All Forum Posts by: Eric Fernwood

Eric Fernwood has started 64 posts and replied 792 times.

Post: What Market would you recommend

Post: What Market would you recommend

- Realtor

- Las Vegas, NV

- Posts 823

- Votes 1,574

Hello Parker Robertson,

Good questions.

On STR and MTRs, I recommend buying a property that is an excellent long-term rental and then using it as either a short-term or mid-term rental. This way you have a fallback position. However, if the property is going to be used as a short or mid-term rental, this does change some aspects of the properties that we recommend. For example, short-term rentals are not allowed in most homeowners associations. Immediate access to restaurants and entertainment is important. So while our selection process doesn't change, we just add additional criteria on the location and configuration.

The renovation also changes slightly for MTRs and STRs. For example, on an LTR, we might put carpet in the bedrooms. If it's going to be an MTR or STR, we put LVP in the bedrooms. The reason is to cut down on turn costs and reduce maintenance costs.

Another example is the external door locks. We normally remove smart locks because they are likely to cause service calls but do not increase the rent. However, if it's going to be an STR or MTR, then we want electronic locks so that they can be remotely reprogrammed.

On high-crime cities - there are multiple reasons to avoid them. Appreciation and rent growth only occur if demand is increasing, and that requires the population to be increasing. The high-crime cities I’ve investigated have declining populations. Unless rent growth keeps pace with inflation, your time off the corporate treadmill will be short-lived.

Also, all private sector jobs are temporary. Unless new companies are moving into the area and creating replacement jobs that pay similar wages and require similar skills, sooner or later, all that will be left are low-paying service sector jobs. As higher-paying jobs vanish, area incomes fall, and city services are cut back. This results in higher crime and lower-quality schools, which causes more people to leave.

Hope I answered your questions. If not, please ask again.

...Eric

Post: What Market would you recommend

Post: What Market would you recommend

- Realtor

- Las Vegas, NV

- Posts 823

- Votes 1,574

Hello @Abraham Berkowitz,

Rather than listing investment locations, I will provide a process for selecting a dependable income location and choosing reliable income properties.

The Process

Years ago, when I was selecting a location to set up my investor services business, I faced the challenge of finding a good investment location. As an engineer, I don't believe in opinions, gurus, or luck. Instead, I took the time to develop a straightforward process for selecting both a reliable passive income location and properties. To date, we have successfully delivered over 480 investment properties using the process, which is shown below. There are clear metrics at every decision point so you know you're making the right choice.

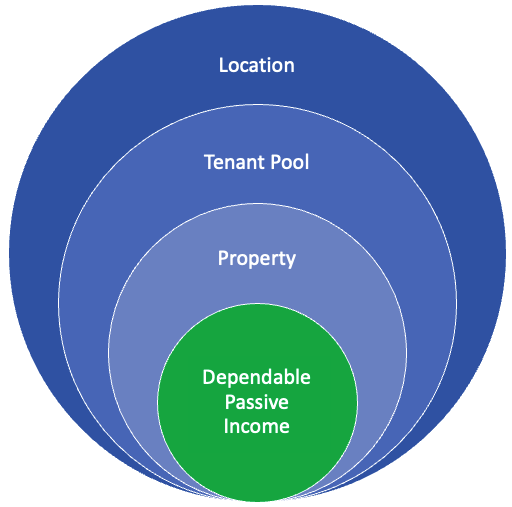

Selecting a Dependable Passive Income Location

The location selection process involves starting with a list of possible cities. Then, using a series of filters, eliminate cities that are unlikely to provide the dependable passive income you need. By the end of the process, you will have narrowed your search down to a small number of cities. The starting list is a metro area population greater than 1M, which you will find on Wikipedia.

- Both state and metro populations are increasing. Do not buy anywhere if the state or metro populations are static or decreasing. Wikipedia

- Low crime - High crime and long-term appreciation and rent growth are mutually exclusive. Do not invest in any city on Neighborhood Scouts’ list of the 100 most dangerous US cities.

