All Forum Posts by: Eric Fernwood

Eric Fernwood has started 64 posts and replied 792 times.

Post: Buying Property in high Unemployment area/low population growth

Post: Buying Property in high Unemployment area/low population growth

- Realtor

- Las Vegas, NV

- Posts 823

- Votes 1,574

Hello @Hung T Nguyen,

If your goal is dependable passive income, location is your most important investment decision. The most important criteria is that pre-COVID rent growth exceeded the inflation rate. Unless the rent growth exceeds the inflation rate, you will not have the necessary additional dollars to continue buying the same goods and services you did in the past due to the effects of inflation. There are a few locations that meet this criteria. For example, since 2013, Las Vegas rent growth has far exceeded the inflation rate.

Location is only the first step in achieving dependable passive income. After location, the second most important investment decision is the tenant pool segment. Each tenant pool segment has different characteristics. For example, there are three major tenant pools in Las Vegas. They have an average length of stay of 1 year, >5 years, and 2 years. So selecting a tenant pool segment that stays long is important to have a reliable income and low vacancy cost.

Once you select a tenant pool, you buy properties that your target tenant pool is willing and able to rent. Thus, the tenant pool defines the characteristics (type, configuration, location, and rent range) of properties you buy. We’ve targeted a narrow tenant pool segment for the last 15 years. Below are our 15-year results from >450 properties:

- Average rent growth of 8% since 2013.

- Average appreciation of over 15% since 2013

- The average tenant stay is over 5 years.

- Only 5 evictions in 15 years

- 2008 crash - Zero decline in rent and zero vacancies.

- COVID - Almost no impact

- Eviction moratorium - No impact

- 2022 YoY rent growth 18%, appreciation 32%

We achieved these results through the combination of the right location, tenant pool, and property selection. And, even though the major employers in Las Vegas are tourism related, the tenant pool we target is not affected by a tourism slowdown. Low-paid, low-skilled workers primarily occupy the lower-cost properties in Las Vegas. Whenever there is a tourism slowdown, low-skilled workers are the first to be laid off and the last to be rehired.

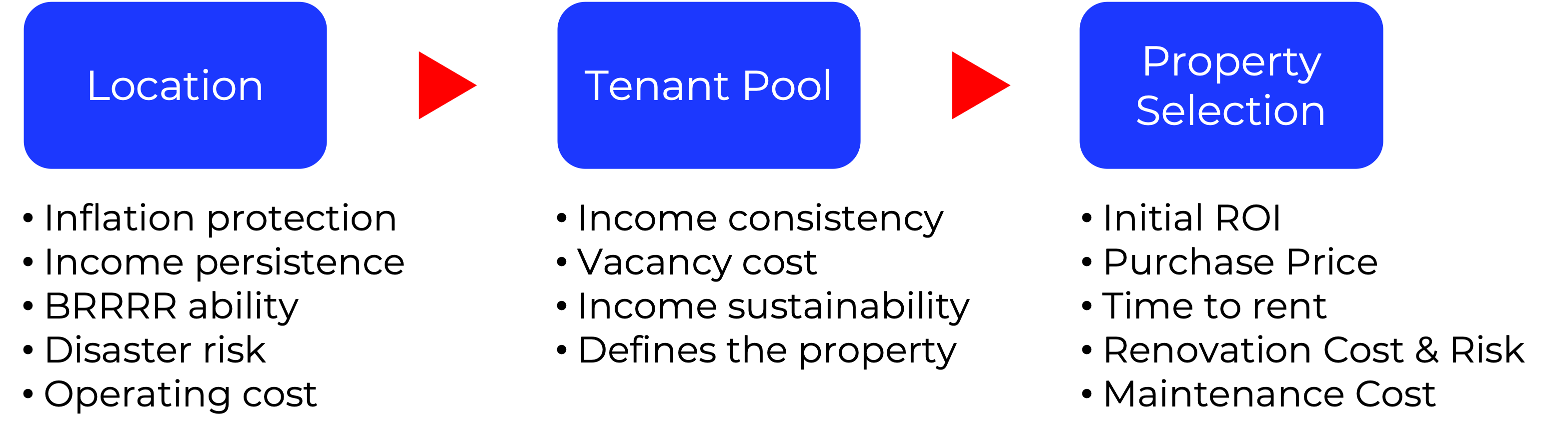

If you follow the process steps below, your probability of acquiring dependable passive income properties is high.

Hung, I hope this helps.

