All Forum Posts by: Eric Fernwood

Eric Fernwood has started 64 posts and replied 793 times.

Post: Help on hiring a property manager

Post: Help on hiring a property manager

- Realtor

- Las Vegas, NV

- Posts 824

- Votes 1,575

Hello @John Matarazzo,

A 20% markup is one of the highest I've heard. For me, charging a percentage of the repair cost is a fatal flaw. It's not just the cost of the markup; it's also an inherent conflict of interest. I believe property managers have a fiduciary responsibility to maximize their client's return. By adding a percentage of the repair cost, I believe they're violating that trust.

I don't have an issue with the property management company charging a flat fee ($25?) per maintenance call. There is a cost for them to contact the service provider and arrange access with the tenant. However, I don't believe that scheduling a garbage disposal replacement ($150) or a new water heater installation ($950) takes any more time or effort on the part of the property management company.

I never want to work with a property management company where my financial loss is their major profit center.

Post: Which market to invest in? Help!

Post: Which market to invest in? Help!

- Realtor

- Las Vegas, NV

- Posts 824

- Votes 1,575

Hello @Lewis Jensen,

Rather than list potential investment locations, I will show the process I used to select a good investment location. So we are on the same page, I believe the purpose of real estate investing is to become financially independent. So you no longer have to show up for a job to survive. If this matches your goals, read on.

To narrow down the focus to a small number of potential investment locations, I used a process of elimination. The steps are listed below. I started with metro areas with a population greater than 1 million and proceeded through each step below.

-

Metro area population size greater than 1M. Small towns may rely too much on a single business or market segment. Wikipedia

-

Both state and metro populations are increasing. Do not buy anywhere if the state or metro populations are static or decreasing. Wikipedia

-

Low crime - High crime and long-term appreciation and rent growth are mutually exclusive. Never invest in any city on Neighborhood Scout’s 100 most dangerous cities list.

-

Inflation compensating - Every time you go to the store, buying the same basket of goods costs more and more dollars. To have the additional dollars you need to pay for inflated prices, rents must rise faster than inflation. Therefore, a critical location selection metric is that rents and prices are rising faster than inflation. Rents track prices, so you can use the appreciation rate if you do not have historical rental data. Zillow Research

-

Rent control - Some states and metro areas have implemented various kinds of rent control. Rent control may prevent you from increasing the rent fast enough to keep pace with inflation. It may limit your property manager's ability to select the best tenant. It may make evictions of non-performing tenants difficult or impossible. Never invest in any location with rent control.

-

Low disaster risk - Natural disasters such as tornadoes, hurricanes, and earthquakes destroy communities. While insurance might rebuild your property, the bigger issue is the loss of jobs, local businesses, and essential amenities. Until the community is rebuilt, you will have an empty property, but mortgage payments, taxes, insurance, and other expenses will continue, with no income to offset these costs. The cost of homeowners insurance is the best indicator of the likelihood of a natural disaster in an area. Insurance - ValuePenguin

-

Low operating cost - High operating costs can turn what appears to be a profitable property into a money pit. The three most apparent are income taxes, property taxes, and insurance. Insurance - ValuePenguin, Metro Property Taxes - LendingTree

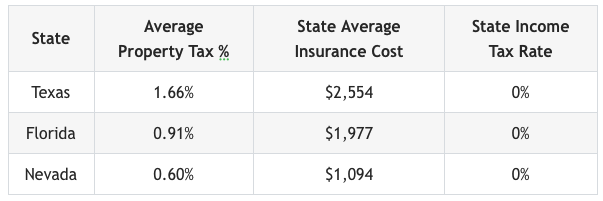

I will expand on operating costs and their impact on cash flow and return. Below are state average property taxes and insurance costs for Texas, Florida, and Nevada. See the table below.

To show the impact of taxes and insurance, I compared overhead costs on a $400,000 property in the three states. (Remember that these are state averages, and individual cities may impose additional taxes.)

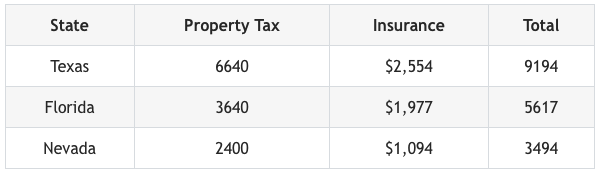

To achieve the same level of net income as a property in Nevada, you need to generate higher cash flow in Texas and Florida. This is due to their higher property taxes and insurance costs. Below is a table showing the incremental cash flow needed to generate the same net income.

