All Forum Posts by: Eric Fernwood

Eric Fernwood has started 64 posts and replied 789 times.

Post: Investing in Las Vegas NV area

Post: Investing in Las Vegas NV area

- Realtor

- Las Vegas, NV

- Posts 820

- Votes 1,573

Quote from @Mark S.:

Las Vegas is crazy too. I'm a cash buyer, either all up front or 50-60% down - and it's nuts out there. I currently have 10 free and clear.

I'm trying to get an eleventh. I put in offers and others start bidding over list and push me out, sometimes over list by 15K - and usually investors from Cali.

I was lucky to start buying in cash in 2018. For example, townhouses I bought for 240 and now going for 380, condos I bought for 170 are going for 265. Another townhouse I dropped 270 on is now nearing 430.

It's become near impossible for me to buy straight-up in those higher-end areas, because prices are nuts. And I say nuts because 20% down on most properties are nothing, because you lose money even with top market Vegas rent. Right now I'm looking to drop as much as 140K down on my next one and pay it off in full by next year, but I keep getting outbid. I went 6K over list on the last property I place an offer on and I was still outbid. However, I only target the hotter areas in town, because I only want certain types of tenants and very high rent revenue - plus guaranteed equity increases from year to year - all of which I've obtained on my first 10.

Hello Mark,

I applaud your focus on a specific tenant pool in Las Vegas; we’ve done the same for the last 15+ years. While the location defines long-term income characteristics, the tenant pool determines income reliability. Too many people focus on what properties or deals they can get but ignore the types of tenants these properties attract. Different tenant pools have drastically different characteristics. For example, there are three major tenant pools in Las Vegas.

- Transient - Occupies C and B- properties. Average tenant stays < 1 year. Skips, evictions, and property damage are frequent. The average annual vacancy cost is >$4,000/Yr.

- Permanent - This is the tenant pool we target. They occupy A and A- properties. Out of a population of over 470 properties, we’ve had five evictions in the last 15+ years. The average tenant stay is over five years, and our clients had no rent interruptions or decreases during the 2008 crash and COVID. The average annual vacancy cost is about $400/Yr.

- Transitional - This segment normally buys homes; only a small percentage rents. They occupy A properties. They rent during stressful events and typically stay <2 years. The average annual vacancy cost is >$4,500/Yr.

On finding good properties, they are few and far between. We find 5 to 10 properties monthly using our proprietary data mining software. Also, the market recently changed. As inventories increase, we see more good opportunities. For example, the seller paying for point buy-down, etc. However, we do not know how long this will last. The fundamentals of Las Vegas market will drive prices and rents higher over time:

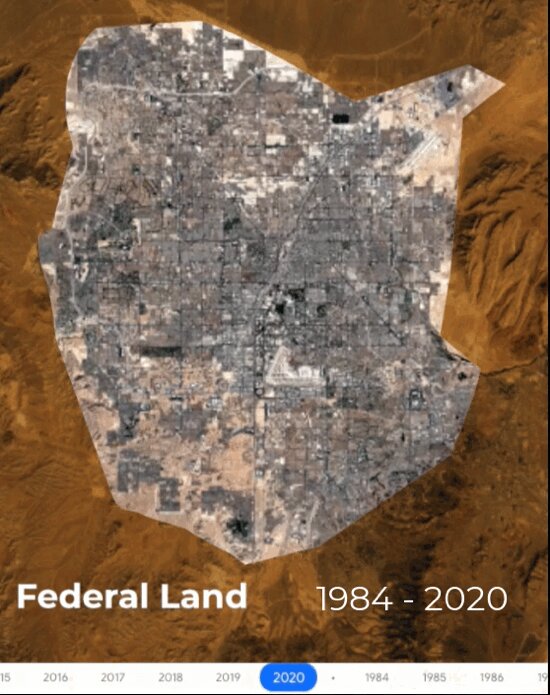

- Land shortage - The population increases by 2% to 3% per year, and the available land for new development is rapidly declining. Below is an aerial view of Las Vegas at the end of 2020. Not much land is available for expansion. Soon, the only option for expansion will be redevelopment. I have never heard of a situation where increasing buyers chased a declining supply where prices did not increase. The land shortage is the primary reason rents and prices will continue to rise.

