All Forum Posts by: Thomas Rutkowski

Thomas Rutkowski has started 20 posts and replied 801 times.

Post: Money in whole life insurance

Post: Money in whole life insurance

- Financial Advisor

- Boynton Beach, FL

- Posts 819

- Votes 791

Originally posted by @Account Closed:

Originally posted by @John Perrings:

Originally posted by @Account Closed:

This headache inducing thread is the main reason I will not ever consider anything other than a simple term life policy (which I have). Anything this complex is not good for consumers. Think about it. Why would an industry create this much complexity for a supposedly high value product? Term life is simple. You pay a premium, you die, beneficiary gets face amount. Nothing more or less. A simple risk transfer transaction, which is what insurance means. Whole life is so hard to unravel, and I have an engineering PhD and dealt with complex contracts for decades in the business world. All the smoke and mirrors is not there for my benefit for sure. And also, if insurance was so good, why is the name so toxic that Insurance Salesmen now call themselves Financial Advisors? Even car salesmen haven't had to change their title!!

The only thing toxic is this irrational fear of life insurance.

Regarding the idea of "Simple." How many peoples' very first real estate transaction was simple for them? How many books did they read on the subject before they bought their first investment property? How many courses did they pay for?

Is it really so out-of-the-question to consider that it might take more effort than reading an internet post to understand how life insurance cash value can improve the efficiency of real estate transactions?

Anyone who is PhD smart(!) should pretty easily see the benefit in owning a guaranteed, tax-deferred cash ASSET that allows you to:

1) Leverage the law of large numbers to indemnify your family against the loss of your income *and,* at the same time;

2) Leverage the present value of your *permanent* death benefit (aka the cash value) to buy real estate assets *and,* also in the future;

3) Leverage the future value of your *permanent* death benefit to strategically offset and/or reduce the amount of tax you'll pay, thereby increasing your income and the use and enjoyment of your other assets while you're still alive

Does anything about the above sound toxic?

But instead of being open-minded about how that could work for them, many people on here would rather opine about insurance agent commissions. ...as if they themselves are not in an industry that that has sales agents who earn commissions on sales lol

Real estate transactions are simple. You don't need mentors or training or anything to buy a house. You choose a house, get a mortgage and buy it. Yes there is a ton of paperwork and CYA forms thrown at you by the agent but in reality it makes no difference to the transaction. You still get title to the house and can sell it as well. Sure you pay the commissions. I don't like them and I think agents have an unhealthy lock on the system but I can very simply calculate the cost of the fees into my transaction. Compare that to life insurance with a hundred moving variables. Guaranteed rate, term, death benefit, dividend, tax deferral etc etc etc. all of which are controlled by the company. Essentially the idea is that I give up control of my money to the company so I get the "benefit' of being able to borrow some of it back. But that money comes out of the death benefit anyway. In addition to that I have to pay for the insurance part at a rate much higher than term and high fees. Why not just keep control of my money, accumulate wealth, self insure and have a shorter term life policy to cover the gaps? Im sure there are worse investments than Whole Life but there are sure as hell a lot better ones too.

Stating that life insurance is too complicated is simply a cop out. You simply can't get past your bias against life insurance. I have no idea what spawned it or why you hold on to such issues, but you are flat out wrong.

A permanent life insurance policy is not a complicated product. Since the insurance company KNOWS that they will have to pay a claim some day, part of the premium goes into a savings component. The cash value is basically the policy owner saving up the death benefit over the insured's expected lifetime. And as that savings steadily grows and compounds over time, the insurance company has to pool resources to cover the delta between the death benefit and the cash value. The risk is slowly transferred from the insurance company to the policy owner. The insurance company is quite literally buying term and investing the difference. Only they can do it much more efficiently than you can.

And here's what everyone forgets: The cash value belongs to the policy owner. If they surrender the policy, it is returned to them. How can it be "expensive" if it is your own money?

As for the leverage, that is pretty simple too. As I've repeatedly showed throughout this post, if you can get a loan against your policy's cash value and use that loan to invest in real estate, you can put your money to work in two places at one time: The Double Play. You will build wealth faster by putting your money into a properly-designed life insurance policy and leveraging the cash value to invest in "A" than simply taking your money and investing in "A".

