All Forum Posts by: Dave Poeppelmeier

Dave Poeppelmeier has started 17 posts and replied 481 times.

Post: Section 8 investor having issues expanding territory.

Post: Section 8 investor having issues expanding territory.

- Realtor

- Maumee, OH

- Posts 490

- Votes 722

Just know about Section 8 here in Toledo... We have a city ordinance that makes income source a protected class, aka you can't say No Section 8, but it also means you can't say ONLY Section 8. IMO, Section 8 is a solid option here as they have closed the waiting list for a voucher, but you have to have a PM that knows how to navigate it. Just like the Due On Sale clause, is a bank going to chase you down because the property is now in an LLC? Not likely, but possible. Same thing here with discriminating against a private pay applicant because they're not government guaranteed income. Just something to think about. *Here's my disclaimer I'm not an attorney, yada yada yada*

Post: Finding good Tenants in Toledo

Post: Finding good Tenants in Toledo

- Realtor

- Maumee, OH

- Posts 490

- Votes 722

Quote from @Anthony Roberts:

Hello BP Family,

I'm new to BP [first post] and really new to the Toledo Market. I have purchased and renovated a couple of SFHs and am having some difficulties finding good tenants. Any processes to share and/or tips/recommendations?

Thanks,

Ant.

Hi Anthony, are you local and managing yourself or out of town? If you're out of town, then yes, you need a good PM. Shameless plug for LaPlante, reach out to @Andrew Fidler for more info on what we do, which is everything.

If you're local and managing yourself, it's a great way to learn the entire rental process: acquisition, renovation, leasing, management, turnover. But, it also depends on where your properties are. If they're in D class neighborhoods (or even lower C class as well), then your options are pretty limited. You can't make a filet mignon with ground chuck beef if that makes sense. To get a better pool of potential renters for you properties, you have to be in areas where they are going to want to live. You also need to have an above average house for the neighborhood to give them.

If you're leasing yourself, you really can't go too wrong with Zillow. I would stay away from Facebook Marketplace, it was a crap show the couple times I threw a house up there, but that's just me.

Bottom line is that it's a learning process. You'll figure out what works best for you, but be ready to learn the hard way along the way. Best of luck to you.

Post: Unpaid utility bill

Post: Unpaid utility bill

- Realtor

- Maumee, OH

- Posts 490

- Votes 722

Quote from @Eric Stewart:

Thank you everyone for your insight and help.

Wasn’t a great first start but I will take what I learned and apply it to my future properties.

However, what I do to avoid this is I have all of my properties on autopay, and I make the water bill part of the rent. Rent and water are due on the 1st. If they pay rent and not water, guess what? Late fees and the 3-day process start. Do I collect every cent of the water bills with move in/outs and whatnot? No, but it's worth my sanity and not having to deal with the big water bill situation you're dealing with now. Just my two cents. Best of luck to you.

Post: What are the zip codes that you would invest in Toledo Ohio?

Post: What are the zip codes that you would invest in Toledo Ohio?

- Realtor

- Maumee, OH

- Posts 490

- Votes 722

Quote from @Greg Scott:

Toledo has been losing population steadily since 1970, so it will be much harder to find a "good" area to invest. I'd look for areas on the outskirts where development has been happening.

Well, it appears that the population of the entire Metro area is doing just fine.

The housing market and rents continue to be very strong in the C class areas and up in Toledo proper, and quite hot in the surrounding suburbs. Our economy is doing very well and Toledo has a very rental-heavy housing culture. @Aaron Maxwell I'd be happy to discuss the positives of investing in Toledo and the local market here.

Post: Nearing 1,000 College Student Tenants: Here's what I've Learned

Post: Nearing 1,000 College Student Tenants: Here's what I've Learned

- Realtor

- Maumee, OH

- Posts 490

- Votes 722

Quote from @Will Gaston:

I'm 100% serious:

Lowest expectations wins in college students.

Can't assume they'll read the lease, follow the lease, etc.

(Remember some of them had braces 2-3 years ago)

Their college housing is part of their learning experience. They need a wide berth.

Post: Nearing 1,000 College Student Tenants: Here's what I've Learned

Post: Nearing 1,000 College Student Tenants: Here's what I've Learned

- Realtor

- Maumee, OH

- Posts 490

- Votes 722

Quote from @Christos Kappatos:

Quote from @Dave Poeppelmeier:

Quote from @Christos Kappatos:

I just listed my property! (On Zillow) Have had a lot of interest (staying very competitive with the market rents) but sooo many people seem to never read the darn post!

I have clearly mentioned a few times that all parties need to submit an application that must be approved before any showings can happen but people keep requesting showings 😐. Any tips to mitigate this for student rentals, or is it part of the game?

haha, thanks Dave. It's crazy how many people just don't READ! Your saved reply, is it just a list of questions, or do you link them to a separate application process?