- Inflation compensating - Every time you go to the store, the same basket of goods costs more and more dollars. In order to have the additional dollars needed to pay inflated prices, rents must rise faster than inflation. Therefore, a critical location selection metric is that rents and prices are rising faster than inflation. Rents tend to lag behind prices, so you can use the appreciation rate if you do not have historical rental data. Zillow Research

- Low operating cost - High operating costs can turn what appears to be a profitable property into a money pit. The three most apparent are income taxes, property taxes, and insurance. Insurance - ValuePenguin, Metro Property Taxes - LendingTree

- Low disaster risk - When a tornado or other natural disaster strikes a city, it doesn't just obliterate individual properties. The entire community, including jobs, shopping, and retail, is destroyed. Your tenants won't wait for your property to be rebuilt in a year or two; they'll move immediately to a location where they can work and live today. Even if your insurance company rebuilds your property, there may be no one to rent it. Everyone in the community will have resettled in other locations, and there's no reason for employers, retail establishments, or people to move back. Locations hit by natural disasters may take many years or never recover. However, your mortgage, taxes, insurance, maintenance, and other expenses will continue without interruption. The cost of homeowners insurance is the best indicator of the likelihood of a natural disaster in an area. Choose a location with low-cost homeowners insurance because they have the lowest risk of natural disasters. Insurance - ValuePenguin

- Rent control - Some states and metro areas have implemented various kinds of rent control. Rent control may prevent you from increasing the rent fast enough to keep pace with inflation. It may limit your property manager's ability to select the best tenant. It may make evictions of non-performing tenants difficult or impossible. Never invest in any location with rent control.

At this point, you will have a small number of potential cities. The next step is property selection.

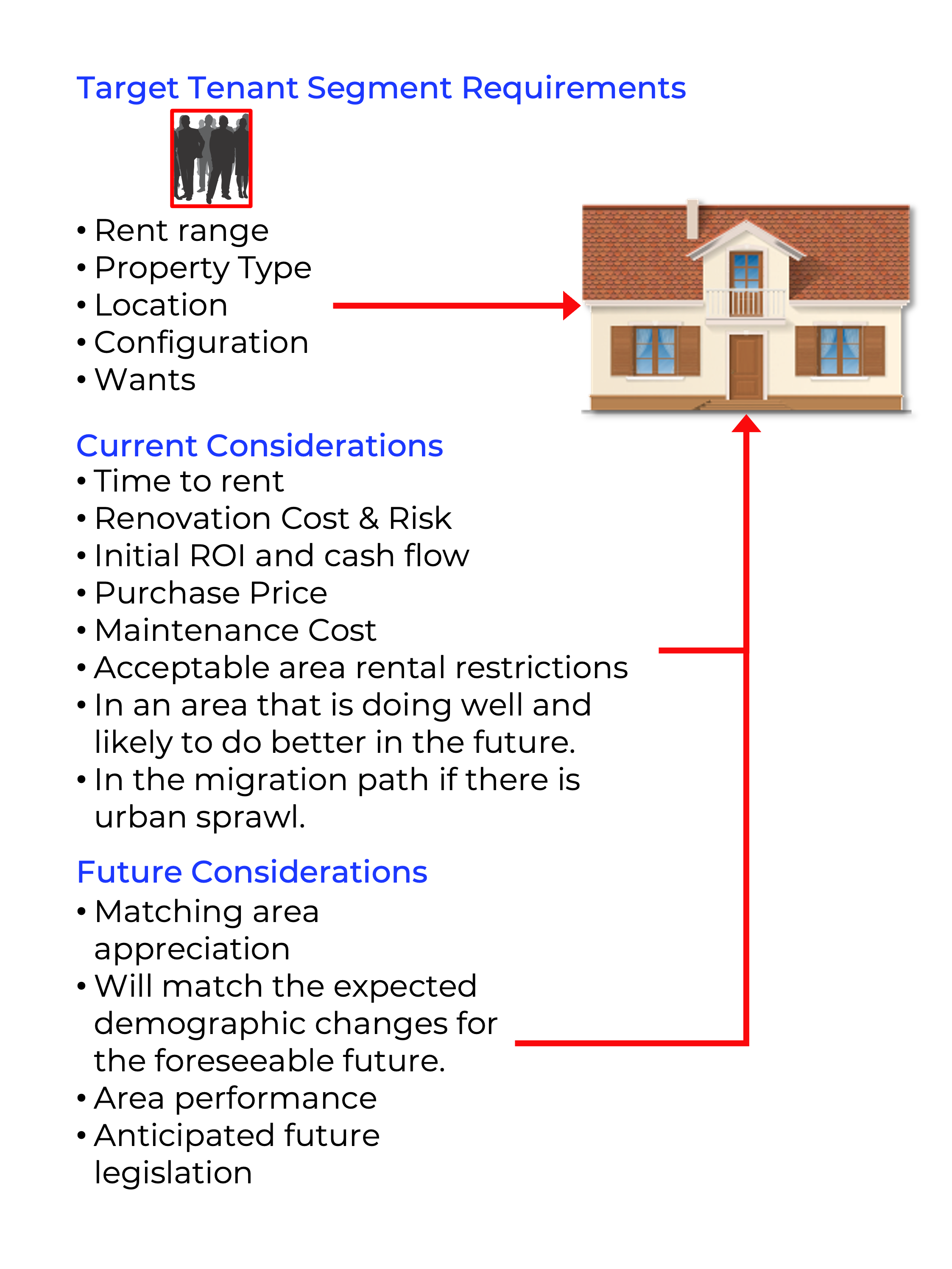

Property Selection

A property is only as good as its tenant. If your tenants don't pay rent, move frequently, or damage the property, you will lose money. A reliable income requires keeping the property continuously occupied by a reliable tenant. What is a reliable tenant? Someone who stays for many years takes care of the property, and always pays the rent on schedule. However, such people are the exception, not the norm.