If you, with your PhD, cannot understand the business model, that's on you. It works regardless of what you may think or can comprehend.

You are also confusing minimally-funded, traditional Whole life policy with the maximum over-funded, cash value monsters that we use for real estate investors. Death benefits and commissions are held to an absolute minimum.

Post: Money in whole life insurance

Post: Money in whole life insurance

- Financial Advisor

- Boynton Beach, FL

- Posts 819

- Votes 791

Originally posted by @Jim Cellini:

So wait if I'm reading this correctly the upside to a whole life insurance policy is that it's a guaranteed 4%? Isn't that like, half of what the s&p500 would return?

I've repeatedly stated throughout this thread that the Guarantee is just a worst case scenario. It is not what the insurance companies actually pay. The insurance companies invest their assets in bonds and mortgages. Their dividends are a function of what they make on those investments. You should never buy a life insurance policy based on just the guarantee. Its nice to know its there, but I would be very disappointed if my policy actually performed that poorly.

It is reasonable to expect the cash value of indexed universal life to earn between 6 - 8%. Returns are a function of the debt markets only to the extent that the interest from their fixed investments gives the insurance company's hedgers the budget they need to purchase options to capture index movement. If interest rates drop, they have less money for hedging and caps drop. If interest rates rise, they have more money for hedging and caps rise.

You can't compare traditional investments to life insurance. The cash value of life insurance can provide 2 to 3 times the INCOME in retirement as money in a brokerage account. Every heard of the 4%-Rule? Life insurance is more like 7-8%. Why? because you are not taking money out of the policy. You are borrowing against it. It keeps growing even while you are taking income.

This is why the Buy Term and Invest the Difference myth is so easy to bust. Mutual funds may outperform an IUL growing at only 6%, but unless you have 2 to 3 times the assets by the time you retire, the IUL will provide more after tax income. Account statements don't pay bills. Income pays bills.

Post: Money in whole life insurance

Post: Money in whole life insurance

- Financial Advisor

- Boynton Beach, FL

- Posts 819

- Votes 791

Originally posted by @Thomas N.:

My only advice for people that are considering a WL insurance policy, ask the agent to show where in the policy it's written of all the benefits. I had a NYLife WL policy and one of benefit the agent kept telling me year after year to convince me to keep my policy was that you can withdraw from the cash value tax free. I finally read the policy line by line and that was not the case. You can only borrow against the cash value and interest must be paid on that loan if you do not pay it back.

Its incumbent upon the agent to make sure that their clients fully understand the product. There are 2 ways to access the cash value: policy loans and withdrawals. Many agents incorrectly use the term "take money out of the policy" when referring to policy loans. Many inexperienced agents don't understand that policy loans are the insurance company's money with the cash value serving as collateral.

Its incumbent upon the policy owner to do their own homework and find a good policy. If you're paying loan interest at 8% while your cash value is earning a 5% dividend, you're going backward and you might, as it sounds like you do, have a poor opinion of policy loans as a means to access the cash value. But, as in the case of Mass Mutual, for example, you can get a variable loan at 5% while your cash value is currently earning a 6% dividend. I trust you can see the advantage in that.

I've saved many people from this problem by showing them banks where they can refinance their high interest rate policy loan with a low interest rate 3d party loan. Banks love cash value as collateral because their loans are fully collateralized and they can get an assignment.

Post: Money in whole life insurance

Post: Money in whole life insurance

- Financial Advisor

- Boynton Beach, FL

- Posts 819

- Votes 791

Originally posted by @Jon Schwartz:

Originally posted by @Thomas Rutkowski:

Originally posted by @Jon Schwartz:

Shaun, I'd be very skeptical of whole life insurance.

I did a deep, deep dive into whole life insurance (including index universal life) about two years ago when my father-in-law insisted I get a whole life policy. My father-in-law is very protective of his daughter, so I figured I had to -- and if not, I had to have danged good reasons why. So, I spent the better part of eight months talking to a wide variety of insurance salesmen, from the small-town old-timers to the "infinite banking" gurus, and here are a few of the things I learned:

- A lot of money goes to the salesperson's commission and the cost of the underlying product, the life insurance. So you might put $50K into your policy over the first few years, but your account will only be credited $40K or so. Sure, that $40K might earn a 4% return, but you invested $50K. The real return, in this hypothetical, is actually 3.2%. My father-in-law bragged about his $200K policy that was earning 7% a year, every year, but he's actually put a lot more money into that account than $200K.

