All Forum Posts by: Eric Fernwood

Eric Fernwood has started 64 posts and replied 793 times.

Post: $100k to start investing into real estate, in California. Stay, or go out of state?

Post: $100k to start investing into real estate, in California. Stay, or go out of state?

- Realtor

- Las Vegas, NV

- Posts 824

- Votes 1,575

Hello @Harry Dhaliwal and @Kimberly C.

It's a good thing you're focusing on the location. The location is the most important investment decision you will make, not the property. The location determines all long-term income characteristics, including whether rents will keep pace with inflation and how long the income will last.

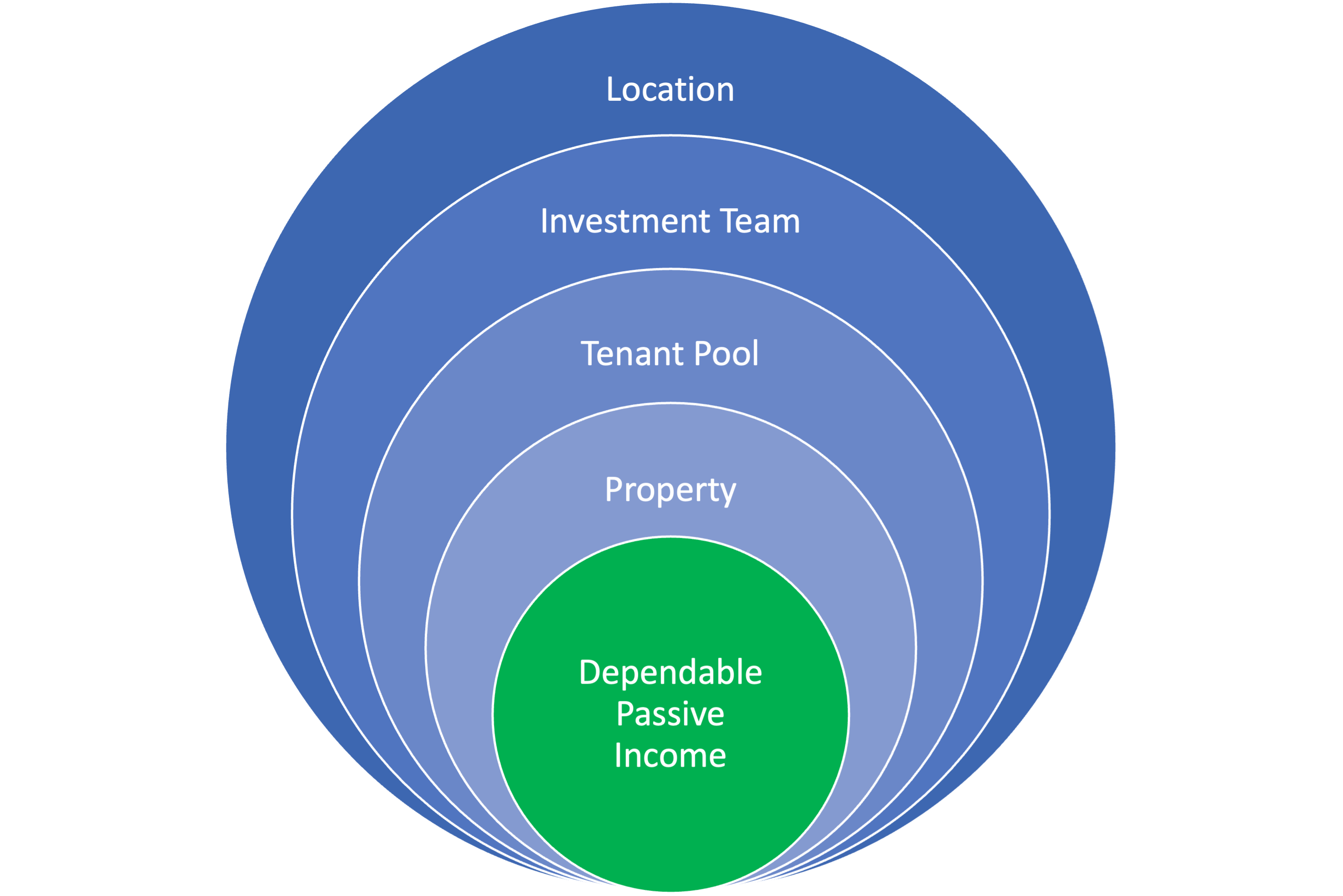

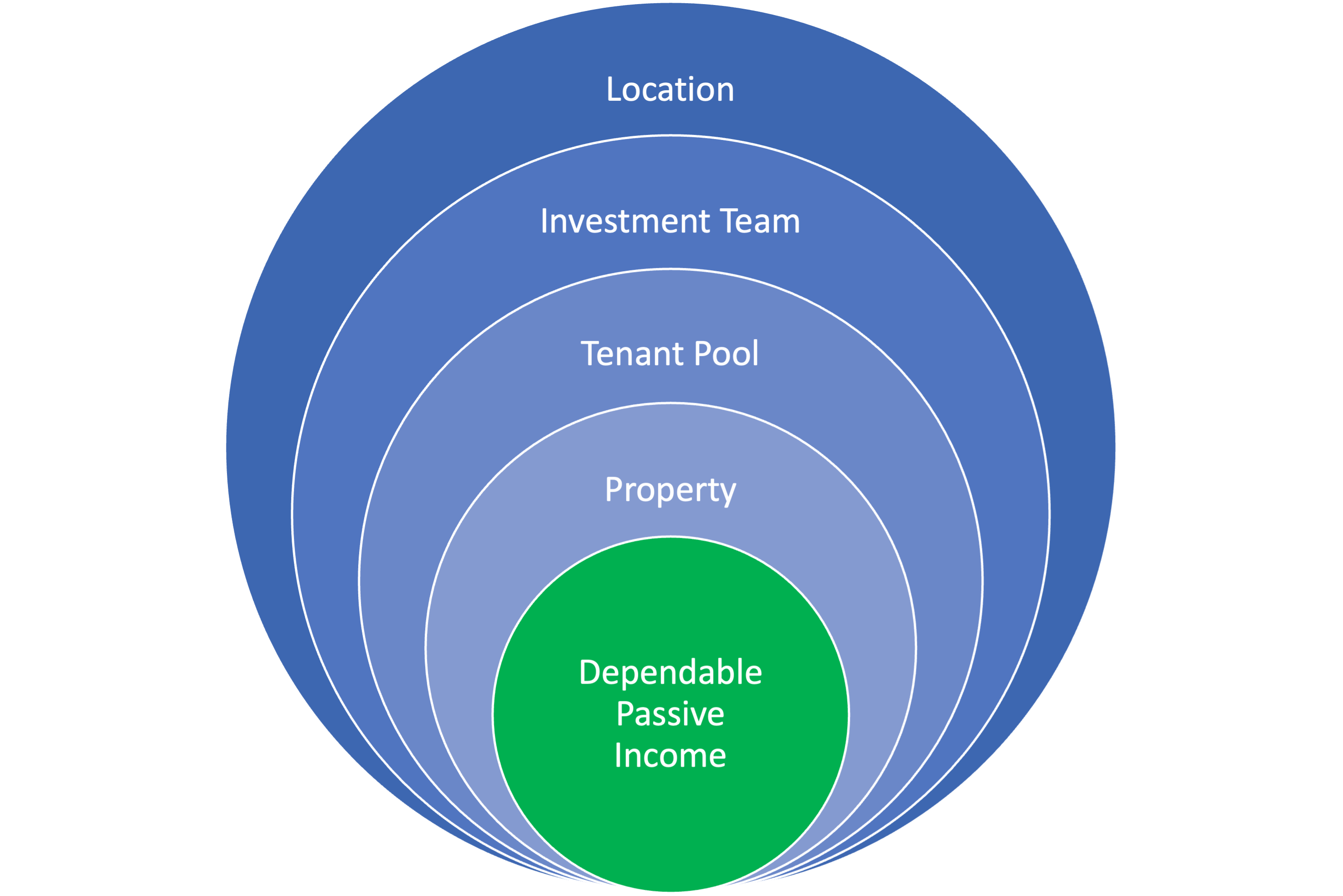

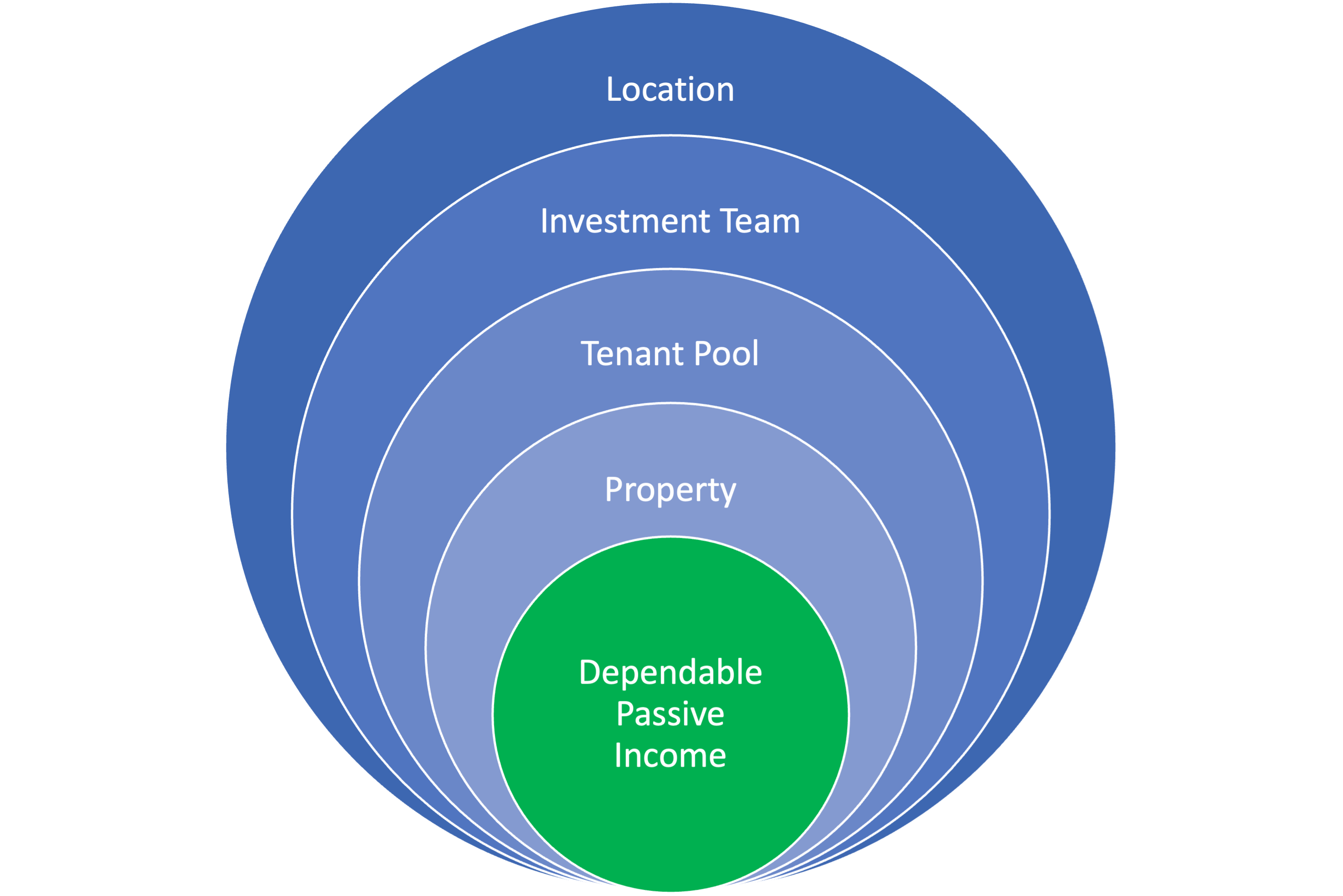

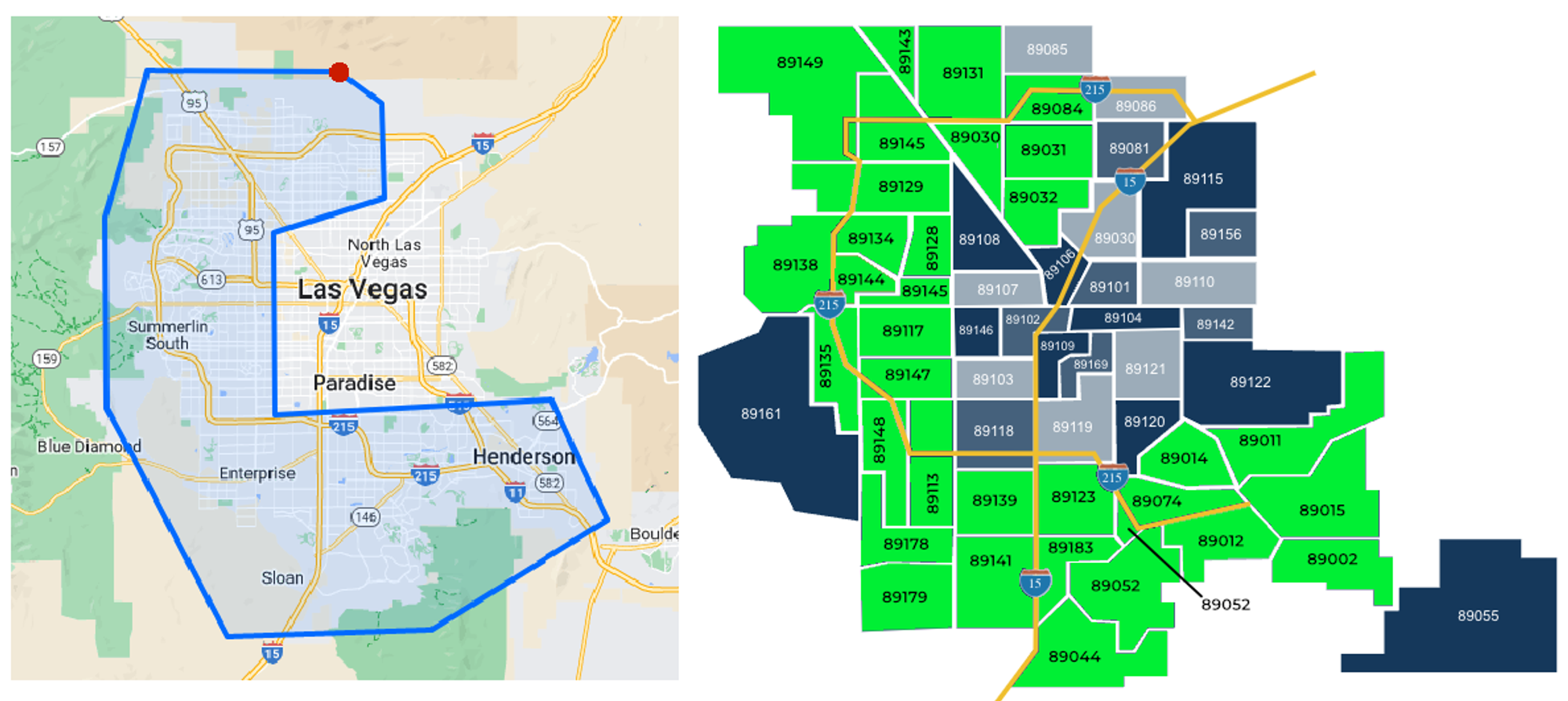

There is a straightforward process, comparable to peeling an onion, as illustrated below. At each step, there are clear decision metrics, so you can be sure you are making the right decision.

