All Forum Posts by: Thomas Rutkowski

Thomas Rutkowski has started 20 posts and replied 801 times.

Post: [Webinar] The Double Play: Debunking Common Life Insurance Myths

Post: [Webinar] The Double Play: Debunking Common Life Insurance Myths

- Financial Advisor

- Boynton Beach, FL

- Posts 819

- Votes 791

If you have been led to believe that permanent, or whole life insurance, is a bad investment, one reason might be all of the common life insurance myths that persist and spread.

The thing is, not all life insurance policies are the same. A policy designed to maximize death benefit is going to have minimal cash value and high costs. But a policy designed for maximum cash value is going to have very low fees. And a max-funded life insurance policy is a very powerful financial tool that can generate 2-3 times the after-tax income of a similar-sized 401(k).

They're not all the same and it's not a one-size-fits-all product. So sign up and attend because we're going to debunk many of the common myths about cash value life insurance.

The goal of this webinar series is to demystify life insurance and to give you the tools you need to know -- without talking to an agent -- to get the most efficiently-designed policy so that you can maximize your wealth accumulation through your utilization of The Double Play: leveraging a max-funded life insurance policy to invest in real estate. I'm going to bust all of the myths and misconceptions about life insurance.

Post: Minimum vs Maximum Funded Life Insurance Policies

Post: Minimum vs Maximum Funded Life Insurance Policies

- Financial Advisor

- Boynton Beach, FL

- Posts 819

- Votes 791

Description:

If you've been searching the internet looking for information on using life insurance to invest in real estate you've probably come across a lot of information (and disinformation!): Whole Life vs IUL, Buy Term and Invest the Difference, Life insurance is a ripoff.

In this webinar I'm going to show you that Maximum over funded life insurance is not the same as your Uncle's Whole Life policy. Not all life insurance is created the same. If you think life insurance is a "ripoff", you're probably thinking of a typical, minimally-funded whole life. A maximum-overfunded policy is far from being a ripoff. A Maximum-funded Life insurance policy imperative for Private Banking strategies like The Double Play: putting your money to work in two places at one time by leveraging the cash value of a maximum-funded life insurance policy.

My goal in this webinar series is to demystify life insurance and to give you the tools you need to know - without talking to an agent - to get the most efficiently-designed policy so that you can maximize your wealth accumulation.

Future Topics:

3/12/2020 – Debunking the Common Myths About Life Insurance

3/19/2020 – Premium Financed Life Insurance: Flipping the Double Play on its Head

3/26/2020 – Understanding the Costs in a Life Insurance Policy

4/2/2020 – The #1 Costliest Mistake Most People Make When They Set Up a Policy

4/9/2020 – Is Buy Term and Invest the Difference Really Better? Let’s Analyze the Numbers.

4/16/2020 – 3 Things to Look for in a Properly-designed Policy

4/23/2020 – 3X the Income from the Same Amount of Savings: Life Insurance as a Retirement Plan

4/30/2020 – Understanding Indexed Universal Life: Caps, Floors, Crediting Rates, and Myths

5/7/2020 – What Companies are Best for Double Play Policies?

5/14/2020 – Why you Shouldn’t Use a Policy Loan. What to do Instead

5/212020 – Understanding Life Insurance Illustrations

5/28/2020 – Common Tricks Agents Use on Illustrations

6/4/2020 – Understanding Fixed, Variable, and Indexed Policy Loans

6/11/2020 – Understanding the Guaranteed Rate in a Life Insurance Policy

6/18/2020 – How to Get the Most Cash Value in a Policy

Post: Which is better for Real Estate Investing: IUL or Whole Life?

Post: Which is better for Real Estate Investing: IUL or Whole Life?

- Financial Advisor

- Boynton Beach, FL

- Posts 819

- Votes 791

Free webinar tomorrow: Which is better for Real Estate Investing: Whole Life or Indexed Universal Life?

Thursday 2/27 @ 1pm Eastern. If you can't make the time, register so you can view the recording.

It's impossible to do research into "Infinite Banking" or "Be Your Own Bank" programs without being told that it HAS to be done with "a Dividend-paying, Mutual Whole Life company that has been around for over 150 years"... yada yada.

Is this true or just marketing BS?