- Insurance companies also pay a dividend, but how they derive it is totally opaque. A 6% dividend doesn't mean you earn a 6% return on your money; it means the insurance company earned/is paying out 6% of its investment account -- but no company discloses how big its investment account is. The insurance companies are basically saying, "This year, we had some amount of money that made 6%. We're not going to tell you how much money or how we made that return. But we'll disperse it, and it's up to you, if you're astute enough, to actually track how much money you've sent us, how much money is in your account, and what that return looks like." The insurance companies are correct that most people don't do the math.

- Whole-life policies are complicated instruments, and that complication allows for a lot of fees. There are fees all over the place. In short, you mail a check for $XXX every year, and some amount less than $XXX ends up in your account. Then the insurance company decides what return that less-than-$XXX will earn. There's no transparency.

- Whole life salesmen advertise these amazing advantages of whole life insurance as though they don't exist in any other vehicle. For example, salesmen tout the guaranteed return. As pointed out earlier, the guaranteed return is lower than advertised. More importantly, you can get a guaranteed return by buying an annuity. The annuity will be cheaper because it doesn't also include overpriced life insurance. If you want a modest guaranteed return, buy an annuity!

- Similarly, a big deal is made of the fact that you can access your policy via a loan. Firstly, if you want equity that you can access via a loan, you're better off putting a down payment into a home. You can borrow against the value of a home just as you can borrow against the value of a whole life policy; there's effectively no difference. It's no miracle of finance (it's certainly not "infinite banking") that you can borrow against equity with a whole life policy. Furthermore, the insurance company is going to charge you an interest rate of their choosing. You can't shop around for this loan because your only lender is the insurance company. So your money is still "at work," as they say, earning that 4%, but now you're paying 3.5% for the privilege of using it. In this hypothetical, your money's only earning 0.5%, and a lot of it has disappeared to commissions and fees.

- Another funny thing: my father-in-law would praise the insurance companies as being bedrocks of our economic system because they own huge buildings. "You know who owns the such-and-such building in Chicago? MetLife does. That's why I trust them with my money." Oh, boy... If you want the stability that comes with owning A+ real estate, buy shares of a REIT. You can own the Empire State Building by buying shares of the Empire State Realty Trust -- and you won't also be paying for life insurance!

Two points to close:

Whole life salesmen will show you a thirty-year projection of how much money you'll earn if you reinvest all of your dividends. It looks AMAZING -- but only a small fraction of that yield is guaranteed (about equivalent to keeping your money in an online savings account), and an index fund will perform better over thirty years. It will. And you can even borrow against an investment portfolio, too.

And, most importantly, don't fall for the baloney that this is what rich people do, that this is rich people's secret, that this makes you the bank. It doesn't. If you want guaranteed income, but an annuity. If you want to build equity, buy a house. If you want a safe and strong return, but an index fund. If you want life insurance to protect your spouse and kids, buy 25-year term insurance. If you want to overpay for a mediocre return from a vehicle that ties up your resources for years -- for the rest of your life, really -- buy a whole life policy.

Good luck!

So using your own math:

If $50K went into premium, and we get $40,000 of cash value, we now have access to a line of credit of $40,000. 4% is the guaranteed rate, not the rate that the companies actually pay. Several companies are still paying over a 6% dividend. IULs can easily earn 6% annualized. This is the growth on the cash value and it can be clearly seen on your policy statements... at least for IULs. WL is more of a black box.

So let's say I can invest in a 12 month notes earning 10%. If I use my cash value line of credit to fund a $40,000 purchase and my loan rate is 5%, I am going to finish the year with $4000, right? I can deduct the interest, so my taxable income is $2000. If I'm paying a marginal tax rate of 40%, I'm paying $800 to the IRS and I'm left with a net gain of $1,200. If you combine the "side fund" gain with the dividend gain inside the policy, you have a total of $3600 of gain.

If you took your $50,000 and invested directly in the same notes, you would finish the year with $5000. At 40% tax, you would write a check to the IRS for $2000 leaving you with a net after tax income of $3000.