Filtering locations by the above criteria will leave you with a small number of potential locations worth further investigation.

One crucial factor to consider is the presence of a local investment team.

All the information you gain from podcasts, seminars, books, and websites is general investing information. You won't be buying a general property in a general location. Instead, you'll be purchasing a specific property in a specific location and condition, subject to specific local regulations. The only source of the hyperlocal information you require is a local investment team.

Working with a local investment team costs no more than working with any other realtor, and it offers several advantages. A local team has already delivered many investment properties and has the processes, resources, and experience you need. Rather than trying to duplicate what it took a team of people years to learn, take advantage of their expertise.

Lewis, I hope this will help you select a good investment location.

Post: WHERE TO INVEST???

Post: WHERE TO INVEST???

- Realtor

- Las Vegas, NV

- Posts 824

- Votes 1,575

Hello @Derek Fike,

Some considerations:

- The investor loans I have seen require a down payment of 20% to 30%. As far as I know, there is no way to obtain an investor loan with a lower down payment.

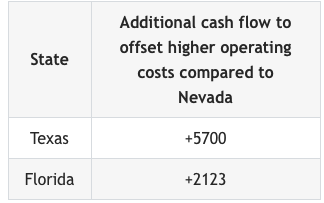

- The lower the down payment, the lower your cash flow and return. I put together the following to demonstrate this.

For what you want, the location is not the issue. The problem is high-interest rates and finding a lender who will permit less than 20% down.

Whether you invest locally or out of state, you need local experts. Everything you've learned through podcasts, books, seminars, and websites is general information. You will buy a specific property in a specific location subject to specific taxes and local regulations. You need hyperlocal information, not general information. This information is only available from a local investment team. You cannot duplicate years of experience and skills from a team of experts.

Does remote investing work? We’ve delivered over 470 investment properties, more than 90% of which are made by clients living in other states or other countries. We know our processes work because over 90% of our clients buy more than one property from us. And, our largest source of new clients is referrals from existing clients.

Also, only five or six of our clients had any prior real estate investing experience before working with us. Part of our onboarding process is to teach new clients how real estate investing works. Real estate investing is straightforward; we teach people how to invest in about two hours.

One of the primary considerations when you are selecting a location, is whether you can find a good investment team.

Post: How to get started investing in real estate.

Post: How to get started investing in real estate.

- Realtor

- Las Vegas, NV

- Posts 824

- Votes 1,575

Hello @Joshua Moses,

Having gone through the process myself, I recommend a three-step process outlined below.

Location - Choosing the right location is crucial. The location defines all long-term income characteristics for the life of the property. This includes appreciation and rent growth. Rent growth that keeps pace with inflation is critical, as rising rents offset the increased cost of living. In addition to the appreciation and rent growth rate, other factors to consider include minimum population size, state and metro population growth, operating costs, and rental regulations.

Target tenant segment - A property is no better than the tenant who occupies it. Choose a tenant pool segment with a high concentration of what I call good tenants. A good tenant stays for many years, pays all the rent on schedule, and takes care of the property.

Property selection - If you want people from your target tenant segment to occupy the property, buy properties similar to what and where they rent today.

The process is straightforward. At each decision point, there are clear metrics so you know you're making the right decision. I know this process works because we’ve delivered over 470 investment properties following it, and all have performed well.

If you have questions or want more details about the process, DM me.

Post: Are Properties in the Best School Districts the Best Rentals?

Post: Are Properties in the Best School Districts the Best Rentals?

- Realtor

- Las Vegas, NV

- Posts 824

- Votes 1,575

Thanks for the great comments on this thread. I will reply to a few of them. First, general comments:

Choosing a property or location and hoping for good tenants is not the best approach. Instead, I identified a narrow segment of tenants who consistently stayed for many years, paid rent on time, and took care of properties. Once I identified this segment, I determined where and what they were renting and then bought similar properties. This approach removes all judgment and opinions from the process.

In Las Vegas, tenants in C-class areas typically stay for about a year on average. They lead cash-based lives, so leases, skips, evictions, or damage judgments have no impact on them. They get paid every Friday, cash their checks, and pay rent and utilities in cash at 7-Eleven or similar locations. Due to their short stays, vacancy costs are high.

