All Forum Posts by: Thomas Rutkowski

Thomas Rutkowski has started 20 posts and replied 797 times.

Post: Help! Selling Ca Duplexes | Cap Gains strategies - 1031 or No.

Post: Help! Selling Ca Duplexes | Cap Gains strategies - 1031 or No.

- Financial Advisor

- Boynton Beach, FL

- Posts 815

- Votes 791

@Debbie Barnes If you want to stay involved with real estate, then 1031 will work for you. But if you want to feel the relief of being done with tenants, toilets, etc., you may want to explore other planning approaches that allow you to get defer the capital gains tax and get cash that you can deploy into other asset classes.

Post: Capital Gains savings by selling rental with allotment sale

Post: Capital Gains savings by selling rental with allotment sale

- Financial Advisor

- Boynton Beach, FL

- Posts 815

- Votes 791

I agree with @Daniel McNulty. There is probably more to the transaction structure than @Jason Thomas is telling us. An annuity could be the funding mechanism for an intermediary installment sale planning approach. This is set up much like qualified intermediary in a 1031 exchange: seller sells to QA on installment sale. QA sells to buyer for cash. QA uses cash to purchase an annuity to guarantee payments to seller over installment sale period. ETFs/RE are too risky for this.

I see the downside of this transaction as the fact that you are not going to have a lump sum of money after closing. Also, the annuity payments include return of principal, so there would likely be a little bit of capital gains tax every year.

When you couple an intermediary installment sale approach with a separate monetization loan, you may be able to get cash at closing that you can use to re-invest and still get tax-deferral.

Post: Lump Sum Whole Life Insurance vs. Simply Invest

Post: Lump Sum Whole Life Insurance vs. Simply Invest

- Financial Advisor

- Boynton Beach, FL

- Posts 815

- Votes 791

Originally posted by @Eric Lunsford:

I have another question for you that may be a bit more of an opinion, but I thought I'd post anyway as there may be some others in the future with a similar question. First of all, one thing that wasn't clicking for me earlier which caused my last post about adding income is that as income grows you can always get another policy, correct? Is there a limit to how many different whole life ins policies one person has?

My primary question thought was surrounding debt - still wrapping my head around this infinite banking concept. I have about $17k of consumer debt I'm working on getting rid of. I pay about $750/mo more than the minimum payments in a snowball method. Is there any value, that you see, in putting that money (about $8400/year) toward a whole life policy and then when the cash value equals or exceeds my debt amount in the next couple of years, borrowing against my policy to pay the debt off? All of this compared to simply just paying the 700 directly to debt?

I see the benefit as my money is growing while I have a policy and while I'm repaying the loan to my policy. But I'm not sure all of that is worth it as I'm waiting a couple of years at least just to have enough CV to take a loan out.

Any advice or input is appreciated.

Yes, you can have multiple policies. With an IUL/UL, you can modify the existing policy as your income changes or start a new one if you want to add coverage for a spouse or children.

You can create a very simple tax arbitrage by swapping out the high interest credit card debt with low interest policy loan debt. Once that is done, then you can start to displace the loans and free up the cash value. I've built a financial model that shows that this is more effective at building wealth than by paying off the debt and then investing. Its pretty obvious when you realize that the money simply has more time to work.

Hope this quick answer helps.

Post: Lump Sum Whole Life Insurance vs. Simply Invest

Post: Lump Sum Whole Life Insurance vs. Simply Invest

- Financial Advisor

- Boynton Beach, FL

- Posts 815

- Votes 791

Most everything you've ever heard about IUL are myths perpetrated by people who sell IUL. Either type of policy works for this, but if you truly want the best performing private bank, an IUL is going to outperform a similarly designed whole life.

Post: Lump Sum Whole Life Insurance vs. Simply Invest

Post: Lump Sum Whole Life Insurance vs. Simply Invest

- Financial Advisor

- Boynton Beach, FL

- Posts 815

- Votes 791

With a Universal life policy, the death benefit and premium can be changed at any time. When you find yourself wanting to increase the premium, all you need to do is increase the death benefit on the policy just enough to allow the new premium into the policy. If done right, the policy will still have the minimum possible death benefit for the premium.

Whole Life doesn't offer the flexibility to increase premiums. If you knew the schedule of premium increases in advance, I might be able to design something that works, but most people don't have the luxury of knowing when they'll have more money.

Post: Does Velocity Banking work????

Post: Does Velocity Banking work????

- Financial Advisor

- Boynton Beach, FL

- Posts 815

- Votes 791

@Victor S. The original question that was posted was "Does Velocity Banking Work?". It was not asking for an opinion on the merits of paying down equity on a home. I find that when people are losing an argument, they like to change the subject. @Joshua S. did a great job explaining the strategy and proving that "velocity banking" does, in fact, work. Though I know that the debate will continue ;)

Whether or not it makes sense to pay down the equity has been beat to death in other threads.

