opportunities for your savings. That and raise your rent ;)

Semper Fi brother.

Post: Cash Accumulation life insurance

Post: Cash Accumulation life insurance

- Financial Advisor

- Boynton Beach, FL

- Posts 819

- Votes 791

It sounds to me like you are ok with sneaking the high death benefit - and the higher commission that goes along with it - into a policy and not telling the client about it because you think its in the client's best interest. If the client's stated goal is a maximum overfunded policy, that is what I am going to give them.

IRR is a useless calculation when comparing life insurance policies. It is looking at the return on the premium. The insurance fees are a loss. I care about the return on the cash value. When $1 of premium turns into 60-cents of cash value, the IRR is going to be much lower than when the cash value is 85-cents.

And talking about a place to store the profits generated...

First, 60-cents of leveraged cash value is not going to generate as much profit as 85-cents of cash value. All the people here standing on the sidelines watching this thread are trying to objectively determine whether or not it makes sense to put cash into a policy and leverage it to invest in "A" or simply invest in "A" directly.

That's what I wanted to see when I first figured this out. And I built a financial model to prove it to myself. And every client and prospective client who has reached out to me. Its a lot easier to accomplish when 85-cents of your premium dollar is going to work in two places at once rather than only 65-cents.

Second, there is nothing but future potential uninsurability stopping someone from increasing the death benefit of the policy or starting a new one to absorb the profits generated from the side fund.

I have no issue with sitting down with someone and explaining how life insurance can meet multiple needs. You have the extreme high DB/low CV on one end of the spectrum and Low DB/High CV on the other. Both can meet the client's needs. But when the emphasis is on CV, give them what they want.

And don't feed them the BS that putting more premium into their policy is "paying themselves interest". That is extremely dishonest. They aren't borrowing from their own bank and their not paying themselves interest. They are borrowing from the insurance company and anything on top of the interest paid to them is just more premium that could have been put into the policy on day 1.

Post: Cash Accumulation life insurance

Post: Cash Accumulation life insurance

- Financial Advisor

- Boynton Beach, FL

- Posts 819

- Votes 791

I agree with everything you have said. Life insurance is an infinitely customizable financial tool.

But, you have no idea how many people rely on me to take a second look at their IBC/BYOB proposals. Those clients, whose goal was specifically to get what they thought was a maximum-overfunded policy, instead were given policy illustrations that WERE NOT funded to the maximum. How would they know?

The vast majority are designed exactly the same. They leave room for the client to add premium later in the form of paid up additions under the guise of "paying yourself interest".

When I do see an illustration that is well-designed, I let them know that there is nothing I can do to improve it.

Post: Cash Accumulation life insurance

Post: Cash Accumulation life insurance

- Financial Advisor

- Boynton Beach, FL

- Posts 819

- Votes 791

Not all policies are created equal. At one end of the spectrum you have basic whole life and their Guaranteed UL equivelent. These are minimally-funded policies that offer the most death benefit protection for the money. This is what your typical "hater" is thinking about when they comment on these forum posts. To use your $1 analogy, its not moving $1 from checking to saving. A minimally-funded policy is trading $1 for "insurance" and maybe 25-cents of cash. If you survive the year, all you have is 25-cents.

The opposite end of the spectrum is an overfunded policy designed right up to the MEC limit. The fees, and death benefit, are held to a minimum. You also have the entire spectrum between these two extremes. Using your analogy again, an overfunded policy is trading $1 for less "insurance" and 85-cents of cash value. If you survive the year, you have is 85-cents. [but that 85-cents is capable of generating more retirement income than the full dollar in a traditional account]

If pure death benefit protection is your goal, then I agree with you: who cares about the costs. But if my goal is creating tax-free retirement income, the fees are a drag on the performance of the cash value. If the policy is not designed properly, the income will be lower. Moreover, when I'm leveraging my policy, I want to know that I am better off by leveraging it as opposed to simply investing directly in the alternative.

With a poorly designed IBC policy, the numbers will never work out, because the high fees mean you have less cash going to work for you. so I had better been after the death benefit protection. When the fees are low, the payback occurs much sooner.

Post: Solo 401K vs SDIRA? Which is a better tool for flipping?

Post: Solo 401K vs SDIRA? Which is a better tool for flipping?

