All Forum Posts by: Axel Meierhoefer

Axel Meierhoefer has started 35 posts and replied 663 times.

Post: Seeking advice: Cashing out ~$300,000 after 1st year investing

Post: Seeking advice: Cashing out ~$300,000 after 1st year investing

- Rental Property Investor

- Escondido, CA

- Posts 676

- Votes 550

I agree with those folks here on the thread who recommend sticking with something that works and becoming a real expert in it. I have done that the last 10 years and I love other people following what I am doing and share the good and the not-so-good things that happen when investing in residential real estate.

if I am in your situation or you came to me with that issue directly, I would recommend investing the funds into a build to rent project where the cash flow is really good and the equity is growing during the construction phase so you can apply somewhat f a flywheel approach in the long run while still staying reasonably passive. That gives you the option to enjoy the results f your investments, and if you like to use the proceeds you can keep investing for however long you love to grow your portfolio.

Noelle, with your sum you could do 5 residential properties in one of the projects I am investing in myself and generate continuous good cash flow and equity gains.

Happy to discuss. Feel free to DM

Post: looking to buy first rental property out of state!

Post: looking to buy first rental property out of state!

- Rental Property Investor

- Escondido, CA

- Posts 676

- Votes 550

@Randall Alan Just curious, does your time have no value? I keep reading these statements that doing it yourself is so much cheaper. I can see this being the case if you only account for your time at minimum wage or a really low hourly rate or zero.

It is true that some property management companies don't take good care of their investors but its not the norm. I have a company in the Quad cities that uses a team of handymen with specializations. They charge me $50 for each trip to a property plus a very reasonable $40/hr and parts. I would value my time higher than that, so its a good deal.

Post: $10,000,000 to deploy -- where would you put it?

Post: $10,000,000 to deploy -- where would you put it?

- Rental Property Investor

- Escondido, CA

- Posts 676

- Votes 550

@Gabriel Craft I would buy 50/50 built-to-rent SFR in Florida and Texas with 80/20 financing, on this scale probably with private money or institutional money for the loans

Post: Do you need to transfer property to llc name?

Post: Do you need to transfer property to llc name?

- Rental Property Investor

- Escondido, CA

- Posts 676

- Votes 550

@Anne Abrams You can have a Series LLC in another state and then report the "Mother" in your state as a foreign entity.

I am not smart enough for all the things I have learned but I know that learning and finding great experts is super-helpful for me and my mentoring clients.

One of those is Scott Smith from Royal Legal Solutions who is probably THE expert on series LLC's. If you or anybody on this thread like an into, just DM me and I am happy to help with that.

Post: Do you need to transfer property to llc name?

Post: Do you need to transfer property to llc name?

- Rental Property Investor

- Escondido, CA

- Posts 676

- Votes 550

@Johnny Dlcrz I agree with the 50% of folks on BP who like to have an LLC structure. To me, there are a few things to consider that the LLC structure, also often called Series LCL structure, provides:

1. The LLC structure creates anonymity - as others here mentioned, it makes it harder or impossible to find out who the true owner of a property is.

2. Have an LLC (often called "mother") as an S-Corp LLC to run all the operations of REI through it (mortgage payments, reserve accumulation, rent deposits, etc.) clearly separates REI from all other business activities, i.e. your construction company as well as your private activities and belongings

3. Having separate LLC's (often called "Children) in a Series LLC structure lowers your liability and risk. If you have your two properties in your name and your construction company has allowed you to accumulate a few nice things, maybe a nice big house you use as your residence, etc. If someone successfully sues your "child-LLC" that owns one of your properties, all your private belongings and all your other "Child-LLC's" with your other houses (maybe more than 2 in the future) are protected. Just to illustrate what that means:

Let's say you own a $900K house/residence, a $50K car, have a W2 paycheck of $100K/year, and have two investment properties each currently worth $150K, your total 'worth' is about $1.3 Million + your W2 income. If someone sues you successfully and the court awards the person $2Million in damages, everything you own is gone and you will pay your paycheck to that person until the full sum of $2 MIllion is covered.

Alternative: You create an LLC structure with a mother and two children (maybe more children as you keep adding investment properties), and a person who feels you did them wrong with or in one of your rental properties sues you. The court again awards damages of $2 Million. All this person can sue is one child LLC. That means you can give them the house worth $150K, and declare bankruptcy for that child LLC. You keep everything else and count the award as a loss in the tax return of your mother-LLC to which all tax-relevant items roll up to.

I am not a lawyer or CPA, but my research has confirmed this construct several times.