The location selection step involves eliminating cities unlikely to provide dependable passive income using a series of elimination filters. Each filter eliminates cities that do not meet a specific requirement. By the end of the process, you will have a few cities worth further consideration.

- Metro area population size greater than 1M. Small towns may rely too much on a single business or market segment. Wikipedia

- Both state and metro populations are increasing. Do not buy in any location if the state or metro populations are static or decreasing. Wikipedia

- Low crime - High crime and long-term appreciation and rent growth are mutually exclusive. Do not invest in any city on Neighborhood Scouts’ list of the 100 most dangerous US cities.

- Low operating cost - High operating costs can turn what appears to be a profitable property into a money pit. The three most apparent are income taxes, property taxes, and insurance. Insurance - ValuePenguin, Metro Property Taxes - LendingTree

- Low disaster risk - When a tornado or other natural disaster strikes a city, it doesn't just obliterate individual properties. It obliterates the entire community. Your tenants won't wait for your property and the community to be rebuilt. They will move immediately to a location where they can work and live today. So, even if your insurance company rebuilds your property, there may be no one to rent it to. Locations hit by natural disasters may take many years or never recover. However, your mortgage, taxes, insurance, maintenance, and other expenses will continue without interruption. The cost of homeowners insurance is the best indicator of the likelihood of a natural disaster in an area. Choose a location with low-cost homeowners insurance because they have the lowest risk of natural disasters. Insurance - ValuePenguin

- Rent control - Some states and metro areas have implemented various kinds of rent control. Rent control may prevent you from increasing the rent fast enough to keep pace with inflation. It may limit your property manager's ability to select the best tenant. It may make evictions of non-performing tenants difficult or impossible. Never invest in any location with rent control.

- Inflation compensating - Every time you go to the store, the same basket of goods costs more and more dollars. In order to have the additional dollars needed to pay inflated prices, rents must rise faster than inflation. Therefore, a critical location selection metric is that rents and prices are rising faster than inflation. Rents tend to lag behind prices, so you can use the appreciation rate if you do not have historical rental data. Zillow Research

At this point, you will have a small number of potential cities. The next step is to find a local investment team. Why is working with a local investment team critical?

Everything you learn from seminars, podcasts, books, and websites is general information. You will purchase a specific property in a specific location that is subject to specific local rental regulations. The only source of the hyperlocal information you need is a local investment team with years of experience working with investors. Also, working with a local investment team costs no more than working with any other realtor so there is no disadvantage and every advantage to working with a local investment team.

There is also a straightforward process for selecting dependable passive income properties. DM me or post, if you want more information on this process.

Hope this helps.

Post: Long-distance or close to home investing?

Post: Long-distance or close to home investing?

- Realtor

- Las Vegas, NV

- Posts 824

- Votes 1,575

Hello @Pj Arora,

I recommend selecting an investment location based on your financial goals. If your goal is to have a dependable passive income that you will not outlive, then the location is the most important investment decision, not the property.

Wherever you decide to invest, it is critical that you work with a good local investment team. The reason is the local knowledge. Everything you learn from podcasts, books, webinars, and websites is general in nature. When you buy a property, you are not buying a general property, but a specific property in a particular location that targets a specific tenant pool segment and is subject to specific local rules and regulations. The only source of the local information you need is a local investment team. Also, no matter how hard you try, you cannot replace the years of investing experience of a team of people. Furthermore, there is no additional cost to working with an investment team compared to any other realtor. Therefore, there is no reason to not work with an experienced investment team.

Does remote investing work? Yes. We've delivered over 490 investment properties and greater than 90% of our clients live in other states or countries; only about ten clients were local.

Back to selecting a good investment location.

We developed a straightforward process for selecting an investment location that is highly likely to provide a passive income where:

- Rents keep pace with inflation, ensuring that you have the sustained buying power needed to maintain your standard of living.

- The rental income will continue for a long time.

Below is an illustration of our overall methodology. It's like peeling an onion: at each decision point, there are clear metrics so you know you're making the right choice.

For the remainder of this post, I will focus solely on how to select a good investment location for dependable passive income. If you are interested in learning how to select high-performing properties, please let me know.

There are too many potential locations to investigate individually. Instead, we use a process of eliminating locations that do not meet specific investing requirements. This results in a small set of cities that require further investigation.

The process starts with metropolitan areas with a population greater than one million.

- Metro area population size greater than 1M. Small towns may rely too much on a single business or market segment. Wikipedia

- Both state and metro populations are increasing. Do not buy anywhere if the state or metro populations are static or decreasing. Wikipedia

- Low crime - High crime and long-term appreciation and rent growth are mutually exclusive. Do not invest in any city on Neighborhood Scouts’ list of the 100 most dangerous US cities.

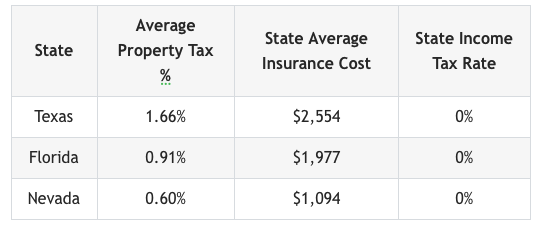

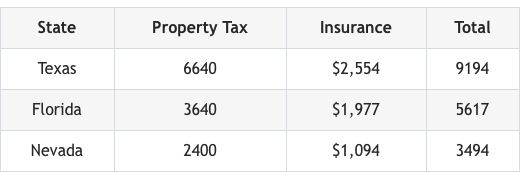

- Low operating cost - High operating costs can turn what appears to be a profitable property into a money pit. The three most apparent are income taxes, property taxes, and insurance. Do not assume that all states with no income tax are equal. Below is a comparison of average state property tax and insurance costs for Texas, Florida, and Nevada.

To show the impact of taxes and insurance, I compared the average state costs for a $400,000 property in the three states. (Remember that these are state averages, and individual cities may impose additional taxes.)