To increase the likelihood of always having a reliable tenant, choose a tenant pool segment with a high concentration of reliable tenants. You can select such a segment through property manager interviews.

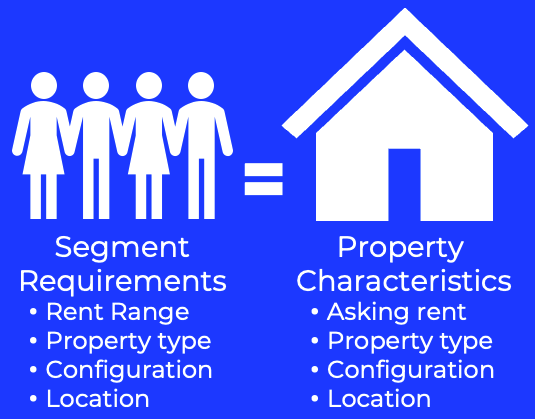

Once you have identified the segment you want to occupy your property, the next step is to attract that segment. You do this by purchasing properties that match the segment's housing requirements.

You will achieve this by utilizing the nearly one-to-one relationship between a segment's housing needs and the unique characteristics of individual properties. This approach works because people will only rent a property if it meets all of their housing requirements. The relationship between a segment’s housing characteristics and a matching property is shown below.

To determine the housing requirements of a specific tenant segment, determine what and where they currently rent. From these properties, you can build a list of the segment’s housing requirements. Below is an example of a segment’s housing requirements.

- Rent range: $1,500/Mo. to $2,250/Mo.

- Type: Single-family

- Configuration: 3+ bedrooms, 2+ baths, 2+ car garage, 1,200 SF to 2,100 SF

- Location: North of the river and east of Line Rd.

You can convert the rent range into a property price range by doing the following.

- Find rental properties that match the housing requirements for your segment on any major real estate site.

- Find properties for sale or recently sold that are similar to the rental properties. This will give you a price range to work with.

Once you have the housing requirements for a segment, any realtor can locate properties that meet those requirements.

However, there is more to selecting than just matching the housing requirements of a target segment. See the image below.

Abraham, I hope this helped. Feel free to reach out to me if you have questions.

Post: buying property in 2023

Post: buying property in 2023

- Realtor

- Las Vegas, NV

- Posts 823

- Votes 1,574

Hello @Rafal Soltysek,

In this post I'll talk about waiting and how our clients are dealing with the high interest rates.

Should You Buy or Wait?

Waiting to acquire a property only makes sense if interest rates and/or property prices decrease significantly, leading to a significant decrease in your acquisition cost and debt service.

Interest Rates

The Fed recently increased the interest rate by another 0.25%. With inflation still around 5% and unemployment near historic lows, I do not anticipate interest rates decreasing significantly in the foreseeable future, instead, they may increase. Keep in mind that if the interest rate falls, the prices will increase as more buyers go after an already tight supply. Higher prices increase your acquisition cost and debt service. So, waiting for interest rates to fall significantly is not a viable option.

Property Prices

Rents and prices are driven by local supply and demand. In Las Vegas, the supply and demand situation depends on the property segment.

The housing market is not homogeneous; it is comprised of multiple segments. The demand for one segment could be high while the demand for another is low. For example, demand for $1M homes might be practically non-existent, while at the same time, there is high demand for homes ranging from $300,000 to $400,000.

Which segment do we target? For over 15 years, we have focused on a narrow tenant segment. The properties that meet this segment's housing requirements are primarily single-family homes currently priced between $320,000 and $475,000. What is the current demand situation with this segment of properties? In a word, high.

Why? It's due to a combination of limited supply and ever-increasing demand. I will address supply first.

