All Forum Posts by: Eric Fernwood

Eric Fernwood has started 64 posts and replied 793 times.

Post: What’s keeping people from pulling the trigger?

Post: What’s keeping people from pulling the trigger?

- Realtor

- Las Vegas, NV

- Posts 824

- Votes 1,574

@Henry Clark - Looking at loss is an excellent comment. Thank you. I decided to scratch the guide idea and instead write about the cost of inaction.

What Are Your Options?

Following @Henry’s excellent advice, what are your options at 8.5% inflation?

- CDs and treasury bills: the best is 4.5%. You lose 4% to 5% each year and have to re-evaluate each year.

- Stocks: 2022 performance: Nasdaq -33%, Dow Jones -20%, with a looming recession.

- Crypto: Bitcoin: 2022 performance: -60%; Ethereum: -60%.

Unless you do something different, you are guaranteed to lose some or most of your hard-earned capital.

Real Estate

It is no secret that wall street has added rental homes to their mainstream portfolio. However, instead of acting, many individual investors are waiting and hoping:

- Prices fall significantly.

- Interest rates fall.

The Fed will keep raising interest rates until inflation is under control, so interest rates will continue increasing.

How much of a price drop is required to offset an increase in interest rates? Check out the table below. Suppose you could purchase a $400,000 property at a 6% rate but choose to hold off. If interest rates increase to 7%, the price must decrease by 10.9%, or almost $40,000, to have the same monthly payment. If the price doesn't fall that much, waiting will cost you more.

I don’t know about other locations, but for Las Vegas, an 11% price drop is not likely when there are only 3 months of inventory; 6 months of inventory is a balanced market.

Everything Depends on the Location

Only buy in a location where pre-COVID rents and prices increased faster than inflation. Select a tenant segment where tenants pay all the rent on schedule and stay for many years. If you do, your equity and passive income will increase faster than inflation, and you can stay off the treadmill.

Summary

Doing nothing is a decision, and the result of doing nothing is guaranteed. However, if you invest in the right location and properties today, you will preserve (and grow) your capital and create a passive income that keeps pace with inflation.

Would love all your feedback on this piece.

Post: What’s keeping people from pulling the trigger?

Post: What’s keeping people from pulling the trigger?

- Realtor

- Las Vegas, NV

- Posts 824

- Votes 1,574

@Scott Mac, I like your analogy of lighting the matches. I also agree on tire kickers. Until people accept they have a serious problem and decide to take action, you can't help them. Once they do, then a clear road map can help.

@Bryce Hammill, I agree that too many people only think short term while real estate is long term. If you find a good property in a good location, buy it. In 12 to 18 months, BRRRR it to a lower rate.

It’s tough taking that first step. I will share our roadmap, which should help you get started. Before I do, I want to explain how it came about. My partner and I are engineers who viewed investing as an engineering problem. Our goal was to create a repeatable process that took the guesswork out of investing. We've used this process for many years on hundreds of properties and have had excellent results.

Below is an outline of the roadmap, which should give you a starting point.

First, choose a location. The location defines all long-term income characteristics. The most important metric is that pre-COVID rents increased faster than inflation.

Second, choose a tenant pool segment. Every location has multiple tenant pool segments, and each has different characteristics. Select a segment with a high percentage of dependable tenants. A dependable tenant pays all the rent on schedule, remains employed even in bad times, and stays for many years.

Third, choose properties your selected segment is willing and able to rent. You do this by choosing properties similar to what and where they rent today.

This process identifies the properties that are most likely to produce dependable income.

If you have questions or want specific, let me know.

Post: What’s keeping people from pulling the trigger?

Post: What’s keeping people from pulling the trigger?

- Realtor

- Las Vegas, NV

- Posts 824

- Votes 1,574

@Nathan Gesner, thank you for the thought-provoking advice.

@Garrett Crosby, I am certainly guilty of not educating myself adequately when I first started.

Decades ago, a real estate investment company hired me to write software to automate property selection. Using the available data (the internet did not exist), I created software that ranked properties based on multiple criteria. That's how I became aware of the potential of real estate.

Using the software, I selected a C Class property where cash flow looked excellent, and the price was low. The owner of the real estate company cautioned me about the tenant pool. I was young and stupid and ignored what he said.