Where going to look under the hood of both types of policies to separate fact from fiction. We'll find out why both work for The Double Play. We'll build on what we learned during Life Insurance 101 and use it to evaluate the popular misconceptions and see which type of policy is truly the better tool... for Real Estate Investors.

The answer might surprise you. Don't miss this session!

Post: Which is better for Real Estate Investing: IUL or Whole Life?

Post: Which is better for Real Estate Investing: IUL or Whole Life?

- Financial Advisor

- Boynton Beach, FL

- Posts 819

- Votes 791

It's impossible to do research into "Infinite Banking" or "Be Your Own Bank" programs without being told that it HAS to be done with "a Dividend-paying, Mutual Whole Life company that has been around for over 150 years"... yada yada.

Is this true or just marketing BS?

Where going to look under the hood of both types of policies to separate fact from fiction. We'll find out why both work for The Double Play. We'll build on what we learned during Life Insurance 101 and use it to evaluate the popular misconceptions and see which type of policy is truly the better tool... for Real Estate Investors.

The answer might surprise you. Don't miss this session!

Future Topics:

3/5/2020 – Minimum vs Maximum Funded Life Insurance Policies

3/12/2020 – Debunking the Common Myths About Life Insurance

3/19/2020 – Premium Financed Life Insurance: Flipping the Double Play on its Head

3/26/2020 – Understanding the Costs in a Life Insurance Policy

4/2/2020 – The #1 Costliest Mistake Most People Make When They Set Up a Policy

4/9/2020 – Is Buy Term and Invest the Difference Really Better? Let’s Analyze the Numbers.

4/16/2020 – 3 Things to Look for in a Properly-designed Policy

4/23/2020 – 3X the Income from the Same Amount of Savings: Life Insurance as a Retirement Plan

4/30/2020 – Understanding Indexed Universal Life: Caps, Floors, Crediting Rates, and Myths

5/7/2020 – What Companies are Best for Double Play Policies?

5/14/2020 – Why you Shouldn’t Use a Policy Loan. What to do Instead

5/212020 – Understanding Life Insurance Illustrations

5/28/2020 – Common Tricks Agents Use on Illustrations

6/4/2020 – Understanding Fixed, Variable, and Indexed Policy Loans

6/11/2020 – Understanding the Guaranteed Rate in a Life Insurance Policy

6/18/2020 – How to Get the Most Cash Value in a Policy

6/25/2020 – When is the best time to use a policy loan?

7/2/2020 The Advantage of an IUL for the Double Play

Post: Using whole life dividend paying life insurance arbitrage

Post: Using whole life dividend paying life insurance arbitrage

- Financial Advisor

- Boynton Beach, FL

- Posts 819

- Votes 791

Originally posted by @Daniel Chun:

Originally posted by @Thomas Rutkowski:

What you need to worry about is whether or not your policy is properly designed to maximize the cash value. The cash value to premium ratio based on the first year premium should be about 85%. And never pay a lump sum premium in the first year, you're shooting yourself in the foot.

Why do you say not to pay a lump sum premium the first year? What is the best strategy for funding the policy?

The death benefit of a policy is a function of the first year premium. The policy issue charge is based on the death benefit and is spread out over the first 10-15 years of the policy. So...

If you drop a lump sum, let's say $50K in the first year and follow it up with annual premiums of $10K per year, your fees will be 5 times higher than if you simply paid $10K per year. The death benefit will be 5X higher than if the premium was $10K. Its all scaleable. Over 10 years, the insurance company will basically pocket most of the extra funds that were paid as premium the first year.

Let's just say that the premium charge is $5,000 when the premium is $50,000. Over the next 10 years, the policy will be hit with a $5000 charge. Had the premium been $10,000, the premium charge would have been $1,000. So the result is that over the next 10 years, less than 50% of the new premium dollars are going to the cash value. And 10 times $5,000 = $50,000... the amount of the first year premium.

I unfortunately see this happen all the time.

The solution is simple. Find the level premium that you can commit for the premium.

Post: The Business Case for The Double Play: Leveraging Cash Value

Post: The Business Case for The Double Play: Leveraging Cash Value

- Financial Advisor

- Boynton Beach, FL

- Posts 819

- Votes 791

If you've ever wondered if life insurance concepts like "infinite banking" or "be your own bank" actually work, this webinar is for you.