- Jobs - A rental property is no better than the jobs around it. Various job boards show Las Vegas has between 26,000 and 31,000 open jobs. And, there is currently $22B in new construction, creating even more jobs.

- Jobs - A rental property is no better than the jobs around it. Various job boards show Las Vegas has between 26,000 and 31,000 open jobs. And, there is currently $22B in new construction, creating even more jobs.

- Continuous California exodus - California seems to be doing all it can to force people and companies out of California. As long as this continues, Las Vegas investments will do well.

- Cheap and reliable energy - California commercial energy is $0.237/KwH, and Nevada is $0.102/KwH. Also, Las Vegas is one of the few cities with dual electricity sources (California and Hoover Dam), which results in high reliability.

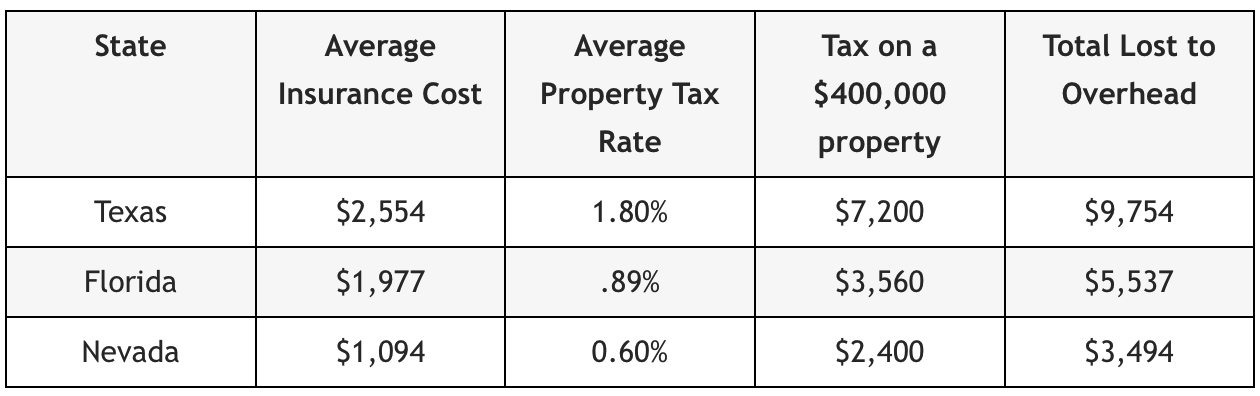

- Low overhead costs - Texas, Florida, and Nevada have no state income taxes and similar average rent/SF, so the cost of insurance and property taxes greatly impact net rental income.

Mark, reach out if we can help.

Post: Housing crash deniers ???

Post: Housing crash deniers ???

- Realtor

- Las Vegas, NV

- Posts 820

- Votes 1,573

Hello Carlos,

I see your point. I should have explained in more detail.

I believe what made the 2008 crash so devastating was the combination of massive job loss and a high percentage of homes underwater. Today is different.

- US unemployment is 3.7%. If people are working, few will be forced to sell their homes.

- I do not recall the percentage of homes underwater during the 2008 crash, but it was a large percentage in some locations. Depending on what report you read, the percentage of underwater homes today is between 2.6% and 3.1%.

If homes had a market value meter, like the stock market, you would see the price go up and down all day/month. The market value of your home does not matter until you decide to sell it. And, homes in all the cities I listed (and many others) purchased two or three years ago are probably not underwater. Also, the 25.2% is if you include the effects of inflation. Still, 18.7% is bad enough.

What is a concern is the financial mismanagement by our federal government. Deficit spending is likely the major source of inflation, and we continue to add major programs that increase the deficit. Another concern is the Federal Reserve. When I listen to the Fed, I question whether they have a clue.

In summary, unless the conditions change significantly, I do not believe we will have a 2008-type crash.

Post: Southwest Drought concerns

Post: Southwest Drought concerns

- Realtor

- Las Vegas, NV

- Posts 820

- Votes 1,573

Hello @Adam Frantz,

I believe every location is different. The Colorado River Compact defines how much water each metro receives. Las Vegas seems to be in better condition than most. For example, below is a quote from this article

However, as you stated, if the water level at Hoover Dam falls significantly lower, Hoover Dam will not generate as much electricity as today. Fortunately, Las Vegas is one of the only major cities in the US with dual electric power sources: Hoover Dam and California. However, I suspect our utility bills may increase if we buy more power from California.