To achieve the same income as a property in Nevada, you need to generate a higher cash flow in Texas and Florida. Source: Insurance - ValuePenguin, Metro Property Taxes - LendingTree

- Low disaster risk -When a tornado or other natural disaster strikes a city, it doesn't just destroy individual properties. The entire community, including jobs, shopping, and retail, can be wiped out. Your tenants won't wait for the community to be rebuilt. They will immediately move to a location where they can work and live today. Even if your insurance company rebuilds your property, there may be no one to rent it. Areas affected by natural disasters may take many years, or even never fully recover. However, your mortgage, taxes, insurance, maintenance, and other expenses will continue without interruption. The cost of homeowners insurance is a good indicator of the likelihood of a natural disaster in an area. Therefore, it's best to choose a location with low-cost homeowners insurance, as this indicates the lowest risk of natural disasters. Insurance - ValuePenguin

- Inflation compensating - Every time you go to the store, the same basket of goods costs more and more. Therefore, it's critical to select a location where rents and prices are keeping pace with inflation. Rents tend to follow prices, so you can use the appreciation rate if you don't have historical rental data. Zillow Research

- Rent control - Some states and metro areas have implemented various kinds of rent control. Rent control may prevent you from increasing the rent fast enough to keep pace with inflation. It may limit your property manager's ability to select the best tenant. It may make evictions of non-performing tenants difficult or impossible. Never invest in any location with rent control. The only source of this sort of information is your local investment team.

At this point, you will have a small number of potential cities.

Pj, When selecting a location, it's important to focus on your end goal. Additionally, working with a good local investment team will minimize your time, cost, and risk.

Post: Information on Markets

Post: Information on Markets

- Realtor

- Las Vegas, NV

- Posts 824

- Votes 1,575

Hello @Mathios Yonan,

It depends on what information you are looking for. If you are looking for general market information, there are many sources. If you are looking for information to select an investment location, I can help.

We developed a straightforward process for selecting investment properties for passive income. At each step, there are decision metrics that help you make the right choice. The process is comparable to peeling an onion, as illustrated below. It starts with the location.

The location, not the property, is the most important investment decision because it determines all the long-term income characteristics including:

- Whether rents will keep pace with inflation

- How long your income stream will last

- How reliable your income stream will be

The location selection process involves eliminating cities unlikely to provide the dependable passive income you need through a series of elimination filters. Each filter removes cities that do not meet a specific requirement. By the end of the process, you will have a few cities worth further consideration.

- Metro area population size greater than 1M. Small towns may rely too much on a single business or market segment. Wikipedia

- Both state and metro populations are increasing. Do not buy anywhere if the state or metro populations are static or decreasing. Wikipedia

- Low crime - High crime and long-term appreciation and rent growth are mutually exclusive. Do not invest in any city on Neighborhood Scouts’ list of the 100 most dangerous US cities.

- Inflation compensating - Every time you go to the store, the same basket of goods costs more and more dollars. In order to have the additional dollars needed to pay inflated prices, rents must rise faster than inflation. Therefore, a critical location selection metric is that rents and prices are rising faster than inflation. Rents tend to lag behind prices, so you can use the appreciation rate if you do not have historical rental data. Zillow Research

- Low operating cost - High operating costs can turn what appears to be a profitable property into a money pit. The three most apparent are income taxes, property taxes, and insurance. Insurance - ValuePenguin, Metro Property Taxes - LendingTree

- Low disaster risk - When a tornado or other natural disaster strikes a city, it doesn't just obliterate individual properties. The entire community, including jobs, shopping, and retail, is destroyed. Your tenants won't wait for your property to be rebuilt in a year or two; they'll move immediately to a location where they can work and live today. Even if your insurance company rebuilds your property, there may be no one to rent it. Everyone in the community will have resettled in other locations, and there's no reason for employers, retail establishments, or people to move back. Locations hit by natural disasters may take many years or never recover. However, your mortgage, taxes, insurance, maintenance, and other expenses will continue without interruption. The cost of homeowners insurance is the best indicator of the likelihood of a natural disaster in an area. Choose a location with low cost homeowners insurance because they have the lowest risk of natural disasters. Insurance - ValuePenguin

- Rent control - Some states and metro areas have implemented various kinds of rent control. Rent control may prevent you from increasing the rent fast enough to keep pace with inflation. It may limit your property manager's ability to select the best tenant. It may make evictions of non-performing tenants difficult or impossible. Never invest in any location with rent control.

At this point, you will have a small number of potential cities. The next step is to find a local investment team. Why is working with a local investment team critical?

Everything you learn from seminars, podcasts, books, and websites is general information. You will purchase a specific property in a specific location that is subject to specific local rental regulations. The only source of the hyperlocal information you need is a local investment team that has years of experience working with investors. Also, working with a local investment team costs no more than working with any other realtor so there is no disadvantage and every advantage to working with a local investment team.

Mathios, I hope this helps. If you have other questions, please DM me or posts and I will respond.

Post: Best Properties for House Hack

Post: Best Properties for House Hack

- Realtor

- Las Vegas, NV

- Posts 824

- Votes 1,575

House hacking is a proven method for generating income. We've worked with multiple clients to select and renovate properties in a way that if house hacking doesn't work out or your life changes, you can turn it into a long-term rental.

Our property selection process is based on the tenant segment we want to occupy the property. A rental property is no better than the tenant who occupies it.

Over 15 years ago, we selected a narrow tenant pool segment that had a high concentration of what I call "good tenants". A "good tenant" is someone who stays for many years, always pays rent on time (even during bad economic times), and takes care of the property. It's important to note that such tenants are the exception, rather than the norm.

Once we identified this segment, we then determined where and what they were renting. Based on this, we develop a property profile, which is a physical description of the properties that this segment is willing and able to rent. We then select conforming properties. So far, we've delivered over 490 rental properties using this process. Our results have been excellent.

There are some differences between the properties we would normally target and those that would also be good for house hacking. I listed some of the considerations for a house hack property below.

- For house hacking, we recommend a four-bedroom, three-bath house with a three-car garage. Larger properties, like five-bedroom houses, have a strong seasonal component and a narrow tenant segment so they are not the best long-term rentals.

- The community in which the property is located must be considered. For example, many homeowner associations do not allow house hacking.

- The number of bathrooms is an important consideration. When selecting a property, make sure that the number of bathrooms is no less than the number of bedrooms minus one. For example, if you have a four-bedroom house, choose a property with at least three bathrooms.

- Parking is an important factor to consider when buying a property. I recommend a property with a three-car garage because it offers more parking space. I would avoid buying a property on a cul-de-sac due to limited street parking.

- It is essential to have a property with an open floor plan. People tend to congregate in one area, so you need to have a large flat screen and ample seating.

- A house with a pool might seem desirable, but it comes with additional insurance and maintenance costs. Some of our clients install a hot tub with attractive lighting and such.

- Do not use a rental agreement from a stationary store. Get a rental agreement from a local property manager and then modify it for house hacking. Also include clear guidelines on quiet hours, cleaning up the kitchen, shared responsibilities, guests, etc.

There are differences in renovation for house hacking. Below are examples.

- We often install commercial-grade nylon carpets in the bedrooms of our rental properties. However, with house hacking, there may be more frequent changes than with long-term rentals. Therefore, I recommend using LVP flooring instead.

- I recommend using Quickset Smart Key locks on the bedroom doors. These locks can be easily rekeyed by yourself. If you use regular locks in Las Vegas, rekeying costs $85 for the first lock and $55 for each additional lock.

- You may want to install garage door openers that support the myQ protocol and have people open the garage door with their app. This saves you from handing out clickers and changing the codes. You can also do the same with the front door lock. This enables you to make quick changes without doing anything physical.

- I would recommend installing surveillance cameras both inside and outside the property. Inside, cover the kitchen and family areas. This is important for insurance purposes and for identifying the source of any problems that arise.