- Financial Advisor

- Boynton Beach, FL

- Posts 819

- Votes 791

Neither. If you want to maximize the amount of tax deductible contributions, use a self-directed defined benefit plan. The contribution limits on defined contribution plans are limited by the government.

A defined benefit plan, on the other hand, represents a commitment by the employer to pay some amount of the employees salary in retirement. Thus, you are required to fund it at the level necessary to meet those obligations. This means generally means that you can contribute FAR more than you can with a defined contribution plan.

As the plan Trustee, the business owner has a fiduciary obligation to the plan participants (you and your wife, right?). You also have control over the assets of the plan.

Post: Cash Accumulation life insurance

Post: Cash Accumulation life insurance

- Financial Advisor

- Boynton Beach, FL

- Posts 819

- Votes 791

Originally posted by @Joe Splitrock:

Originally posted by @John Perrings:

A recurring objection to permanent insurance is the perceived "high cost" of the premiums as compared to the perceived "low cost" of term insurance.

Something to understand: Term insurance is a true cost. When you pay term insurance premiums, you will never see that money, nor the interest you could have earned on that money, ever again.

With permanent insurance, you still have access to the cash you put into the policy.

If you move money from your checking account to your savings account, is there a cost?

The same thing is happening with permanent insurance.

And since there are the additional features of a permanent death benefit and disability waiver, this "savings account" (insurance policy) self-completes all the deposits you would have made into it, over the course of your working life, in the event you die or become disabled. Does your bank or brokerage account do that?

Are you trying to say that permanent insurance has no "true cost" built into it? In other words, none of the money you pay goes towards a fund to cover death benefit? That is really hard to believe. I am fairly sure that for every 1000 permanent policies written, some percentage of people die prior to funding anywhere near the death premium. The money to pay those premiums comes from that risk pool of all 1000 people (just for example). So a portion (the term portion) of your permanent policy payment does not get invested. It goes towards the risk pool and insurance company profit/administration costs.

My point is a permanent policy has a term component. So what is the difference if you buy a term policy and then just invest the other money into a brokerage account? So instead of paying $1000 a month for a permanent life policy, I pay $50 term and invest the other $950 in my brokerage.

There are two huge differences between simply buying term and investing the difference and buying a permanent life insurance policy.

The first is the tax benefit of the cash value of the life insurance.

The second benefit, that no one here has mentioned, is that you can get about 2 to 3 times the after tax income from the cash value of a life insurance policy that you can get from a typical brokerage account or IRA/401(k).

Tax Benefit

While the permanent life insurance policy is certainly hit with high upfront charges, the cash value within the policy accumulates tax-free. And, as you'll see below, the increased income potential more than makes up for the fees. Money in a typical brokerage account will be hit with taxes on the interest and dividends as well as capital gains tax on the increases. Contributions to a Roth are already taxed as are the premium dollars used for the life insurance policy. It too grows tax free, but the contributions are limited whereas life insurance has no limits. And you won't get nearly as much income from the Roth as you will from the cash value.

Traditional IRA/401(k) will grow tax free, but you will pay ordinary income taxes on every dollar that is distributed.

Income Benefit

This is the beautiful thing about permanent insurance. And especially Indexed Universal Life. All 50 states in this country have language written into their statutes that requires that life insurance companies make loans to their policy owners that are secured by the cash value of the policy. It doesn't state that they can borrow their cash value. It states that they must make loans to the policy owner.

The way that a life insurance retirement plan works is this: you borrow against the policy to get tax free income. At the end of the year, when the interest is due, the insurance company, knowing that the collateral securing the loan also went up in value, loans you the money to pay themselves the interest and tacks it onto the loan balance. This continues year after year with the loan balance getting ever larger each year, but it is always secured by the cash value that is also growing every year.

When the policy owner dies, the death benefit (which includes the small term payout plus ALL of the cash value) first satisfies all of the policy loans and then the balance is paid to the beneficiary.

The magic is that the overall balance is not reduced as income is taken as it is with every other type of retirement savings. The full amount of cash value continues to earn interest/dividends and grow.

---------------------------------------------------------------------------

Look up the 4% Rule. Financial advisors recommend not taking any more than 4% of your retirement saving as income. This reduces the risk that you will run out of money before you die.

So...