Maybe that helps explain why I prefer an LLC structure versus not having one. Naturally, you can decide to take the risk and keep it all under your name as some people here said. The only thing that is really driving it one way or the other is the answer to the question: How likely is it that someone tries to find a reason to sue me and convince a court that they are right?

I decided I don't want to find out. Therefore, I make the LLC structure and other protective aspects of becoming a professional real estate investor part of my mentoring approach.

Post: QOTW: How to help a new investor stuck in “Analysis paralysis?

Post: QOTW: How to help a new investor stuck in “Analysis paralysis?

- Rental Property Investor

- Escondido, CA

- Posts 676

- Votes 550

@Bhekizwe M. I am mentoring people in the OOS TK SFR strategy I developed originally for myself and have used investing in a dozen properties.

You are right and my clients tell me that they appreciate the in-depth review of all the components of a deal and the support from start to finish. It results in more successful deals and creates confidence in the process.

Post: 2nd home or investment property?

Post: 2nd home or investment property?

- Rental Property Investor

- Escondido, CA

- Posts 676

- Votes 550

@Krystl Matsunaga Several people here already stated that more details would help give better feedback. One of the big things to answer your question has to do with the goal or purpose of the purchase.

Let's assume you could have a second home in Hawaii even if you already live there (maybe each island could count separately), you would still want to determine what you will use it for. To stay within the rules, you would be limited to short-term rental use so you could maintain the claim that it is a second home. If generating cash flow from short-term rental income is your goal you would be better off doing that but keep in mind rules change on April 1st, 2022 (see the article I posted above) and make second home financing much more expensive on a monthly cost basis.

If your goal is to develop a passive portfolio that benefits from rental income and appreciation and does not require a lot of your time, you might be better off with an investment property. Be aware that the investment property could be acquired turnkey and would not have to be in Hawaii, which could mean your 20% downpayment, let's say in Ohio, is equal to a 10% downpayment of a vacation home in Hawaii. You would have to run the numbers but avoid the HELOC use (not recommended when you are just starting out).

Making sure you have identified what the goals are and then find the best performing approach to meet your goals has proven to be a path to success. In my mentoring, I use the approach shown in the image below to test/check goals for viability and completeness.

Post: 2nd home or investment property?

Post: 2nd home or investment property?

- Rental Property Investor

- Escondido, CA

- Posts 676

- Votes 550

@Brian Plajer There are specific rules for second homes that are similar to first home owner-occupied. Yes, you can get those with as low as 10% down and good rates but you have to be quick as the federal government has changed the G-fee rules starting April 1st. If you can't close before that the loan would get much more expensive o interest rates. Here is a good article about it:

Post: Realistically most investors won’t replace all income W/ cashflow

Post: Realistically most investors won’t replace all income W/ cashflow

- Rental Property Investor

- Escondido, CA

- Posts 676

- Votes 550

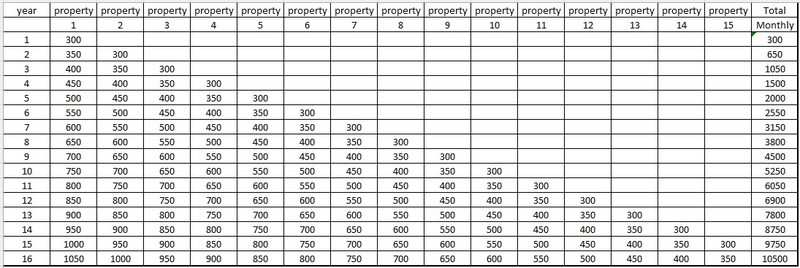

I would not want a deal with $200 cash flow/month these days. I also don't like it when the assumption is that anybody would ever buy a property and never increase rent. I just put the picture together below to show that it takes 15 properties with $300 monthly cash flow to start, increase rent $50/year and buy one additional property each year. I don't know why people need $10000/month but if they do, here is one way it can be done:

Post: Realistically most investors won’t replace all income W/ cashflow

Post: Realistically most investors won’t replace all income W/ cashflow

- Rental Property Investor

- Escondido, CA

- Posts 676

- Votes 550

Originally posted by @Patrick Snyder:

Something else to consider:

https://www.forbes.com/sites/marcprosser/2017/07/19/data-proves-reits-are-better-than-buying-real-estate/?sh=56385bd7d6b7

I am happy to invest in a REIT if anybody can show me one where I can put 20% down and get 80% from the bank. Somehow this article appears to assume that a direct investor would buy the property cash, same as REIT investing..