Another consideration is that prices and rents are low because there is limited demand. Where there is limited demand, prices, and rents do not increase very fast. So, rents will not keep pace with inflation. Also, in Las Vegas, the rent for C-class housing is loosely tied to the minimum wage. Unless the minimum wage increases, rents cannot increase that much. Also, in such locations, appreciation is minimal.

@John Morgan A handful of our clients tried section 8. None of them continued after the first year. The experience most had was that the government would reliably pay a portion of the rent. But the tenant did not reliably pay their portion of the rent. Also, there was a lot of property damage, which had to be repaired in order to continue receiving government funds. You do get higher rent. In my opinion, Section 8 properties rent for $100/Mo more than non-section 8 properties. However, it's not the gross rent you receive; what matters is your net cash flow. One of the properties required over $15,000 in renovations after one year of having a section 8 tenant. Section 8 is not a free pass. It is an option that must be weighed against all the costs.

@Scott Mac I enjoyed your comments on schools.

@Henry T. We've completed over 70 1031 exchanges and the majority came from California, Portland, and Seattle. We've also had a fair number from Florida and Texas. These were driven by the very high taxes and insurance in both states. Henry, if you'd like to chat about Las Vegas, reach out.

@Joseph T. Miller The algorithms I developed will work anywhere, but a lot of historical behavioral information for the specific tenant pool you want to target is required. Plus, the software can only go so far. You need an expert team to validate, renovate, and manage the properties.

Post: Should I Sale or Should I Rental

Post: Should I Sale or Should I Rental

- Realtor

- Las Vegas, NV

- Posts 824

- Votes 1,575

Hello @Eddy Tijerina,

My recommendation is If the property is situated in a market that has experienced long-term rapid appreciation and rent growth, it is advisable to hold onto it. However, if it is not in such a market, selling and buying in a rapidly appreciating market might be your best option.

Will the property have a positive cash flow if you were to pull money out of it? If the property is in a high appreciation and rent growth market, rents will rise, making it a positive cash flow property in the foreseeable future. If the estimated time until positive cash flow is acceptable and you can afford any negative cash flow during this time, then keeping it also makes sense.

If the property is not in a high appreciation and rent growth market, and it is unlikely to ever become a positive cash flow property, then selling it is probably your best option.

Post: Suggests for "Comp" software

Post: Suggests for "Comp" software

- Realtor

- Las Vegas, NV

- Posts 824

- Votes 1,575

Hello @Mel Park,

You are welcome. Rereading my post, I want to add some additional information and it has to do with rental properties.

Rental comps are different than sales comps. People think that their rental property’s competition is the property for rent down the street. That is not true. Renters select rental properties based on proximity to where they work. See the image below. The competition might be across town. The ability to recognize the competition for a property is a skill few property managers possess.

In the current Las Vegas market, there is a strong demand for rental properties, as evidenced by falling inventories and more homes rented (see below). However, it can be difficult to determine the correct rental price. One strategy we use is to ask for a higher rent than the estimated rent and then monitor the showing traffic. If we don't see the expected number of people viewing the property, we reduce the rent. This way, we maximize the rent and capture potential tenants' attention in the first few weeks on the market. Also, reducing the rent triggers notifications to people who are on drip feeds for a rental property.

The following charts are for our target property profile only.

The number of homes for rent is decreasing.

At the same time, the number of homes rented is increasing, indicating increasing demand.

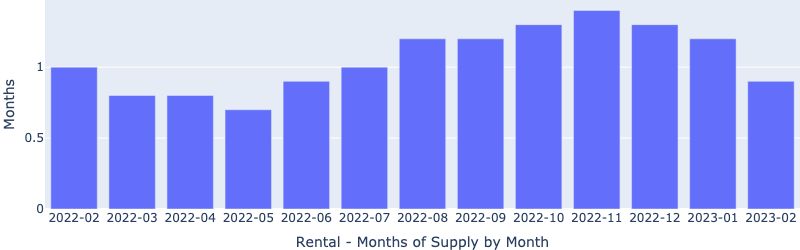

The result is less than 1 month of supply for rentals. This will push up the rent.

Post: Las Vegas Rental Trends

Post: Las Vegas Rental Trends

- Realtor

- Las Vegas, NV

- Posts 824

- Votes 1,575

Hello @Justin Buswell,

Thanks for the kind words. We are engineers and believe in data and analytics, not opinions, which is why our posts are as they are.