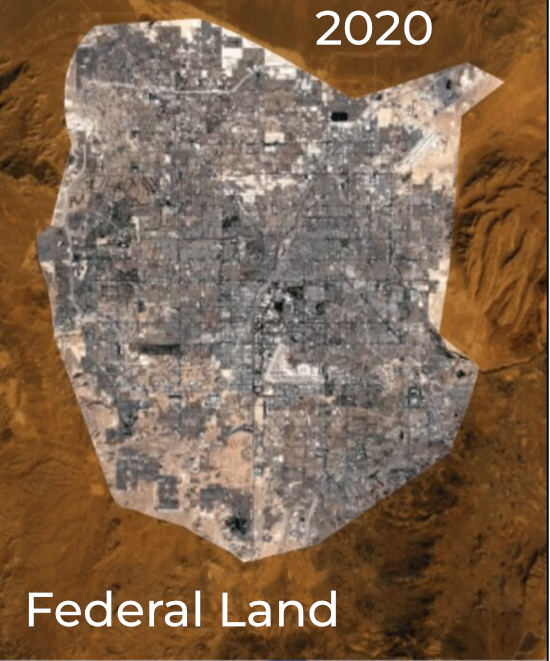

Almost Fixed Supply of Properties

The limited supply of properties within our target price range is due to the high cost of land. See the 2020 aerial view of Las Vegas below. Las Vegas is a small island of private land in an ocean of federal land. And, there is little undeveloped non-federal land remaining.

In the areas we target, land costs more than $1 million per acre. As a result, the prices of most new homes in these areas start at $550,000. No matter how many +$550,000 they build, they do not increase the number of properties in the $320,000 to $475,000 price range. So, the number of properties in the $320,000 to $475,000 range is almost fixed.

Below are the 13-month trailing stats showing the supply of our target segment. We are at 1 month of supply and I do not see any factors that will reverse the trend abruptly.

Demand

Demand is driven by population growth. Las Vegas’ average annual population growth has been between 2% and 3%. And, is likely to increase. Penske Truck Rental’s annual report on where people are moving lists Las Vegas as the #2 destination, following Houston as #1.

What is bringing so many people to Las Vegas? Jobs. In January, the Monster and Glass Door job sites showed there were between 26,000 and 31,000 open jobs. And, depending on which article you read, today there is between $18B and $26B under construction. As these projects come online, they will create thousands of additional jobs. Jobs will continue to bring more people to Las Vegas.

And every person will need a place to live. The two options are to buy or rent.

Many people will purchase homes in the $320,000 to $475,000 price range, while the majority of others will rent homes in that same price range. As the population increases, the demand for homes in the $320,000 to $475,000 price range will continue to rise, driving up both home prices and rents.

The combination of a nearly fixed supply and rising demand almost guarantees that prices and rents will continue to increase.

I Have a Question for You

If you had the opportunity to purchase a business that provided a reliable, passive income that you would not outlive and that kept pace with inflation, would you pass on the opportunity because the initial returns did not match what you could have earned two or three years ago?

Dealing with High-Interest Rates

Gone are the days of 2% and 3% interest rates. Today, investment loan rates range between 7% and 7.5%, and they're not expected to decrease anytime soon. We need to deal with this reality. The question is, how?

Interest Rate Buy Downs

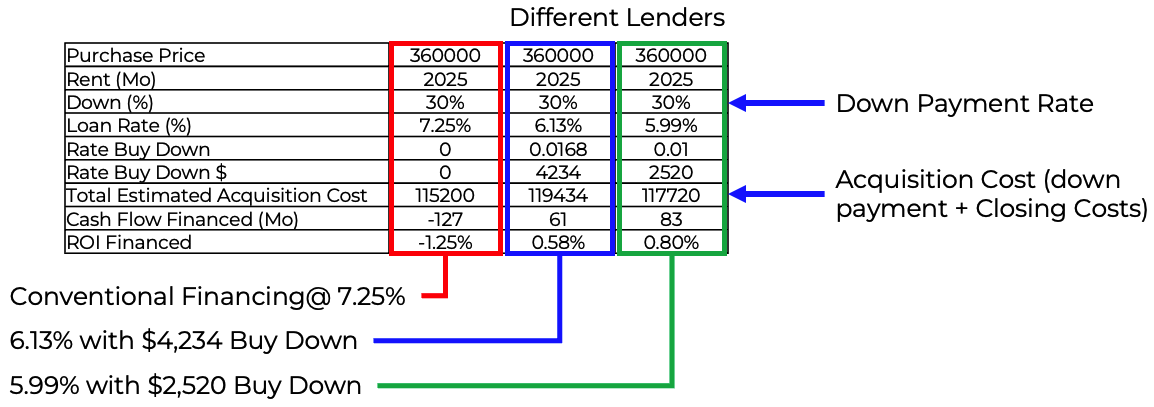

An interest-rate buydown is an option where you pay an amount upfront to reduce the interest rate on a loan. Below is a comparison between a conventional 7.25% rate compared to two interest-rate buy-down options.

