All Forum Posts by: Thomas Rutkowski

Thomas Rutkowski has started 20 posts and replied 797 times.

Post: Life Insurance and REI

Post: Life Insurance and REI

- Financial Advisor

- Boynton Beach, FL

- Posts 815

- Votes 791

This topic has been beat to death in many different threads here on BP:

https://www.biggerpockets.com/forums/51/topics/854192-money-in-whole-life-insurance

Post: Whole Life Insurance as a Foundation for Real Estate Investing

Post: Whole Life Insurance as a Foundation for Real Estate Investing

- Financial Advisor

- Boynton Beach, FL

- Posts 815

- Votes 791

Originally posted by @Jenning Y.:

Originally posted by @Mike S.:

Originally posted by @Jenning Y.:

The problem with your numbers is that on the life insurance side you only considered the return produced by the new loan each year.

You forgot to reinvest the profit from the prior year return.

So in year two, you are taking a loan of $81,090 but the return will be $8,568 because the 10% return was not only on the $81,090 but on the $81,090 +$4,590 that was left over from the prior year.

Let's me try to explain again of how to calculate the compounding of the return of the borrowed money, about the last three columns of the table.

The borrowed money earns $4590(Column G) the first year, we assume it compounding at rate of 10%, it will continue compounding 11 times until it reach the 12th year, so the "Compounding Factor" in the column H: 1.1^11=2.853116706, Column G*H = 13096, put another word, $4590 compounding 11 times at rate of 10% should be 13096.

For second year, the earned money can only compounding 10 times (only 10 years left), so the "Compounding Factor" in the last column H: 1.1^10=2.59374246,

Of course for the third year it can only compounding 9 times

And the last year it can do not compound any more because it reach the term end

and so on......

We add all the last column together, which is $129235, this is the total compounding return of all the borrowed money.

SO it is a 9.6% vs 10% compounding game FOREVER, and in this example the 10% will always win, from year 1 to year 10000 !

Let's say you by a 12 month note paying 10%. Your after tax return in a 40% tax bracket is 6%.

If you put the same amount of money into a properly designed and max over-funded policy, you'll have 85% of your money available to make the exact same investment.

i.e. a $100,000 premium will result in ~$85,000 cash value.

If you use a CV LOC at 4% to make the exact same investment, you'll finish up the year with $8,500 in interest income. You'll have $3,400 of tax-deductible interest expense on the investment, so your taxable income is $5,100. In the same 40% tax bracket as above, you will write a check to the IRS for $2,040. That leaves you with a profit of $3,060. If the $85,000 of cash value simultaneously earned a 6% dividend (Mass or Penn Mutual's dividend rate right now.), you'll receive $5,100 dividend crediting.

This results in a total after tax increase of $8,060

You are making it way more complicated than it has to be.

Would you rather have $100,000 growing at a net of 6% or $85,000 growing at a net of 8.06%? I don't know about anyone else following this, but I'll take the 8% all day long. Compounding interest is a powerful force.

This snapshot repeats itself every year as you put more premium into the policy.

Post: Whole Life Insurance as a Foundation for Real Estate Investing

Post: Whole Life Insurance as a Foundation for Real Estate Investing

- Financial Advisor

- Boynton Beach, FL

- Posts 815

- Votes 791

Originally posted by @Jenning Y.:

Originally posted by @Brian J Haney:

In reading this give and take, I am curious @Jenning Y. - What is the applicable tax drag you're factoring into this 10% return for real estate. Having worked with a variety of wealthy investors over the years, I can't say I have seen a consistent 10% rate of return in RE portfolios net of taxes. Frankly, it's hard to net a consistent 10% rate of return with most investments, especially after taxes.

For example, if I am pulling $10,000 of rental income each year, there's a tax bite year over year on that 10k. If I am selling RE (flipping) there is a tax bite coming out of the sale proceeds.

I understand how factoring the appropriate tax drag is tricky to say the least, since there can be many ways you might be taxed depending on how you're making money - I just want to point to the importance of NET rate of returns if you're trying to dig into comparisons. All of these static growth models can both help (give you some projections to consider) and hurt if that's not exactly how the growth plays out overtime (Real Estate is rarely perfectly consistent year-over-year).