Post: Out of State Investing

Post: Out of State Investing

- Realtor

- Las Vegas, NV

- Posts 823

- Votes 1,574

Hello @Vidal Gonzales,

If your goal is a dependable passive income, the most important decision you will make is the location. The location determines all the long-term characteristics of an investment property necessary for a dependable passive income. The following is how I define a dependable passive income.

- Reliable - You continuously receive the income with minimal interruptions, in good and bad economic times.

- Inflation Adapting - Your rental income increases faster than inflation, so you have the additional dollars you need to maintain the same lifestyle.

- Persistent – The income continues for a long time; you and your spouse will not outlive the income.

Once your goals are defined, the next step is to select a location that will provide a dependable passive income. The most important criteria is that pre-COVID rent growth was greater than the current inflation rate. As long as you buy in a location where rents and prices increase faster than the inflation rate, appreciation and rent increases will correct all but the worst mistakes. However, if you buy in a location where prices and rents increase below the inflation rate, you can do nothing to reverse the situation.

Below are some of the most important criteria by which I would evaluate potential locations based on dependable passive income characteristics.

- Inflation Protection - Unless your rental income increases as fast as or faster than inflation, your buying power will decline. The best indicator for inflation protection is the pre-COVID appreciation rate. Why pre-Covid? Covid distorted many markets. Locations that have not seen rent or price growth in years started performing. Such increases were transitory since the economic fundamentals of these markets have not fundamentally changed. And prices in many locations are reverting to the pre-COVID conditions.

- Jobs - Rental properties are no better than the jobs around them. And, it is not just the number of jobs, the quality (how much these jobs pay) matters too. Also, it is not just about the jobs your tenants have today. Companies have an average life span of about ten years. Even S&P 500 corporations only have an average life of 18 years. So every job your tenant pool currently has will disappear in the next 10 to 20 years. Unless the location has new employers setting up operations and creating new replacement jobs that pay similar wages and require similar skills, the area will decline, and your rents will fall or, at best, fail to keep pace with inflation. One metric for determining the economic health of a metro area is inflation-adjusted median household income. Check the St. Louis federal reserve site for this sort of information.

- Population - Prices and rents are driven by demand. Where there is little demand, prices and rents are low. And there is insufficient demand to increase prices and rents at or above the current inflation rate. A good indicator of rising demand is population growth. Only invest in locations where both the state and location population are increasing.

- Operating Costs - It does not matter how much rental income you gross. What matters is how much you net after deducting all operating expenses. There are two types of operating costs; direct costs and indirect costs. Direct costs include insurance and property taxes and such. Do not buy in any location with high insurance and property taxes. Your cash flow must be much higher in these locations to offset the high insurance and property taxes. Indirect costs can be even more expensive than direct costs. These include regulations, code compliances, rental restrictions and the cost and time to remove non-performing tenants.

- Crime - Crime is far more prevalent in some locations than others. Employers considering locations for expansion will not create new operations in locations perceived as a high crime. The best source of high crime cities is Neighborhood Scouts' top 100 most dangerous US cities list.

If you’d like to dive deeper, I have a free training video that goes into more detail about the above process. You can access it from the link below or my profile page.

A couple of additional thoughts:

- ROI and similar metrics are only a snapshot in time. They predict how the property will likely perform under ideal conditions on day one. Such metrics do not indicate how property and location are likely to perform over the long term. What is likely to happen over the next ten years is far more important than what happens on day one.

- Low-cost locations are very tempting. However, prices are driven by demand, and prices and rents only increase in high-demand locations, with higher prices than in low-demand locations. You cannot afford to buy in a location where pre-COVID price and rent growth were less than the inflation rate.

Vidal, I hope the above helps.

Post: Thoughts on investing out of state?

Post: Thoughts on investing out of state?

- Realtor

- Las Vegas, NV

- Posts 823

- Votes 1,574

Hello @Brandon Gamblin,

Live where you like but invest where you can achieve your investment goals. The need for a dependable passive income location is why many people invest remotely. Of the 150 to 200 clients we've worked with, only 10 or 12 lived locally; all the rest lived in other states or countries. We know remote investing works because over 90% of our clients buy more than one property, and over 80% buy more than two.

As to where to invest, select a location where you can achieve a dependable passive income. My definition of a dependable passive income is as follows:

- Reliable - You continuously receive the income with minimal interruptions, in good and bad economic times.

- Inflation Adapting - Your rental income increases faster than inflation, so you have the additional dollars you need to maintain the same lifestyle.

- Persistent – The income continues for a long time; you and your spouse will not outlive the income.

