All Forum Posts by: Eric Fernwood

Eric Fernwood has started 64 posts and replied 793 times.

Post: What markets do you consider to be the most promising?

Post: What markets do you consider to be the most promising?

- Realtor

- Las Vegas, NV

- Posts 824

- Votes 1,574

Quote from @Nathan Harden:

If you are looking for cash flow, then you can't go wrong with the midwest. Indiana, Ohio, etc. There some different types of markets in these regions. On one hand you have Cleveland which a little more cash flow, then you have Columbus which is a little bit more of a hybrid market (appreciation and cash flow)

Appreciation markets are going to be more like Austin Texas and Arizona. I would not recommend jumping into one of these markets as a newer investor, it is always an option.

Hello Nathan,

I agree that cities like you mentioned in the mid-west will likely have a higher initial cash flow. The problem I have with such cities is that they are not good long-term investment locations.

On the cities you mentioned.

- Cleveland - Cleveland's population has been declining over the past several decades. Factors such as economic struggles and out-migration have contributed to this trend. With a declining population, the demand for housing will continue to fall. Without an increasing population, there is little to drive up long-term prices and rents. Cleveland is also subject to urban sprawl. Here is a time-lapse aerial view. Urban sprawl results in prices and rents of existing homes rising slowly. Another issue with Cleveland is crime. (#11 on Neightbohood Scount's 100 most dangerous cities list - https://www.neighborhoodscout....). A rental property is no better than the jobs around it. Companies will not move to high-crime areas and set up new operations. So, Cleveland is economically a declining city.

- Columbus - Columbus is a better investment option because the population has increased. The city's population was about 787,000 in 2000, and in 2020, the population increased to about 892,000. However, the prices of existing homes are unlikely to rise rapidly (excluding COVID) because of urban sprawl. Here is a time-lapse of Columbus - https://earthengine.google.com.... The city will continue to expand outward, and the prices of existing homes will stagnate.

On appreciation markets, you mentioned Austin, Texas, and Arizona. I assume you meant Phoenix.

- Austin - Austin has a significant urban sprawl issue. There is no barrier to expansion, like in Cleveland, Phoenix, and Columbus. (Austin time lapse - https://earthengine.google.com...) If you buy near the lake or other highly desirable areas, houses are very expensive. If you buy on the city's outskirts, like Cedar Park, Leander, Buda, Kyle, etc., prices are lower but less likely to rise significantly. There is too much open land for expansion, so existing houses there will not appreciate rapidly. You cannot look at a metro area and draw conclusions about any specific area within the metro area. The same is true of any metro area.

- Phoenix - Suffers from urban sprawl (Phoenix time-lapse - https://earthengine.google.com...). Except during COVID, property prices of existing homes have risen slowly, as have rents.