- Column one is a conventional loan at 7.25% with no buy-down. The result is a -1.25% return. The acquisition cost (down payment plus closing cost) is $115,200.

- Column two uses an interest buy-down to reduce the interest rate to 6.13%. The upfront cost to decrease the interest rate is $4,234. The acquisition cost (down payment plus closing cost plus buy-down cost) is $119,434 resulting in a 0.58% return.

- Column three uses an interest rate buy-down to reduce the rate to 5.99%, for an upfront cost of $2,520. The acquisition price is $117,720 resulting in a 0.80% return.

Column two and column three are from different lenders. As you can see, there is a significant difference in buy-down costs and rates. Our clients always rate shop these days once they have a property under contract.

Conclusion

If you are hoping to wait for conditions to change back to what they were two or three years ago, that is not going to happen. And, delaying your purchase will result in paying more and missing out on a lot of appreciation and tax savings. The time to act is now.

Post: Where is everyone investing these days for both STR and LTR?

Post: Where is everyone investing these days for both STR and LTR?

- Realtor

- Las Vegas, NV

- Posts 823

- Votes 1,574

In my opinion, the biggest problem with short-term rentals (STRs) is that they are rentals of desire, primarily occupied by vacationers for short periods of time. If times are difficult, no one has to take a vacation, so STRs sit vacant. In contrast, mid-term rentals are rentals of necessity, typically for people like traveling nurses or other people who are in a location for business reasons.

Due to the seasonality and other issues of short-term rentals, mid-term rentals can actually provide a higher annual cash flow. Additionally, there are property managers who will handle mid-term rentals at a reasonable rate.

Post: How to Reliably Predict Rental Trends

Post: How to Reliably Predict Rental Trends

- Realtor

- Las Vegas, NV

- Posts 823

- Votes 1,574

Property prices and rents are both driven by supply and demand.

- If there are more sellers than buyers, prices will fall.

- If there are more buyers than sellers, prices will rise.

If prices rise, fewer people can afford to buy and will be forced to rent. Demand for rental properties increases as will rents.

If prices fall, more people will buy so fewer people will rent. Demand for rental properties decreases as will rents.

Where prices go, rents follow.

Depending on the market, it can take 1 to 5 years for rents to catch up to price changes.

Primary causes of the lag between price changes and rents:

- Lease Term - Leases are usually for a year or more. So, changes in rent due to fluctuations in rental demand are delayed by up to a year.

- Practical Limitations to Rent Increases - The maximum rent increases tenants can accommodate is usually 8-12%, so it takes time for rents to catch up to current market conditions.

So, current price trends are an excellent indicator of future rent trends.

Post: Seeking Investor friendly agents in Las Vegas NV

Post: Seeking Investor friendly agents in Las Vegas NV

- Realtor

- Las Vegas, NV

- Posts 823

- Votes 1,574

Hello @Armand P.,

Over the last 15+ years, we have delivered more than 480 investment properties. However, rather than focusing on our accomplishments, this post will describe how you can find an investment realtor in any location.

An investment realtor is fundamentally different from a residential or "investor-friendly" realtor.

Residential or "Investor Friendly" Realtors

Residential realtors enable people to buy or sell homes. The process is simple. Homebuyers select properties, and the residential realtor provides access. Once a property is selected, the residential realtor facilitates the offer and closing process.

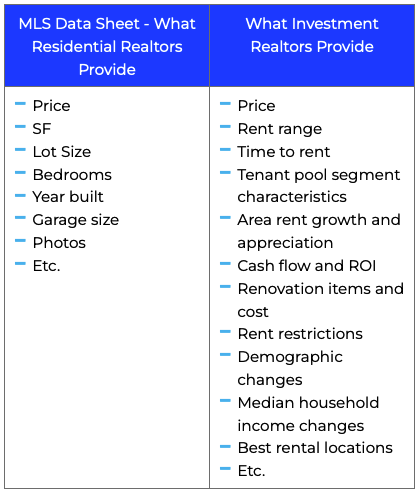

Although some residential realtors occasionally sell real estate that will become rental properties, they provide limited value beyond MLS data sheets. To an investor, MLS data sheets are worthless. Below is a table comparing what an MLS data sheet contains and what you, as an investor, need to make informed decisions.

Investment Realtor

Where residential realtors sell homes, investment realtors sell passive income streams. Also, investment realtors are always part of a team. Only a team of experts can provide the end-to-end processes, skills, and knowledge necessary to bring a property to market. See below for a diagram of the process we follow.