Do you see the difference?

Do you understand the power of compounding interest?

Would you rather have $50,000 growing at a net of 6%? or $40,000 growing at a net of 9%

I think its a no-brainer.

You made the case for life insurance all by yourself.

Thomas, you forgot to factor in that year's insurance premium. When you account for that, the annual totals are much closer.

I have no idea what you are talking about. Would you rather have $40,000 growing at 9% or $50,000 growing at 6%. That's what this all comes down to. The power of time and compounding interest.

I think its pretty simple and totally accounts for your $50,000 premium turning into $40,000 of cash value. Its not close at all. It will only take a few years for Life Insurance plus side fund value to cross over the alternative scenario.

Show me the numbers or where you think I'm wrong.

Post: Money in whole life insurance

Post: Money in whole life insurance

- Financial Advisor

- Boynton Beach, FL

- Posts 819

- Votes 791

Originally posted by @Brian G.:

@Thomas Rutkowski perhaps I’m misinformed. Are you saying when an individual dies with a Whole Life policy in place the beneficiary receives *both the total face value of the death benefit and the Cash Value* that has built up in the policy?

I was under the impression that the insured can *either* surrender their policy while alive and receive the Cash Value *or* their beneficiary can receive the Death Benefit after their passing. Is that not the case?

Brian - That's not what I'm stating at all. The cash value is part of the death benefit. For example, if you have a $1M death benefit and $500,000 of cash value, your beneficiary is going to get $1M. The insurance company is not keeping the cash value, the cash value will make up the first $500,000 of the death benefit and the "mortality costs" pay for the other $500,000.

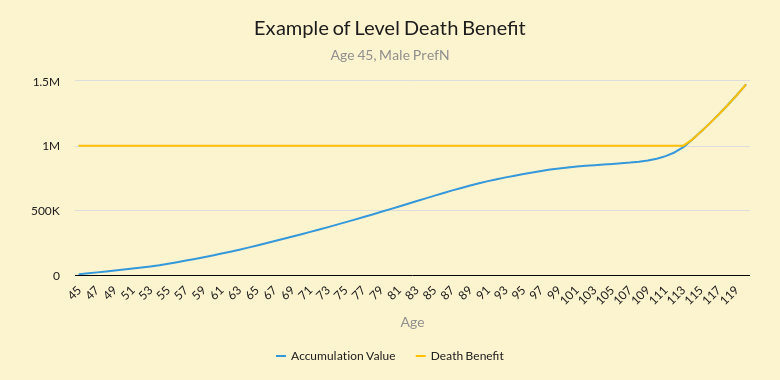

As the cash value accumulates over time, the net amount at risk to the insurance company steadily and predictably declines. If you are 40 years old, for example, the "mortality cost" represents the amount of money that must be pooled in order to pay all of the expected claims on all of their 40 year insureds. So while the cost of insurance increases each year, the net amount at risk to the insurance company is declining over time. [So the myth that IULs are going to lapse due to rising mortality costs is just that, a myth. The mortality costs stay relatively constant as a percentage of cash value. Whole life companies work off of the same mortality tables.]

This graph shows the cash value and death benefit over time. The delta between the death benefit and the cash value is the net amount at risk to the insurance company. This also illustrates why a company who's cash value grows at a faster rate (i.e. an IUL) will actually have lower cost of insurance, not higher. The gap will be smaller because the cash value will close the gap with the death benefit faster. (Note: This is a Minimally-funded policy. i.e. what most people think of when they think of "Whole Life") This is not an example of an maximum over-funded policy design that you would use for leveraging into real estate.]

Given the same $1M policy, if you had taken out a policy loan for $500,000 on that $1M policy, your beneficiary would only receive $500,000. That's not because "the loans reduce the Death Benefit" as many people incorrectly state. The death benefit is still $1M ($500K of which is the cash value), but the loan must be satisfied. So the "net" death benefit received by the beneficiary is $500,000.

This is the proof that the insurance company does not keep the cash value, which is another popular myth constantly repeated by people who don't understand how life insurance works.

Post: Money in whole life insurance

Post: Money in whole life insurance

- Financial Advisor

- Boynton Beach, FL

- Posts 819

- Votes 791

Originally posted by @Jon Schwartz:

Shaun, I'd be very skeptical of whole life insurance.