I strongly recommend you work with an investment team that has extensive investment experience and all the resources you need, including renovation.

Post: Long Distance Investing from SoCal

Post: Long Distance Investing from SoCal

- Realtor

- Las Vegas, NV

- Posts 824

- Votes 1,575

Hello @Jonathan Hinojosa,

California is an anti-landlord state with high operating costs. This makes it very difficult to acquire dependable passive income properties that enable you to get off and stay off the daily worker treadmill.

There is a straightforward process for acquiring dependable passive income properties that does not rely on opinions, luck, or “secrets.” There are clear metrics at every decision point to ensure that you are making the right choice. The process is comparable to peeling an onion, as illustrated below.

The critical investment decision is the location, not the property. The process involves eliminating cities unlikely to provide the dependable passive income you need. Each elimination filter removes cities that do not meet specific requirements. By the end of the process, you will have a few cities worth further consideration.

- Metro area population size greater than 1M. Small towns may rely too much on a single business or market segment. Wikipedia

- Both state and metro populations are increasing. Do not buy anywhere if the state or metro populations are static or decreasing. Wikipedia

- Low crime - High crime and long-term appreciation and rent growth are mutually exclusive. Do not invest in any city on Neighborhood Scouts’ list of the 100 most dangerous US cities.

- Inflation compensating - Every time you go to the store, the same basket of goods costs more and more dollars. In order to have the additional dollars needed to pay inflated prices, rents must rise faster than inflation. Therefore, a critical location selection metric is that rents and prices are rising faster than inflation. Rents tend to lag behind prices, so you can use the appreciation rate if you do not have historical rental data. Zillow Research

- Low operating cost - High operating costs can turn what appears to be a profitable property into a money pit. The three most apparent are income taxes, property taxes, and insurance. Insurance - ValuePenguin, Metro Property Taxes - LendingTree

- Low disaster risk - When a tornado or other natural disaster strikes a city, it doesn't just obliterate individual properties. The entire community, including jobs, shopping, and retail, is destroyed. Your tenants won't wait for your property to be rebuilt in a year or two; they'll move immediately to a location where they can work and live today. Even if your insurance company rebuilds your property, there may be no one to rent it. Everyone in the community will have resettled in other locations, and there's no reason for employers, retail establishments, or people to move back. Locations hit by natural disasters may take many years or never recover. However, your mortgage, taxes, insurance, maintenance, and other expenses will continue without interruption. The cost of homeowners insurance is the best indicator of the likelihood of a natural disaster in an area. Choose a location with low-cost homeowners insurance because they have the lowest risk of natural disasters. Insurance - ValuePenguin

- Rent control - Some states and metro areas have implemented various kinds of rent control. Rent control may prevent you from increasing the rent fast enough to keep pace with inflation. It may limit your property manager's ability to select the best tenant. It may make evictions of non-performing tenants difficult or impossible. Never invest in any location with rent control.

At this point, you will have a small number of potential cities. The next step is to find a local investment team. Why is working with a local investment team critical?

Everything you learn from seminars, podcasts, books, and websites is general information. You will purchase a specific property in a specific location that is subject to specific local rental regulations. The only source of the hyperlocal information you need is a local investment team that has years of experience working with investors. Also, working with a local investment team costs no more than working with any other realtor so there is no disadvantage and every advantage to working with a local investment team.

The leader of any investment team is an investment realtor. In a large metropolitan area, there may be thousands of residential (or "investor-friendly") realtors but only one or maybe two investment realtors. There is a straightforward process for finding an investment realtor. If you or anyone is curious about how to do this, DM me.

Post: April Las Vegas Rental Market Update

Post: April Las Vegas Rental Market Update

- Realtor

- Las Vegas, NV

- Posts 824

- Votes 1,575

It’s April, and time for another Las Vegas update. For a more in-depth view of the Las Vegas investment market, DM me for our 2023 Las Vegas Investor Outlook.

Before I continue, note that the charts only include properties that match the following profile, unless otherwise noted.

- Type: Single-family

- Configuration: 1,000 SF to 3,000 SF, 2+ bedrooms, 2+ baths, 2+ garage, minimum lot size is 3,000 SF.

- Price range: $320,000 to $475,000

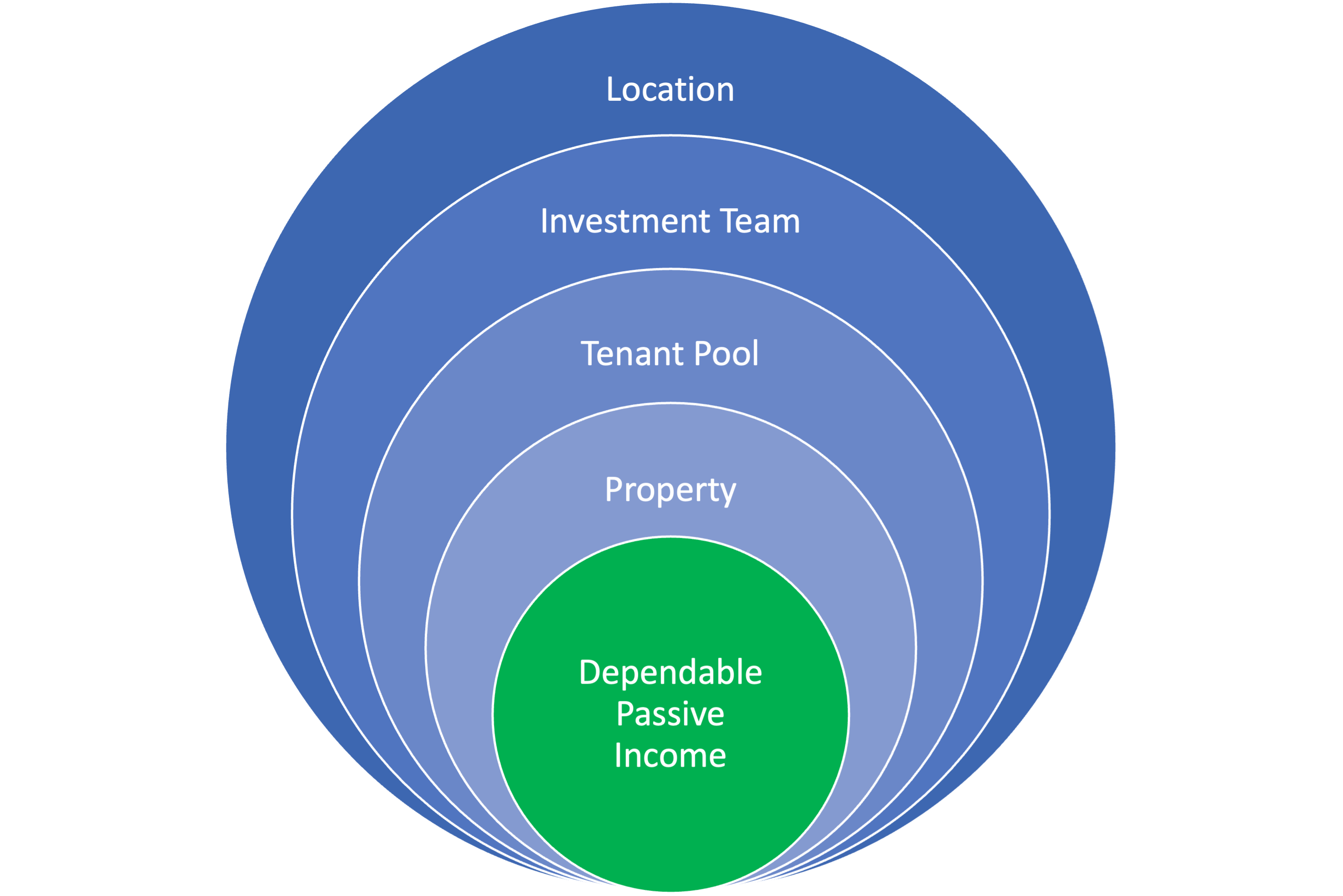

- Location: All zip codes marked in green above have one or more of our client’s investment properties.