At least with properly designed cash value life insurance you should be able to pull out after-tax dollars, so the tax element there is fairly straightforward.

Just my two cents.

Hi Brian, you are right, tax is a very important factor in investment, and I have to admit I do not know much about WL tax benefit though I have an impression it has huge advantage.

Real estates are also not that bad on taxes. For most long term buyer and hold landlords, you should not expect them to pay ANY tax unless they flip or sell properties. Depreciations will offset most of their taxable income. Most of their profit will be in capital gain and equity buildup when they sell them. They can also use 1031 exchange to defer taxes.

I am not saying we should not consider tax when we do investment. The problem is that some insurance sale people mislead people, for example, in the previous example, if you just look at the table, you will think the WL has much better return than real estate ( assume no tax), but in fact, if you carefully look at the numbers, you will know the real estate will have better return. I know in the above example if considering the tax, WL may be better, but the table is presented in a misleading way, or even cheating way.

My sense is if that you can get above 10% return, WL is probably not a good idea. Lots of real estate people can do far better than that, that’s why not lots of people like WL here in BP.

If you can get above 10% on REI alone, then you will earn even more than that by combining REI and Cash Value leverage because you are putting your money to work in two places at once. The graph that I inserted above shows this.

Post: Life Insurance Cash Value as a "Magic Checking Account"

Post: Life Insurance Cash Value as a "Magic Checking Account"

- Financial Advisor

- Boynton Beach, FL

- Posts 815

- Votes 791

In today's session I'm going to be talking about using cash value life insurance as a Magic Checking Account. The purpose of this session is to simply take a look at The Double Play model from a different perspective. Since The Double Play involves life insurance, there is often a lot of preconceived bias against life insurance and people get wrapped around the axle about the life insurance without understanding the fundamental value of putting your money to work in two places at one time and earning a higher combined rate of return.

I utilize the concept of a Magic Checking Account to simply help people understand the flow of cash by taking away the life insurance element which is a complicating variable.

As you watch this video, the power of The Double Play putting your money to work in two places at one time will quickly and easily become evident. Because your money can work in two places at one time, you can powerfully and systematically accelerate your wealth building over time.

Join me at 1pm Eastern.

Post: Whole Life Insurance as a Foundation for Real Estate Investing

Post: Whole Life Insurance as a Foundation for Real Estate Investing

- Financial Advisor

- Boynton Beach, FL

- Posts 815

- Votes 791

Originally posted by @Jenning Y.:

I know WL has other purposes. But from pure wealth building perspective, I think the math is pretty simple.

If you really can not find any other investments which can return much higher than 6~8%, WL may be not a bad choice. However, if you can find investment opportunity which can bring much higher rate than that, For example, with real estate it is not difficult to bring over 15% with leverage ( 3% appreciation with 75% LTV will enlarge the return to 12%, plus rent so get 15% is not that difficult). Will be a fool try to catch the 6~8%, even with tax advantage (real estate also not bad on tax).

Some WL people argue that you can always borrow your money out, but even if you can borrow 90% of your money that you have put in one day before, the 10% wasted money still can bring huge losses with higher opportunity cost. Take myself, in the past 8~9 years, my annual compounding return is over 35%, think about the potential losses if I wasted even one penny of my initial cash. I know I cannot repeat the 35% return in the future, but my point is very clear.

Most people on BP can achieve much higher returns, no wonder lots of them not fans of WL.

You yourself used the example of utilizing a HELOC to do the same thing. Show me a HELOC that allows for you to leverage 100% of the value of the underlying asset. Its like you forgot what you wrote in your earlier post.

Regardless, you are missing the fact that by leveraging anything greater than 50% of the underlying asset's value, you can earn a higher combined rate of return on your original dollar.

This is illustrated in the example that I posted in an earlier reply, so I'm not going to repeat the math here. @mike s also provided a great example.

Post: Whole Life Insurance as a Foundation for Real Estate Investing

Post: Whole Life Insurance as a Foundation for Real Estate Investing

- Financial Advisor

- Boynton Beach, FL

- Posts 815

- Votes 791

Originally posted by @Tom Jensen:

@John Perrings

Gotcha, so through premiums, dividends, interest, etc. the cash value grows to the DB amount.

Thanks John.