I did a deep, deep dive into whole life insurance (including index universal life) about two years ago when my father-in-law insisted I get a whole life policy. My father-in-law is very protective of his daughter, so I figured I had to -- and if not, I had to have danged good reasons why. So, I spent the better part of eight months talking to a wide variety of insurance salesmen, from the small-town old-timers to the "infinite banking" gurus, and here are a few of the things I learned:

- A lot of money goes to the salesperson's commission and the cost of the underlying product, the life insurance. So you might put $50K into your policy over the first few years, but your account will only be credited $40K or so. Sure, that $40K might earn a 4% return, but you invested $50K. The real return, in this hypothetical, is actually 3.2%. My father-in-law bragged about his $200K policy that was earning 7% a year, every year, but he's actually put a lot more money into that account than $200K.

- Insurance companies also pay a dividend, but how they derive it is totally opaque. A 6% dividend doesn't mean you earn a 6% return on your money; it means the insurance company earned/is paying out 6% of its investment account -- but no company discloses how big its investment account is. The insurance companies are basically saying, "This year, we had some amount of money that made 6%. We're not going to tell you how much money or how we made that return. But we'll disperse it, and it's up to you, if you're astute enough, to actually track how much money you've sent us, how much money is in your account, and what that return looks like." The insurance companies are correct that most people don't do the math.

- Whole-life policies are complicated instruments, and that complication allows for a lot of fees. There are fees all over the place. In short, you mail a check for $XXX every year, and some amount less than $XXX ends up in your account. Then the insurance company decides what return that less-than-$XXX will earn. There's no transparency.

- Whole life salesmen advertise these amazing advantages of whole life insurance as though they don't exist in any other vehicle. For example, salesmen tout the guaranteed return. As pointed out earlier, the guaranteed return is lower than advertised. More importantly, you can get a guaranteed return by buying an annuity. The annuity will be cheaper because it doesn't also include overpriced life insurance. If you want a modest guaranteed return, buy an annuity!

- Similarly, a big deal is made of the fact that you can access your policy via a loan. Firstly, if you want equity that you can access via a loan, you're better off putting a down payment into a home. You can borrow against the value of a home just as you can borrow against the value of a whole life policy; there's effectively no difference. It's no miracle of finance (it's certainly not "infinite banking") that you can borrow against equity with a whole life policy. Furthermore, the insurance company is going to charge you an interest rate of their choosing. You can't shop around for this loan because your only lender is the insurance company. So your money is still "at work," as they say, earning that 4%, but now you're paying 3.5% for the privilege of using it. In this hypothetical, your money's only earning 0.5%, and a lot of it has disappeared to commissions and fees.

- Another funny thing: my father-in-law would praise the insurance companies as being bedrocks of our economic system because they own huge buildings. "You know who owns the such-and-such building in Chicago? MetLife does. That's why I trust them with my money." Oh, boy... If you want the stability that comes with owning A+ real estate, buy shares of a REIT. You can own the Empire State Building by buying shares of the Empire State Realty Trust -- and you won't also be paying for life insurance!

Two points to close:

Whole life salesmen will show you a thirty-year projection of how much money you'll earn if you reinvest all of your dividends. It looks AMAZING -- but only a small fraction of that yield is guaranteed (about equivalent to keeping your money in an online savings account), and an index fund will perform better over thirty years. It will. And you can even borrow against an investment portfolio, too.

And, most importantly, don't fall for the baloney that this is what rich people do, that this is rich people's secret, that this makes you the bank. It doesn't. If you want guaranteed income, but an annuity. If you want to build equity, buy a house. If you want a safe and strong return, but an index fund. If you want life insurance to protect your spouse and kids, buy 25-year term insurance. If you want to overpay for a mediocre return from a vehicle that ties up your resources for years -- for the rest of your life, really -- buy a whole life policy.

Good luck!

So using your own math:

If $50K went into premium, and we get $40,000 of cash value, we now have access to a line of credit of $40,000. 4% is the guaranteed rate, not the rate that the companies actually pay. Several companies are still paying over a 6% dividend. IULs can easily earn 6% annualized. This is the growth on the cash value and it can be clearly seen on your policy statements... at least for IULs. WL is more of a black box.

