All Forum Posts by: Thomas Rutkowski

Thomas Rutkowski has started 20 posts and replied 801 times.

Post: Infinite Banking, Is it cut out to what it is said to be?

Post: Infinite Banking, Is it cut out to what it is said to be?

- Financial Advisor

- Boynton Beach, FL

- Posts 819

- Votes 791

You don't have to take my word for it. There are dozens of posts from mortgage lenders that state that you can use cash value for the down payment. The way you access the cash value is via a policy loan, though, as you know, many people incorrectly refer to it as "taking money out of the policy".

Its a beautiful thing: infinite rate of return.

Post: Infinite Banking, Is it cut out to what it is said to be?

Post: Infinite Banking, Is it cut out to what it is said to be?

- Financial Advisor

- Boynton Beach, FL

- Posts 819

- Votes 791

Originally posted by @Clayton Hepler:

@Thomas Rutkowski, I have been unable to find any such companies that offer lower than 5% on loans. I am only focusing on whole life too.

In addition, I see that companies “register” dividends of 6% but have to use some of the % to pay for administrative? Which takes it down to 5%.

If your intent is to leverage the cash value for real estate investing, then you shouldn't be using a policy loan anyway. You should go to a bank and get a cash value line of credit. These are typically at Prime, which is well below 5% right now. The interest on a policy loan is not tax deductible.

So if you are utilizing a poorly designed policy whole life and not gettng the tax deduction for the interest, you are probably right, its not going to work for you. I covered this in my weekly webinar last week: The 3 Key Success Factors for The Double Play.

1. You need a properly designed and maximum over-funded policy. You know you have this when your cash value to premium ratio is about 85% or better.

2. You need to access the cash value in a tax-advantaged manner.

3. You should use the right policy type. For any two policies with the same death benefit and the same premium, an IUL will outperform a WL because its cash value earns a portion of the "equity premium" whereas WL simply earns a "debt market" return. Both work off of the exact same mortality tables.

Also, its not fair to state that the fees will take a 6% dividend down to 5%. The fees could eat up all of the dividend and more in some years and based on poor policy design. You need to understand the underlying fee structure of the policy. There is a premium charge that is related to the amount of premium, there are Policy Issue Charges related to the Death Benefit amount and only assess during the surrender charge period, and finally the actual mortality charges. These vary as a percentage of the premium or growth based on whether the policy is minimally-funded (typical whole life) or maximum over-funded, or anywhere in between.

Post: Infinite Banking, Is it cut out to what it is said to be?

Post: Infinite Banking, Is it cut out to what it is said to be?

- Financial Advisor

- Boynton Beach, FL

- Posts 819

- Votes 791

Using the numbers that you stated, you are correct, The Double Play does not make sense. But I think you have it backward. The arbitrage is the other way in the real world.

4% represents the Guaranteed Rate for most Whole Life companies, not the dividend that they actually pay. Don't focus on the Guaranted Rate, its not a real number. Its simply the worst-case growth rate that the company is willing to put their name on. Since the cash value represents the policy owner saving up their own death benefit over their natural life expectancy, the insurance company has a vested interest in your cash value growing as quickly as possible.

And even with today's low Cap rates on IULs, the "expected" interest crediting, based on a 30-year lookback, and assuming interest rates stay as low as they are today, is still between 5 and 6%. You can get a policy loan or a cash value line of credit at less than 4%.

Post: Using Whole Life insurance to save on tax money

Post: Using Whole Life insurance to save on tax money

- Financial Advisor

- Boynton Beach, FL

- Posts 819

- Votes 791

Originally posted by @Joe Splitrock:

@Mark Leclair I am a huge Tony Robbins fan, but I was very disappointed with this book. First of all he was promoting a financial adviser that he was going to partner with, which is a conflict of interest. Other than that I thought his book really just offered conservative advice. Probably fine for the masses. I don't recall anything about using life insurance to avoid paying taxes on income. Maybe tax free to your heirs when you die is what you are thinking? I am not a fan of whole life as an investment vehicle. You pay major fees on the front end and once your money is in the plan, you basically can't take it out. You can loan yourself money but withdrawing is difficult without loosing a substantial amount. Insurance companies ultimately invest your money in low risk investments such as bonds and mortgages. Your "return" is really limited by these investments. Ultimately you could invest directly into these type of investments and avoid the high fees.