What is the long-term water situation? Below is an article I wrote on the (Las Vegas) water situation.

Around 1890, research showed that the water supply would limit the LA population to about 400,000. Everyone agreed; end of the story. Then William Mulholland, head of the LA water district, proposed building the Los Angeles Aqueduct. A 233-mile-long system to move water from Owens Valley to the San Fernando Valley. Today, the Los Angeles Aqueduct supplies a lot of LA’s water.

About 15 years ago, a study estimated the cost to build a pipe from Las Vegas to a location in Northern Nevada where there is sufficient water at about $2B. However, whether the cost is $2B, $4B, or $20B does not matter. The Resorts World Casino alone cost over $7B to build. No one will shut down a trillion-dollar business (Las Vegas) for a few billion dollars.

One of our clients works for the local water company. I asked him about water usage in the Las Vegas valley and learned that about 80% of the total water consumed is for irrigation in private homes, mostly watering grass. When the water situation gets sufficiently dire, the water company will increase prices, and the lawns will disappear. Grass in the Mojave Desert makes no sense.

What do others think? We have a lot of major projects under construction in Las Vegas; the total is over $22B. All these companies did their homework on the water supply and other potential issues before committing so much money. I trust their research.

In summary, Las Vegas’ water supply is secure for the foreseeable future. Long term, the water need will be met. How it will be met will be resolved in the future.

Post: Housing crash deniers ???

Post: Housing crash deniers ???

- Realtor

- Las Vegas, NV

- Posts 820

- Votes 1,573

Hello Greg,

I do not see a 2008-type housing crash occurring for multiple reasons:

- Few properties are underwater. For example, in Nevada, only about 0.7% are underwater. If people can't handle their mortgage, most will sell the property, bank the profit, and rent.

- Sub-prime loans partially caused the 2008 crash. Since 2010, loan requirements have become much stricter.

- The number of jobs continues to increase - people will be able to make mortgage payments.

While I do not see a major crash, I believe higher interest rates, inflation, and the waning effects of COVID will result in locations reverting to their pre-COVID appreciation and rent growth rates. That is already happening in many cities. A Realtor.com article listed cities where property prices have fallen the most. Below are the top (bottom?) ten and the actual drop once you include inflation:

What Now?

We are where we are. The real question is, “How do we hedge against inflation and position ourselves for the future?”

Select single-family rental homes are the premier choice for hedging against inflation and a volatile stock market. Don’t take my word for it.