Below is an illustration of the process I recommend following:

- Goals - Start with your goals. If your goal is to acquire low-cost properties, there are many places you can purchase them. You might want to wait on such locations because many have declining prices. If your goal is dependable passive income, the most important consideration is whether the location’s rental income has consistently exceeded the inflation rate for many years before COVID. What happened during COVID is not relevant today.

- Location - The most important investment decision you make is the location, not the property. The critical decision factor is whether rents consistently increased faster than the inflation rate before COVID.

- Tenant pool - After location, the most important decision is the tenant pool. The only way to have a dependable passive income is if your properties are continuously occupied by tenants that pay all the rent on schedule, remain employed in good times and bad, stay for many years, and take care of the properties.

- Property - Only buy properties that your target tenant pool is ready, willing, and able to rent at full rental value.

If you follow the process above, the odds of consistently acquiring dependable passive income properties are high. I know this because this is the process my partner and I developed and followed for the past 15+ years, and it has delivered over 450 passive income properties that consistently performed in good or bad times (through the 2008 crash and Covid).

Whatever location you choose, you need a local investment team, not just an investor-friendly realtor.

In summary, only buy where you can achieve a dependable passive income. Once you select a location, find a good local investment team and work through your team to reduce time, money, and risk.

Post: Everyone is saying its a bad time to get into real estate?

Post: Everyone is saying its a bad time to get into real estate?

- Realtor

- Las Vegas, NV

- Posts 823

- Votes 1,574

Hello @Serge DuLaudAllemans,

Whether to invest now or wait depends on your goals. If your goal is to buy inexpensive properties, then waiting might be a good option. Prices are already falling in many locations, and more will follow.

However, if your goal is acquiring dependable passive income, I only advise waiting if you believe one of the two conditions is likely to occur.

- Interest rates will drop significantly soon. I see this as unlikely since the inflation rate just increased (officially) to 9.1%. Until inflation is under control, I see no likelihood that interest rates will fall significantly.

- Prices will drop significantly soon. In many locations, this is already occurring. But not in locations where pre-COVID demand drove prices faster than the inflation rate. Price and rent increases in such locations were driven by actual demand, not by pandemic effect or speculation. Such locations might slow down, but I do not expect a significant decrease in prices or rents due to ongoing demand.

What is the downside of waiting if you plan on investing in one of the appreciating markets?

- Lost appreciation - Appreciation is where you make the most money and how you grow your portfolio with the least capital.

- Higher prices and higher interest rates - Due to the demand, prices will continue to increase, and until inflation is under control, so will interest rates. Waiting will cost you more money.

Serge, I hope this helps.

Post: I am paralyzed - can’t pick a market

Post: I am paralyzed - can’t pick a market

- Realtor

- Las Vegas, NV

- Posts 823

- Votes 1,574

Hello @Nerlande Joseph,

Instead of listing locations as opinions, I will show you a process for selecting good investment locations.

The location you choose is defined by your goal. If your goal is a dependable passive income, the location is your most important decision. So we are on the same page, a dependable passive income must meet three requirements:

- Reliable - You continuously receive the income with minimal interruptions, in good and bad economic times.

- Inflation Adapting - Your rental income increases faster than inflation, so you have the additional dollars you need to maintain the same lifestyle.

- Persistent – The income continues for a long time; you and your spouse will not outlive the income.

Selecting a dependable passive income location is the second step in the process of consistently buying dependable passive income properties. The order of the steps is illustrated below.

Below are some of the most important criteria by which I would evaluate potential locations based on dependable passive income characteristics.

- Inflation Protection - Unless your rental income increases faster than inflation, your buying power will decline. The best indicator for inflation protection is the pre-COVID appreciation rate. Why pre-Covid? Covid distorted many markets. Locations that have not seen rent or price growth in years started performing. Such increases were transitory since the economic fundamentals of these markets have not changed. And prices in many locations are reverting to the pre-COVID conditions.

- Jobs - Rental properties are no better than the jobs around them. And, not just the number of jobs is important; the quality (how much these jobs pay) matters too. Also, it is not just about the jobs your tenants have today. Companies have an average life span of about ten years. Even S&P 500 corporations only have an average life of 18 years. So every job your tenant pool currently has will disappear in the next 10 to 20 years. Unless the location has new employers setting up operations and creating new replacement jobs that pay similar wages and require similar skills, the area will decline, and your rents will fall or, at best, fail to keep pace with inflation. One metric for determining the economic health of a metro area is inflation-adjusted median household income. Check the St. Louis federal reserve site for this sort of information.

- Population - Prices and rents are driven by demand. Where there is little demand, prices and rents are low. And there is insufficient demand to increase prices and rents at or above the current inflation rate. A good indicator of rising demand is population growth. Only invest in locations where both the state and location population are increasing.