If you have $1 Million in a traditional IRA or 401(k), you can reasonably expect to take annual distributions of $40,000. BUT, that money hasn't been taxed yet. In the 25% tax bracket, the US Treasury will get $10,000 of that and you will net only $30,000.

If you have $1 Million in a Roth IRA, congratulations! You don't have any taxes to pay. Your annual income will be $40,000 per year. (The 4%-Rule)

If you have $1 Million of Cash Value, you can safely take about $80,000 per year in loans against your policy's cash value. That is damn near 3X the income from the traditional IRA and 2X the income from the Roth.

SHOW ME HOW YOU CAN DO THAT WITH THE BUY TERM AND INVEST THE DIFFERENCE MODEL.

And do it without making outrageous assumptions about growth. This is simply nice, safe life insurance. Principal protected.

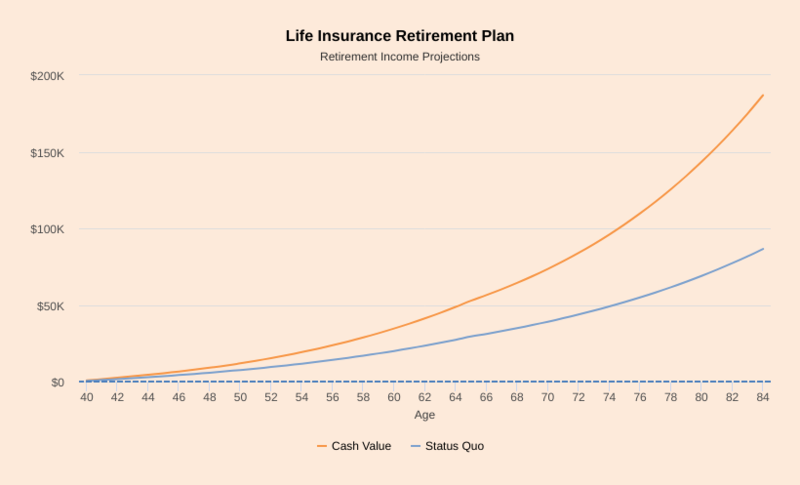

This chart is comparing the income projections for a 40 year old client saving $12,000/yr to age 65. The orange line is the income from the life insurance policy. The growth rate on the cash value is 6.38% which matches Penn or Mass Mutual Whole Life and is reasonable for any Indexed UL. The Blue line represents a market alternative and is based on a reasonable 9% growth assumption.

What this is showing is the income the client could take if the client retired at that age. Retirement at age 65, for example, would allow retirement income of around $52,000 per year TAX-FREE from the cash value versus maybe $30,000 of income from the brokerage account.

Here is what the accumulation looks like over time...

Yep. The brokerage account has more money in it at retirement age. So what? You can still get more Income from the life insurance policy. You can take your quarterly account statement from your broker to starbucks and it won't buy you a cup of coffee. Income is what matters.

I can show the math underlying these assumptions. Its not hard, simply build a spreadsheet and tally the loans and financed interest.

As a Fiduciary, I have no issues with recommending an overfunded life insurance policy. I know that my clients will pay less in fees and commissions and will receive greater income at retirement.

The haters here can think what they want. They are confusing a minimally-funded whole life policy with over-funded life insurance. These are two completely different animals.

Post: Cash Accumulation life insurance

Post: Cash Accumulation life insurance

- Financial Advisor

- Boynton Beach, FL

- Posts 819

- Votes 791

Originally posted by @John Perrings:

Originally posted by @Joe Splitrock:

Originally posted by @John Perrings:

A recurring objection to permanent insurance is the perceived "high cost" of the premiums as compared to the perceived "low cost" of term insurance.

Something to understand: Term insurance is a true cost. When you pay term insurance premiums, you will never see that money, nor the interest you could have earned on that money, ever again.

With permanent insurance, you still have access to the cash you put into the policy.

If you move money from your checking account to your savings account, is there a cost?

The same thing is happening with permanent insurance.

And since there are the additional features of a permanent death benefit and disability waiver, this "savings account" (insurance policy) self-completes all the deposits you would have made into it, over the course of your working life, in the event you die or become disabled. Does your bank or brokerage account do that?