- Why Wall Street May Be in the Single-family Rental Market for Keeps

- Investors buying large numbers of homes in Las Vegas

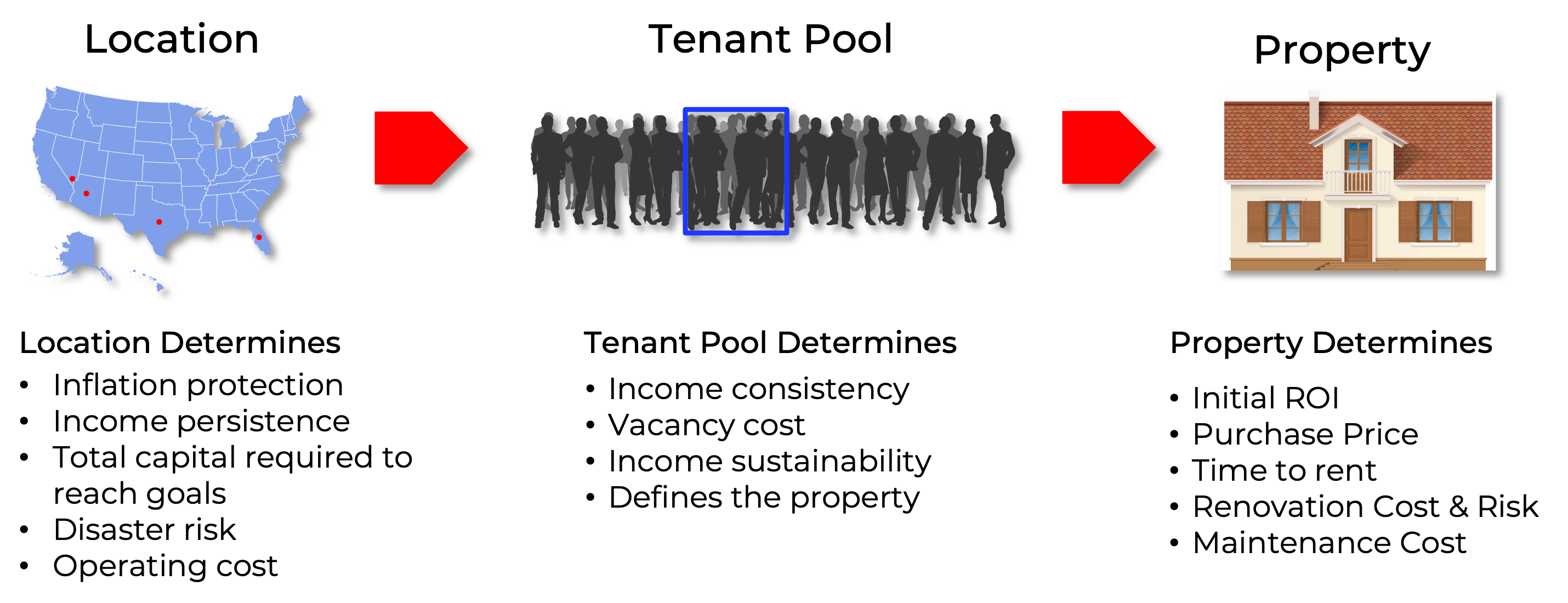

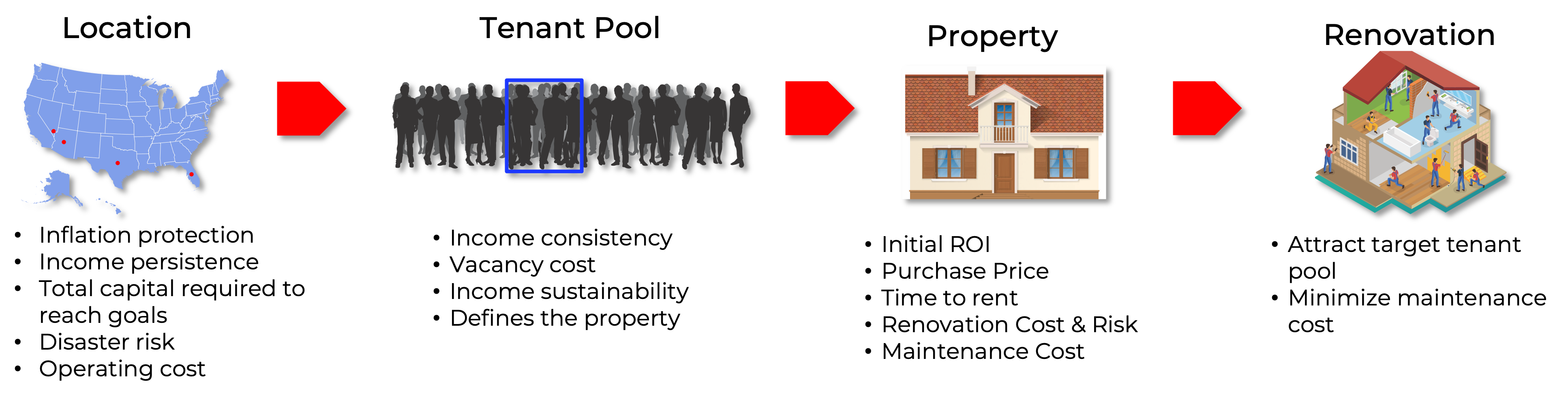

But not just any single-family property will do. You must get three things right to have a dependable passive income and capital appreciation.

- Location

- Tenant pool

- Property

So we are on the same page, I believe a dependable passive income must meet three requirements.

- Reliable - You continuously receive income with minimal interruptions in good and bad economic times.

- Inflation Adapting - Your rental income increases faster than inflation, so you have the additional dollars you need to maintain the same lifestyle.

- Persistent – The income continues for a long time; you and your spouse will not outlive the income.

Below is the order to follow for dependable income properties.