A friend and I closed on the property. To keep costs low, we did the renovation ourselves.

We posted fliers on bus stops near the property to attract tenants. Soon, all four units were rented. Things went well for two or three months, and then headaches started.

Even though all tenants signed one-year leases, one tenant skipped after only 3 or 4 months. I contacted the investment company owner for advice. I learned that skips, evictions, and property damage were the norm with C Class properties due to the tenant pool. And, even if we could get a judgment against the tenant, we would not be able to collect. The tenant segment is cash-based, not credit-based, so judgments meant nothing.

Repairing the tenant's damage cost more than the original renovation.

Before we finished, a tenant stopped paying the rent. We filed for eviction. We got them out, but it took two or three months (mainly because we didn't know what we were doing.)

So far, we lost 4 or 5 months of rent due to vacancies and a lot of money for renovations. What was on paper a cash cow, in reality, was actually a money pit.

I could continue my tale, but it is rinse-and-repeat with variations.

Takeaways:

- One of the best days in my life was buying my first property. An even better day was when I sold that property.

- The tenant pool is EVERYTHING when it comes to profitability. Choose a good tenant pool and buy the properties to attract them.

- Paper returns have no relationship to actual returns.

- Never manage your properties. No matter how much a property manager costs, we lost more because we did not know what we were doing.

My subsequent properties did well because I learned the importance of tenant pools. This is why I selected a tenant pool segment with the right characteristics. Then, buy properties that attract that specific tenant pool segment.

Post: What’s keeping people from pulling the trigger?

Post: What’s keeping people from pulling the trigger?

- Realtor

- Las Vegas, NV

- Posts 824

- Votes 1,574

Thank you for your excellent input. I try to provide useful information, but without your feedback, I wouldn’t know if I am on the right track.

- @Bryce Hammill - Analysis paralysis. Excellent point. We see this in some of our new clients, but I didn’t have it on the list. Thanks.

- @Mike Dymski - Fear and incorrect action. People keep looking for “the answer” in podcasts, books, and seminars. Sooner or later, you have to stop looking and start doing.

- @Nate Sanow - On shame and regret, if you have the time, please expand on this. I think these are important, and I did not consider them. In what context are you thinking?

- @Nathan Gesner - Excellent point. I had not considered “negative programming.” Any thoughts on how people can overcome this?

- @Account Closed - Rates - do you mean interest rates? Rates may be a problem today, but people failed to act when rates were low. What do you think about this?

If anyone else has ideas, please post them.

In the next week, I will draft the guide and get back to you for your criticism.

Thank you all again for your input.

Post: What’s keeping people from pulling the trigger?

Post: What’s keeping people from pulling the trigger?

- Realtor

- Las Vegas, NV

- Posts 824

- Votes 1,574

I think fear is what keeps many people from starting. I'm in the process of creating a guide to help people better overcome their fears. Below are what I think are the most common fears.

-

Don’t know where to start

-

Losing money

-

Follow bad pieces of advice

-

Marking bad decisions

-

The mass of conflicting information

-

Buying a bad property

Do you agree that fear is the problem? If you do, what other fears should I include? If not, what is keeping people from acting?

I appreciate your help.

Post: How to minimize your time to rent

Post: How to minimize your time to rent

- Realtor

- Las Vegas, NV

- Posts 824

- Votes 1,574

When your property is vacant, income stops, but expenses continue. You cannot afford a vacant property. How can you reduce the time to rent?

It depends…

Are you purchasing a property?Only buy properties that have a low estimated time to rent. How do you determine how long properties take to rent?

Two options:

- Recent rentals - Check out nearby recently rented similar properties in similar condition. Such properties are a good indicator of how long the property will take to rent.

- Property managers - Property managers consider recent rentals and similar properties currently for rent. An experienced property manager is the best source of time to rent.

Do you already own the property?

Your options are:

- Renovation - Every property competes with all properties tenants perceive as comparable. Renovation enhances your property, so it is more desirable than the competition. Be careful not to over renovate, though.

- Quality photos - People spend $400,000 or $500,000 and another $25,000 for renovation. Then, market the property with photos that look like a crime scene. Properties won’t rent unless you get people to see them. Quality photos of a clean and attractive property get tenants into your property. You can’t afford to not use a professional real estate photographer.

Anybody sees more ways to reduce the time to rent?