What we are seeing:

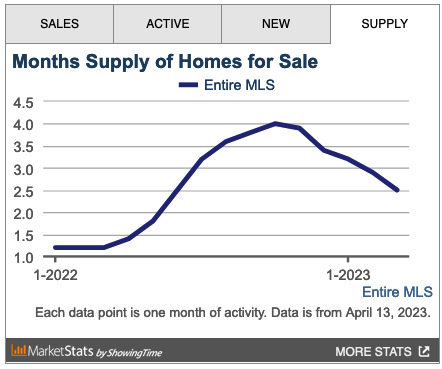

Overall inventory is falling in Las Vegas. The chart below is from the MLS and includes all property types and price ranges.

The Charts

The charts below are only for the property profile we target.

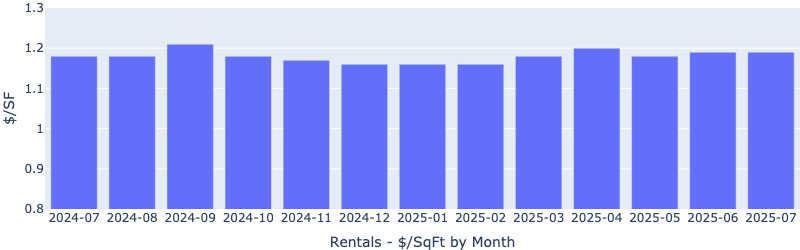

Rentals - Median $/SF by Month

As expected, the rents started increasing. This is due to increasing demand and decreasing supply, as shown in the charts below.

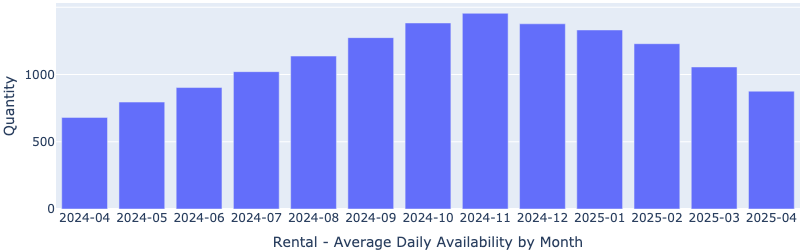

Rentals - Availability by Month

The number of homes for rent dropped rapidly in the last three months, showing decreasing supply.

Rentals - Median Time to Rent

Median time to rent dropped significantly since February, indicating increasing demand.

Rentals - Months of Supply

Just one month of supply for our target rental property profile. Demand is greater than supply. This will push up the rent.

We saw a similar drastic drop in sales supply as well.

Sales - Months of Supply

What is driving long term demand for rental properties in Las Vegas?

Las Vegas Fundamentals

Unlike financial markets, real estate prices and rents are driven by supply and demand. What is the supply and demand situation in Las Vegas?

Supply

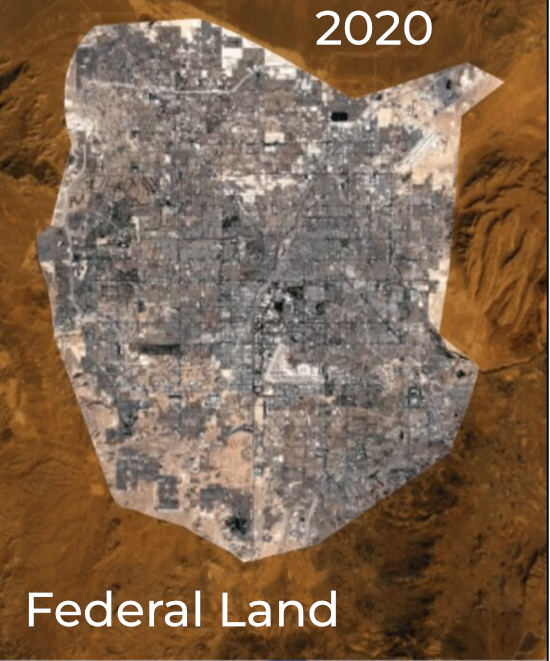

Las Vegas is unique in that it is a tiny island of privately owned land in an ocean of federal land. See the 2020 aerial view below.

There is very little undeveloped private land remaining, and any available land in desirable areas costs more than $1 million per acre. Due to the high cost of land, new homes in our targeted locations start at $550,000. The homes that appeal to our target tenant segment are priced between $320,000 and $475,000. Therefore, no matter how many new homes are built, the housing stock we target remains almost constant. This is different from metropolitan areas with unlimited expansion potential, where the construction of new homes limits the growth of rent and home prices of existing properties.

Demand

The driver for housing demand is population growth. The average Las Vegas annual population growth is between 2% and 3%. What attracts most people to Las Vegas (and other metros) is jobs.

In a study I did in January, I looked at two major job sites (Monster and Glass Door) for the number of open jobs in Las Vegas. According to these sites, there are between 26,000 and 31,000 open jobs in Las Vegas.

The number of available jobs will increase in the future. Depending on which study you read, there is between $18B and $26B of new construction under development. As these come online, they will create even more jobs attracting more people to Las Vegas.

Of the people who will move to Las Vegas, a significant portion matches the tenant segment we've targeted since 2005. So, the demand for conforming properties priced between $320,000 and $475,000 will increase over time.

Summary

Due to the unique combination of a fixed supply and increasing demand, I believe Las Vegas fundamentals will continue to drive up prices and rents for the foreseeable future.

Let me know if you want more sales or rental data, and I will post additional charts.

Post: Finding Rockstar Real Estate Agents

Post: Finding Rockstar Real Estate Agents

- Realtor

- Las Vegas, NV

- Posts 824

- Votes 1,575

Hello @Rogelio M.,

Thank you for the kind words.

On the interview questions - I would add a few questions. Below are the ones that come to mind. Note that I added some recommendations and such later in this post.

- Have you worked with house hackers before? [If the person you're speaking to gives you a deer-in-the-headlights look or asks what house hacking is, you have your answer.]

- If I want to house hack, would the properties be different than for a long-term rental? [For example, a larger property with more bedrooms and bathrooms, an open floor plan, and not located on a cul-de-sac due to limited parking.]

- How would the renovation differ for a house hack? [What you're looking for is an acknowledgment that there will be changes from a standard long-term rental renovation.]

- Will house hacking limit my location choices? [For example, some homeowners associations may not permit you to house hack.]

These are the additional questions that come to mind. Now for my comments.

We have worked with several house hackers, and I recommend buying a property that would make an excellent long-term rental and then using it for house hacking. This way, if house hacking doesn't work out or your life changes, you can turn it into a rental property.

There are some additional considerations on top of the requirements for a rental property. I listed some below.