Are you trying to say that permanent insurance has no "true cost" built into it? In other words, none of the money you pay goes towards a fund to cover death benefit? That is really hard to believe. I am fairly sure that for every 1000 permanent policies written, some percentage of people die prior to funding anywhere near the death premium. The money to pay those premiums comes from that risk pool of all 1000 people (just for example). So a portion (the term portion) of your permanent policy payment does not get invested. It goes towards the risk pool and insurance company profit/administration costs.

My point is a permanent policy has a term component. So what is the difference if you buy a term policy and then just invest the other money into a brokerage account? So instead of paying $1000 a month for a permanent life policy, I pay $50 term and invest the other $950 in my brokerage.

Hi Joe,

Yes, there is a cost for insurance. That cost is often paid in the first 1-3 years of the policy. During those first couple of years, you get less cash value per year than what you put into it.

After that, however, for every $1 in premium you pay, you end up with more than $1 in cash value for that year.

That is net of all costs, fees, etc.

At some point, say around 3-7 years, you will completely break even - meaning the total available cash value will be greater than or equal to every cumulative premium dollar you've paid into the policy.

If I put $1 in and my cash value is greater than or equal to $1, isn't that just like a savings account?

To use your example, if you paid $50/mo for term insurance for 20 years, that's $12,000 total cost. But it's $20,000 in lost opportunity cost if you would have put that $50 somewhere earning, say, 5% annually for 20 years. That's $20,000 you never earned and can never earn on in the future.

If you put the entire $1,000/mo in a permanent policy earning 5% for 20 years, that's $240,000 in total premium payments, but you'd have $400,000 in cash value, or a $700,000 death benefit. All tax free.

You have more tax-free money than what you put in. Was there a cost to you for this life insurance?

100% Control, Use, and Certainty

This is not an accurate statement. You are conflating the crossover point where cash value exceeds the premiums as the point where expenses cease. That is not the case. There is no point where 100% of the premium goes straight to the cash value.

There are generally 3 groups of expenses in a life insurance policy: Premium charges, Policy Charges, and the Cost of Insurance. The insurance company takes a percentage of every dollar of premium every year for life. This is explicit in a Universal Life and buried in a Whole Life. The Policy Charges are related to the death benefit: the higher the death benefit, the higher the policy charges. This is where the savings occurs in overfunded policies designed with minimum death benefits. These charges are spread across the surrender charge period of the policy. They go away after 10-15 years.

The final charge is the cost of insurance. The insurance company needs to pool money in order to pay the expected claims. This cost is made explicit in a universal life and is simply buried in a whole life.

As I've written repeatedly throughout this thread, the cash value of a policy represents the policy owner saving up their own death benefit over their natural life expectancy. The cost of insurance is there every single year to cover the gap between the cash value and the death benefit.

Whether the policy is a whole life or universal life, these costs are there. We know they're virtually the same in both types of policies because both types of policies will have identical cash accumulation values when the same design assumptions are used.

Post: Cash Accumulation life insurance

Post: Cash Accumulation life insurance

- Financial Advisor

- Boynton Beach, FL

- Posts 819

- Votes 791

Originally posted by @Todd Concienne:

@Peter York this is exactly the strategy I use to invest in real estate and other investment opportunities. I have a whole life permanent insurance policy. I have become my own banker with this vehicle and take loans against it to invest in real estate deals as well as other investments.

The advice I would give you though is to make sure you work with an infinite banking practitioner because it is extremely important that the policy is structured to suit your needs. Not all life insurance policies or life insurance salesman are creayed equal. Do your homework before jumping in so you understand fully what you are jumping in to, how to use your new “be your own banker” system, and the discipline it will take. Study Mr Nelson Nash’s work become your own banker, read as many books on the subject as you can.....many are free. Search be your own, infinite banking system, cashflow banking system, what would the Rockefeller’s do, the banking effect. For me it has been a game changer

The policies designed by infinite banking practitioners are not funded to the maximum. They are certainly "over funded" policies, but they are not funded to the maximum limit. Their gimmick is convincing you to put in more premium later in the form of "interest you are paying yourself". There is absolutely nothing stopping you from simply putting that premium in up front and having even more cash value to borrow against right from the get-go.

I design overfunded policies for real estate investors every day. Every person I talk to want to know: "will I be better off putting $X into a life insurance policy and leveraging the cash value to invest in "Y", or simply taking $X and investing directly in "Y".