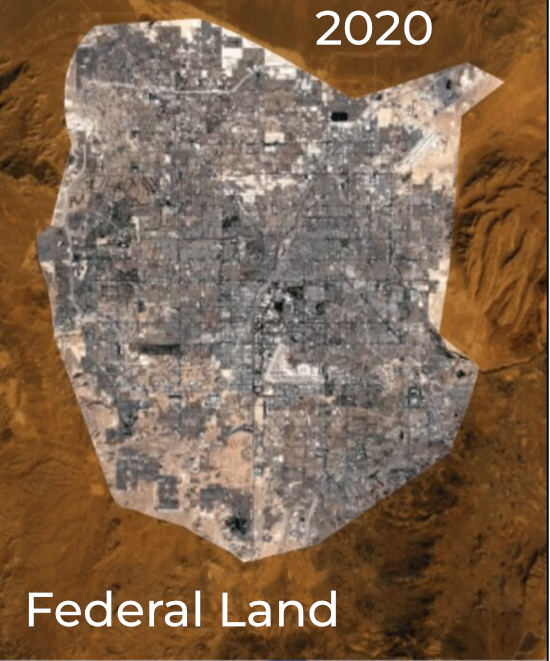

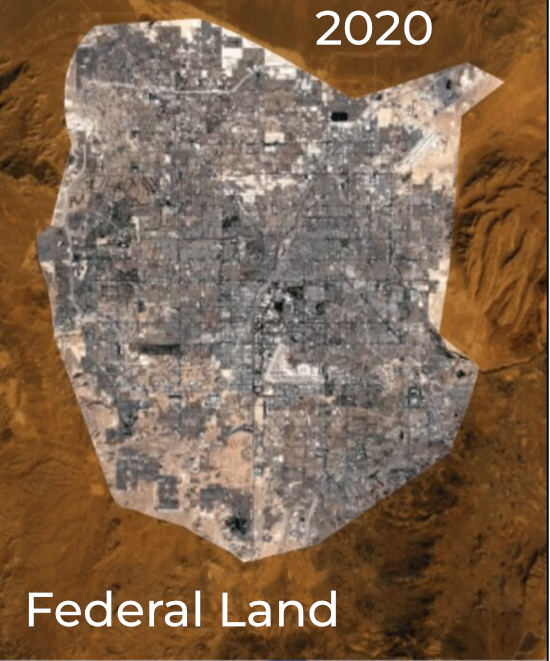

Las Vegas is a city that does not have urban sprawl and has experienced high appreciation in the past, and is expected to continue this trend in the future. Here is the time-lapse for Las Vegas - https://earthengine.google.com.... Below is an aerial view of Las Vegas in 2020, with the federal land shaded brown.

As you can see, Las Vegas has little land left for expansion. Las Vegas is a small island of private land in an ocean of federal land. With a growing population (2-3%), companies expanding or moving into the city, and $18B to $26B in new development, rents and property values are almost guaranteed to increase.

I want to point out that ROI and cash flow are only snapshots in time. Return calculations only predict how a property is likely to perform on day one under ideal conditions. The calculations tell you nothing about the future. Unless there are fundamental factors, like limited room for expansion, cities keep expanding, and prices and rents for existing properties remain stagnant.

You are likely to hold a property for many years, so always consider the long-term aspects of any location.

Post: Las Vegas / Henderson Property Management

Post: Las Vegas / Henderson Property Management

- Realtor

- Las Vegas, NV

- Posts 824

- Votes 1,574

As people stated in this thread, you need to talk to your property manager. Some questions for the property manager.

- To rent the property quickly, what do you recommend?

- Please show me the rental comps upon which you based the current rent.

- What do you see as competition for my property?

- How long have similar properties been on the market?

Several things about the property could make it unlikely to rent.

- Poor quality photos - People spend $400,000 or $500,000 and another $25,000 on renovations. Then, market the property with photos that look like a crime scene. Properties won’t rent unless you get people to see them. You will attract potential tenants with quality photos of a clean and attractive property. You must use a professional real estate photographer.

- Incorrect pricing - Did you set the rent or the property manager? Most people buy "an investor's dream" and demand the property manager rent the property for the amount they believe it should rent.

- The property is not market ready - Did you work with a property manager when selecting the property? Did they provide a list of necessary renovation items? Did you make all the changes during the renovation? Is the property clean and attractive? Does it smell clean? If you put a masking scent in the property, you are telling potential tenants that there is something bad smelling in the property, and they need to leave.

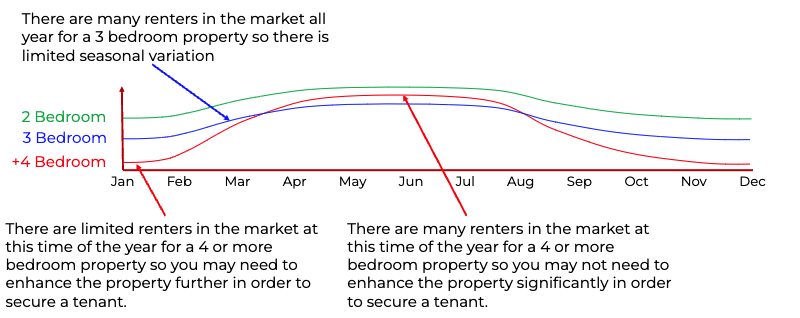

- Seasonal factors - See the chart below.

- Market factors - See the charts below. Note that the charts include rent data for properties that conform to our specifications.

While the $/SqFt and month of inventory remained stable or improved, the days on market significantly increased in December, indicating that rental activity was slow.

Rentals - Median $/SF by Month

Rentals - Inventory by Month

Rentals - List to Contract Days by Month

Mickey, I hope the above helped.

Post: Henderson, NV Rental market trend

Post: Henderson, NV Rental market trend

- Realtor

- Las Vegas, NV

- Posts 824

- Votes 1,574

Hello @Sam Patel,

Regarding your question about getting reliable tenants, the concept is simple. First, select a tenant pool segment with a high concentration of good tenants. Then, buy what they are willing and able to rent. More on this a bit later. My definition of a good tenant.