If you don't understand how life insurance works, you should really keep your opinions to yourself. You're spouting pure nonsense.

1. You are obviously confusing a minimally-funded whole life with a maximum over-funded policy. The fees on a maximum over-funded policy are minimal... which you know because we've been debating this for years and I have put my numbers up for everyone to see while you are just spouting your opinion.

2. You can Withdraw your cash value any time you want. But you should never do that when you can get a loan against the policy's cash value.

3. You do not loan yourself money. A policy loan is a loan from the insurance company with your cash value serving as collateral. The cash value never leaves the policy.

4. Why do you think it is difficult to get a policy loan? You call up the insurance company and tell them how much you want. They verify that you have the cash value to secure the loan and they send you a check. Alternatively, you go to a bank and give the lender an assignment of collateral against the policy's cash value.

5. Please show me how you "lose a substantial amount". If you have a $100,000 of cash value, you can get a loan for almost all of that. They usually only hold back enough to pay the interest for the first year.

The Double Play is not about the life insurance. The cash value in the policy may only capture a low debt market rate of return, but the loans against the policy's cash value are creating value outside of the policy. The sum of the outside investing and The Double Play will outperform real estate alone... as I've shown repeatedly in my posts.

Post: Using Whole Life insurance to save on tax money

Post: Using Whole Life insurance to save on tax money

- Financial Advisor

- Boynton Beach, FL

- Posts 819

- Votes 791

@Mark Leclair You can utilize life insurance for investing in real estate. However, its not going to be a tax-free transaction. It will be a tax-advantaged transaction.

All you are really doing is leveraging the cash value of a maximum over-funded cash value life insurance policy. It's no different than leveraging your house for a home equity line of credit. If you do it right, you can invest in a tax-advantaged manner because the interest expense will reduce the taxable income on your Investments. You'll know that your policy is maximum over-funded when the ratio of cash value to premium on your illustration is about 85% or better. That means most of your money is going to the cash value and not towards the costs of the policy or the sales commissions.

This is a solid approach if you are saving for your retirement, but if you are a flipper trying to live off of your investing activities, you'll have to keep in mind that much of your wealth is held in the cash value of the life insurance. But leveraging the cash value allows you to put that cash value to work outside of the policy at the same time... The Double Play

Post: Infinite Banking? Do or Don’t

Post: Infinite Banking? Do or Don’t

- Financial Advisor

- Boynton Beach, FL

- Posts 819

- Votes 791

If you don't mind doing a little reading, this subject was beat to death in this thread: https://www.biggerpockets.com/forums/519/topics/245380-paradigm-life-infinite-banking-whole-life-insurance?page=3 and several others here on BP.

As you've no doubt seen, there are wide ranging opinions, but very few people who actually understand how permanent life insurance works. A properly designed, and maximum over-funded policy is not the same as the typical whole life that most of these people think they understand.

Post: Installment sales. How do they work exactly?

Post: Installment sales. How do they work exactly?

- Financial Advisor

- Boynton Beach, FL

- Posts 819

- Votes 791

An interest only installment sale will defer the capital gain until the balloon payment is received, but the depreciation recapture will be due for the year of the sale. This can be deferred as well if the sale is transacted through a qualified intermediary.

More info here...

Post: Why do REI dislike or avoid life insurance?

Post: Why do REI dislike or avoid life insurance?

- Financial Advisor

- Boynton Beach, FL

- Posts 819

- Votes 791

Originally posted by @Tony Kim:

Originally posted by @Thomas Rutkowski:

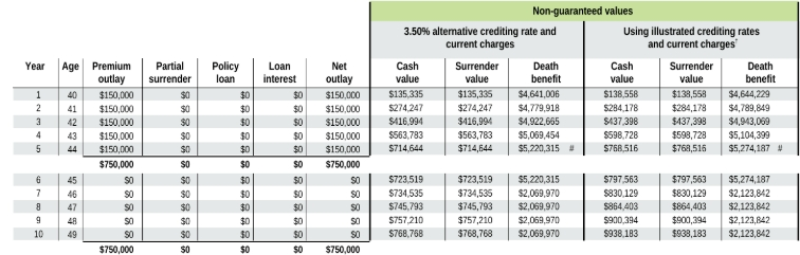

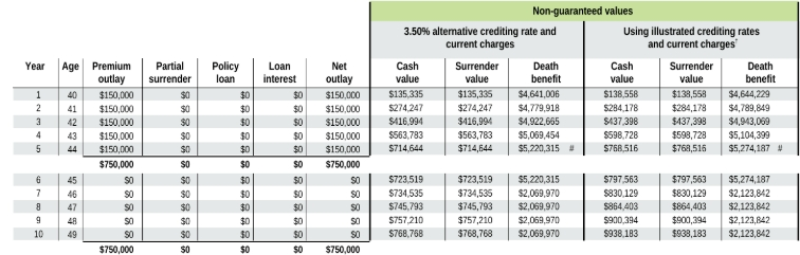

I was presenting an illustration yesterday. He is a 40 year old, healthy, non-tobacco and his crossover around the end of the 4th year. Hey @Joe Splitrock - note that the cash value = the surrender value. Premium minus charges = cash value.

That said, this crossover point is meaningless. The graph I posted above looks at the true opportunity cost. Its not about how long until you have your money back. Its about how long before you catch up to where your money would have been had you invested it all in real estate without the life insurance. THAT is what the earlier graph above is showing.

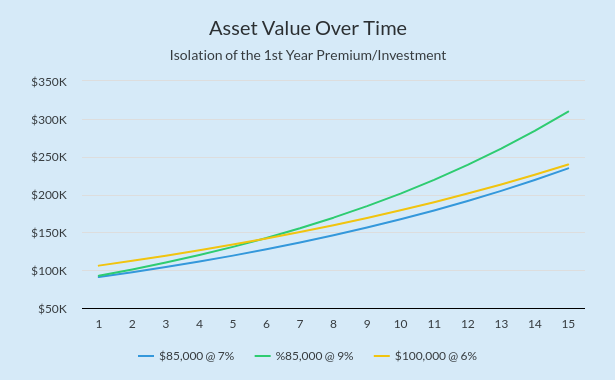

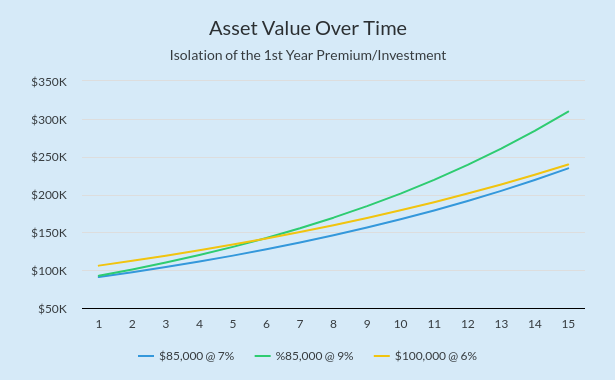

This graph is from my webinar last week. It is examining one premium in isolation. The $85,000 represents the cash value from a properly-designed, maximum over-funded policy receiving the first premium of $100,000.

The numbers used in this analysis correspond to the simplistic assumptions in my example above (10% growth opportunity, 40% tax, 5% loan rate. The Green line represents getting a cash value line of credit at 5% and using the loan proceeds to invest at a 10% rate and paying 40% taxes. The Yellow line represents the alternative: simply taking $100,000 and making the same investment. The life insurance PLUS leverage for REI catches up before the 6th year.

The blue line is for there to illustrate the same example without tax-deductible interest (as with a policy loan from the insurance company).

Hi Thomas,

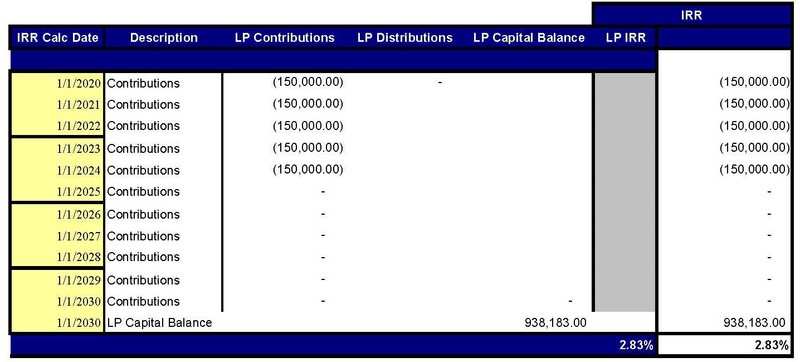

Thank you for that information and providing me with a sample. So based on the spreadsheet that you posted, am I correct in assuming that if we pay 150K in premiums for the first 5 years and no longer have to pay additional premiums starting in year six, by the time we reach year ten, the cash value will be 938,183? Money going in is 750K, cash value of 938K over a period of ten years?