Also, I have a few applicants who live in student housing. I have never had to call student housing to verify their previous residence. Is that the same as calling any other apartment or landlord?

Post: Nearing 1,000 College Student Tenants: Here's what I've Learned

Post: Nearing 1,000 College Student Tenants: Here's what I've Learned

- Realtor

- Maumee, OH

- Posts 490

- Votes 722

Quote from @Christos Kappatos:

I just listed my property! (On Zillow) Have had a lot of interest (staying very competitive with the market rents) but sooo many people seem to never read the darn post!

I have clearly mentioned a few times that all parties need to submit an application that must be approved before any showings can happen but people keep requesting showings 😐. Any tips to mitigate this for student rentals, or is it part of the game?

Post: Why I'd focus on Fix and Flip, not renting in Toledo, OH

Post: Why I'd focus on Fix and Flip, not renting in Toledo, OH

- Realtor

- Maumee, OH

- Posts 490

- Votes 722

Quote from @Engelo Rumora:

Quote from @Dave Poeppelmeier:

Quote from @Engelo Rumora:

Quote from @Frank Barletta:

Quote from @Engelo Rumora:

Quote from @Andrew Syrios:

I don't know a lot about Toledo but generally speaking with rates having skyrocketing and prices still creeping up, it makes it very difficult to cashflow on a rental if you use debt. So generally speaking, it's a better time to flip than to buy rentals for the time being. (House hacking is an exception.)

Who uses debt?

Only cash mate hehe 😁

I wish that were the case, but not everyone has cash or wants to tie up their liquidity. It also doesn't allow to scale faster, so its not a strategy for everyone.

Slow and steady wins the race mate.

Too many guru's and marketing companies pumping leverage to rookies because they make more money, the more somebody buys.

Being patient and using all cash to begin is always safer in the long run.

Build the foundation of your portfolio with cash and make it strong.

After a few years, look at using leverage for faster growth.

And only after you have experienced the true income and expenses of your portfolio and not just paper figures.

Cash is King

Cashflow is Queen

Leverage is the Peasant

Just my opinion 🙏

My wife and I started in RE having come from no significant family money. My parents were able to pay for most of my college tuition, my wife's parents paid for even less. We were caught in the Rat Race, me working as a Physical Therapist and my wife as a teacher until our 2nd child came along, and we did the math and found that 2/3 of her take home income would go towards child care. So, she stayed at home with the kids and I busted my *** on the weekends to make up that extra money.

We bought our first property by cashing out what money we had left from our 401k, took the penalty hit, and made the down payment. We were all in on RE, putting all of our extra money we saved toward the next down payment and the renovations. We bought one more house the next year, and one more the year after that. But, a funny thing happened on our way to the Forum: we were able to learn first hand how to manage properties, deal with renters (including the House from Hell and the Renters from Hell on our 3rd property), what to look for in deals, etc. Every house I put a ton of sweat equity in to save money.

The year after that, we sold those 3 and bought our first few Student Rentals. Having participated in our local REIA and other Real Estate groups (Toledo PIN), people started to know what we were doing. Then houses started finding us in addition to the MLS. My wife got her Real Estate license to start looking for houses ourselves, and I was eventually able to leave my W2 job as a PT that I hated and despised, and because a Realtor as well. We are now up to 23 properties, with our goal being 25. We are cash flowing great, and continue to pour those profits back into our houses by replacing roofs, painting/siding, and improving the properties to make them more appealing and to get the Cap Ex taken care of. Once we get half of those Free and Clear, we will be financially independent. When all are Free and Clear, we can do whatever we want essentially.

I tell this story because if we waited to buy a house with cash, we would have never done it. Life would have happened, the money would have gone somewhere else, and I wouldn't be loving the life I currently live in Real Estate. Most people don't have jobs in Silicon Valley with money to burn and buy turnkey houses for cash. There is no "safe" investment in the stock market, real estate, etc., but you have to roll the dice and get in the game. We have had several craps and 7's, but we've hit a lot of points as well.

#getinthegame

#financingisfine

#workhard

#rollthedice

Thanks Dave,

I agree for a realtors sake. Why buy 1 for $100,000 in cash when you can help them get leverage. Use the same capital to buy 5 and you make the 5 x the commission, right?

Make intro to contractor and PM, maybe make a few extra bucks also?

I feel sorry for all of the over leveraged folks when interest rates shot up like they did last year. Especially the ones that had adjustable portfolio loans. Each to their own and nothing personal but there is also the other side of the spectrum where folks don’t know what they are doing, use stupid leverage and get into a lot of trouble. Not related to “turnkey” as you stressed.