Post: Want a dependable rental income? Start with the location

Post: Want a dependable rental income? Start with the location

- Realtor

- Las Vegas, NV

- Posts 824

- Votes 1,574

Hello @Darius Ogloza,

There are three major tenant pool segments in Las Vegas (and I suspect the same in other locations). The image below summarizes segment characteristics. I chose the segment names based on the average length of stay.

Additional information on the segments.

- Transient - This tenant pool is primarily low-skilled hourly workers making little more than minimum wage. The average tenant stay is about one year. The average rent is $950/Mo. The average time to rent is eight weeks. Low-skilled workers are the first ones to be laid off in difficult economic times and the last to be rehired. They are cash-based, so leases, skips, and property damage have no future impact on their lives.

- Permanent - This tenant pool could be hourly or salaried, but they earn well above minimum wage. They are direct income producers for their employers, and their skills cannot be easily replaced. They are rarely laid off, no matter the economy (unless the company is going under). They are credit-based and rarely make late payments. They typically use credit cards and autopay bills. We target families in this segment. The average tenant stay is over five years. We’ve had five evictions in the last +15 years out of a population of over 470 properties.

- Transitional - This tenant pool is salaried and normally home buyers. They typically only rent if there is a significant adverse event in their lives. For example, a divorce, the death of a spouse, etc. Once they sort out the problem, they buy a home. The average stay is less than two years. Unless they are direct line management, they are subject to layoffs during economic downturns.

Let me if you have more questions.

Post: Want a dependable rental income? Start with the location

Post: Want a dependable rental income? Start with the location

- Realtor

- Las Vegas, NV

- Posts 824

- Votes 1,574

Most people start by finding a “deal.” “Deals” are usually low-cost properties.

Buying property based on price or initial return leaves a lot to chance. What do I mean by that?

Below is an illustration showing what you are also buying.

- Tenant pool demographics - Every property is only desirable to a narrow tenant pool segment. Not all tenant pool segments are the same. In Las Vegas, there are three major tenant pools. The annual vacancy cost for the three ranges between $400/Yr and $3,500/Yr. The same is likely true in any location.

- Economic Viability - The location determines the long-term characteristics of the rental income. If the location is in decline or stagnant, the rental income will not keep pace with inflation.

- Whether rents can keep up with inflation

- Maintenance Cost

- Rental restrictions

- Etc.

If you want a dependable rental income, do not leave anything to chance. Start with a good location (market), because your future depends on it. Then select a dependable tenant pool segment. Then after that is the property.

Let me know if you have a different opinion.

Post: 20 Housing Markets Cooling the Fastest

Post: 20 Housing Markets Cooling the Fastest

- Realtor

- Las Vegas, NV

- Posts 824

- Votes 1,574

I recently read an article listing 20 markets that are cooling the fastest. I can’t comment on the other markets mentioned, but I know Las Vegas.