- Has stable employment in a market segment that is very likely to be stable or improve over time

- Pays all the rent on schedule

- Takes care of the property

- Does not cause problems with neighbors

- Does not engage in illegal activities while on the property

- Stays for many years

We’ve worked with investors for +15 years targeting a single narrow tenant segment. This approach resulted in

- Over 470 properties delivered

- Average tenancy of over five years.

- Five evictions in the last 15 years (over 1,000 tenants).

- 2008 crash - Zero decline in rent and zero vacancies.

- COVID - Almost no impact

- Eviction moratorium - Almost no impact

- 2013 through 2021 appreciation averaged >15% and rent growth averaged >8%. In 2022, rents increased by 4.5%, but there was little appreciation.

All of the above was largely due to the tenant segment we targeted.

How do you target a specific tenant segment? By buying properties that match that segment’s housing requirements.

Every tenant segment has specific housing requirements and is unlikely to rent a property that does not match all their requirements. There are four basic housing requirements.

- Location - Locations where significant percentages of the target segment live today.

- Property type - What type of properties are they renting today? Condo, high rise, multi-family, single family?

- Rent range - What the segment is willing and able to pay. Usually, this is about 30% of their gross monthly household income.

- Configuration - Two bedrooms, three-car garage, large back yard, single-story, two stories? What configuration are they currently renting?

The image below shows the relationship between housing requirements and the properties the segment is willing and able to rent.

How do you find out this information? By interviewing local property managers. If you’d like sample interview questions, DM me.

One of the best things about selecting the tenant segment first is that it eliminates all guesswork. Your target segment tells you exactly what to buy and where.

However, buying properties that meet a segment’s requirements is not enough. The property must meet several other requirements, as illustrated below.

If you would like to learn more about our processes and what we can do for you, DM me. and we can set up a time to talk.

Sam, I hope this helped.

Post: Is a owner-occupied fourplex a good investment idea?

Post: Is a owner-occupied fourplex a good investment idea?

- Realtor

- Las Vegas, NV

- Posts 824

- Votes 1,574

In theory, living in one unit and renting the other three sounds great. You have a place to live and the other three units pay the mortgage. However, theory always loses to reality.

When the tenants find out you are the owner,

- Be prepared for every excuse imaginable why they cannot pay the rent. If you insist, then you will be subject to abuse. Probably from all three tenants.

- No matter how small the repair, expect people banging on your door to want it fixed now.

- Plan on being pestered for new appliances, window treatment, faucets, paint, carpets, etc. If you do not agree to the demands, you will be subject to abuse.

- When a tenant does not pay, you will be evicting someone you know. This will not be a pleasant situation and the other tenants will not be on your side. Be prepared for a lot of abuse.

An even bigger problem is that once a unit goes vacant, you need to find a replacement tenant. Do you:

- Have a lease agreement that is enforceable and conforms to all federal, state, county, and city regulations.

- Know how to enforce a contract within the limitations of the regulations? This includes court appearances, fees, and processes. When you lock a tenant out, you will be subject to a lot of abuse from all tenants.

- Do you know how to select a good tenant? Hint, FICO score is not the critical factor. Also, if you do not conform to all regulations, you could find yourself in serious trouble.

On paper, living in one unit and renting the others sound great. I believe reality will squash theory.

Post: Best Market Research Sites

Post: Best Market Research Sites

- Realtor

- Las Vegas, NV

- Posts 824

- Votes 1,574

Hello @Robb Silverstein,

Hello Robb,

No problem sharing. Know that I went through the location selection process in 2004, so things may be different now.

I was living in NYC when I decided to change professions and build an investor services business. I knew NYC was not a viable location, so I developed the process I listed in my previous post for selecting a good location.

Initially, I was attracted to the states of Texas, Florida, and Nevada because they had no state income tax. I did a comparison of the property taxes and insurance costs in these three states and discovered the following average costs.

To show the impact of taxes and insurance, I compared costs on a $400,000 property in the three states. (Remember that these are state averages and individual cities may impose additional taxes.)

So, due to higher property tax and insurance, you need to have a higher cash flow in Texas and Florida than in Nevada. Below is how much additional cash flow you need to generate in Texas and Florida compared to Nevada.

After I realized the impact of higher taxes and insurance, I eliminated Texas and Florida from consideration.

Going through the multi-step elimination process I listed, it narrowed down to just Las Vegas. The two biggest Las Vegas factors are below.

Limited Room for Expansion

Las Vegas is an island of privately owned land surrounded by an ocean of federal land (87.5% of Clark County is federally owned; 85% of the entire state is federally owned). At the end of 2019, the amount of vacant, buildable land in the Las Vegas Valley was less than 28,000 acres. Of these, 5,000 to 7,000 acres were not viable for residential development. The consumption rate is about 5,000 acres per year. See the aerial view from 2020. The shaded areas are federal land. As you can see, there is hardly any remaining land for expansion. The shortage of land, combined with the increasing population, almost guarantees that property prices and rents will continue to increase.