While the above diagram depicts our process, any investment team will have a similar process.

Now that you see the value of working with an investment realtor, how do you find one?

How to Find an Investment Realtor

There are usually thousands of residential realtors in a metro area, but only one or two investment realtors. How do you find one?

Start by compiling a list of candidates. Get names from

- Real estate investing websites (such as Biggerpockets.com)

- Property managers

- Local investors

- Talk to real estate brokers

- Google searches

- Local meetups

After creating a pool of candidates, evaluate each one using interview questions. The primary objective of these questions is to determine the individual's character and capabilities in identifying, validating, and bringing properties to market.

Interview Questions

Before beginning candidate interviews, create a list of 10 or fewer questions. You won't have time for more. Ask each candidate the same questions and record their responses. Below are sample questions. It's unlikely to find a candidate with the "perfect" response to every question, but they should provide reasonable answers.

- Tell me about your investment team.

- Do you or have you owned investment properties?

- How many investment properties did you close in the last 12 months?

- Did you or your client select the properties?

- What were your primary selection criteria?

- Tell me about the tenant pool you target.

- How did you estimate rent and time to rent?

- Tell me about your renovation process.

If you’d like more details on how to vet investment realtors, DM me.

Post: Realistic beginner strategy? (Las Vegas)

Post: Realistic beginner strategy? (Las Vegas)

- Realtor

- Las Vegas, NV

- Posts 823

- Votes 1,574

Hello @Jennifer Dargento,

Some considerations.

203K loans

With 203K loans, the loan amount is based on the home's projected value after renovations have been completed. To get this loan, the borrower works with a HUD-approved lender to create a detailed renovation plan and budget. Funds are released in stages as the work is completed. Some considerations:

- A 203K loan can only be used on a personal residence. It cannot be used for investment properties or second homes.

- You are required to use licensed contractors. Generally, the cost of licensed contractors is about three times that of a handyman.

- Finding a licensed contractor who was willing to do all the paperwork and hassle for a relatively small renovation job is difficult.

- Closing a 203k loan typically takes 60 days or more, while a typical FHA loan takes about 30 days. There is more paperwork involved with a 203k loan, and a significant back-and-forth process with the contractor to get the final bids. This puts you at a disadvantage as you will be competing with other buyers who can close faster.

The concept of 203K loans is outstanding. The reality is somewhat lacking.

Multi-Family in Las Vegas

The concept of multi-family is that you reduce vacancy risk and you can live in one of the units and rent out the others. I have experience with multi-family in Las Vegas, Houston, and Atlanta and offer the following considerations.

- Although Las Vegas multi-family properties may seem promising on paper, their actual cash flow is likely to be significantly less. I learned this lesson firsthand with my first investment property in Houston, which was a C (or D) class property. Before buying the property, I estimated my return at between 12% and 14%. However, it turned out to be a money pit due to continuous tenant turnover, evictions, vacancies, property damage, and vandalism. For instance, one of the tenants who signed a one-year lease moved out after only two months, leaving extensive damage. At first, I was losing over $1,000/Mo. By doing all the maintenance myself, I was able to reduce my losses to about $1,000 per year (after tax savings). I spent every Saturday and many Sundays making repairs. The best day in my early investment life was when I sold that property. The multi-family properties in Las Vegas are similar to the one I owned in Houston.

- The majority of multi-family properties in Las Vegas were built prior to 1987. Almost all are in distressed areas where only minimum-wage or near-minimum-wage workers are willing (forced) to live. There are some that are newer multi-family but these typically cost $1,000,000 or more.

- Investors never sell performing assets. In over 15 years of dealing with investment properties in Las Vegas, I have never seen a single performing property sold by an investor. 100%, all, of the properties were losing money either due to deferred maintenance or tenant issues, or both.

- It's important to take the information provided by the listing agent with a grain of salt. I learned this lesson firsthand a few years ago on a multi-family property that a client was considering. According to the listing agent, all units were rented for $900 per month, and all tenants had been in place for at least a year. As part of my due diligence, I spoke with all tenants. When I spoke to one tenant, the answers seemed off. So, I offered him $50 for the facts. He told me that he had only been living there for six months and believed he was the longest-tenured resident. Additionally, tenants had the option of paying $900 by check or $600 in cash. The leases they signed stated $900 per month, but they were all paying only $600 per month. A thorough due diligence is essential.

- These properties commonly have Section 8 tenants. While many believe that Section 8 provides guaranteed income, the only guaranteed portion is the portion paid by the government. In my experience, Section 8 tenants have a poor track record of paying their portion of the rent. For instance, a client of mine has four Section 8 tenants, but he only receives the government portion of the rent, as none of the tenants have paid their portion. While he could evict these tenants, the replacement tenants would likely have similar payment issues.