I entered those numbers in my IRR spreadsheet and get an annualized return of 2.83%. Is there someplace in which my schedule is incorrectly configured?

If you choose to focus on the life insurance alone, you are missing the whole point. I call it The Double Play for a reason.

1.) As the charts clearly show, you will build more wealth by leveraging the cash value to do whatever you were going to do in the first place. Fees, commissions, and IRR on the premium don't have anything to do with this. After all the fees are taken out of the premium, you will be left with about 85% that goes to the cash value. THAT plus a line of credit against THAT allows you to put the money to work in two places at one time. You have less, but it will be growing at a faster rate and will eventually catch up to where you would have been had you done something else.

2. We haven't discussed income from life insurance, but at risk of going down another rabbit hole, the remaining cash value (~85% of the premium) is capable of generating 2 to 3 times the after tax income of money held in traditional retirement assets. Think 4%-rule. Cash value is more like an 8%-Rule and its tax free.

3. You are looking at the return on premium. This does not take policy design into consideration. A basic whole life is going to have much, much higher fees than a maximum over-funded whole life. The CASH VALUE in both will be growing at the same rate. But the policy design dictates how much cash value is left over after the fees are subtracted from the premium.

My charts and the simple example, show a 6% growth ON THE CASH VALUE.

Post: Why do REI dislike or avoid life insurance?

Post: Why do REI dislike or avoid life insurance?

- Financial Advisor

- Boynton Beach, FL

- Posts 819

- Votes 791

Originally posted by @Todd Goedeke:

@Aaron K. I agree. To shed light on the subject of insurance commissions, there are two parts to commissions; target premium commission and the commission on the excess. The total of both can be around 10% of total deposit.

Has yourself If life insurance is such a great investment why do you never hear from people saying how much money they made off their policy?

Anybody can use software to produce a graph. Legally there is about 5-8 pages of disclosures that should accompany a graph. Also an insurance company name should be present to prevent insurance agents from printing misleading graphs and charts.

Again, you don't understand the difference in policy designs. It's not 10% if the policy is properly designed.

You don't get it: Its not the life insurance that is the investment. The life insurance is helping you build wealth in whatever you are investing in. The graphs are not showing life insurance returns, they are showing the combination of life insurance and real estate vs real estate alone. The charts aren't misleading, you just aren't interpreting the data properly.

Do you think of your checking account as an investment? Its a place to store your liquid wealth.

Post: Why do REI dislike or avoid life insurance?

Post: Why do REI dislike or avoid life insurance?

- Financial Advisor

- Boynton Beach, FL

- Posts 819

- Votes 791

I was presenting an illustration yesterday. He is a 40 year old, healthy, non-tobacco and his crossover around the end of the 4th year. Hey @Joe Splitrock - note that the cash value = the surrender value. Premium minus charges = cash value.

That said, this crossover point is meaningless. The graph I posted above looks at the true opportunity cost. Its not about how long until you have your money back. Its about how long before you catch up to where your money would have been had you invested it all in real estate without the life insurance. THAT is what the earlier graph above is showing.

This graph is from my webinar last week. It is examining one premium in isolation. The $85,000 represents the cash value from a properly-designed, maximum over-funded policy receiving the first premium of $100,000.

The numbers used in this analysis correspond to the simplistic assumptions in my example above (10% growth opportunity, 40% tax, 5% loan rate. The Green line represents getting a cash value line of credit at 5% and using the loan proceeds to invest at a 10% rate and paying 40% taxes. The Yellow line represents the alternative: simply taking $100,000 and making the same investment. The life insurance PLUS leverage for REI catches up before the 6th year.

The blue line is for there to illustrate the same example without tax-deductible interest (as with a policy loan from the insurance company).