- We generally recommend a four-bedroom, three-bath house with a three-car garage. If you later decide to switch to a long-term rental, larger properties like five-bedroom houses have a strong seasonal component. Large houses attract large families who typically do not move during the holidays. Therefore, we recommend sticking with a four-bedroom, three-bath house.

- Many homeowner associations do not allow house hacking.

- The number of bathrooms is an important factor to consider when choosing a property. It is not recommended to choose properties where the number of bathrooms is less than the number of bedrooms minus one. For instance, if you have a four-bedroom house, we recommend selecting a property with at least three bathrooms.

- Parking is an important consideration. I recommend a property with a three-car garage because it provides more parking space. I would not buy a property on a cul-de-sac because of limited street parking.

- It is essential to have a property with an open floor plan. People tend to congregate in one area, so you need to have a large flat screen and ample seating.

- A house with a pool might seem desirable, but it comes with additional insurance and maintenance costs, as well as effort. Our clients will install a hot tub with attractive lighting and so forth.

Another consideration is the leasing contract. Do not use something from a stationary store. You need to get a rental agreement from a local property manager and then modify it for house hacking. Also include clear guidelines on quiet hours, cleaning up the kitchen, shared responsibilities, guests, etc.

The major change for house hacking is in the renovation. Below are examples.

- We often install commercial-grade nylon carpets in the bedrooms of our rental properties. However, with house hacking, there may be more frequent changes than with long-term rentals. Therefore, I recommend using LVP flooring instead.

- I recommend using Quickset Smart Key locks on the bedroom doors. These locks can be easily rekeyed by yourself. If you use regular locks in Las Vegas, rekeying costs $85 for the first lock and $55 for each additional lock.

- You may want to install garage door openers that support the myQ protocol and have people open the garage door with their app. This saves you from handing out clickers and changing the codes. You can also do the same with the front door lock. This enables you to make quick changes without doing anything physical.

- I would recommend installing surveillance cameras both inside and outside the property. Inside, cover the kitchen and family areas. This is important for insurance purposes and for identifying the source of any problems that arise.

There are more differences, but they won't change much when it comes to acquiring a good long-term rental. Just be aware that there are some additional considerations.

Hope this helps.

Post: Buyers need to understand the mistake in "waiting for rates to drop"

Post: Buyers need to understand the mistake in "waiting for rates to drop"

- Realtor

- Las Vegas, NV

- Posts 824

- Votes 1,575

Great comments on this thread. Below are my two cents.

Unlike the stock market, which is more influenced by market sentiment in the short term, real estate is driven by local supply and demand. Additionally, the real estate market is not homogeneous. For instance, the demographic that purchases $400,000 properties is not the same as the demographic that purchases million-dollar properties. There could be a surplus of million-dollar homes while there is a shortage of $400,000 homes. Therefore, it is necessary to examine more granular information than just metro averages. My point is that national averages and even metro averages may not apply to any specific segment of the market.

Seasonality is a consideration in any market. Below is a diagram showing seasonality effects based on property characteristics.

Interest rates and inflation - I believe interest rates will decrease before the 2024 election. The number one concern of politicians is getting elected or reelected. It will not be to their advantage to have high inflation or interest rates.

1031 exchange - We have completed over seventy 1031 exchanges so far. Considering the potential limitations on 1031 exchanges that the Biden administration may implement to increase tax collections, the advantage of 1031 exchanges may end for many people. (source: https://www.cnbc.com/2022/04/26/what-bidens-proposed-1031-exchange-limits-mean-for-investors-economy.html) Therefore, despite the high-interest rates, anyone considering a 1031 exchange would likely want to complete it before 2024.

@Carlos Ptriawan - I am curious why you feel the Midwest is the least sensitive to interest rates. Can you elaborate please.

@Stephen Rinaldi - I totally agree with you that if interest rates even appear that they're going to decrease, demand will drive up prices. In our January newsletter, I wrote an article about the high cost of waiting to buy. The only reason it would make sense to delay a purchase is if you believe either property prices or interest rates will decline enough that the acquisition cost in monthly debt service will be lower. I see no chance that either will occur.

The Fed continues to increase interest rates until they see a significant decline in inflation. They have already achieved what they wanted, but they're looking backward as opposed to looking forward, so they can't see this. Consequently, interest rates will continue to increase.

We are already seeing prices increase for the segment we target in Las Vegas. According to my estimate, if property prices increase by as little as 5%, it will cost you more, even if interest rates decrease to 5.75%.

Consequently, there is no scenario that I see where it will not cost you more in the future than it does today. However, that assumes you are in a high-appreciation market like Las Vegas. Many cities in the US have had no or limited appreciation for years. This could be a different story, and I have not evaluated this scenario.

Post: Finding Rockstar Real Estate Agents

Post: Finding Rockstar Real Estate Agents

- Realtor

- Las Vegas, NV

- Posts 824

- Votes 1,575

Hello James,

Based on my experience, less than 1% of all realtors are able to select and analyze an investment property. Before starting my business over 15 years ago, which provides investor services, I purchased around 20 properties. All the realtors could provide me were MLS data sheets for the properties I selected. I had to do everything else on my own, which required a significant amount of time and wasted money.

What you need is an investment realtor. In this post, I will discuss the differences between investment realtors and residential realtors, and provide a process for finding an investment realtor.

Residential or "Investor Friendly" Realtors

Residential realtors facilitate the buying and selling of homes. Homebuyers select properties, and the residential realtor provides access. The process is simple. Once the buyer selects a property, the residential realtor facilitates the offer and closing process. Some residential realtors may also sell real estate that will become rental properties. However, they typically only provide MLS data sheets and offer limited value beyond that.

Investment Realtor

Where residential realtors sell homes, investment realtors sell income streams. Investment realtors also provide the information you need to evaluate an investment property. Below is a comparison of the information a residential realtor can provide vs. what an investment realtor provides.

Investment realtors are always part of a team. Only a team of experts can provide the end-to-end processes, skills, and knowledge necessary to bring a property to market. See below for a diagram of the process we follow.

House hacking adds an additional level of complexity. You need to buy a property that will make an excellent long-term rental and a good house-hacking property. This gives you a fallback position if house hacking is not the best option for you at the time. Also, renovation items are different for a property for house hacking versus a long-term rental.

How do you find an investment realtor?

There are thousands of residential realtors in a metro area, but only one or two investment realtors. How do you find one?

Candidates

Start by compiling a list of candidates. Get names from

- Real estate investing websites (such as Biggerpockets.com)

- Property managers

- Local investors

- Talk to real estate brokers

- Google searches

- Local meetups

Once you have a pool of candidates, evaluate each using the following interview questions. The primary purpose of the questions is to determine the individual's character and capabilities.

Interview Questions

Before you start interviewing candidates, create a list of 10 or fewer questions. You won't have time for more, so it's important to choose carefully. Ask the same questions of each candidate and take note of their responses.

Below are some sample questions, along with acceptable responses. Keep in mind that you might not find a candidate with the "perfect" answer to every question, but they should at least provide reasonable responses.

- Tell me about your investment team. - You're looking for a response like, “I've worked with X property manager for years. We've completed X properties. "I work with several renovation companies..."

- Do you or have you owned investment properties? - If they have not personally owned investment properties, I would reject the candidate.

- How many investment properties did you close in the last 12 months? - Some realtors only sell two or three properties per year, which is not enough repetition to develop the necessary processes, experience, and resources even if all the properties were investment properties. I believe that a minimum of 12 investment properties per year is necessary to become and remain proficient.