- Almost no matter what improvements you make to most Las Vegas multi-family properties, you will not be able to increase the rent significantly. These properties are located in high-crime distressed areas. If anyone could afford to pay higher rent, they would not live in this area.

- These are older properties that require significant maintenance.

- Typically, tenants attracted to these properties stay for less than a year. The shorter the tenant's stay, the more money you lose.

- There may be some multi-family properties on the market with nice-looking interiors. However, cosmetic improvements are cheap compared to updating systems. For example, installing granite kitchen counters in these properties should only cost around $2,000 per unit. In contrast, replacing the sewer line between the property and the main can cost anywhere from $5,000 to $40,000. These are older properties that have experienced significant wear and tear and require expensive updates to their systems.

You may think that I do not like multi-family properties, but this is not true. Although I had a terrible experience with a multi-family property in Houston, I purchased two 4-plexes in a suburb of Atlanta that targeted young professionals. My experience with these properties was vastly different. The rent was always paid on time, with no skips or evictions. I cannot even recall a single late payment.

The primary difference between the Houston and Atlanta properties was the tenant segment the properties attracted, not the property itself.

Post: AI & ChatGPT

Post: AI & ChatGPT

- Realtor

- Las Vegas, NV

- Posts 823

- Votes 1,574

There's a lot of hype about ChatGPT and similar AI products. Some people even believe that AI will take over the world! Spoiler alert: Skynet does not exist.

However, as usual, the hype does not match reality. But this does not mean that ChatGPT is not a powerful tool.

ChatGPT can enable you to complete tasks in minutes that used to take hours. However, it is just a tool and you need to know how to use it to get what you want. Here are some of the ways that I use chatGPT on a daily basis.

- ChatGPT enables me to find information, not links to web pages. ChatGPT enables me to ask what I want and get a quick response, instead of skimming through a dozen web pages trying to find an answer to my question.

- The ability to quickly get answers has enabled me to do more “what if” types of scenarios. So, instead of wondering what something might be, I can just ask ChatGPT.

- Demographic research - This is an invaluable capability. For example, the population changes over time for a metro area.

- When writing an article, I use ChatGPT to determine which points interest readers most. I use a prompt similar to the following: "I am writing an article on the relationship between rental prices and inflation. Based on Google searches, what points would investors find most informative?”

- Summarizing publications - Our investor services are based on data science. To keep up with relevant advances, I read numerous publications each week. However, I don't know if an article is actually relevant to the area of mathematics or programming we use until I read it. My guess is that less than 10% of the articles I read are actually relevant, and each one takes several minutes to read. Now, I use ChatGPT to summarize articles. By reading the summary, I can quickly determine whether the article is relevant to what we do.

- Finding information sources - For example, I can ask ChatGPT to provide information sources on a specific topic.

- Refine emails and articles. I write quickly, but editing takes a long time. Today, ChatGPT greatly reduces the time to create quality content.

While ChatGPT and similar AI tools are not magic, they are very powerful.

People wonder whether AI will replace their jobs.

The simple answer is no. However, the person who knows how to effectively use AI tools like ChatGPT to get more done will replace you.

Post: Should You Buy Turnkey?

Post: Should You Buy Turnkey?

- Realtor

- Las Vegas, NV

- Posts 823

- Votes 1,574

If you're considering purchasing turnkey properties, this post is for you.

Turnkey is only a purchase method. Using Turnkey does not reduce the time or effort required for due diligence. Turnkey is simply an alternative purchase method to direct purchase.

Where Does Turnkey Fit in the Passive Income Process?

After:

- Location selection

- Tenant selection

- Property profile defined

Location Selection

The first step is to select an investment location. Investment location is your most important decision, not the property.

Select a location based on

- Metro area population size greater than 1M

- Both state and metro populations are increasing

- Low crime

- Low operating cost

- Rents consistently kept pace with inflation

Tenant Segment Selection

Before selecting a property, you need to decide which tenant segment you want to occupy it.

A rental property is only as good as the tenant who occupies it. You need your property to be continuously occupied by a "good" tenant. A good tenant is someone who stays for many years, always pays rent on time, and takes care of the property.

Good tenants are the exception, not the norm.

Target a tenant segment with a high concentration of good renters to increase the likelihood of consistently getting good tenants. Locate this segment through property manager interviews.

Once you have identified this segment, determine what and where they are currently renting. Based on these properties, create a property profile, like the one below.

- Rent range: $1,500 - $1,900

- Type: Single-family

- Configuration: 3+ bedrooms, 2+ baths, 2+ car garage

- Stories: One or two.