I have moved the monthly Las Vegas rental update to another thread under the Market Trends and Data forum. Here is the thread: https://www.biggerpockets.com/...

I pasted the March 2023 update below for your convenience.

It’s March, and time for another Las Vegas update. For a more in-depth view of the Las Vegas investment market, DM me for our 2023 Las Vegas Investor Outlook.

Before I continue, note that the charts only include properties that match the following profile, unless otherwise noted.

- Type: Single-family

- Configuration: 1,000 SF to 3,000 SF, 2+ bedrooms, 2+ baths, 2+ garage, minimum lot size is 3,000 SF.

- Price range: $320,000 to $475,000

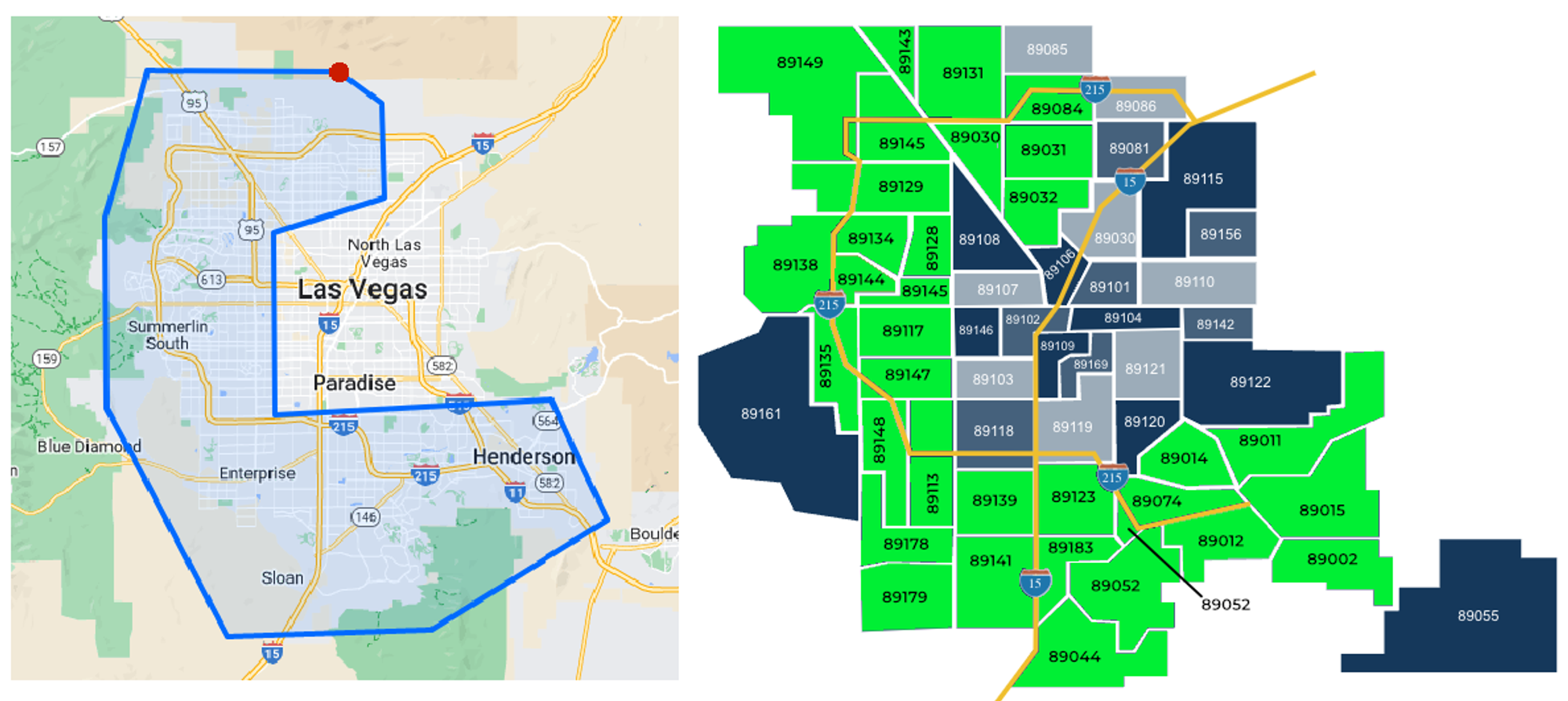

- Location: All zip codes marked in green above have one or more of our client’s investment properties.