Population Growth

Las Vegas’ population continues to grow by 2-3% per year.

- Las Vegas, NV Will be Among the Fastest Growing Cities by 2060

- Las Vegas Metro Area Population 1950-2022 - https://www.macrotrends.net/ci...

A rental property is no better than the jobs around it. I just completed our 2023 Las Vegas Investor Outlook (DM me if you want a copy) so I have current information. According to Monster and Glass Door, there are between 26,000 and 31,000 open jobs in Las Vegas today.

Also, depending on which source you read, there are between $18B and $26B of new developments under construction which will create even more jobs in the future. Jobs bring people, who will need a place to live, which will increase housing demand.

In summary, the combination of limited land for expansion and a rising population, prices and rents are almost guaranteed to increase.

What have been our +15-year results?

- 2013 through 2021, >15% annual appreciation, >8% annual rent growth.

- In 2022, appreciation was flat but rents increased by 4.5%.

Summary

The most important investment decision is location, followed closely by the tenant pool. If anyone is interested, I can post why the tenant pool segment is critical and how to target a specific tenant pool segment.

Post: Best Market Research Sites

Post: Best Market Research Sites

- Realtor

- Las Vegas, NV

- Posts 824

- Votes 1,574

Hello @Ashley Chen,

Good question. The source I use for price growth is Zillow research data.

There is no direct source of rent growth. I have it for Las Vegas because I wrote software to extract the information.

However, you can get a reasonable feel for rental trends based on price trends. Rents and prices are related. Depending on the study, rents lag prices by 2 to 5 years. So, rents today reflect property prices 2 to 5 years prior. So, what happened to prices is a reliable indicator of what happened to rents.

When looking at price data, I recommend ignoring the COVID years. COVID had a strong impact on real estate prices starting in 2020, where price increases were not based on fundamentals. The impact continued to be felt in 2021. So, judge locations based on price trends between 2013 (when most markets recovered from the 2008 crash) and 2019.

Post: Las Vegas Rental properties

Post: Las Vegas Rental properties

- Realtor

- Las Vegas, NV

- Posts 824

- Votes 1,574

Hello @Marco Ramirez,

I believe Las Vegas is an excellent long-term investment location. While I could list several reasons for this, I will limit myself to two.

Land shortage - Las Vegas is a small island of privately held land in an ocean of federal land. 87.5% of Clary County is federally owned. 85% of Nevada is federally owned. See the aerial view below of Las Vegas in 2020.

As you can see, room for expansion is limited. In the near future, Las Vegas will only be able to expand through redevelopment. In some areas, this has already happened.

Population growth is steady at 2-3% and is projected to continue to grow (https://247wallst.com/city/las-vegas-nv-will-be-among-the-fastest-growing-cities-by-2060/.) So the demand for housing is increasing.

The combination of limited room for expansion and increasing demand almost ensures that prices and rents will continue to rise for the foreseeable future.

We've evaluated condos many times over the years and always decided against them for the following reasons:

- Short tenant stays - Condos typically attract tenants who stay for about two years. These are mobile people with no children to lock them to a location. In comparison, the average stay in the single-family and townhouse properties we target is over five years.

- High HOA fees - Condos typically have high HOAs, making it difficult to get a reasonable rate of return.

- Condos have a lot of competition - In Las Vegas, condos compete with apartments for tenants, which keeps condo rents low. After all, would you rather rent a 20-year-old condo, or would you prefer a newly built apartment with multiple pools, a theater, a running track, an exercise room, free WiFi, etc?

- Financing limitations - While residential financing is available for most condos, I believe investment financing is only available if certain criteria are met (such as 51% or higher owner-occupants). Investors will most likely have to pay cash for most condos. Single-family homes and townhomes are easily financed.

- Condo cross-unit maintenance issues - Condos are in close proximity to other units. The result is unwanted interactions. For example, if the unit above has a leak, and your unit is downstairs, it damages your unit. You have almost no way to compel the upstairs owner to fix it, let alone pay for your damage. Sometimes it isn't easy to get hold of the owner. It could take days or weeks. Meanwhile, the problem in your unit gets worse. This is especially true if there is mold caused by a leak upstairs or a unit on the other side of the wall.