- Operating Costs - It does not matter how much rental income you gross. What matters is how much you net after deducting all operating expenses. There are two types of operating costs; direct costs and indirect costs. Direct costs include insurance and property taxes and such. Do not buy in any location with high insurance and property taxes. Your cash flow must be much higher in these locations to offset the high insurance and property taxes. Indirect costs can be even more expensive than direct costs. These include regulations, code compliances, rental restrictions, and the cost and time to remove non-performing tenants.

- Crime - Crime is far more prevalent in some locations than others. Employers considering locations for expansion will not create new operations in locations perceived as a high crime. Neighborhood Scouts’ top 100 most dangerous US cities list is the best source of high crime cities I’ve found.

Once you select a location that meets all the above requirements, the next step is to choose a tenant pool. The only way to have a dependable passive income is if a “good” tenant continuously occupies the property. I will not go into details about the tenant pool here but if you’d like to learn more, I have a free training video that goes into more details. You can access it from the link below or my profile page.

Nerlande, I hope the above is enough to get you started. Feel free to reach out to me if you have questions.

Post: What state(s) should I look into buying rental properties?

Post: What state(s) should I look into buying rental properties?

- Realtor

- Las Vegas, NV

- Posts 823

- Votes 1,574

Hello @Gregorio Villar,

If your goal is a dependable passive income, the most important decision you will make is the location. The location determines all the long-term characteristics of an investment property necessary for a dependable passive income. The following is how I define a dependable passive income.

- Reliable - You continuously receive the income with minimal interruptions, in good and bad economic times.

- Inflation Adapting - Your rental income increases faster than inflation, so you have the additional dollars you need to maintain the same lifestyle.

- Persistent – The income continues for a long time; you and your spouse will not outlive the income.

Selecting a dependable passive income location is the second step in a process for consistently buying dependable passive income properties. The order of the steps is illustrated below.

If you’d like to learn more, I have a free training video that goes into more detail about the above process. You can access it from the link below or my profile page.

Below are some of the most important criteria by which I would evaluate potential locations based on dependable passive income characteristics.

- Inflation Protection - Unless your rental income increases faster or faster than inflation, your buying power will decline. The best indicator for inflation protection is pre-COVID appreciation rate. Why pre-Covid? Covid distorted many markets. Locations that have not seen rent or price growth in years started performing. Such increases were transitory, since the economic fundamentals of these markets have not changed. And prices in many locations are reverting to the pre-COVID conditions.

- Jobs - Rental properties are no better than the jobs around it. And, not just the number of jobs is important; the quality (how much these jobs pay) matters too. Also, it is not just about the jobs your tenants have today. Companies have an average life span of about ten years. Even S&P 500 corporations only have an average life of 18 years. So every job your tenant pool currently has will disappear in the next 10 to 20 years. Unless the location has new employers setting up operations and creating new replacement jobs that pay similar wages and require similar skills, the area will decline, and your rents will fall or, at best, fail to keep pace with inflation. One metric for determining the economic health of a metro area is inflation-adjusted median household income. Check the St. Louis federal reserve site for this sort of information.

- Population - Prices and rents are driven by demand. Where there is little demand, prices and rents are low. And there is insufficient demand to increase prices and rents at or above the current inflation rate. A good indicator of rising demand is population growth. Only invest in locations where both the state and location population are increasing.

- Operating Costs - It does not matter how much rental income you gross. What matters is how much you net after deducting all operating expenses. There are two types of operating costs; direct costs and indirect costs. Direct costs include insurance and property taxes and such. Do not buy in any location with high insurance and property taxes. Your cash flow must be much higher in these locations to offset the high insurance and property taxes. Indirect costs can be even more expensive than direct costs. These include regulations, code compliances, rental restrictions and the cost and time to remove non-performing tenants.

- Crime - Crime is far more prevalent in some locations than others. Employers considering locations for expansion will not create new operations in locations perceived as high crime. The best source of high crime cities is Neighborhood Scouts top 100 most dangerous US cities list.

A couple of additional thoughts:

- ROI and similar metrics are only a snapshot in time. They predict how the property will likely perform under ideal conditions on day one. Such metrics do not provide any indication of how property and location is likely to perform over the long term. What is likely to happen over the next 10 years is far more important than what is likely to happen on day one.

- Low-cost locations are very tempting. However, prices are driven by demand, and prices and rents only increase in high-demand locations, with higher prices than in low-demand locations. You cannot afford to buy in a location where pre-COVID price and rent growth were less than the inflation rate.