Because you are putting your money to work in two places at once, you WILL earn a slightly higher rate of return. If every dollar you put into a policy gives you 85 cents of cash value, but you can earn 3% more on that 85-cents, you will most assuredly catch up to and surpass simply investing in "Y". Its simple compounding growth math.

But if you have a crappy policy design, and you only have 65-cents of cash value for every premium dollar, you can see that it will take a very long time for that additional 3% improvement in investment returns to pay back what you lost in fees let alone catch up to and surpass the returns you would have received by simply investing in "Y".

If you want to use your policy's cash value for leveraging into real estate, you need a properly designed policy that is funded to the legal limit.

Post: Cash Accumulation life insurance

Post: Cash Accumulation life insurance

- Financial Advisor

- Boynton Beach, FL

- Posts 819

- Votes 791

Originally posted by @Billy Smith:

Funny how they keep changing names of life Insurance. Sounds like a whole life policy stay away from its terrible way to have life insurance.

Life issuance should be used if you die and leave wife /children with un paid BIG bills.

I bought term insurance read up on its fact I need to drop it I really no longer need it.

The cost of whole life insurance can easily exceed a term policy with the same death benefit by thousands of dollars a year. As a general rule, expect whole life policies to cost five to 10 times more than a comparable term policy.

There is no "general rule". With a permanent life insurance policy, you are saving up your own death benefit over your life expectancy. The insurance company is simply responsible for the delta between the amount of the cash value and the death benefit. As you age and your cash value accumulates, the risk is shifted from the insurance company to you. If you are older and have a shorter life expectancy, your premiums are more expensive simply because it takes more money to make up for the shorter planning horizon.

When you consider that the cash value belongs to you, and you'll get it back if you surrender the policy, permanent insurance is really not more expensive than term. They are buying term and investing the difference... under the hood of the policy.

Post: Cash Accumulation life insurance

Post: Cash Accumulation life insurance

- Financial Advisor

- Boynton Beach, FL

- Posts 819

- Votes 791

Originally posted by @Account Closed:

Go with a whole life policy!

Cons for IUL

- 0% Returns WILL Reduce your Cash Value. ...

- Cost of Insurance Increases as you Age. ...

- “Net Amount of Risk” ...

- The S&P Index Crediting does NOT include Dividends. ...

- There is a Crediting Cap. ...

- You Don't Keep “Excess” Returns. ...

- It's Complicated.

This is nonsense.

Again. The cash value of a life insurance policy is literally the policy owner saving up their own death benefit. That is why your premiums to get a big policy in your 50s were so high. You have a shorter amount of time in which to save up the death benefit. The insurance company is buying term and investing the difference.

A UL/IUL is no different from a Whole Life. What the Whole Life policy calls "mortality costs" the UL simply prices out as a 1-year term. Its the same thing under the hood. The insurance company reserves are all invested in the same exact kinds of assets: Treasuries, Bonds, Mortgages, etc. Nice safe, secure assets with predictable growth.

The difference in an IUL is that they take the interest that would have otherwise been credited to the policy's cash value and they use it to hedge in the Index Options markets. They are trying to buy as much movement in the market as they can get with the money they have to spend. Some years there are zero return because the options expire worthless. But other years they are able to capture large market movements. The only important factor is that they capture some portion of the "Equity Premium": the extent by which the return on the equity markets exceeds that of the debt markets.

The dividend/Interest earning of a Whole Life policy is tied to the return of the bond markets. The same is true with a true Universal Life. However, the returns of the IUL will capture a portion of the Equity Premium. Insurance companies are playing a very long term game. Even if the net return is just one percent higher over time, that will have a significant impact on the policies internal costs. Nobody cares that the returns don't include the S&P 500 dividends. So what? Anything greater than the debt market rate of return is an improvement in the policy's performance. All they are after is a portion of the equity premium.

If you take two identically designed policies (One a Whole Life and the other an IUL with the same premium and same Death benefit, ), the IUL will most assuredly outperform the Whole Life.

Both types of policies start off with exactly the same resources (Premium) and face the exact same liabilities (Death Benefit). The cash value of the IUL will grow faster. And since the cost of insurance covers the delta between the Cash Value and the Death Benefit, the internal costs of the policy will actually be lower, not higher.

Whole life policies have mortality costs too. And they get more expensive every year just as they do in an IUL.