- The close proximity of neighbors - When neighbors cause problems, your tenants will complain about noise, cigarette smoke seeping through their unit, etc. There's nothing you can do about such neighbor issues. One problematic neighbor in a condo will have your tenants wanting to leave instead of renewing the lease.

- Maintenance costs - Condo associations typically maintain the exterior of the properties, but you still maintain everything else, including the HVAC. Due to the climate (Mojave Desert), the construction materials used in single-family properties make them very low maintenance. In our experience, the annual maintenance costs for condos and single-family properties are about the same. This would not be true in other climates.

I recommend single-family homes and townhouses that target a specific tenant pool segment. The ones we targeted performed well over the +15 years we've worked with investors.

Post: 2023 Las Vegas Investor Outlook

Post: 2023 Las Vegas Investor Outlook

- Realtor

- Las Vegas, NV

- Posts 824

- Votes 1,574

I realized that all the reference links were removed from the post. Please DM me for the full report (with links).

Post: 2023 Las Vegas Investor Outlook

Post: 2023 Las Vegas Investor Outlook

- Realtor

- Las Vegas, NV

- Posts 824

- Votes 1,574

Every January, we release our outlook on what we believe is likely to happen in the coming year. This year is difficult because so many things are happening simultaneously worldwide.

I started this outlook in our December newsletter, which included a SWOT analysis of the major events. My thanks to all of the people who responded with their views.

My approach: I have always been frustrated by "experts" that are purposely ambiguous so that they are "right" no matter what happens. Our approach is to tell you what we think as specifically as we can, provide the data upon which we base our conclusions, and discuss any contraindicating data that we perceive as major threats to our assumptions.

Las Vegas Investment Situation

I decided to start with the most frequent questions I get concerning the current state of the market.

Foreclosures, REO, and Short Sales

Are there a lot of distressed properties in Las Vegas? No. Below are the number of distressed properties as of 01/10/2023.

- Bank Owned: 16 or 0.3% of total properties for sale.

- Short Sale: 3 or 0.06% of total properties for sale.

- Foreclosure started: 4 or 0.08% of total properties for sale.

The number of distressed properties is insignificant. I do not expect a significant increase due to the equally insignificant number of NODs (Notice of Default) and NOS (Notice of Trustee’s Sale) each month. Few properties are underwater, so if someone can't pay their mortgage, they will sell the property in a few weeks, pocket the profit, and rent.

Are Prices Decreasing?