Thanks and keep being great 👍

Also, I don't expect kickbacks from people I introduce my Investor clients to. I simply want contractors and PMs to take care of my clients, so they have a great experience investing in Toledo.

What I'm talking about is how the little guy can use leverage to get into the game and not have all of their money tied up in one property. If that one property goes bad, the whole portfolio goes bad. If they used that $100k to put down payments on 4 properties and one goes bad, the other 3 are still working.

You have your niche in turnkey properties, and that's fine. But I'm telling the little guy to not feel like they can't get started because they don't have $100k sitting around to buy in cash.

Post: Why I'd focus on Fix and Flip, not renting in Toledo, OH

Post: Why I'd focus on Fix and Flip, not renting in Toledo, OH

- Realtor

- Maumee, OH

- Posts 490

- Votes 722

Quote from @Engelo Rumora:

Quote from @Frank Barletta:

Quote from @Engelo Rumora:

Quote from @Andrew Syrios:

I don't know a lot about Toledo but generally speaking with rates having skyrocketing and prices still creeping up, it makes it very difficult to cashflow on a rental if you use debt. So generally speaking, it's a better time to flip than to buy rentals for the time being. (House hacking is an exception.)

Who uses debt?

Only cash mate hehe 😁

I wish that were the case, but not everyone has cash or wants to tie up their liquidity. It also doesn't allow to scale faster, so its not a strategy for everyone.

Slow and steady wins the race mate.

Too many guru's and marketing companies pumping leverage to rookies because they make more money, the more somebody buys.

Being patient and using all cash to begin is always safer in the long run.

Build the foundation of your portfolio with cash and make it strong.

After a few years, look at using leverage for faster growth.

And only after you have experienced the true income and expenses of your portfolio and not just paper figures.

Cash is King

Cashflow is Queen

Leverage is the Peasant

Just my opinion 🙏

My wife and I started in RE having come from no significant family money. My parents were able to pay for most of my college tuition, my wife's parents paid for even less. We were caught in the Rat Race, me working as a Physical Therapist and my wife as a teacher until our 2nd child came along, and we did the math and found that 2/3 of her take home income would go towards child care. So, she stayed at home with the kids and I busted my *** on the weekends to make up that extra money.

We bought our first property by cashing out what money we had left from our 401k, took the penalty hit, and made the down payment. We were all in on RE, putting all of our extra money we saved toward the next down payment and the renovations. We bought one more house the next year, and one more the year after that. But, a funny thing happened on our way to the Forum: we were able to learn first hand how to manage properties, deal with renters (including the House from Hell and the Renters from Hell on our 3rd property), what to look for in deals, etc. Every house I put a ton of sweat equity in to save money.

The year after that, we sold those 3 and bought our first few Student Rentals. Having participated in our local REIA and other Real Estate groups (Toledo PIN), people started to know what we were doing. Then houses started finding us in addition to the MLS. My wife got her Real Estate license to start looking for houses ourselves, and I was eventually able to leave my W2 job as a PT that I hated and despised, and because a Realtor as well. We are now up to 23 properties, with our goal being 25. We are cash flowing great, and continue to pour those profits back into our houses by replacing roofs, painting/siding, and improving the properties to make them more appealing and to get the Cap Ex taken care of. Once we get half of those Free and Clear, we will be financially independent. When all are Free and Clear, we can do whatever we want essentially.

I tell this story because if we waited to buy a house with cash, we would have never done it. Life would have happened, the money would have gone somewhere else, and I wouldn't be loving the life I currently live in Real Estate. Most people don't have jobs in Silicon Valley with money to burn and buy turnkey houses for cash. There is no "safe" investment in the stock market, real estate, etc., but you have to roll the dice and get in the game. We have had several craps and 7's, but we've hit a lot of points as well.

#getinthegame

#financingisfine

#workhard

#rollthedice

Post: Why I'd focus on Fix and Flip, not renting in Toledo, OH

Post: Why I'd focus on Fix and Flip, not renting in Toledo, OH

- Realtor

- Maumee, OH

- Posts 490

- Votes 722

Quote from @Frank Barletta:

Honestly, I would have never guessed that this market is actually not great for rental investments and real strong for fix and flips. Who knew?!

Here is the scoop:

About this Market: Toledo, OH, emerges as a prime market for property flipping, thanks to its combination of affordable purchase prices, economic revitalization, and strong rental demand. The city's ongoing cultural and economic resurgence, supported by proactive local government incentives, enhances property values and attracts a growing population. Strategic geographical positioning near major Midwest cities further amplifies Toledo's appeal, offering investors significant ROI potential through both immediate flips and long-term rental strategies. With its diverse economic base stabilizing the rental market and a community-centric revitalization in full swing, Toledo stands out as a surprisingly lucrative market for real estate investors looking to maximize their investments.