This is where the rubber hits the road. A simple A vs B Comparison:

Are you better off by taking your money and putting it into a max-funded life insurance policy and then leveraging the cash value to invest or by simply taking your money and investing directly? The spreadsheet business model makes an apples to apples comparison. The result is a graph that shows wealth accumulation over time for both approaches.

We'll review a sample business case and you'll get to see all the assumptions and user-definable projections.

This is the third in a weekly, 20-Minute webinar series that will cover all of the key aspects of private banking utilizing life insurance.

Post: Life Insurance 101: Cash Value, Max-Funding, Whole Life vs. IUL

Post: Life Insurance 101: Cash Value, Max-Funding, Whole Life vs. IUL

- Financial Advisor

- Boynton Beach, FL

- Posts 819

- Votes 791

Educational Only!

Don't do infinite banking or be your own bank strategies with life insurance until you understand the basics. The purpose of this session is to take the mystery out of permanent life insurance. When you take a peek under the hood and look at the mechanics of a permanent life insurance policy, you’ll find that it is actually very simple. I get tired of seeing YouTube videos and so-called experts making Whole Life sound mysterious and esoteric. Its not. YOU, as a consumer, need to understand the product that you are purchasing before you commit to using it as a bank to fund your real estate.

This session will provide the fundementals so that we can start taking a deeper dive into The Double Play: using life insurance to fund real estate.

This is the second of a once a Week, 20-Minute Webinar series covering every key aspect of Life Insurance and "The Double Play".

Webinars will be every Thursday at 1pm Eastern.

Signup for a reminder each week

Thursday February 13th @ 1pm Eastern

Future topics will include:

2/20/2020 The Business Case for Leveraging Cash Value

We're going to take a close look at the business model that I use to compare putting $X amount per year into life insurance and leveraging the resulting cash value to invest in Y growing at Z% against simply taking $X and investing it directly in Y and skipping the life insurance. Its an apples-to-apples comparison of using life insurance vs not using it.

2/27/2020 – Which is better for the Double Play: Indexed UL or Whole Life?

3/5/2020 – Minimum vs Maximum Funded Life Insurance Policies

3/12/2020 – Debunking the Common Myths About Life Insurance

3/19/2020 – Premium Financed Life Insurance: Flipping the Double Play on its Head

3/26/2020 – Understanding the Costs in a Life Insurance Policy

4/2/2020 – The #1 Costliest Mistake Most People Make When They Set Up a Policy

4/9/2020 – Is Buy Term and Invest the Difference Really Better? Let’s Analyze the Numbers.

4/16/2020 – 3 Things to Look for in a Properly-designed Policy

4/23/2020 – 3X the Income from the Same Amount of Savings: Life Insurance as a Retirement Plan

4/30/2020 – Understanding Indexed Universal Life: Caps, Floors, Crediting Rates, and Myths

5/7/2020 – What Companies are Best for Double Play Policies?

5/14/2020 – Why you Shouldn’t Use a Policy Loan. What to do Instead

5/212020 – Understanding Life Insurance Illustrations

5/28/2020 – Common Tricks Agents Use on Illustrations

6/4/2020 – Understanding Fixed, Variable, and Indexed Policy Loans

6/11/2020 – Understanding the Guaranteed Rate in a Life Insurance Policy

6/18/2020 – How to Get the Most Cash Value in a Policy

6/25/2020 – When is the best time to use a policy loan? The Advantage of an IUL for the Double Play

Recordings of past webinars will be available on YouTube and at innovativeretirementstrategies.com/Webinar Library. If you sign up, you'll automatically receive a link to the recording.

Post: Using whole life dividend paying life insurance arbitrage

Post: Using whole life dividend paying life insurance arbitrage

- Financial Advisor

- Boynton Beach, FL

- Posts 819

- Votes 791

Zachary - I think you need to do more homework on IULs. The cash value of both policies is held in the exact same types of assets. And those assets are the same for nearly every insurance company. If you look at the balance sheets, you'll see that your comments about "fraternal companies" "dividend calculations" "mode of income" is nonsense.