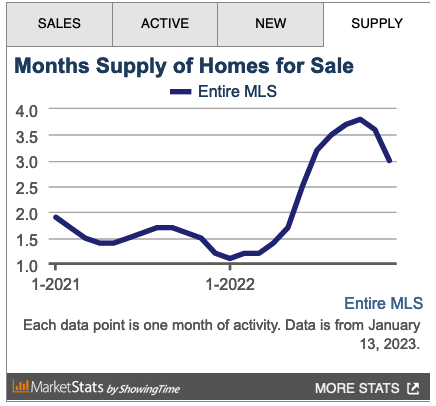

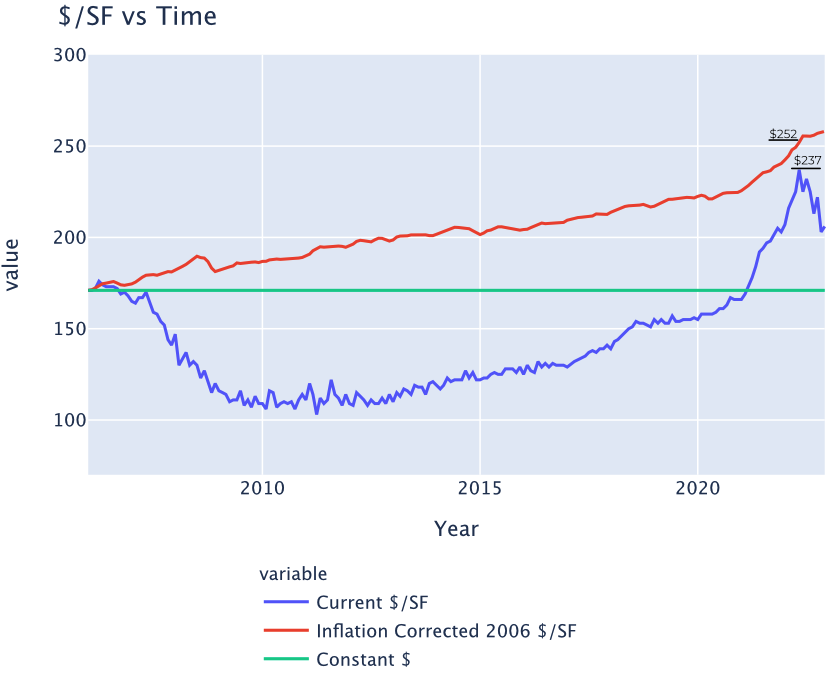

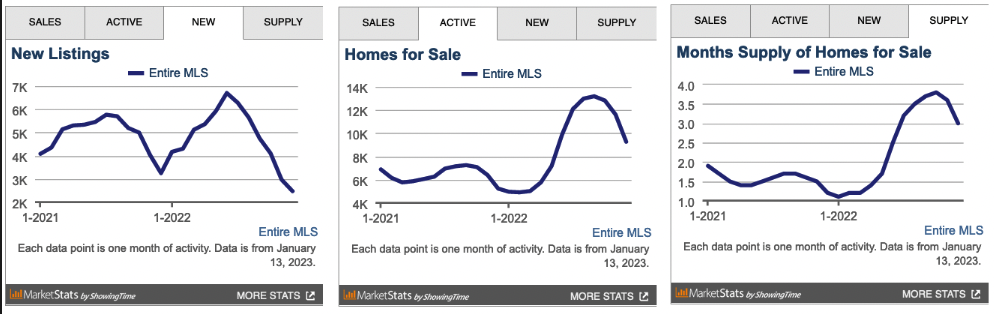

Yes, but prices are not crashing. Also, I do not know if the decreases will continue. It depends on what happens with the interest rates. The chart below is from the MLS (01/13/2023) and includes all single-family homes in all price ranges, not just our target segment. Inventory is currently at about three months and falling. A balanced market in Las Vegas is six months of inventory. With a dwindling inventory, I do not expect any significant price decreases in the foreseeable future.

Are Las Vegas Prices Over-Heated?

No. See the chart below. The blue line shows the median $/SF without correcting for inflation. The green line is the 2006/2007 peak price uncorrected $/SF. The red line is the inflation-adjusted 2006/2007 peak price. As you can see, the current $/SF is still below the inflation-corrected peak prices of 2006 and 2007.

How Does the Current Market Compare to 2008?

The market conditions of 2008 are in no way comparable to the current market. See the table below for some specifics.

What Is Happening With Tourism?

A significant part of the Las Vegas economy is based on tourism. Fortunately, tourism is at or near 2019 (pre-COVID) levels. Conventions are back, and gaming is doing well. See the articles below for specifics.

- - "Convention attendance near pre-COVID levels"

- - Las Vegas is considering building a reliever airport south of Las Vegas to handle increased travel.

I believe tourism will increase in 2023. For example, before the COVID lockdown, Chinese nationals were a significant component of total visitors. Due to Chinese COVID policies, the number of Chinese nationals visiting Las Vegas drastically decreased. It appears that quarantine policies have been relaxed or eliminated. Once the COVID situation in China stabilizes, I expect many Chinese will come to Las Vegas, increasing tourism revenues and creating demand for more workers. Another example is the increasing number of major sports events that will attract more visitors to Las Vegas.

Will A Recession Affect Rental Income?

I expect the potential coming recession will have little or no impact on our clients’ rental income. Why?

In 2005, I did extensive research to find a reliable tenant pool segment. I selected a narrow segment based on multiple characteristics. One is that they are largely direct income producers for their employers. Because they are direct income producers, companies rarely lay them off unless the business shuts down operations.

Over the last +15 years, rental income from our target segment has been very consistent. While history is not a reliable predictor of the future, it is our best indicator. Below is what happened during two major traumatic economic events and the eviction moratorium.

- During the 2008 crash, rents did not decline, and there were no vacancies. Although property prices plunged by more than 50%, rental income remained unchanged.

- COVID - Almost no impact.

- Eviction moratorium - Almost no impact.

However, owners of C and B-class properties are likely to be seriously impacted if there is a significant recession. The tenant segment that occupies C and B-class properties is largely low-paid, low-skilled workers who are easily replaced. They are the first to be laid off and the last to be rehired during economic stress. During the 2008 crash, many C and B-class properties were vacant.

Should I Buy Real Estate in 2023?

When I talk to people, I ask how they did in 2022. Depending on who I talk to, the answer ranges from "lost a lot" to "millions." Many had most of their capital in the stock market, and some had fixed-rate instruments. Many also had significant money in crypto.

- Stock market - And analysts aren’t sure if the worst is over yet.

- Crypto - There are no signs that the crypto winter will turn around in 2023.