The cash value is quite literally the policy owner saving up the death benefit for the insured over the insured's life expectancy. In a a maximum over-funded policy design, that gets turned around so that every dollar of cash value is purchasing a legally-defined minimum amount of additional death benefit protection. As the CV rises, it continues to push the death benefit higher.

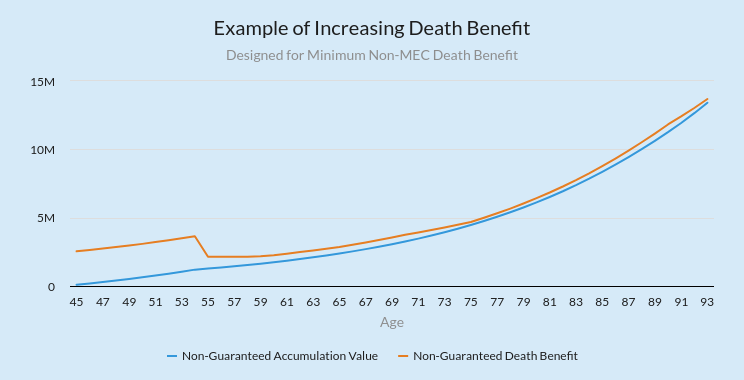

This graph shows a Death Benefit and Cash Value in a 0-pay design where the face amount is kept to an absolute minimum. You can see that there is VERY LITTLE additional death benefit in years 11+. The cost of insurance at this point in time is only about 0.25% of the cash value each year. Its not much of a drag at all.

Post: Whole Life Insurance as a Foundation for Real Estate Investing

Post: Whole Life Insurance as a Foundation for Real Estate Investing

- Financial Advisor

- Boynton Beach, FL

- Posts 815

- Votes 791

Originally posted by @Dan Heimer:

This idea and structure makes no financial sense whatsoever. You want to put money into a WL insurance and then borrow against your own money up to 85% our whatever amount they "allow" you without affecting the life insurance itself (many complicated rules there causing a 30% lapse within the first few years) and then you want to convince me that both entities are working for you?

No.... the best way to do this is to use all your money to buy the real estate asset and increase its cash flow output then have the asset buy you a level term insurance which will cost you less money and over time your property will be paid off.

That's when you will get the asset to finance your purchases including life insurance. You can even buy a WL insurance of that's what you want to do.

Ironically those who wrote in this thread that overfunding WL makes sense for the wealthy, they are also wrong. It makes sense for no one except the life insurance agents selling it (they call themselves "financial advisors") The wealthy buy PPLI (Private placement life insurance). Notice that the ones who repeatedly argue the worthiness of the WL over funding concept and private banking are the insurance agents or brokers whom I caution you again are called financial advisors and this misleading title is bestowed upon them by none other than the insurance companies.

Their concepts are based on hypothetical numbers and unreal projections so their math is skewed, and yet they come into real estate websites to tout how great it is to borrow your own money at less than you gave the insurance company plus high fees because you have a life insurance.

I repeat, your cash flowing asset can buy you the coverage and all your money can work for you for extra no fees!

Read the replies of @Kim Jones and @Cliff H. and compare them to @Thomas Rutkowski (salesman) and other poor souls who do not understand how money works then you be the judge

LOL. Sorry. Not spending any effort responding to this. Your assumptions are wrong.

Post: Whole Life Insurance as a Foundation for Real Estate Investing

Post: Whole Life Insurance as a Foundation for Real Estate Investing

- Financial Advisor

- Boynton Beach, FL

- Posts 815

- Votes 791

Originally posted by @Jenning Y.:

Very interesting topic. I also spent times reading some articles and books and try to get some understanding on it.

Well, WL's so called "double plays", allowing to borrow against the policy so can grow the policy's cash value at the same time also grow the borrowed money. This is nice, but it is not its OWN patent. Other ways such as real estate can do same or even better than that. Take real estate, using either HELOC or cashout refinance can achieve the same: old property is still growing while borrowed money can also grow itself. And considering WL's cash growth rate is only about 3~4%, real estate can do better than that. As some people mentioned before, you can also borrow against your other investment portfolio.