Below is a brief description of the location and tenant pool essentials. If you would like information on the entire process, let me know.

Location

Location requirements:

- Inflation adapting - Pre-Covid rents (and prices) must rise faster than the inflation rate. If rents are not rising faster than inflation, your inflation-adjusted rental income (buying power) will continuously decline.

- Population growth - Both the state and local populations must be increasing. Many things must be right for both state and local populations to increase. If you buy in a location where both state and local populations are not increasing, conditions must be pretty bad to drive people to move to another state. With a declining population, rents and prices will fail to keep pace with inflation.

- Population Size - Metro population greater than 1 million. Small towns rely too much on a single business or market segment.

Once you select the right location, you can start looking for properties now, right? Wrong. You don’t know what to buy. Every property is only attractive to a narrow segment of potential renters. It is critical to only buy properties that attract the tenant pool you need for a dependable income.

Tenant Pool

A dependable passive income depends on your property being continuously occupied by a tenant who:

- Pays all the rent on schedule

- Stays employed in good times or bad

- Takes care of the property, and

- stays for many years.

Only a narrow segment of the entire tenant pool spectrum will have a high concentration of tenants with the above characteristics. Once you select that segment, you can determine what properties to buy by learning the following about the selected tenant pool segment:

Knowing the above, you can create a physical property description any realtor can use to find candidate properties.

People debate whether single-family, condos, or multi-family properties are better. The property type is not your decision. Your tenant pool segment defined all the property characteristics. They even define the renovation elements.

Take a Long-Term View of Each Location

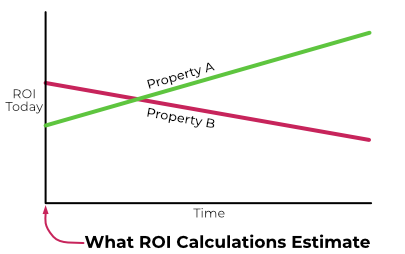

People put too much weight on ROI when selecting an investment location. Return calculations only predict how a property will perform under ideal conditions on day one. Return calculations tell you nothing about the future. Take a look at the two properties below.

Property A is in a location where rent growth and appreciation rise faster than inflation. Property B is in a location where rents and prices are increasing below the inflation rate. Over time, Property B’s rent growth does not keep pace with inflation, so your buying power continuously declines over time. Property A’s rent increases faster than inflation, so your buying power increases over time, despite inflation.

If you selected a location solely by initial return, you would likely end up selecting the location with the higher initial return but a declining rental income. However, if you selected Property A in a high appreciation market, your initial return will be lower, but Property A’s rent growth and appreciation will provide a dependable passive income.

Use It or Lose It

What will you do if you do not invest your cash? The stock market is down 16.8% since the first of the year, and is not expected to improve in the foreseeable future. Many analysts expect high inflation to continue. If you take your money out of the market and put it in a more secure instrument, like a CD or US Treasury bond, you will lose 4% to 6% per year. However, if you invest in the right real estate, even if your initial return might be low, you will have inflation protection, appreciation, rent growth, and tax advantages.

Post: Best places for market research…

Post: Best places for market research…

- Realtor

- Las Vegas, NV

- Posts 820

- Votes 1,573

Hello @Rich Emery,

Excellent question. When faced with an ambiguous situation, I start by establishing an end goal. Based on what you wrote, I believe you have two primary goals.

- A dependable passive income that outpaces inflation and you will not outlive.

- Equity accumulation to enable additional investment property purchases minimizing the total capital required.

If these are your goals, I recommend following the process illustrated below.

In this post, I will only discuss location selection. However, after the location, you must also select the right tenant pool and the right properties that attract those tenants. There is a proven process for tenant pool selection and property selection. If you want information on these processes, let me know.

Location selection is where you need a lot of national-level information. I will briefly describe the critical selection criteria and provide some sources for the information.

Key selection criteria:

- Rental income increases faster than inflation - Unless your rental income increases faster than inflation, you will not have the additional dollars you need to maintain or increase your buying power.

- Jobs - A rental property is no better than the jobs around it. Unless the quantity and quality of jobs are increasing, the location will decline.

- Population - The location will decline unless the state and metro population increase.

