All Forum Posts by: Thomas Rutkowski

Thomas Rutkowski has started 20 posts and replied 801 times.

Post: Why do REI dislike or avoid life insurance?

Post: Why do REI dislike or avoid life insurance?

- Financial Advisor

- Boynton Beach, FL

- Posts 819

- Votes 791

@Daniel McNulty So if you can't win your argument, you just change the game?

All I'm saying is that if you were going to invest in "A", then you can do better by putting your money into a properly-designed, maximum over-funded policy and then leverage that cash value to invest in "A". Pretty simple.

To both you and @Joe Splitrock, if you don't like it, don't do it. But neither of you can get past your dislike of life insurance to admit that it works. Logic trap? Give me a break. I built a model to compare doing this against not doing this so I could prove it to myself. If its too complicated for you, let it go. I know it works and my clients all know it works.

"Suggesting it is simple math is misleading...Your model is completely based on the tax benefits and leverage." Duh. That's the point.

Please tell me how a life insurance policy is illiquid if I can access 100% of the cash value at any time?

Post: Why do REI dislike or avoid life insurance?

Post: Why do REI dislike or avoid life insurance?

- Financial Advisor

- Boynton Beach, FL

- Posts 819

- Votes 791

Originally posted by @Joe Splitrock:

@Brook Vosler investors don't like life insurance because they are sophisticated and understand it is not a good deal. They understand that fees, including sales commissions are ridiculous. Of course that is why insurance agents and financial planners try to force it down your throat.

At the end of the day, insurance companies invest in bonds, mortgages and some in the stock market. So insurance companies have no special formula to reduce risk and increase return. They just add a fee layer and tie you into a product that is impossible to get out of, without loosing everything you put in.

The "be your own bank" nonsense it just another angle to try to sell the insurance. You can only "be your own bank" after you have funded the policy with massive amounts of money. You would be better using that cash to invest in real estate, then pulling it out through long term financing.

@Thomas Rutkowski I have trouble with these "results not guaranteed" graphs that are just sales tools. How much more could someone have made if they reinvested everything into REI - way more that is the point.

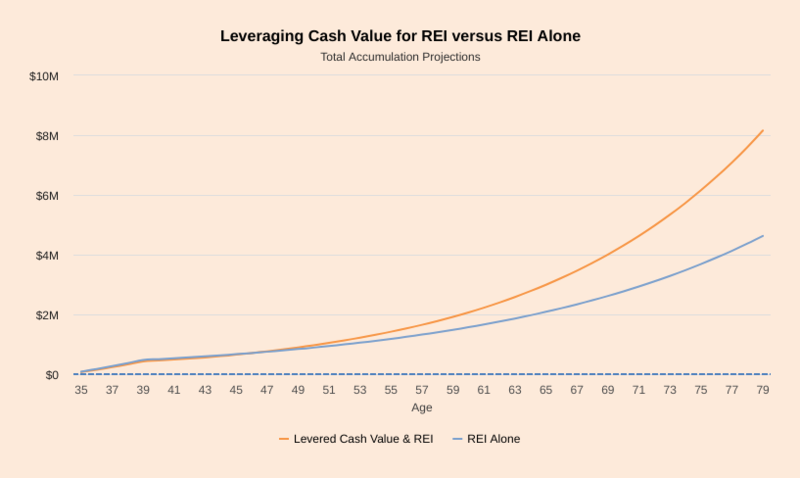

Look at the graph closely. It is showing the result if someone invested 100% of their money into real estate. Putting your money to work in two places at one time results in better wealth accumulation than putting your money to work in only one place at one time. Again: would you rather have 85% of your money earning 9% or 100% of your money earning 6%? Pretty simple math.

Post: Why do REI dislike or avoid life insurance?

Post: Why do REI dislike or avoid life insurance?

- Financial Advisor

- Boynton Beach, FL

- Posts 819

- Votes 791

@Daniel McNulty - As I stated, it is a simple example to illustrate the concept. There is no need to get into sophisticated modeling here. The concept works regardless of the tax rates.

A line of credit against a life insurance policy will be for nearly 100% of the cash value. A line of credit against a brokerage account will be a much lower LTV. Cash value is principal protected. Apples and oranges.

Post: Why do REI dislike or avoid life insurance?

Post: Why do REI dislike or avoid life insurance?