So let's say I can invest in a 12 month notes earning 10%. If I use my cash value line of credit to fund a $40,000 purchase and my loan rate is 5%, I am going to finish the year with $4000, right? I can deduct the interest, so my taxable income is $2000. If I'm paying a marginal tax rate of 40%, I'm paying $800 to the IRS and I'm left with a net gain of $1,200. If you combine the "side fund" gain with the dividend gain inside the policy, you have a total of $3600 of gain.

If you took your $50,000 and invested directly in the same notes, you would finish the year with $5000. At 40% tax, you would write a check to the IRS for $2000 leaving you with a net after tax income of $3000.

Do you see the difference?

Do you understand the power of compounding interest?

Would you rather have $50,000 growing at a net of 6%? or $40,000 growing at a net of 9%

I think its a no-brainer.

You made the case for life insurance all by yourself.

Post: Money in whole life insurance

Post: Money in whole life insurance

- Financial Advisor

- Boynton Beach, FL

- Posts 819

- Votes 791

Originally posted by @Jon Schwartz:

Shaun, I'd be very skeptical of whole life insurance.

I did a deep, deep dive into whole life insurance (including index universal life) about two years ago when my father-in-law insisted I get a whole life policy. My father-in-law is very protective of his daughter, so I figured I had to -- and if not, I had to have danged good reasons why. So, I spent the better part of eight months talking to a wide variety of insurance salesmen, from the small-town old-timers to the "infinite banking" gurus, and here are a few of the things I learned:

- A lot of money goes to the salesperson's commission and the cost of the underlying product, the life insurance. So you might put $50K into your policy over the first few years, but your account will only be credited $40K or so. Sure, that $40K might earn a 4% return, but you invested $50K. The real return, in this hypothetical, is actually 3.2%. My father-in-law bragged about his $200K policy that was earning 7% a year, every year, but he's actually put a lot more money into that account than $200K.

- Insurance companies also pay a dividend, but how they derive it is totally opaque. A 6% dividend doesn't mean you earn a 6% return on your money; it means the insurance company earned/is paying out 6% of its investment account -- but no company discloses how big its investment account is. The insurance companies are basically saying, "This year, we had some amount of money that made 6%. We're not going to tell you how much money or how we made that return. But we'll disperse it, and it's up to you, if you're astute enough, to actually track how much money you've sent us, how much money is in your account, and what that return looks like." The insurance companies are correct that most people don't do the math.

- Whole-life policies are complicated instruments, and that complication allows for a lot of fees. There are fees all over the place. In short, you mail a check for $XXX every year, and some amount less than $XXX ends up in your account. Then the insurance company decides what return that less-than-$XXX will earn. There's no transparency.

- Whole life salesmen advertise these amazing advantages of whole life insurance as though they don't exist in any other vehicle. For example, salesmen tout the guaranteed return. As pointed out earlier, the guaranteed return is lower than advertised. More importantly, you can get a guaranteed return by buying an annuity. The annuity will be cheaper because it doesn't also include overpriced life insurance. If you want a modest guaranteed return, buy an annuity!

- Similarly, a big deal is made of the fact that you can access your policy via a loan. Firstly, if you want equity that you can access via a loan, you're better off putting a down payment into a home. You can borrow against the value of a home just as you can borrow against the value of a whole life policy; there's effectively no difference. It's no miracle of finance (it's certainly not "infinite banking") that you can borrow against equity with a whole life policy. Furthermore, the insurance company is going to charge you an interest rate of their choosing. You can't shop around for this loan because your only lender is the insurance company. So your money is still "at work," as they say, earning that 4%, but now you're paying 3.5% for the privilege of using it. In this hypothetical, your money's only earning 0.5%, and a lot of it has disappeared to commissions and fees.

- Another funny thing: my father-in-law would praise the insurance companies as being bedrocks of our economic system because they own huge buildings. "You know who owns the such-and-such building in Chicago? MetLife does. That's why I trust them with my money." Oh, boy... If you want the stability that comes with owning A+ real estate, buy shares of a REIT. You can own the Empire State Building by buying shares of the Empire State Realty Trust -- and you won't also be paying for life insurance!