Since the cash value of a life insurance policy is quite literally the policy owner saving up their own death benefit, it behooves the insurance company for that cash value to grow as quickly as possible. That motivation is the primary driver for good investment returns, not "mutual" or "fraternal" or any other nonsense.

In an IUL the insurance company takes the money they earn investing in those identical assets, and they go to the index options markets with the simple goal of hedging to capture as much movement in the market as they can get with the money the have to spend. As an example, we see caps on IULs dropping in today's low interest rate climate. That's because they have less budget to work with.

The goal of an IUL is simple: have the cash value earn a premium over the debt market rate of return. And this gets me back to the 2nd paragraph, the goal is simply to have the cash value grow and eliminate the insurance company's risk. For two identically designed policies, the IUL WILL outperform the WL over time.

In regards to this comment...

4) Be prepared to properly fund the account. If you can’t overfund it properly the first few years, don’t take the policy out. Have the money to fund it. Borrowing money to pay premiums early on is a bad sign, any advisor that recommends it you should be suspicious of.

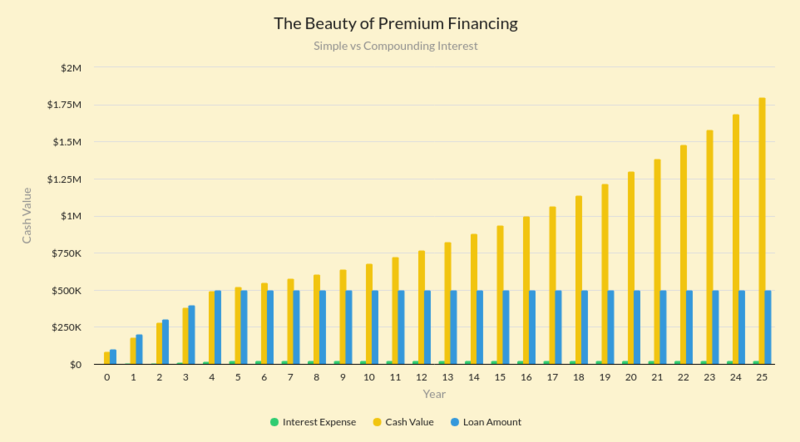

Have you never heard of Premium Financing? PF is a beautiful thing. If I can borrow money at 5% and I can invest it at 6%, I am going to take as much money as the bank is willing to give me. This isn't just an interest rate arbitrage, its simple interest vs compounding interest. Life insurance is the perfect product for this type of arbitrage because the cash value is principal-protected and earns a long term rate of return that is likely to be at or greater than the borrowing cost.

@Stoney Pitzer - here's your arbitrage...

Post: [Webinar] Intro to The Double Play: Life Insurance 101

Post: [Webinar] Intro to The Double Play: Life Insurance 101

- Financial Advisor

- Boynton Beach, FL

- Posts 819

- Votes 791

For anyone contemplating using life insurance strategies like Infinite Banking or Be Your Own Banker in conjunction with your real estate investing, this Life Insurance 101 presentation is a must see.

I'll explain...

- What the cash value is and what it represents,

- The difference between over-funded and minimally-funded policies,

- Why over-funded isn't necessarily MAX-funded,

- The differences between Whole Life and Indexed Universal Life.

- By the time we are done, you'll be able to separate life insurance fact from all the life insurance myths.

Hope to see you on Thursday. If you sign up, you'll have access to the recording [in case you can't make it during work hours]

Post: Using whole life dividend paying life insurance arbitrage

Post: Using whole life dividend paying life insurance arbitrage

- Financial Advisor

- Boynton Beach, FL

- Posts 819

- Votes 791

Its not the policy you need to vet. This will work with any permanent life insurance policy, not just whole life.

The concept is very simple: if you can put your money into an asset that will grow at 6-8%, and you can get a credit line against that asset at Prime, then anything you do with that credit line is adding value on top of the original asset. YOU create the arbitrage by making sure your investment return will be greater than your cost of money. Its the same as when you use bank financing to buy an investment property.

What you need to worry about is whether or not your policy is properly designed to maximize the cash value. The cash value to premium ratio based on the first year premium should be about 85%. And never pay a lump sum premium in the first year, you're shooting yourself in the foot.