- Fixed-rate instruments - The current "official" inflation rate is 6.5%, so you are guaranteed to lose 2% or more each year. Plus, you pay taxes on any gains, further reducing your rate of return.

In my opinion, if you keep your money in the stock market, CDs or crypto, you can expect more losses in 2023.

Our Client's Property Performance in 2022

Rents increased 4.5% YoY, but prices were almost flat. (I did not include the charts in this post due to length considerations, but I'd be glad to share them if anyone wants to see them.) From 2013 through 2021, average annual appreciation was over 15%, and annual rent growth was over 8%. So, while 2022 was not a great year for appreciation, clients had no break or decrease in rental income.

Las Vegas Fundamentals

Why do I believe Las Vegas will do well in the medium and long term?

There are multiple reasons, including the following.

- Land shortage - Las Vegas is an island of privately owned land surrounded by an ocean of federal land. At the end of 2019, the amount of vacant buildable land in the Las Vegas Valley was less than 28,000 acres, of which 5,000 to 7,000 acres is not viable for residential development. (87.5% of Clark County is federally owned. 85% of the entire state is federally owned.) The consumption rate is about 5,000 acres/Yr. See the animated GIF below. The areas in brown are federal land. The time-lapse only goes through 2020, and there was a large amount of development in 2021 and 2022. The shortage of land combined with the increasing population almost guarantees property prices and rents will continue to increase.

- Pro-business government - With a low-regulation environment, streamlined licensing and approval processes, and favorable tax policies, Nevada is a very business-friendly state.

- Jobs - According to Glass Door and Monster, today, Las Vegas has between 26,000 and 31,000 open jobs. Jobs bring people, which will increase the demand for housing.

- Low property taxes and insurance - The average property tax rate in Nevada is 0.55%. According to , Nevada has the 8th lowest property tax rate in the nation. See the table below comparing three popular no-income tax states. Property taxes and insurance are a direct hit on the bottom line.

- Dependable passive income properties are affordable - The current sweet spot for single-family and townhouse investment properties is between $320,000 and $475,000.

- Low maintenance cost - Las Vegas properties have low maintenance costs due to the construction materials required by the Mojave Desert's climate. Due to the lack of moisture, our selection criteria, and construction materials, our average annual maintenance is about $350.

- Growing - There is over $22B under construction and more announced, which will create thousands of new well-paying jobs. All these new jobs will bring thousands to Las Vegas and continue to drive up prices and rents.

- Low commercial energy cost - . Also, Las Vegas is one of the few cities in the US with dual electric power sources, critical for servers and electricity-dependent industries like data centers and Internet switching.

- Internet backbone - The fiber optic bundle connecting Southern California to the East Coast runs under Las Vegas Boulevard. This is why Google is building a $1.2B data center here.

- Population growth - The population continues to grow at a sustainable rate of between 2.5% to 3%.

- Landlord friendly - The time and cost to evict a non-performing tenant are about 30 days (depending on whether the tenant retains an attorney and court backlog) and $500. Also, the laws allow lease agreements to place much of the cost for damages on the tenant. Plus, the ability to deduct any damage beyond reasonable wear and tear from the tenant's security deposit. The lease agreement terms are the major reason our target properties' average tenant turn cost is under $500.

- Proximity to California - California seems to be doing all it can to drive people and companies out of the state. The proximity to California, especially LA, ensures that Las Vegas will continue to gain population and businesses.

Threats to Las Vegas Investments

Below is a list of threats that could adversely impact Las Vegas as an investment location.

Water Shortage

The short answer, Las Vegas is unlikely to have a water shortage. However, electric rates could increase if more power is purchased from California. Because tenants pay for all utilities, higher rates will have little impact on owners.

Significant Price Decrease

The charts below are from the MLS (01/13/2023). The supply of properties is falling. With falling inventories, I do not see prices decreasing significantly.

Significant Interest Rate Increases

Significant interest rate increases will put downward pressure on prices. However, as the Fed is expected to slow its rate hikes amid cooling inflation and the economy,

Severe Recession

Many economists are predicting that the US will likely tip into a mild recession in 2023. Some even argue that a “soft landing” is possible, meaning no recession at all.

Based on the strong job data, stable weekly unemployment claims, and high household cash balances,

In the (unlikely) event of a severe recession, the Fed will cut rates, which helps to boost home prices.

Severe Unknown Unknowns

No one predicted the impact of COVID until it was upon us. There will be additional events that will impact the economy, but none that I have read seem credible: war with China, war with Russia, another COVID, etc.

My Predictions

In the near term, interest rates will be the key factor.