Two points to close:

Whole life salesmen will show you a thirty-year projection of how much money you'll earn if you reinvest all of your dividends. It looks AMAZING -- but only a small fraction of that yield is guaranteed (about equivalent to keeping your money in an online savings account), and an index fund will perform better over thirty years. It will. And you can even borrow against an investment portfolio, too.

And, most importantly, don't fall for the baloney that this is what rich people do, that this is rich people's secret, that this makes you the bank. It doesn't. If you want guaranteed income, but an annuity. If you want to build equity, buy a house. If you want a safe and strong return, but an index fund. If you want life insurance to protect your spouse and kids, buy 25-year term insurance. If you want to overpay for a mediocre return from a vehicle that ties up your resources for years -- for the rest of your life, really -- buy a whole life policy.

Good luck!

So using your own math:

If $50K went into premium, and we get $40,000 of cash value, we now have access to a line of credit of $40,000. 4% is the guaranteed rate, not the rate that the companies actually pay. Several companies are still paying over a 6% dividend. IULs can easily earn 6% annualized. This is the growth on the cash value and it can be clearly seen on your policy statements... at least for IULs. WL is more of a black box.

So let's say I can invest in a 12 month notes earning 10%. If I use my cash value line of credit to fund a $40,000 purchase and my loan rate is 5%, I am going to finish the year with $4000, right? I can deduct the interest, so my taxable income is $2000. If I'm paying a marginal tax rate of 40%, I'm paying $800 to the IRS and I'm left with a net gain of $1,200. If you combine the "side fund" gain with the dividend gain inside the policy, you have a total of $3600 of gain.

If you took your $50,000 and invested directly in the same notes, you would finish the year with $5000. At 40% tax, you would write a check to the IRS for $2000 leaving you with a net after tax income of $3000.

Do you see the difference?

Do you understand the power of compounding interest?

Would you rather have $50,000 growing at a net of 6%? or $40,000 growing at a net of 9%

I think its a no-brainer.

You made the case for life insurance all by yourself.

Post: Money in whole life insurance

Post: Money in whole life insurance

- Financial Advisor

- Boynton Beach, FL

- Posts 819

- Votes 791

Originally posted by @Brian G.:

Originally posted by @John Perrings:

Originally posted by @Brian G.:

@Shaun R. be careful, whole life is 15-20x more expensive than term for the same pay out upon death (ie death benefit) but they are usually structured so the *Insurance Company Keeps* the savings component of the policy upon your death that you’ve been paying extra to build up. It’s not an efficient financial product imo especially when you can borrow against better performing investments (ie retirement accounts, taxable brokerage accounts, etc.) Buy term insurance, save the difference and invest in something else with a better return. 4%? No thanks. Is there anyone who recommends whole life insurance policies besides insurance salesmen? Maybe a Financial Planner on BP can weigh in? I’ve heard they can serve a purpose for a very small % of very wealthy individuals but can’t remember how exactly.

To add on to the good info Zachary posted.

If a 45 yr old makes payments of $290/mo for 20yrs on a $1M 20yr term policy and your cost of money is 4%, unless you die in that 20 yr term, the net compound cost of that term policy is $107,772 or -4%. It is a pure cost.

If a 45 yr old makes payments of $1,465/mo for 20yrs on a $1M whole life policy, and your cost of money is 4%, the 20yr compound cost of those payments is $544,439. But you will have $480,131 in cash value at the end of those 20yrs. The 20yr *net* compound cost is $64,308.

The payment is 5x higher (not 15-20x), but it was a 40% reduction in cost. All because this person had a permanent, guaranteed death benefit.

If someone takes $1 from their checking account and puts that $1 in their savings account, is that an expensive transaction? The same thing is happening with cash value life insurance. It's just that this particular "savings account" earns upwards of 40x over that of a bank, has creditor protection, is tax-deferred, and comes with death and disability protection baked-in.

Payment ≠ Cost

Hmmm...just pulled up a free quote from Zander Insurance on a 20 Year Term Life Insurance of $1M for a male age 45 and have multiple quotes for under $100/mo. Not sure why you used $290.

Pretty sure a simple investing calculator would tell me if I invested the difference of $1,365/mo ($1,465-$100 = $1,365) at a very reasonable rate of return I would have way more than $480k at the end of 20 years.