Market Trends and Growth

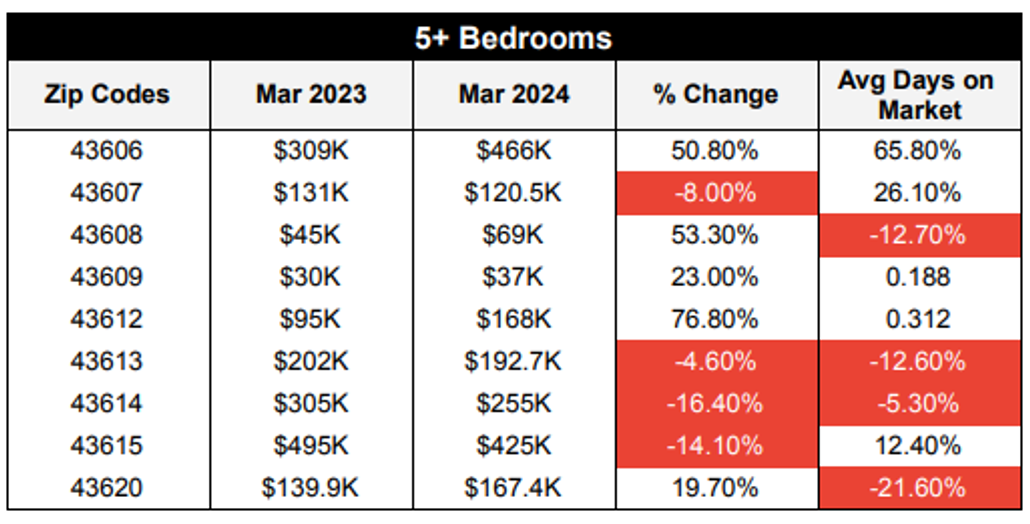

Price Growth in 43620

- Homes with 5+ Bedrooms: In the past year, these properties have shown a substantial increase in median sold prices, rising from $139.9K to $167.4K, a growth of 19.7%. This indicates a strong market demand and a promising opportunity for investors.

Days on the Market (DOM)

- Reduced Sale Time: The average sale duration has decreased from 86 days to 67 days year-over-year. This improvement suggests a growing buyer interest and possibly limited inventory, creating favorable conditions for quick turnovers.

Toledo OH - RE Analysis (April 2024) - House Sales (1).pdf

Demographics and Economic Factors

Population and Economic Characteristics

- Population Size: With a smaller population of 5,341, 43620 offers less competition in buying and selling, which is beneficial for flippers targeting niche market needs.

- Income Levels: The lower median household income ($27,442) suggests a demand for affordable, refurbished homes—ideal for flipping projects aimed at cost-sensitive buyers.

Housing and Ownership Trends

- Renter-Occupied Properties: A high percentage (68%) of renter-occupied properties indicates a transient population, potentially less targeted for flipping. However, converting these into desirable, owner-occupied homes could capture untapped market segments, particularly as economic conditions improve.

Age Distribution and Market Demand

- Diverse Age Groups: The presence of young adults and an aging population suggests varied housing needs—from starter homes to downsizing options. Tailoring renovations to these demographics can maximize appeal and marketability.

Comparative Analysis with Surrounding Zip Codes

- 43613 and 43615: These areas, with higher median incomes, might offer opportunities for higher-end flips but may also face stronger competition and higher property costs.

- 43606 and 43608: While the potential exists, these zip codes may not experience the same level of market appreciation as 43620, which could affect profit margins.

Strategic Recommendations

Investment Focus in 43620

- Cost-Effective Renovations: Focus on upgrades that enhance fundamental property values, such as kitchen and bathroom remodels and improvements in curb appeal. These will likely attract both renters looking to become homeowners and first-time buyers seeking affordable options.

- Target Market: Position properties to appeal to the existing rental demographic and potential homeowners by offering competitively priced, well-renovated homes.

The big flip, but remember the 70% rule of flipping: 2032 Robinwood Ave, Toledo, 43620

This is the type of home that would work perfectly for the demand, however, this should be converted to a multifamily property most likely a triplex. The most recent comp to sell was 2114 Robinwood Ave, Toledo, 43620 which was converted to a Triplex and sold 8/4/2023.

Ensure the purchase and renovation costs adhere to the 70% rule relative to the after-repair value (ARV), which is estimated at $250K for sound investment planning.

Frank, I would like to see your Permits and Certificate of Appropriateness for this bad boy. This is the Old West End, a historical district in Toledo that has a very strict HOA/Historical Protection group that basically forbids you to use most modern building materials. I agree with others, that Toledo is a rental market and not a flipping market for the most part. I also think it's not right that you're advising people to start flipping in the OWE without knowing what they're getting into. Just my two cents.