Post: How to get the most Cash Value in a Life Insurance Policy

Post: How to get the most Cash Value in a Life Insurance Policy

- Financial Advisor

- Boynton Beach, FL

- Posts 815

- Votes 791

Let's face it, life insurance is not "the perfect" vehicle to put your money to work in two places at one time. It's got fees and expenses that must be kept to a minimum so that you get the most cash value for every dollar of premium that you put into the policy. As you are thinking about getting a policy for The Double Play, you need to know that you are not wasting your money with a poorly-designed policy. You want to get the most "BANG" for your "BUCK".

The fees determine your "handicap". Your money will be growing at a faster rate, but how long it takes to catch up to where you could be is directly related to how much cash you start with. In this session, I'm going to discuss how to keep the costs to an absolute minimum in both Whole Life and Indexed Universal Life policy designs so that you can get the most out of your premium dollars. I'll show you how to know that your policy illustration is designed properly.

Post: Lump Sum Whole Life Insurance vs. Simply Invest

Post: Lump Sum Whole Life Insurance vs. Simply Invest

- Financial Advisor

- Boynton Beach, FL

- Posts 815

- Votes 791

1. The real problem is liquidity. If you do a 5-pay design with $6K/yr for 5 years, you'll start with approximately $4,800 of cash value in your policy plus the remaining $24,000 that isn't in the policy. $28,800 that can be invested. Depending upon what you invest in, you may have trouble getting the $6K out each year to pay the premiums.

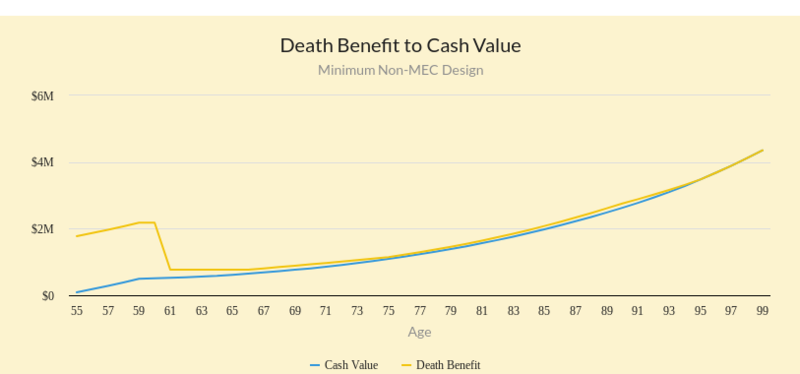

2. Its all about driving the cost out of the policy, not refinancing. If you graph the death benefit and cash value in a 5-pay design, it looks like this...

If you think of the death benefit as the primary cost driver in a policy, you can see that from year 6 onward, there is very little cost in the policy. The expense ratio after Year 10 is ~0.25%... very low. This one has a very large premium and death benefit, but its all scaleable.

Post: Lump Sum Whole Life Insurance vs. Simply Invest

Post: Lump Sum Whole Life Insurance vs. Simply Invest

- Financial Advisor

- Boynton Beach, FL

- Posts 815

- Votes 791

Don't do it. The quick explanation is that the death benefit is a function of the first year premium. The policy issue charge is a function of the death benefit. The policy issue charge is assessed annually during the surrender charge period of your policy.

So by dropping in a lump sum instead of spreading it over 5 years, you will have a death benefit that is 5X higher. The costs will also be 5X higher and will continue long after the premium is paid. This consumes a lot of the extra cash value that you had at the beginning.

If you have a lump sum, the optimal funding period is 5 years. That keeps the fees to a minimum while allowing your cash to go to work as soon as possible. You could do 10 years and keep the costs down even more, but you'll have less cash value because you missed out on the compounding interest in the early years.

Post: Life Insurance and REI

Post: Life Insurance and REI

- Financial Advisor

- Boynton Beach, FL

- Posts 815

- Votes 791

None of your thoughts make sense. You've inappropriately tied the dividend rate and the borrowing rate to the payback period. And then you made a leap to stating that it only makes sense if you have a lot of money. Your interpretation of the facts is wrong, for starters and you've offered no evidence to support your claim.

If your cash value is growing at 5% and you can borrow against it at 5%, you are borrowing at 5%, not 0%.

If you can take that 5% money and use it to earn 10%, you are creating a 5% arbitrage on the outside of the policy. If you are in a 40% tax bracket, you'll give 2 of that 5% to the IRS leaving you with a net of 3% EXTRA, created OUTSIDE the policy. That is in addition to the 5% that the cash value earned during that same time. That is an 8% total return.

Had you done the exact same thing without life insurance, using the same assumptions, you would have given 4% of your 10% income to the IRS leaving you with 6%.

Bottom line: It doesn't matter how much money you have. What matters most is how WELL your policy is designed so that you can minimize the length of time it takes to catch up to and surpass where you would have been had you simply taken your money and invested directly into whatever you were planning to do. A properly-designed, maximum over-funded policy should have about 85% cash value to premium. Obviously it would take much less time for this model to work out with that 85% ratio than it would if your cash value to premium ratio was much less than that.