- Operating cost - Every dollar you spend on overhead is a dollar lost. There are two types of operating costs. Direct costs and indirect costs. Two major direct costs are property taxes and insurance. Indirect costs include rent control, the inability to remove non-performing tenants, and similar regulations.

- Crime - Any location with high levels of crime are poor investment locations.

- Minimum population size - I recommend only considering metros with a population of 1M or more. Smaller cities tend to be too dependent on a single industry.

Below are the information sources I recommend.

- Population size – Wikipedia

- Metro and state population growth – Wikipedia and PewTrust

- State income taxes – Google

- Crime – Neighborhood Scout - The 100 most dangerous cities in the US. I would not choose any cities on this list.

- Property tax rate – LendingTree has a good comparison.

- Pre-COVID appreciation - COVID distorted price and rent growth. Some areas that performed well for the last two years are declining. For example, below are ten cities that performed during COVID but are now falling. When you take inflation into account, the drop is even greater.

Where can you find pre-COVID rent growth? This data is difficult to obtain except through a local realtor who understands investing. However, rental trends follow price trends, with a two to ten-year time lag. So, if you look at appreciation rates for the years before 2020, you will have an excellent indicator of what was happening with rents. The best source I know of for historical price data is Zillow Research. If properties were not appreciating at least 6% before COVID, I would eliminate the location from consideration.

Summary

If you evaluate potential locations in the order specified, the shortlist will contain cities worthy of further investigation.

Let me know if you are curious about what is next in the process.

Post: QOTW: Is your market reporting an influx of foreclosures?

Post: QOTW: Is your market reporting an influx of foreclosures?

- Realtor

- Las Vegas, NV

- Posts 820

- Votes 1,573

I live in Las Vegas and exclusively work with investors, and I am often asked if there will be another 2008-type crash. The short answer is, “No.” Today’s market is not like in 2008. Below is a comparison.

2008:

- The majority of homes were underwater.

- The only options were short sales or foreclosure.

- Massive lay-offs.

- Construction was at a standstill.

- Population growth was zero after the crash.

Today:

- According to CoreLogic, only 0.7% of homes are underwater in Nevada. Today in MLS (09/14/2022), there are 35 bank-owned properties, 26 short sales, and 26 foreclosures. Short sales typically include foreclosures. Data from our partner title company: the number of NODs recorded in August 2022 is 216; NOS' recorded: 134; Trustee Sales sold: 44. In short, very little distressed properties.

- Today, if homeowners can’t pay the mortgage, they sell their home in days, bank the profit, and rent for the foreseeable future.

- ~3 months of inventory.

- According to GlassDoor, there are currently 31,332 open jobs in Las Vegas.

- $22B is under construction, with more projects announced.

- 2% to 3% annual population growth.

So, I doubt we will see a significant downturn in the Las Vegas market. But what if one does occur? Below is what happened to our clients’ and our income during times of economic stress:

- 2008 crash - Zero decline in rent and zero vacancies.

- COVID - Almost no impact

- Eviction moratorium - No impact

I attribute the results to our targeting the right tenant pool.

While I see little likelihood of a crash, due to higher interest rates and less buyers, we are seeing an increase in inventory and finding some excellent deals.

Post: QOTW: If you've bought a property in 2022, how did you find it?

Post: QOTW: If you've bought a property in 2022, how did you find it?

- Realtor

- Las Vegas, NV

- Posts 820

- Votes 1,573

Hello @Joe S.

Thanks for asking. We exclusively work with investors and mostly individual investors or families. My partner and I aim to provide the “little guys” with software and services that are usually only accessible to “big guys.” We have a high percentage of repeat buyers (>90%). So, we always have many properties we owe existing and new clients. That is why we average >5 properties per month. We could do a higher volume of properties, but we are currently limited on our renovation capacity.

Post: Biggest Mistake in Real Estate

Post: Biggest Mistake in Real Estate

- Realtor

- Las Vegas, NV

- Posts 820

- Votes 1,573

Hello @Ethan Hanes,

Good question. There is a reason 90% of the world’s millionaires made their money through real estate. Real estate investing is relatively simple and secure. However, some people still fail. I have witnessed many and listed below a few reasons that had the biggest impact.

Do Nothing

Doing nothing is the most common cause of failure. For some, it is the desire to find a “perfect” property. Others spend years looking for the right book or seminar to give them the “secret” to success. Spoiler alert! There are no perfect properties and no “secrets” in real estate investing.