- Location: North of the river, east of Vine Rd.

- Size: 1,200 to 2,100 SF

To translate the rate range into a property price range, find conforming properties on a real estate website and their sale price.

With a property profile, you know exactly what to buy.

Determine the Best Purchase Method

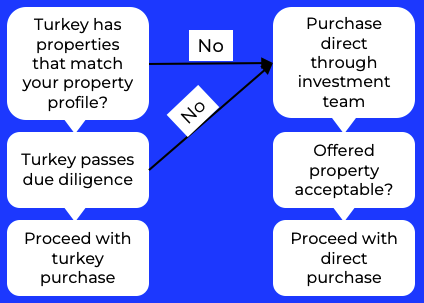

The next step is to determine the purchase method. The chart below outlines the process for selecting between turkey or direct purchase.

Turnkey Due Diligence

Below are some essential due diligence questions to consider when purchasing a turnkey property. These questions are necessary because some turnkey purchase contracts limit your options, and it's important to verify critical information.

- You must be allowed to have an independent property inspection.

- If you are not satisfied with the turnkey’s property management, you must be allowed to move your property to another property manager.

- You must be allowed to get multiple bids on expensive repairs. You choose the vendor.

- No percentage markup on repairs.

- Determine the fair market rent for the property. Does it match what the turnkey is stating?

- They must provide all disclosures from the prior owner of the property.

- They must provide the results of any code inspections.

If the turnkey does not provide/allow for all of the above, either find a different turnkey vendor that does or make a direct purchase instead.

Turnkey Purchase Convenience Cost

Turnkey properties are almost always more expensive than direct purchases. See the diagram below why a turnkey purchase will always cost more.

If you choose to purchase a turnkey property, you will pay more and receive a lower return on investment. However, you will save time compared to a direct purchase.

Summary

- Turnkey is only a purchase method.

- Due diligence remains the same.

- Turnkey properties cost more than direct purchases.

- The higher turnkey price reduces your returns.

Post: How do I know where to invest?

Post: How do I know where to invest?

- Realtor

- Las Vegas, NV

- Posts 823

- Votes 1,574

Hello @Agatha Michalak,

“Live where you like but invest where you can make money.”

Your financial goal determines what and where you want to buy. For most people, the goal is financial independence. To achieve and maintain financial independence, you need a passive income that keeps pace with inflation and lasts a long time.

To accomplish this, it's necessary to choose the appropriate location and property.

- The location determines all long-term income characteristics, including whether rents will keep up with inflation and how long the income will continue.

- Each property defines a specific tenant segment, and the segment determines income reliability.

In this post, I will discuss location and property selection.

Location Selection

Your financial future is tied to the economic future of the metropolitan area where your investment is located. Fortunately, there are straightforward metrics to help with location selection. Below are three.

- Metro area population size greater than 1M. Small towns may rely too much on a single business or market segment. Wikipedia

- Both state and metro populations are increasing. Do not buy anywhere if the state or metro populations are static or decreasing. Wikipedia

- Low crime - High crime and long-term appreciation and rent growth are mutually exclusive. Do not invest in any city on Neighborhood Scouts’ list of the 100 most dangerous US cities.

If you would like a complete list of location selection requirements, let me know.

Property Selection

The reliability of your income depends upon having a reliable tenant continuously occupy your property. A reliable tenant is someone who stays many years, pays all the rent on schedule, and takes care of the property. Search tenants are the exception, not the norm.

Select a tenant segment with a high concentration of reliable tenants to increase the likelihood of always having a reliable tenant in your property. You can find this segment by interviewing multiple property managers.

Once you determine the segment you want to target, identify their housing requirements. Understanding the specific housing needs of each segment is critical, as tenants will only rent properties that meet all of their requirements.

Below is an example of a segment's housing requirements.

- Property type: Single Family

- Location: North of the river and east of 14th St within 10 miles of the city center.

- Rent range: $1,600 to $2,000

- Configuration: 3 or 4 bedrooms, 2+ car garage, one or two-story, 1,200 to 2,000 SF, 3,000+ SF Lot

You need a property description that you can hand to any realtor so they can find conforming properties. To accomplish this, you must translate the rental range into a property price range. Search for rental properties that meet your target segment's requirements on any real estate website. Once you locate conforming properties, search for similar properties that are for sale or have recently sold. This will provide you with a price range for conforming properties.

Summary

Your financial future is tied to the economic future of the metropolitan area where your investment property is located. The reliability of your income depends upon having a reliable tenant occupy your property. To choose properties that provide inflation compensation and a long-lasting income stream, follow the approach outlined above.