- If interest rates rise significantly, buyers will be choked off, and prices will fall slightly.

- If interest rates remain relatively stable, I believe prices will remain relatively static.

- If interest rates fall even slightly, the demand for homes will surge, and prices and rents will rise.

Mid-term (1-2 years), I believe interest rates will fall to 4% or 5%, and prices and rents will resume significant increases.

This will add upward pressure to housing prices and rents.

In summary, in the short term, it all depends on what happens with interest rates. Longer term, the shortage of homes and increasing population will drive up prices and rents at a rapid rate.

It's 2023. What are you going to do?

2022 was brutal for anyone with money in stocks, bonds, or crypto. Depending on your investment mix, you probably lost 20% of your total capital or more. It's now 2023. Is your plan to continue holding the same investments that lost so much money in 2022, even though expectations are further losses?

"Insanity is doing the same thing, over and over again, but expecting different results." - Albert Einstein.

I believe every portfolio should have a significant portion allocated to real estate. Of course, we want you to invest in real estate with us.

Post: Best Market Research Sites

Post: Best Market Research Sites

- Realtor

- Las Vegas, NV

- Posts 824

- Votes 1,574

Hello @Lauren Mattina,

There is no single source for what you need. I will show you the sources I used for selecting a dependable passive income location and the process I followed.

Before I do, I want to explain that location selection is more about elimination than selection. There are too many potential investment locations, and you cannot evaluate all of them. I used a process for eliminating locations that were unlikely to provide dependable passive income. Using an elimination filter, I removed locations with characteristics that made them unlikely to be viable investment locations. Locations that pass all the elimination filters are highly likely to provide the dependable passive income you seek.

Start with Wikipedia’s list of metro locations with a population >1 million (Wikipedia). Small towns may rely too much on a single business or market segment. Metros with a population over 1M will likely have the economic diversity you need. Next, apply the following filters to this list.

- Both state and metro populations are increasing - Do not buy anywhere if the state or metro populations are static or decreasing. Wikipedia

- Low crime High crime and long-term appreciation and rent growth are mutually exclusive. Jobs, and people with sufficient funds, leave high crime locations. Companies will not set up new operations in such locations. Do not invest in any city on Neighborhood Scouts' list of the 100 most dangerous US cities.

- Low or no state income taxes There are many websites with comparative information. Here is an example. Just because a state has no income tax does not mean it does not have a high overhead.

- Low operating costs - High operating costs can turn what appears to be a profitable property into a money pit. The two most apparent are property taxes and insurance. Insurance - ValuePenguin, Metro Property Taxes - LendingTree

- Economic health - A good indicator of economic health is a rising median household income. The best source at the county level is St Louis Federal Reserve. Here is an example, Clark County, Nevada.

- Natural disasters risk - Almost every month, I read an article where a tornado, hurricane, tsunami, earthquake, or some other natural disaster that destroyed a city. If your property was in that city, it was most likely destroyed. If you maintain proper insurance, they will rebuild your property and pay you market rent until it is rent-ready. The real problem is that jobs, stores, and everything else were also destroyed. With no jobs, stores, doctor's offices, or anything else, there is no reason for anyone to remain and rent your property. Restoring a city could take years, or it might never recover. Your property will remain vacant for a long time, but your mortgage and other costs will continue. No one can afford this situation. Homeowner insurance costs are the most reliable indicator of the likelihood of a natural disaster. If homeowners insurance costs are high, the odds that your property will be destroyed are also high. Do not take this chance.

- Metro rent and price growth rate - To have the additional dollars you need to pay for inflated prices, rents must rise faster than inflation. Therefore, a critical location selection metric is that rents and prices are rising faster than inflation. Rents follow prices, so you can use the location appreciation rate if you do not have historical rental data. Only consider the decade before COVID; COVID distorted markets.

- Landlord/tenant rules and regulations - Some states and metro areas have implemented rent control. Rent control may prevent you from increasing the rent fast enough to keep pace with inflation. It may limit your property manager's ability to select the best tenant. It may make evictions of non-performing tenants difficult or impossible. Never invest in any location with rent control. The only source for this information is a local investment team.

Once you have a short list, make a final selection based on whether you can find a good local investment team. Everything you learn in seminars, podcasts, books, and on websites is general information. You will not buy a general property in a general location. You will buy a specific property in a specific location, subject to local rental regulations. The only source of hyperlocal information is a local investment team with years of investment experience. Their experience, processes, and resources cannot be replicated.

If you follow the above process, your odds of selecting a dependable passive income location are excellent.