Buying in a Bad Location

As long as you buy in a location where prices and rents increase faster than the inflation rate, all but the worst mistakes will be corrected over time through appreciation, inflation, and rent increases. If you buy in a location where rents and prices are not increasing faster than the inflation rate, your inflation-adjusted income will continuously decline. In this case, you can do nothing to turn the situation around other than sell the property.

Not Working with an Investment Team

If you needed surgery, you would not start medical school. Also, not just any doctor will do. You want a surgeon specializing in the surgery you need, not a general practitioner. The same is true with real estate investing. You cannot learn what you need to know in 1 or 50 seminars, books, or podcasts. The information all these sources provide is general knowledge. Real estate is local. Only by working with a local experienced real estate Investment Team that already has all the skills and resources will you maximize your investment dollars.

Selling Winners and Keeping Losers

I was talking to someone about a 1031 exchange. To my surprise, they wanted to keep their loser properties and exchange their winners. Sadly, this is not uncommon. There is even a name for it, the “Disposition Effect.” Investors will sell winners and marvel at their profits but hold onto losers hoping they will “come back.” Following this approach, you almost guarantee a losing portfolio of properties over time. Everyone makes mistakes. Sell the under-performers and buy winners.

If you make any of the above mistakes, your success odds are greatly reduced.

Post: QOTW: If you've bought a property in 2022, how did you find it?

Post: QOTW: If you've bought a property in 2022, how did you find it?

- Realtor

- Las Vegas, NV

- Posts 820

- Votes 1,573

We still find good passive income properties; we average closing five properties each month in 2022. However, good investment properties are always few and far between.

Only about 0.4% of all available properties meet our requirements. We find these properties using the data mining software we developed. The data mining software only selects properties that meet our target tenant pool segment's housing characteristics (property type, configuration, location, and rent range). All properties of interest must then pass a rigorous validation process, including estimated renovation cost and risk.

In 2017 we standardized almost all renovation components and costs. Due to standardization, we can quickly estimate renovation costs using software we developed. Knowing renovation cost enables us to make offers based on the probable total acquisition cost.

The entire process, from candidate property through validation and estimating renovation cost, is typically completed within 24 hours of the property coming on the market. Good properties usually go under contract within three days (it was less than 24 hours in Q1 2022). We usually only get about one out of every seven offers because we have to get the property at the right price and terms.

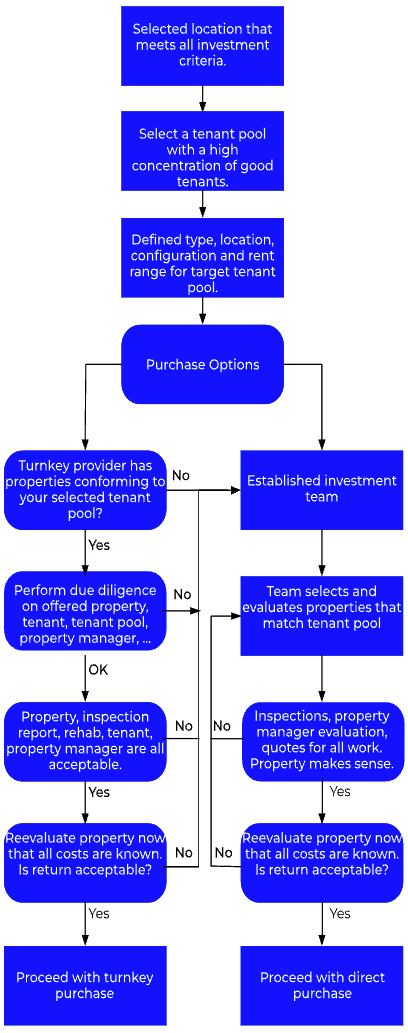

Our processes and software are the result of 15 years of continual process and software improvement. The two founders are engineers, and we approached real estate investing as an engineering problem. So, everything is a documented, repeatable process. The process we followed is illustrated below.

In short, our software and processes (still evolving) enable us to continue finding, closing, and renovating five or more properties each month.

Post: Would you purchase strictly for cash flow?

Post: Would you purchase strictly for cash flow?