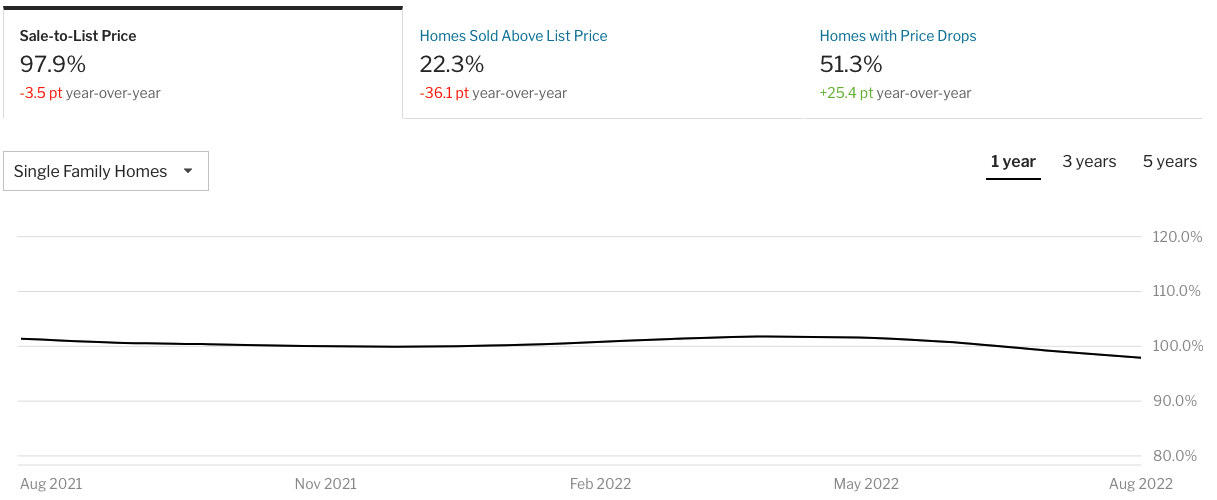

Below is the data I believe they referenced from Redfin for Las Vegas. (Redfin notes that their data is from the local MLS.) It shows the Sale-to-List price ratio and Homes with Price Drops.

While the above data is attention-grabbing, it does not provide useful information or a valid representation of the Las Vegas market. Below are charts from the MLS (10/11/2022), including ALL property types and price ranges.

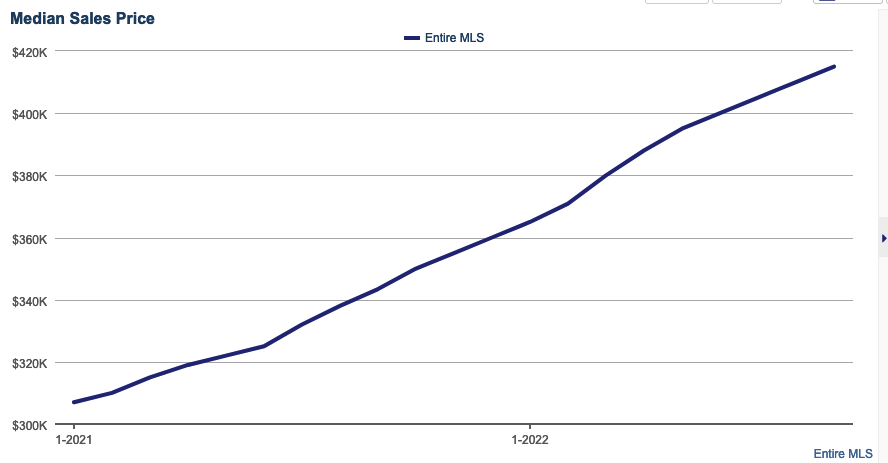

Median Sales Price

Median sales prices continue to rise.

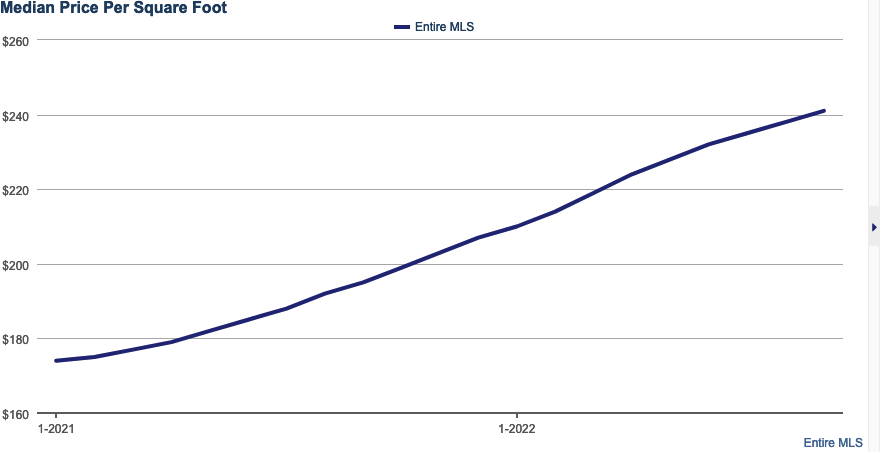

Median Price Per Square Foot

The median price per square foot continues to increase.