Gregorio, I hope the above helps. Also, I see that you live in Las Vegas. If you select the right tenant pool and properties, Las Vegas meets all the dependable passive income requirements.

Post: Invest now or wait for recession?

Post: Invest now or wait for recession?

- Realtor

- Las Vegas, NV

- Posts 823

- Votes 1,574

Hello @Marcos Carbi,

Whether we will have a soft, hard, or no recession depends on which “expert” you listen to. Also, the “experts” provide national opinions, as if every location in the US is the same. Every location is different. Real estate is local. You need to understand the economies of each location and their susceptibility to economic turbulence. Also, some tenant pools are more prone to be laid off than others, even in the same location.

Whether to invest now or wait depends on your goals. If your goal is to buy inexpensive properties, then waiting is a good option. Prices are already falling in many locations, and more will follow.

If your goal is acquiring dependable passive income, I only advise waiting if you believe one of the two conditions is likely to occur.

- Interest rates will decrease significantly in the near future. I see this as unlikely since the inflation rate just increased (officially) to 9.1% (07/13/2022). Until inflation is under control, I see no likelihood that interest rates will fall significantly.

- Prices will drop significantly in the near future. In many locations, this is already occurring. But not in locations where pre-COVID demand drove up prices faster than the current inflation rate (Las Vegas is an example). Price and rent increases in such locations were driven by actual demand, not by pandemic effect or speculation. Such locations might slow down, but I do not expect a significant decrease in prices or rents due to ongoing demand.

What is the downside of waiting?

- Lost appreciation - Appreciation is where you make the most money and how you grow your portfolio with the least capital.

- Higher prices and higher interest rates - Due to the demand, prices will continue to increase and until inflation is under control, so will interest rates. Waiting will cost you more money.

In short, the decision to wait or act now depends on your goal and the market (and tenant pool) you are investing into.

Post: New Investor - Which market to pick?

Post: New Investor - Which market to pick?

- Realtor

- Las Vegas, NV

- Posts 823

- Votes 1,574

Quote from @Account Closed:

Hello,

My name is Jason and I'm a new real estate investor. I'm having trouble deciding on a market as this is my first purchase. I plan to purchase a MRH in order to Brrrr. I'm familiar with the following areas either be because of college, friends, or family.

- DC/Alexandria, VA

- Blacksburg, VA

- Richmond/Henrico, VA

- Gainesville, FL

- Austin, TX

- San Antonio, TX

- San Francisco, CA (I live here)

I'm willing to look outside those markets, but would love to hear reasons behind that.

Thank you

Not every location will meet everyone’s goal. So, instead of providing a list of locations, I will provide the process I would follow for selecting a location. That way, you can alter the process to match your specific goal.

Dependable Passive Income

So we are on the same page, my investment goal is dependable passive income streams, not just buying properties. My definition of a dependable passive income is as follows:

- Reliable - You continuously receive income in good and bad economic times.

- Inflation Adapting - Your rental income increases faster than inflation, so you have the additional dollars you need to maintain the same lifestyle.

- Persistent – The income continues for a long time; you and your spouse will not outlive the income.

To meet all three requirements, you must follow a process. The one we use is illustrated below.

I will briefly walk through each step, but focus on location selection.

Location

Location is the most important investment decision; it is not the property. The location determines all long-term characteristics. When evaluating a potential investment location, choose one that meets the following requirements.

-

Inflation adjusting - The dollar's buying power is decreasing; you see this every time you go to the store or buy gas. Inflation is currently at about 8.5%. Unless your rental income increases faster than the current inflation rate, you will not have the needed dollars to maintain the same standard of living. For example, suppose your rental properties generate $10,000/Mo. At 8% inflation, in 10 years, you will need $20,000/Mo. to buy the same set of goods and services as you can today for $10,000/Mo. If your rental income increases to $20,000/Mo. over 10 years, you did not have an increase in buying power; your rental income just maintained the same buying power. If your rent did not increase to $10,000, your buying power declined. If this is the case, your living standard will also decline. The critical metric for determining whether your rental income will rise fast enough is pre-COVID rent and price growth rate. If rents and prices did not keep pace with inflation before COVID, rents will not keep pace once COVID effects go away. For example, prices in many cities are starting to decline, and many more will follow. Below are 10 cities where prices fell the most over the last 12 months.