What we are seeing:

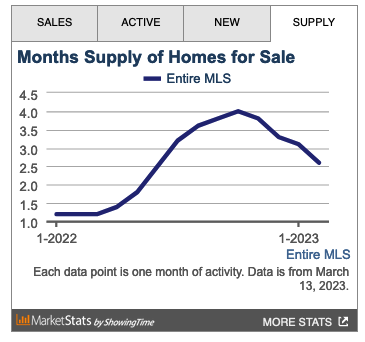

Overall inventory is falling in Las Vegas. The chart below is from the MLS and includes all property types and price ranges.

The Charts

The charts below are only for the property profile we target.

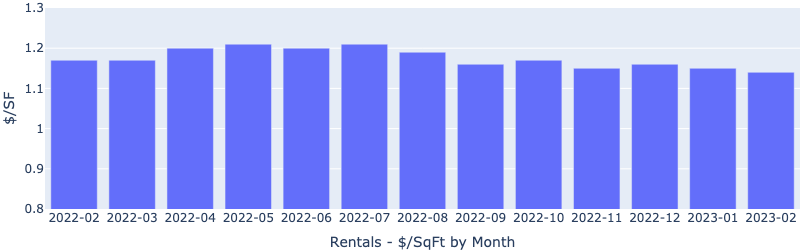

Rentals - Median $/SF by Month

Surprisingly, rent dropped slightly in February, despite the inventory decreasing rapidly. I suspect that the trend will reverse soon.

Rentals - Median Time to Rent

Median time to rent dropped significantly in February, indicating increasing demand.

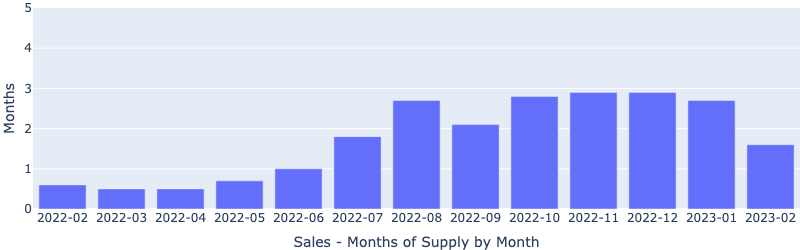

Rentals - Months of Supply

Inventory saw another significant drop in February. Now at below 1 month of supply. This will push up the rent.

We saw a similar drastic drop in sales supply as well.

Sales - Months of Supply

What fundamentals continue to drive Las Vegas rents and prices:

- Land shortage. At the current consumption rate (~5000 acres a year), Las Vegas will run out of developable land in about 6 years. The only growth path would be tearing down and redeveloping, resulting in high new home prices. This will push up existing home prices as well.

- The population is growing and is projected to grow by 2% to 3% annually.

- Enough jobs to support the growing population. Depending on the job site, there are between 26,000 and 31,000 open jobs in Las Vegas.

- Massive construction projects (>$22B) will create thousands more jobs. Many of these jobs match our target tenant segment, increasing demand for residences and driving up rents and prices.

- Pro-business government, no state income tax, low property taxes, and low energy prices continue to attract businesses to Las Vegas.

I believe Las Vegas fundamentals will continue to drive up prices and rents for the foreseeable future.

Let me know if you want more sales or rental data, and I will post additional charts.

Post: Help on hiring a property manager

Post: Help on hiring a property manager

- Realtor

- Las Vegas, NV

- Posts 824

- Votes 1,575

Hello @John Matarazzo,

Finding a good property manager can be challenging. In my experience working with property managers over the last 15 years, most of them are only rent collectors. You need more than just a rent collector.

How to find a Good Property Manager

List Your Requirements

Create a list of the capabilities and services that the property manager must possess. For instance, if you intend to purchase residential properties on the southwest side of the city, exclude property managers that specialize in commercial properties or do not serve the southwest.

Find Candidates

How will you find property manager candidates?

- Look on rental property websites for properties similar to what you are considering and record the names of the management companies.

- Search engines.

- Ask realtors for referrals.

- Ask other investors.

- Real estate websites.

Once you have a pool of candidates, look at their web pages.

- Does their webpage look old?