- Financial Advisor

- Boynton Beach, FL

- Posts 819

- Votes 791

@Aaron K. My incentives are aligned to help my clients make money. Maximum over-funded policies have as little death benefit and commission as you can legally get in an insurance contract. This is what an investor needs for this type of strategy to work. Unfortunately, these forums are filled with people who see insurance as a one size fits all and lump all agents and life insurance into the same category. The math works.

Commissions on a maximum over-funded policy are less than 5% of the premium. As I stated in my original post above, the premium to cash value ratio in a maximum over-funded policy should be about 85%. When its not, that means that the death benefit is higher than it needs to be and so are the fees and expenses of the policy.

The Double Play math is simple. Imagine if your first premium was $100,000. Think big. $15,000 of that is lost to the policy charges. You are starting with $85,000 of cash value. Premium minus expenses equals cash value. You can get a line of credit against that cash value at prime, but let's just say 5% to keep the math simple and be conservative. If you can take the proceeds of that credit line and invest it at 10%, you'll make $8,500 the first year. Your interest is a business expense, so you end up with $4,250 of taxable income.

If you're in a 40% tax bracket, you'll write a check to the IRS for $1700, leaving you with a net of $2,550. The cash value of the policy also earns a dividend during that same period, so assuming that is 6%, your cash value grows by $5100. The total growth is $7,650.

Compare this with investing $100,000 of your own cash directly in the same investment earning 10%. This time all $10,000 is subject to income taxes, so your net after tax is $6,000.

As I stated in my first post: would you rather have 85% of your money making 9% or 100% of your money making 6%? The graph clearly shows the benefit of this planning approach over time.

This is just a simple example. Depreciation in real estate requires a little more sophisticated modeling, but it still works. And you can see that a poorly designed policy with less than 85% cash value would negatively impact the results.

Post: Why do REI dislike or avoid life insurance?

Post: Why do REI dislike or avoid life insurance?

- Financial Advisor

- Boynton Beach, FL

- Posts 819

- Votes 791

@Todd Goedeke You may have been an agent at one time, but you don't know the difference between a minimally-funded and a maximum over-funded policy. If you did, you wouldn't ask such a ridiculous question. Not all life insurance policy designs are the same.

The graph I showed includes the commissions and the strategy still works. So if you're making more money, who cares what the agent is making?

Post: Why do REI dislike or avoid life insurance?

Post: Why do REI dislike or avoid life insurance?

- Financial Advisor

- Boynton Beach, FL

- Posts 819

- Votes 791

Correct. The model used to generate the output used in the graph is an A vs B comparison using apples-to-apples inputs. Its hard to tell by the scale, but the sum of life insurance cash value and real estate starts off at a disadvantage due to the charges in a life insurance policy. But since your money is working in two places at one time and earning a higher rate of return, the power of compounding interest eventually takes over.

Would you rather have 85% of your money growing at 9% or 100% of your money growing at 6%?

Post: Why do REI dislike or avoid life insurance?

Post: Why do REI dislike or avoid life insurance?

- Financial Advisor

- Boynton Beach, FL

- Posts 819

- Votes 791

Post: Deferred Sales Trust

Post: Deferred Sales Trust

- Financial Advisor

- Boynton Beach, FL

- Posts 819

- Votes 791

You understand that those two cases are Stan Crow vs the Government, not the other way around, right? I interpret this to mean that he is very confident in his deal structure and wants a definitive ruling. Imagine what that would do for his business.

-Tom

Post: Is Buy Term and Invest the Difference Really Better?

Post: Is Buy Term and Invest the Difference Really Better?

- Financial Advisor

- Boynton Beach, FL

- Posts 819

- Votes 791

Here's the link to the replay: https://meeting.zoho.com/publi...

Post: Is Buy Term and Invest the Difference Really Better?

Post: Is Buy Term and Invest the Difference Really Better?

- Financial Advisor

- Boynton Beach, FL

- Posts 819

- Votes 791

Have you ever heard that you should just "buy term and invest the difference"? Is this really better than buying a permanent life insurance policy? I've built a "buy term and invest the difference calculator" and the results will surprise you.

The Double Play is putting your money to work in two places at one time by leveraging the cash value of a maximum overfunded life insurance policy.

In this session we're going to bust the "Buy Term and Invest the Difference Myth".