-

Income reliability - A rental property is no better than the jobs around it. If your tenant is unemployed, they are not paying the rent. And, it is not just the jobs they have today. Companies and corporations have a limited life span. The national average for companies is 10 years. The average life of an S&P 500 is only 18 years and falling. So, new employers must be setting up new operations in the location, creating new jobs that pay similar wages as your tenant pool is earning today and requires similar skills. Indicators for a location that will have the current and future jobs needed to keep your tenants employed and paying rent:

- Increasing state and metro population - The state and metro population must be increasing. If the state or metro area is flat or losing population, do not consider it. Moving to a different location is expensive, both financially and emotionally. If conditions are bad enough for the population to decrease, many things must be undesirable.

- Low crime - Eliminate any city listed on Neighborhood Scout’s list of the 100 most dangerous cities in the US. Companies considering new operation locations and people looking for a place to live will not consider any city on this list.

-

Low operating costs - People and companies are fleeing high tax states due to the cost of living and doing business. Regulations, rental restrictions, and similar indirect costs are a financial burden. There are also direct costs for investors like property and state income taxes. All of these indirect and direct costs are a direct hit on the net income from the property. Also, regulations like rent control and eviction restrictions may prevent you from raising the rent fast enough to keep pace with inflation or removing non-paying tenants.

-

Low probability of natural disaster - I regularly see pictures of communities devastated by tornadoes, hurricanes, floods, etc. When such a natural disaster occurs, the entire community is destroyed. Even if your insurance company builds back your property, all the jobs, retail, and services are gone. Your tenant pool will not wait years for your property to be rebuilt. People and companies will immediately move to where they can live and work today. So, if a disaster occurs, you may be in a position where you have the same overhead (mortgage, taxes, insurance, etc.) and no tenants are paying the rent. Are such disasters common? No. I view natural disasters like I view cancer. The odds of your getting cancer are relatively small. But, if you do get cancer, it is devastating, and “odds” mean nothing. The best metric I know for evaluating natural disaster risk is comparing the cost of homeowners insurance (ValuePenguin is one such source). The states that are the most prone to natural disasters are California, Texas, Oklahoma, Washington, Florida, New York, New Mexico, Alabama, Colorado, Oregon, and Louisiana. Do not buy in high-risk locations.

After Selecting a Location

Tenant Pool

The next step in the process is selecting a good tenant pool. The only way to have a dependable passive income is if your property is continuously occupied by what I define as a good tenant. I define a good tenant as someone who:

- Has stable employment in a market segment that is very likely to be stable or improve over time

- Has a credit history with which you can evaluate the likelihood that they will perform

- Pays all the rent on schedule

- Takes care of the property

- Does not cause problems with neighbors

- Does not engage in illegal activities while on the property

- Stays for many years

Property Selection

Once you select a good tenant pool, you target them through the properties you purchase. You want to select properties that your target tenant pool is willing and able to rent. I will not go into specifics but there is a direct relationship between the tenant pool and the properties they are willing and able to rent.

Renovation

Renovation is transforming a property that your target tenant pool is willing and able to rent into one that will rent quickly and for full market value. Also, renovate to minimize long-term maintenance costs. There are many considerations when it comes to renovating the right way.

Summary

If you just want to buy properties and you do not care if the rent keeps pace with inflation, is reliable, or persistent, almost any location will do. If you want a dependable passive income that you will not outlive, will keep pace with inflation and is reliable and persistent, then the location is the most important decision you will make. I put together the following simplified process, which will enable you to quickly eliminate locations that will not meet your passive income requirements.

Thanks for your time,

…Eric

Post: Best Places To Buy Investment Properties In America

Post: Best Places To Buy Investment Properties In America

- Realtor

- Las Vegas, NV

- Posts 823

- Votes 1,574

Not every location will meet everyone’s goal. So, instead of providing a list of locations, I will provide the process I would follow for selecting a location. That way, you can alter the process to match your specific goal.

Dependable Passive Income

So we are on the same page, my investment goal is dependable passive income streams, not just buying properties. My definition of a dependable passive income is as follows:

- Reliable - You continuously receive income in good and bad economic times.

- Inflation Adapting - Your rental income increases faster than inflation, so you have the additional dollars you need to maintain the same lifestyle.

- Persistent – The income continues for a long time; you and your spouse will not outlive the income.

To meet all three requirements, you must follow a process. The one we use is illustrated below.

I will briefly walk through each step, but focus on location selection.

Location

Location is the most important investment decision; it is not the property. The location determines all long-term characteristics. When evaluating a potential investment location, choose one that meets the following requirements.