- What do they state their business is? You may discover that their focus does not match your property profile.

- How long have they been in business?

- How many properties are they managing?

After some web work, you should have a short list of candidates. The next step is to email candidates and request a time to talk. If I do not hear back within two business days, I eliminate them from consideration.

Below is a sample list of questions. You will not be able to ask every question; choose no more than ten and rewrite them for your specific situation. Start by telling them that you own a property and you're looking for a property manager.

- How long have you been exclusively managing properties? (No part-timers.)

- Tell me about your staff and how many are full-time?

- How many properties are you currently managing?

- What is your process for screening tenants? [The most important skill for a property manager is the ability to select a reliable tenant. It is important to understand their process for screening prospective tenants. Some property managers choose tenants based on FICO scores. However, a FICO score does not indicate how long they are likely to stay or if they will take care of the property. Additionally, a high FICO score may mean they will be buying a home soon and will leave your property after only a short stay.]

- Where/how do you market properties? [This should be segment specific. For example, a good place to market low-end properties is flyers at mass transit stops.]

- Tell me about your fee structure.

- Do you have a startup fee?

- What percentage of collected rent do you charge?

- Is there an annual fee?

- Do you charge a lease renewal fee?

- Are there other fees?

- Do you expect any increase in your fees?

- When do you collect the rent, and when do I get paid?

- Do you have an in-house repair department? [Avoid property managers that have an in-house repair staff. Property managers make more money through their repair department than by collecting rent. You don't want your unplanned expenses to be their primary source of income. The property managers we work with use trusted third-party service providers for repairs, they do not have their own repair staff.]

- Do you add a fee to the contractor's bill? [Adding a fee like $25 to manage the repair is reasonable. What is not reasonable is adding a percentage of the total cost as a fee.]

- Do I receive a copy of the actual bill from the contractor?

- How do tenants request repairs? Do you have a 24 x 7 emergency phone number? Does a member of your staff answer this line? [If there is a burst pipe in your property, you don't want to wait until Monday afternoon to have someone start sorting it out. Tenants have to have a way to contact the property manager 24 hours a day seven days a week for emergency repairs.]

- Under what conditions do you contact me for prior approval for repairs? [Usually, there's a dollar threshold like $200 or $300.]

- If there are significant repairs, do you get more than one quote?

- What is your process when a tenant is late with rent?

- How much does an eviction cost and how long does it take?

- How many evictions have you had in the last 12 months?

The above is a good start. Record the answers from each property manager. Comparing answers will tell you a lot about the market and whether they have the skills you need.

Additional considerations

- Few property managers excel at selecting tenants, which is the most important skill they offer.

- Many people mistakenly believe that all property managers are equal and thus choose the cheapest option available. However, this approach can be the most costly in the long run. A single bad tenant can cost more than a year or two of property manager fees. Instead, focus on the value provided rather than on minimizing costs.

- Avoid property managers with an in-house repair staff, as they often make more money from their service department than from rent collection. You don't want your unplanned expenses to become their profit center.

- I prefer medium-sized property managers. The big property managers don’t have time for individual owners. Mid-sized property managers have all the needed software and process but will still have time to work with individuals.

- Get a copy of the following documents and review them.

- Property management agreement

- Rental agreement

- Sample monthly statement

If you have questions, let me know.

Post: House prices up much higher than rent

Post: House prices up much higher than rent

- Realtor

- Las Vegas, NV

- Posts 824

- Votes 1,575

Hello @Gowtham Natarajan,

Whether now is a good time to buy depends on your goals. If your goal is a passive income stream that will get you off and keep you off the daily workout treadmill, then yes. If your goal is immediate cash flow and you don't care about the future, then maybe not.

Dependable Passive Income

Waiting only makes sense if either property prices or interest rates fall enough that your acquisition cost and debt service decrease significantly. Interest rates are national, but appreciation and rent growth are specific to the metropolitan area and property segment.

Unlike the stock market and other financial instruments, rents and prices are driven by supply and demand. In locations where prices are low, there is little long-term demand, so prices and rents will not increase significantly over time. Where prices are higher, there is strong demand, so prices and rents will increase significantly over time. It is simply supply and demand.

So I have actual data to present, I will show what is happening in Las Vegas for the specific property segment we target. Every location and property segment will likely be different so you need to research each location you are considering.