Now I think the only advantage of WL is its tax advantage ( for life insurance we can always buy a cheap term), disadvantages are cost and unexpected withdraw or cancel cost. This is hard to balance for me.

A savvy investor probably can do a far better job with no WL. As someone said before: Do not mix investment with insurance. Buy an insurance if necessary and then focus on your investment. I agree.

You absolutely can leverage home equity or even a stock portfolio. I often use these more familiar examples as analogous to The Double Play. Even if someone has home equity or a stock portfolio, most lenders are not going to lend anywhere near 100% of the value. Realistically, you will be limited to about 65% of the value of the underlying asset.

You can leverage nearly 100% of a policies cash value. They may withhold the first year interest in some cases. That makes up for the fact that your premium dollars are getting hit with fees.

Generally, its someone who doesn't like life insurance who repeats the "don't mix insurance and investments". I don't care what you call it. Its a powerful financial tool that can be used to put your money to work in two places at once.

Post: Whole Life Insurance as a Foundation for Real Estate Investing

Post: Whole Life Insurance as a Foundation for Real Estate Investing

- Financial Advisor

- Boynton Beach, FL

- Posts 815

- Votes 791

Originally posted by @Albert Ng:

Originally posted by @Mike S.:

Instead you put $100,000 in a cash value permanent life insurance. You get $85,000 in cash value that will return 6% that year so $5,100. In addition, you take a loan out of the policy for $76,500 and pay $3,060 interest on it (4%). That loan invested in the real estate investment at 10% will give you $7,650 return. So in total, in year one, you will get only $9,690. And I did not even considered the tax deduction of the interest and the tax free return of the life insurance.

In year two, you are still making $10,000 in your real estate investment, while with the life insurance now you are making $10,271.

I see your calculation. You assume the life insurance policy pay a 6% return, while the insurance company charge you 4% to loan the money. Is this assumption realistic? Why would the insurance company pay you more than it can get from the loan? (i.e. if you borrow from them, and pay them with that money, you would earn 2%)

Policy loans are very low risk to the insurance company. They are 100% secured by the policy owner's cash value. As a result, they can lend money at lower rates. Obviously, they can't invest 100% of their general fund in policy loans, but policy loans are generally a very small percentage of an insurance company's general fund.

Whole Life Dividends are in the 5-6% range. IUL should earn 6-8%. Prime is well below 4%. So, yes, it is very realistic.

Post: Whole Life Insurance as a Foundation for Real Estate Investing

Post: Whole Life Insurance as a Foundation for Real Estate Investing

- Financial Advisor

- Boynton Beach, FL

- Posts 815

- Votes 791

Originally posted by @Mike S.:

Originally posted by @Dan Schwartz:

Can someone describe the tax treatment of WLI and/or IUL?

- premiums paid to the insurance company are after-tax dollars?

-- can this be altered if a business pays the premium? If yes, which kind of entity? If yes, does this affect taxation of distributions?

- loans against cash value are distributed without tax consequences?

-- what if the loan is never paid back? It is deducted from the death benefit, but is it now taxable?

- death benefit is not taxed?

My understanding is as follow for (but I remember reading about some very narrow exceptions that may be different), as long as the policy does not become a MEC.

premium are not deductible (after tax).

grow of the cash value is tax deferred

Withdrawals from cash value are taxable above the premium basis (FIFO).

Death benefit to a beneficiary are tax free but are counted towards the total estate value for estate tax. If there are some loan outstanding, the death benefit will be reduced by the loans amount.

Loans from the policy are tax free.

Interests paid to an inside policy loan are not tax deductible, however the interests for a third party loan secured by the cash value may be tax deductible.

A lapse of the policy will trigger a taxable event.

The death benefit is received tax-free. But, generally speaking, any time the premium is tax deductible in a business application, then the death benefit will be taxable. Its a trade-off. An example is a defined benefit plan. The employer will get a tax deduction on contributions to the plan, even if used for life insurance premium. The death benefit of the life insurance would be received by THE PLAN tax free, but it would be taxed as it leaves the plan.

Loans are tax-free and are satisfied from the death benefit proceeds if still outstanding at death. Many agents mistakenly state that loans reduce the death benefit. That is not technically true. The death benefit remains the same its just that the loan has to be satisfied. Policy loans are loans and are thus not taxable as income at any time.