-

Inflation adjusting - The dollar's buying power is decreasing; you see this every time you go to the store or buy gas. Inflation is currently at about 8.5%. Unless your rental income increases faster than the current inflation rate, you will not have the needed dollars to maintain the same standard of living. For example, suppose your rental properties generate $10,000/Mo. At 8% inflation, in 10 years, you will need $20,000/Mo. to buy the same set of goods and services as you can today for $10,000/Mo. If your rental income increases to $20,000/Mo. over 10 years, you did not have an increase in buying power; your rental income just maintained the same buying power. If your rent did not increase to $10,000, your buying power declined. If this is the case, your living standard will also decline. The critical metric for determining whether your rental income will rise fast enough is pre-COVID rent and price growth rate. If rents and prices did not keep pace with inflation before COVID, rents will not keep pace once COVID effects go away. For example, prices in many cities are starting to decline, and many more will follow. Below are 10 cities where prices fell the most over the last 12 months.

-

Income reliability - A rental property is no better than the jobs around it. If your tenant is unemployed, they are not paying the rent. And, it is not just the jobs they have today. Companies and corporations have a limited life span. The national average for companies is 10 years. The average life of an S&P 500 is only 18 years and falling. So, new employers must be setting up new operations in the location, creating new jobs that pay similar wages as your tenant pool is earning today and requires similar skills. Indicators for a location that will have the current and future jobs needed to keep your tenants employed and paying rent:

- Increasing state and metro population - The state and metro population must be increasing. If the state or metro area is flat or losing population, do not consider it. Moving to a different location is expensive, both financially and emotionally. If conditions are bad enough for the population to decrease, many things must be undesirable.

- Low crime - Eliminate any city listed on Neighborhood Scout’s list of the 100 most dangerous cities in the US. Companies considering new operation locations and people looking for a place to live will not consider any city on this list.

-

Low operating costs - People and companies are fleeing high tax states due to the cost of living and doing business. Regulations, rental restrictions, and similar indirect costs are a financial burden. There are also direct costs for investors like property and state income taxes. All of these indirect and direct costs are a direct hit on the net income from the property. Also, regulations like rent control and eviction restrictions may prevent you from raising the rent fast enough to keep pace with inflation or removing non-paying tenants.

-

Low probability of natural disaster - I regularly see pictures of communities devastated by tornadoes, hurricanes, floods, etc. When such a natural disaster occurs, the entire community is destroyed. Even if your insurance company builds back your property, all the jobs, retail, and services are gone. Your tenant pool will not wait years for your property to be rebuilt. People and companies will immediately move to where they can live and work today. So, if a disaster occurs, you may be in a position where you have the same overhead (mortgage, taxes, insurance, etc.) and no tenants are paying the rent. Are such disasters common? No. I view natural disasters like I view cancer. The odds of your getting cancer are relatively small. But, if you do get cancer, it is devastating, and “odds” mean nothing. The best metric I know for evaluating natural disaster risk is comparing the cost of homeowners insurance (ValuePenguin is one such source). The states that are the most prone to natural disasters are California, Texas, Oklahoma, Washington, Florida, New York, New Mexico, Alabama, Colorado, Oregon, and Louisiana. Do not buy in high-risk locations.

After Selecting a Location

Tenant Pool

The next step in the process is selecting a good tenant pool. The only way to have a dependable passive income is if your property is continuously occupied by what I define as a good tenant. I define a good tenant as someone who:

- Has stable employment in a market segment that is very likely to be stable or improve over time

- Has a credit history with which you can evaluate the likelihood that they will perform

- Pays all the rent on schedule

- Takes care of the property

- Does not cause problems with neighbors

- Does not engage in illegal activities while on the property

- Stays for many years

Property Selection

Once you select a good tenant pool, you target them through the properties you purchase. You want to select properties that your target tenant pool is willing and able to rent. I will not go into specifics but there is a direct relationship between the tenant pool and the properties they are willing and able to rent.

Renovation

Renovation is transforming a property that your target tenant pool is willing and able to rent into one that will rent quickly and for full market value. Also, renovate to minimize long-term maintenance costs. There are many considerations when it comes to renovating the right way.

Summary

If you just want to buy properties and you do not care if the rent keeps pace with inflation, is reliable, or persistent, almost any location will do. If you want a dependable passive income that you will not outlive, will keep pace with inflation and is reliable and persistent, then the location is the most important decision you will make. I put together the following simplified process, which will enable you to quickly eliminate locations that will not meet your passive income requirements.

Thanks for your time,

…Eric

Post: QOTW: What are your "hard pass" items when evaluating real estate

Post: QOTW: What are your "hard pass" items when evaluating real estate

- Realtor

- Las Vegas, NV

- Posts 823

- Votes 1,574

Quote from @Alicia Marks:

Welcome to our Question of the Week! We have a lot of people who are entering the world of real estate investment who could use your wisdom. When evaluating a property, what are your automatic no or exclusion list items and why? Was there an experience that caused you to exclude them? How did you handle that experience?