Las Vegas

Below are my observations on supply and demand for the narrow property segment we target in Las Vegas.

Supply

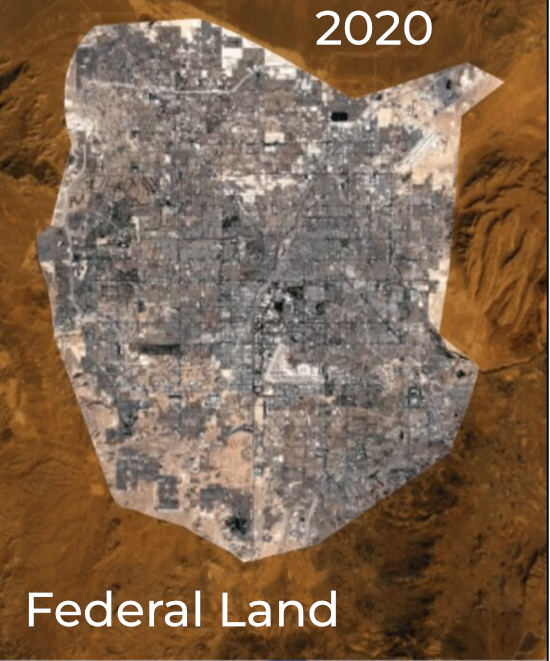

Las Vegas is unique in that it is a tiny island of privately owned land in an ocean of federal land. See the 2020 aerial view below.

There is very little undeveloped private land remaining, and any available land in desirable areas costs more than $1 million per acre. Consequently, new homes in our targeted locations start at $550,000. The homes that appeal to our target tenants are priced between $320,000 and $475,000. Thus, no matter how many new homes are built, the housing stock we target remains almost constant. This differs from metropolitan areas with unlimited expansion potential, where the construction of new homes limits the growth of rent and home prices of existing properties.

Demand

The driver for demand in Las Vegas is population growth. The average annual population growth is between 2% and 3%. What attracts most people to Las Vegas (and other metros) is jobs.

In a study I did in January, I looked at two major job sites (Monster and Glass Door) for the number of open jobs in Las Vegas. According to these sites, there are between 26,000 and 31,000 open jobs in Las Vegas.

The number of available jobs will increase in the future. Depending on which study you read, there is between $18B and $26B of new construction under development. As these come online, they will create even more jobs attracting more people to Las Vegas.

Of the people who will move to Las Vegas, a significant portion matches the tenant segment we've targeted since 2005. So, demand for conforming properties priced between $320,000 and $475,000 will increase over time.

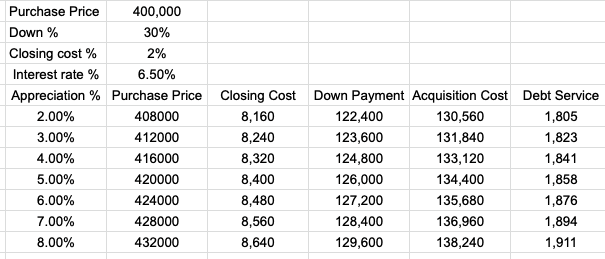

Because supply is fixed and demand is increasing, prices will rise. The table below shows the impact of various appreciation rates on acquisition cost and debt service, assuming a 6.5% interest rate.

If prices are increasing, waiting will cost you more than buying today.

Impact of Interest Rates

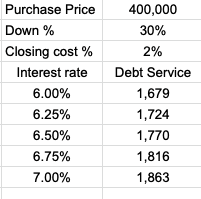

Raising interest rates increase debt service cost and decreases initial return. The Fed stated it will continue increasing interest rates until inflation falls. So, I expect interest rate hikes to continue for the foreseeable future. Below is a table showing debt service for a $400,000 property at different interest rates

If interest rates continue rising, waiting will cost you more than buying today.

Buy Now or Wait?

Most of our clients plan to hold onto their real estate for the rest of their lives. Therefore, what happens in any given month or year is not that relevant. One client I spoke with put it well: “Higher interest rates are reducing cash flow by about $300 per month. I believe interest rates will be significantly lower in one or two years. Assuming two years, that means I will actually pay $3600 ($300 per month times 2 years) more for the property. On a $400,000 property, $3600 is not significant. What is significant is locking in the price and then refinancing when rates are lower in the future.”

My conclusion is that waiting will cost you more than purchasing today.