- Did you or your client select the properties? This is an important question. Residential and investment-friendly realtors do not pick properties. They send MLS data sheets for the properties the client selects. The client evaluates the properties and selects one or more to make an offer. If you do all the work, what value is the realtor providing other than access to properties? Reject the candidate if their client selected the property.

- What were your primary selection criteria? - It could be the initial return, appreciation, tenant pool, or something else. You're looking for a plausible answer based on analytics, not opinion or “feelings.”

- Tell me about the tenant pool you target. - Understanding the concept of tenant pools and their characteristics is not common knowledge. It requires someone with a lot of investment experience. If a candidate cannot provide a plausible answer or does not understand the question, move on to the next one.

- What is the average tenant's stay? - If the realtor is working with investors, they know how long the tenants of a specific tenant pool segment typically stay in the property. If the realtor has no good answer, move on to the next candidate.

- How did you estimate rent and time to rent? - They should be able to describe a process like, "I look at recently rented comparable rentals." Another good answer is that they work with a property manager who supplies this information. If they answer Zillow, Redfin, Rentometer, etc., they do not know how to evaluate investment properties. No real estate sites that I’ve seen provide usable estimates on rent or time to rent. This is critical information when you are looking for investment properties.

- Tell me about your renovation process. - You are looking for an answer similar to, “I work with the property manager to determine a list of renovation items. Next, I work with XXX company to get a quote. Once escrow closes, the renovation company does the work, and the property manager does final acceptance.”

- What else should I have asked you? - This is an absolute golden question. I've learned a lot by asking this question at the end of interviews. For example, I was checking out a neighborhood in an area of Las Vegas I did not know. Nothing looked unusual or concerning. I came across an older woman sitting on her front porch. I talked to her about the neighborhood for a while. As I was about to leave, I asked her, "Is there anything else I should have asked you?” Her response blew me away. She told me that when two drug dealers were on the street, they would occasionally shoot at each other. One was sent to prison about a year ago, and the remaining drug dealer keeps things quiet. I saw nothing to indicate the presence of drug dealing and would not have known if I did not ask the "What else?" question.

If the candidate answered all questions satisfactorily, you can be reasonably assured that they know what they are doing. The next step is meeting their team members.

James, I hope this helps.

Post: How to even start with Investment Properties....Prefer Out of State

Post: How to even start with Investment Properties....Prefer Out of State

- Realtor

- Las Vegas, NV

- Posts 824

- Votes 1,575

Hello Casey,

We’ve provided investor services in Las Vegas for the last 15+ years. We've delivered over 480 investment properties with over 90% repeat business rates. So, we have the experience you're looking for.

You asked multiple questions, and I divided them into the following sections.

- Should I get a pre-approval first?

- How to consistently acquire dependable passive income properties?

- What about LLCs?

Should I Get a Pre-Approval First?

Yes. You need to know how much you can afford while still keeping a pad for unexpected events in your life. Also, there is more than just the down payment. Below is information specific to Las Vegas.

- Down payment - The majority of our clients put down 25%. This provides the best combination of down payment and interest rates.

- Closing costs - For financed purchases in Las Vegas, typical closing costs are 1.5-2% of the purchase price. Closing costs are lower in Las Vegas because Nevada is a title state. Only 19 states are title states; the others are warranty deed states, and closing costs will be higher.

- Renovation cost - The typical renovation cost for properties we target ranges between $10,000 and $20,000. However, I recently spoke with a California property manager and discovered that their typical renovation cost is between $100,000 and $150,000.

Below is the estimated cost to close for a $400,000 property:

- Down payment: 25% x $400,000 = $100,000.

- Closing costs: 2% x $400,000 = $8,000.

- Renovation and carrying costs: $15,000.

Total cash necessary to acquire the property and bring it to market: $100,000 + $8,000 + $15,000 = $123,000.00

How to Consistently Acquire Winning Properties

There is no magic or secrets, and gurus are not required. Consistently buying dependable passive income properties is a straightforward process. At each decision point, there are clear metrics, so you know you are making the right decision. Below is an image showing the process.

Successful investing is like peeling an onion. You start with the location.

Location

When making an investment decision, the location is more important than the property itself. Choose a location based on factors including:

- Rents increased faster than inflation.

- State and city populations increasing.

- Metro population > 1M.

- Low crime.

- Low operating costs.

Tenant Segment

After selecting a location, choose a tenant segment with a high concentration of reliable tenants (by interviewing multiple local property managers). A reliable tenant is someone who stays for many years, pays rent on time, and takes good care of the property. However, good tenants are the exception rather than the norm.

Property Selection

You identified a segment with good tenants and want them to rent your property. The only way to do this is to buy properties similar to what they are currently renting and in the same location(s). If you buy a different type of property or in a different location, you will be excluding the segment you want.

By following the approach outlined above, you can consistently acquire dependable passive income properties through a step-by-step process that involves little subjectivity. As long as you adhere to the process, the likelihood of success is high.

I wrote a guide on the process. If you would like a free copy, DM me.

LLCs

One purpose of holding properties within a Limited Liability Company (LLC) is to limit the liability of the property owner or investor. By forming an LLC, the property owner creates a separate legal entity that can own property and conduct business in its own name. If a property owner holds properties in their own name and the property is subject to a lawsuit, the property owner may be personally liable for any damages or losses.

Our clients follow a two-step process.

- Buy the financed property in your own name. While it may be possible to obtain financing for the LLC to buy the property directly, it is likely to be much more expensive.

- After closing escrow, transfer the deed into the LLC.

Considerations

-

I have never heard of a lender that allows you to transfer the deed into an LLC or a trust. However, I have also never heard of a lender calling the note due because of a property transfer. As long as you continue making payments, I don't believe they will care.

-

Transfer tax - some states, such as Nevada, charge a property transfer tax if the ownership is changed. However, there are scenarios where the transfer tax can be exempted.

-

An LLC only provides protection if you treat it like a business. If you were to mingle funds in your personal checking account, someone might be able to break apart the LLC in court. To avoid this, set up a separate bank account for LLC and don't use it as your personal checking account.

-

Whether an LLC is necessary depends on the litigation environment where the property is located and what assets you need to protect. Another option is an umbrella policy. For example, suppose your landlord insurance covers you up to $1 million in liability. Then, you could have an umbrella policy that covers you from $1 million-$2 million. While this approach does not offer the same level of protection an LLC would, it covers all of your assets.

-

One method for reducing risk is to include your property manager as an additional insured on your landlord policy. This way, you ensure they remain on your side if someone decides to sue you.

-

The best way to avoid litigation is to reduce the odds of it occurring. Below are some examples.

- In Las Vegas, the landlord is not required to install a carbon monoxide detector. When we do renovations, we take them out. The concern is that if the tenant does something stupid and someone is harmed by carbon monoxide, they will sue you. By taking out the carbon monoxide detector and requiring in the lease that they install and maintain one, you avoid this potential risk.

- We remove alarm and monitoring systems. I can imagine a situation where a tenant is robbed, and they blame you because the alarm system failed to work.

- You need to be aware of the exterior as well. Century plants look like giant artichokes with spikes on the ends of their leaves. We remove such plants if they are within 3 feet of a walkway. I can see a situation where a child runs into the plant and is injured.

Casey, I hope the above helped.