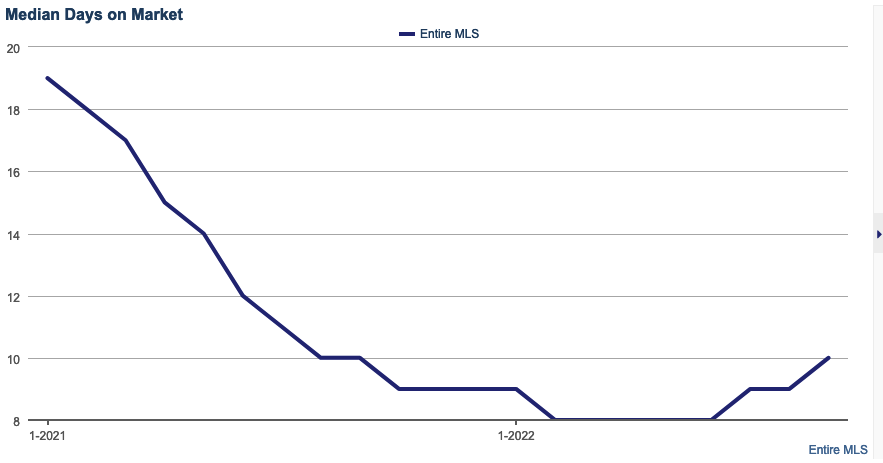

Median Days on Market

In a “normal” market, properties stay on the market for 30 to 45 days. Today, the median number of market days is about ten. So, the market has “cooled” from 8 to 10 days. Not much “cooling,” in my opinion.

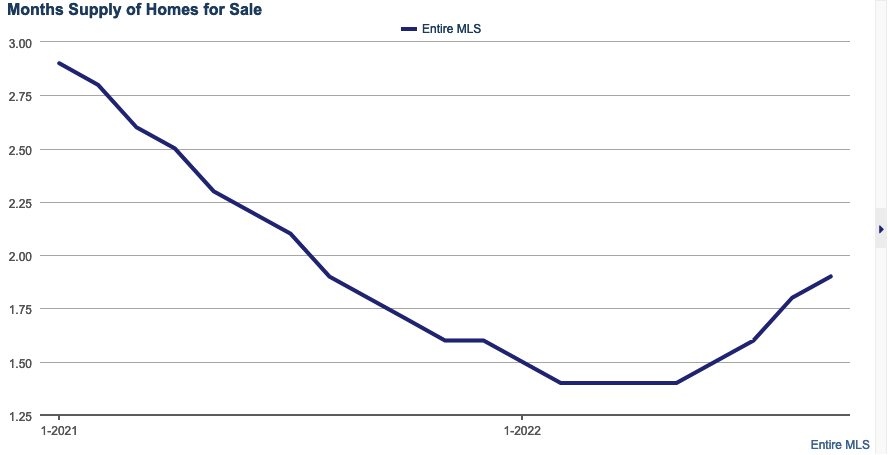

Months of Supply

In Las Vegas, a balanced market is six months of supply. We are approaching two months of supply. There are still more buyers than sellers. Inventory did rise, but we are also approaching the slowest time of the year. So there is a seasonal component. Plus, rising interest rates turn would-be buyers into renters.

Statistics Can Be Misleading

As an engineer, I can tell you that statistics is a great way to make data say anything you like. A quote from Mark Twain.

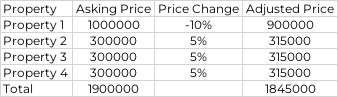

Whenever I hear the word “adjusted,” I know someone altered the data to suit their purpose and should usually be disregarded. For example, based on the following data, I can factually state that home prices fell 2.9% ((1900000 - 1845000)/1900000).

While mathematically correct, it is, at best, misleading. Here is how I would describe the market change. Properties priced at $300,000 increased by 5%. Over the same period, a million-dollar property decreased by 10%.

The error is combining sales data for $300,000 and $1,000,000 properties and taking an average. They are not the same buyer demographic. You can have a high demand for $300,000 homes and little demand for million-dollar homes.

You cannot average apples and oranges and get anything useful.

Summary

Rumors of a significant housing decline in Las Vegas are greatly exaggerated.

Post: Can you afford to buy in a location prone to natural disasters?

Post: Can you afford to buy in a location prone to natural disasters?

- Realtor

- Las Vegas, NV

- Posts 824

- Votes 1,574

Wonderful that your properties were not damaged. What advantage do you see investing in locations with a high probability of natural disasters?

Also, it is not "if" your properties will be damaged. It is when. For example, Mississippi averages between 30 and 100 tornados a year. In 2021, there were 76. It could be this month or 20 years from now. But it will happen. Instead of gambling that your properties will not be destroyed, it is better not to play the game by buying in safer locations.