Setting that aside, I have a couple questions:

1) Is it true that whole life insurance policies are structured so that upon one's death, the death benefit is paid out but the cash value, ie "savings account" portion of the policy is forfeited by the deceased (kept by the insurance company)?

2) Are there other investing vehicles that also provide protection from creditors, are tax deferred and that you can borrow from/against?

3) Is this a product that you sell/recommend to all of your clients or just some of them and why?

Thanks for weighing in!

Brian - The cash value is quite literally the policy owner saving up the death benefit for the insured over their expected lifetime. So as the cash value increases over time, the net amount at risk to the insurance company goes down. To a certain extent, the insurance company is buying term and investing the difference. Only they can do it more efficiently than you can. They need to cover the delta between the cash value and the death benefit.

When the death benefit is paid, it is the sum of the cash value and the additional coverage provided by the company. If you have borrowed against you policy, the insurance company will pay off that loan from the death benefit and your beneficiary gets the remainder. The insurance company does not keep the cash value. That is a myth perpetuated by people who don't understand life insurance.

Post: Money in whole life insurance

Post: Money in whole life insurance

- Financial Advisor

- Boynton Beach, FL

- Posts 819

- Votes 791

Some life insurance agent probably pee'd in @Joe Splitrock's wheaties in a prior life. He hates life insurance and doesn't seem to understand the difference between a minimally-funded policy and one that is designed for maximum cash value for these types of private banking strategies. He'd rather hate life insurance than employ a strategy that actually results in building more wealth.

You're on the right track, just be careful, any agent touting the "guaranteed" rates, may not know his business. The Guaranteed Rate is a worst-case scenario. The dividend rate of most whole life companies is well in excess of the Guaranteed Rate. The cash value in a permanent life insurance policy truly represents the policy owner saving up the death benefit for the insured. As a result, you can see that the insurance company would have a vested interest in the cash value performing as well as possible. They use the Guaranteed Rate only for pricing out the policies. They don't expect to ever have to pay it.

This topic was beat to death on this thread: https://www.biggerpockets.com/forums/519/topics/245380-paradigm-life-infinite-banking-whole-life-insurance?page=3

If you want to network with people successfully utilizing "The Double Play", just let me know. I have a user's group with well over a hundred members.

Post: Infinite Banking, Is it cut out to what it is said to be?

Post: Infinite Banking, Is it cut out to what it is said to be?

- Financial Advisor

- Boynton Beach, FL

- Posts 819

- Votes 791

Originally posted by @Joe Schaak:

I was also introduced to Infinite Banking recently. I'm really intrigued by it and wanted to run my plan by the knowledge that's on display on this thread (@Mike S., @Zachary Paschke, @Thomas Rutkowski). I rehab homes and often receive large chunks of funds from private investors. Rather than let that money sit in a checking account, my plan was to use it to pay the premiums and/or loans made from my life insurance account. This way, in addition to making those funds work, I'm also building the value of the policy which can be used to fund other real estate deals. Thoughts? Am I on the right path?

Joe,

The key is that the policy must be designed to be a maximum over-funded life insurance policy (whether Whole Life or Indexed UL). You know it is designed right when your 1st year cash value to premium ratio is about 85% when you look at the illustration. You literally cannot buy any less death benefit for the money and still meet the definition of life insurance. If you flip that around, it also means that you cannot put any more cash (premium) into the policy than what you put in the first year. To be the most efficient, you want the premium to be at that level every single year for at least 5 years. At that point you can exit out by dropping the term rider and doing a reduced paid-up. On an IUL you simply reduce the DB to drive out the cost related to the Death Benefit.

Most IBC policies are not designed this way. They are designed to leave room under the limit for paid up additions from outside the policy in future years. This policy design is inefficient for real estate investors because you want as many of your dollars working in two places at once as is possible. It results in higher internal costs in order to support the higher death benefit that results.

Since you are a flipper, I doubt you would be willing to commit to a high annual premium for at least five years. It would be better to find that amount that you can comfortably commit to every year.

While you cannot drop in a lump sum, I do want to clarify that you CAN leverage the cash value immediately when the policy is issued and funded. For example, if you designed a policy for 5 years of $50,000 per year in premium, you would have access to a line of credit of over $40K right from the beginning. And each new increment of $40K+ on each policy anniversary.