- Realtor

- Las Vegas, NV

- Posts 820

- Votes 1,573

Hello @Lane Kawaoka,

You brought up a great topic, turnkey. I am occasionally asked about turnkey vs. working with an investment team.

Turnkey is a purchase method and nothing more. Buying turnkey does not reduce your due diligence. The most important decision you will make is the location, not the property. Select the investment location based on factors including:

- Rent growth and appreciation rate vs. the inflation rate.

- Population size

- Population growth

- Crime

- Disaster risk

- Operational costs

Once you’ve selected the location, the next decision is which tenant pool to target. Every property is only desirable to a narrow tenant pool segment. Choose a tenant pool segment that will provide a reliable income stream (in good times and bad) and only buy properties that the tenant pool segment is willing and able to rent. Once you select your tenant pool segment, all decisions about the property characteristics are defined. Your target tenant pool defines the location, property type, configuration, rent range, and more.

Once you know the characteristics of the properties you want, the next step is deciding how to purchase the property. Two options are direct or turnkey. As an engineer, I believe in processes, not feelings and guesses. So, I put together the following decision tree to help decide which purchase method was best for meeting your goals.

Other considerations

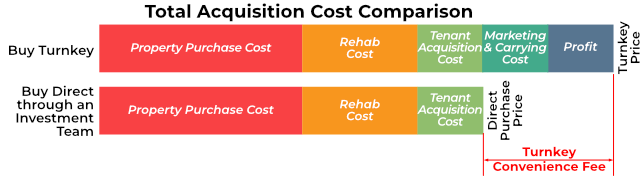

Turnkey Convenience Fee

Turnkey properties will always be more expensive than direct purchases, resulting in a lower return. Turnkey providers must charge enough to cover a renovation, carrying costs, marketing expenses, tenant acquisition, and profit. These costs are in addition to the actual property cost. Below is a diagram illustrating the cost difference between direct vs. turnkey. The difference between a direct purchase and buying turnkey is the "convenience fee.”

Note that while you pay more with turnkey, you will save time. That is the main advantage of buying turnkey.

Property Condition

Most turnkey providers put their money into cosmetics, not systems. Painting, carpet, and light fixtures are low-cost items compared to termites, roof, plumbing, wood rot, electrical, HVAC, and foundation issues. For example, during the inspection of a flipped property, we learned that the plumbing system needed replacement; the flipper just patched over the leaks. A typical cost to re-plumb a house is $10,000 to $20,000. The paint, carpet, and everything else probably cost under $5,000.

I have also heard that some turnkeys do not allow independent property inspectors. Unless I know the actual property condition, how do I know the actual cost? Never buy a property without an independent inspection.

Property Management

One of the selling points for turnkeys is that they manage the property after the sale. The flip side is that you cannot use a different property manager, even if you are dissatisfied with their property manager's performance. While Yelp (and similar) reviews are problematic, read the turnkey's property manager's reviews. One large turnkey property manager has a 1.5 stars rating. Such a poor-performing property manager will result in more frequent tenant turns, which generates more income for the property manager (lease-up fees).

Another claimed advantage of the property manager is their internal maintenance staff. Internal maintenance staffs are an inherent conflict of interest. Property managers make more money on repairs than they do on rent collections. I do not want my maintenance costs to be the property manager's profit center.

If You Decide on Turnkey

I recommend the following as a condition of purchase.

- The right to have an inspection by an independent licensed property inspector.

- A list of all repairs made by the turnkey. You need to know which items (from the inspection report) still need to be corrected. Get a quote for all these repairs, so you know how much the property will cost you, including repairs.

- Get independent rental and sales comps for the property. Compare this to what the turnkey states.

- Get copies of their management and leasing agreement and read them. For example, I've seen terms requiring you to sell the property through the turnkey at a very high commission rate.

- You must have the right to choose the property manager. You want a property manager that works for you, not the turnkey. I have heard that you do not have that option with most turnkeys. Property management is a significant residual income for the turnkey.

- Results from any code inspections. In some locations, the house must pass specific codes to get a certificate of occupancy.

- All disclosures that the property's prior owner provided to the turnkey.

- A written statement from the property manager with specifics on the time and cost to evict a non-paying tenant.

If you obtain all the above, buying turnkey or direct becomes a simple time vs. return decision.