Let's help each other learn to analyze a deal quickly and effectively. Share your thoughts!

Good question. Unfortunately, there is no short answer. So my answer will make sense, I will first explain my overall property selection process.

Consistently acquiring dependable passive income properties is a process. We've delivered over 400 passive income properties, and we know our process works because >90% of our clients buy 2 or more properties. The process is illustrated below.

The first step is to select the location. While there are multiple criteria a dependable passive income location must meet, I will mention three.

- Inflation protection - Unless your rental income rises faster than inflation, you will no longer be able to continue buying the same goods and services. Any location where rents do not keep pace with inflation is a declining market and will not provide the dependable passive income you want.

- Jobs - Your rental property is no better than the jobs around it. So the major employers of your tenant pool must be doing well today and likely to do better in the future.

- Population - An excellent barometer of the desirability of a location is the population change. If the state and city's population increases, the location will have increasing demand, which drives up prices and rents. If the population at either the state or city level is not increasing, the city is in decline and not a good place to invest.

Now that you understand the importance of the location to dependable passive income, I will next talk about the property. Many people take the approach of buying a property only based on the initial ROI. I disagree with this approach for two reasons.

- First, ROI and similar metrics only predict how the property is likely to perform on day one of a lifetime hold; ROI tells you nothing about how the property will likely perform in the future.

- When you select a property, you are selecting much more than just the property. Every property will only attracts a narrow tenant pool segment. When you select a property, you get the default tenant pool segment for that property and a lot more. See the diagram below.

Choosing the property first is the wrong approach. After selecting a good passive income location, select a tenant pool segment that:

- Consistently pays all the rent on schedule.

- Remains employed in good times and bad.,

- Takes care of the property

- Stays for many years.

Only if such a tenant continuously occupies your property will you have a dependable passive income.

Now that you understand my dependable passive income process steps (location > tenant pool > property), I will list my "hard pass" items.

My hard pass items fall into the following categories:

Desirability to your target tenant pool

To attract your target tenant pool, the property must meet a minimum set of tenant pool specific requirements.

- Type: Condo, high rise, single-family, etc.

- Configuration: For example, 2,000SF, two bedrooms, three-car garage, large back yard, single-story, two stories, etc.

- Location: Where the target tenant pool wants to live.

- Rent range: Usually about 1/3 of the median gross monthly household income for your target tenant pool segment.

Any property that does not conform to all 4 of the above is eliminated from further consideration.

Renovation cost and risk

There are two primary renovation considerations for any renovation, cost, and risk. There are the two cost considerations.

- Can you afford the renovation? Acquisition cost = down payment + closing costs + renovation cost + startup costs. The property is eliminated if I cannot afford the total cash required.

- Will the total acquisition cost exceed the property's market value? I will eliminate the property if the total acquisition cost (Purchase price + renovation cost) exceeds the market value.

Renovation risk is always a big consideration. Below are examples of high-risk renovation items.

- Foundation issues

- High water

- Structural

- Mold

- Improper wiring (aluminum, etc.)

- Fire damage

- Some roof damage

- Dry rot

- Settlement

- Termites

- Significant plumbing issues

- Water damage

We eliminate any property from consideration with any high-risk renovation due to the unpredictability of the total renovation cost.

Maintenance Cost

The only way to have low-cost maintenance is not to buy properties that require a lot of maintenance. Below are some generalizations about the property and ongoing maintenance cost

- Older properties require more maintenance than newer properties.

- The tenant pool has a large impact on your ongoing maintenance cost.

- Composition roofs require more maintenance than tile roofs.

- Properties in climates with hard freezes require more maintenance than properties in mild climates.

- Properties in locations with a lot of moisture require more maintenance than dry climates.

- Wood siding requires more maintenance than aluminum or stucco siding.

- Properties with lush vegetation require more maintenance than properties with little or no vegetation.

- Locations with high levels of termite activity will require more maintenance than areas with little or no termite activity.

Future rentability

Today, almost anything will rent in the Las Vegas market due to high demand and limited rental inventory. However, this was not always the case and will not always be the case in the future. During the 2008 crash, I studied which properties were rented and which did not. We eliminate any property type or configuration that did not rent well during the 2008 crash. While this is location and tenant pool specific, below is an example property with several negative characteristics, any one of which would cause us to eliminate a property from consideration.

Long answer to a short, but excellent, question.