All Forum Posts by: Eric Fernwood

Eric Fernwood has started 64 posts and replied 789 times.

Post: Where to begin with cash on hand

Post: Where to begin with cash on hand

- Realtor

- Las Vegas, NV

- Posts 820

- Votes 1,572

Hello @Adam Berlinberg,

I will assume that you are looking for a long-term passive income to supplement or eventually replace your current income. If this is the case, you need an investment strategy, not simple ratios and short-term objectives. In this post, I will discuss a process for selecting the right location/market, tenant pool, properties, and the importance of working with an investment team.

Passive income streams must meet three criteria.

- Reliable - You must receive all the rent, on schedule, every month, during good times and bad. And, rents must keep pace with inflation.

- Low Operating Cost - Operating costs are a direct hit to cash flow.

- Minimize - Time, money, and risk.

What are the drivers for these three criteria? See the table below.

Consolidating the drivers and ranking in order of importance:

- Location/Market

- Tenant Pool

- Investment Team

- Specific Property

I will not go into detail on each driver but I will mention some important considerations.

Location - the most important investment decision

The location determines long-term passive income reliability, inflation adaptability, operating cost, risk, and the total capital required to grow your portfolio. While there are several criteria for location selection, the most important is (pre-COVID) appreciation. I will demonstrate why.

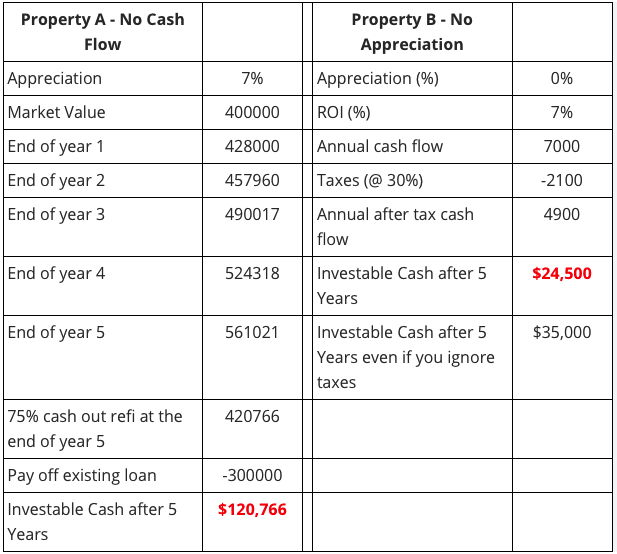

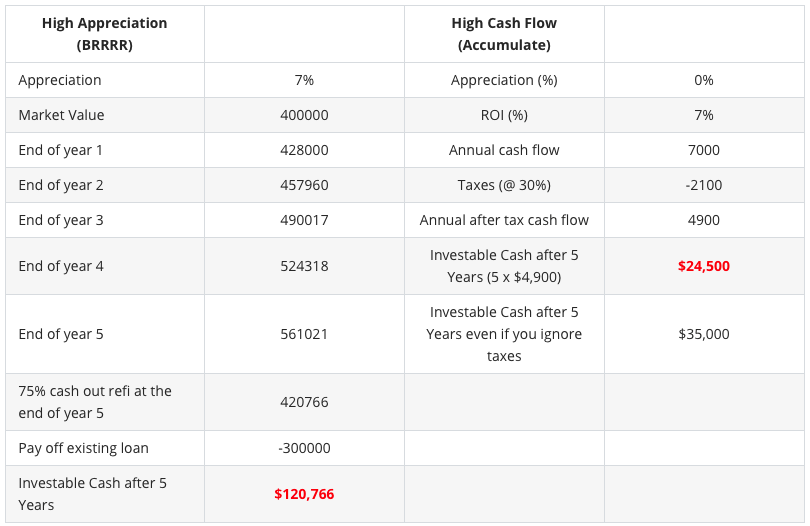

Below is an oversimplified example comparing appreciation vs. cash flow. Property A has 7% appreciation and no cash flow (you would never do this). Property B has no appreciation but 7% cash flow. All other factors (inflation, etc.) are ignored. Look at the amount of cash you will have for investment after five years of ownership under these two situations.

As you can see, at the end of 5 years, you can do a cash-out refi and would have $120,000 to buy another investment property. You have substantially less if you purchased a property focusing on initial cash flow.

Reduced total capital required is only one benefit of selecting a high-appreciation location. In addition, prices and rents are linked. So, if prices are rising, rents will also increase. High appreciation locations have higher cash flow over time than locations with lower appreciation rates where rents fall behind inflation, reducing your buying power and standard of living.

Tenant Pool - the second most important investment decision

The only way to consistently make money is to keep the property continuously occupied by what I call a "good" tenant. A good tenant is someone who:

- Has stable employment in a market segment that is very likely to be stable or improve over time

- Has a credit history with which you can evaluate the likelihood that they will perform

- Pays all the rent on schedule

- Takes care of the property

- Does not cause problems with neighbors

- Does not engage in illegal activities while on the property

- Stays for many years

Once you select a tenant pool with the highest concentration of good tenants, you can determine what properties they are willing and able to rent.

Property Selection

You select properties that your target tenant pool is willing and able to rent. The characteristics of these properties are a reflection of the specific tenant pool. See the image below. On the left is the process prospective tenants follow to select a property. On the right is the property's physical description that matches the target tenant pool.

However, it is not just the physical property characteristics that matter. Each property must optimize the following 5 aspects:

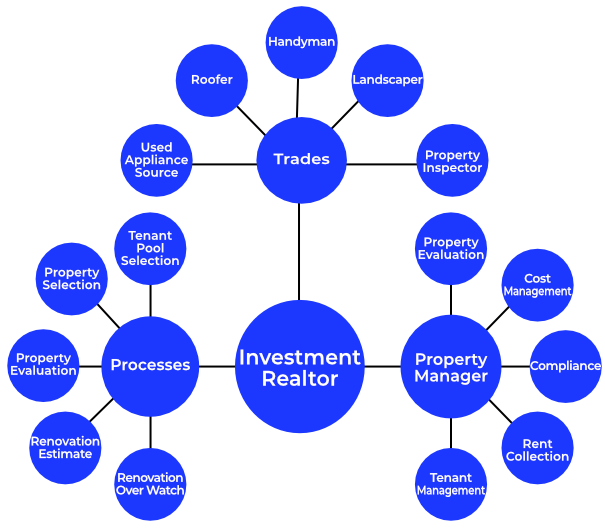

Investment Team

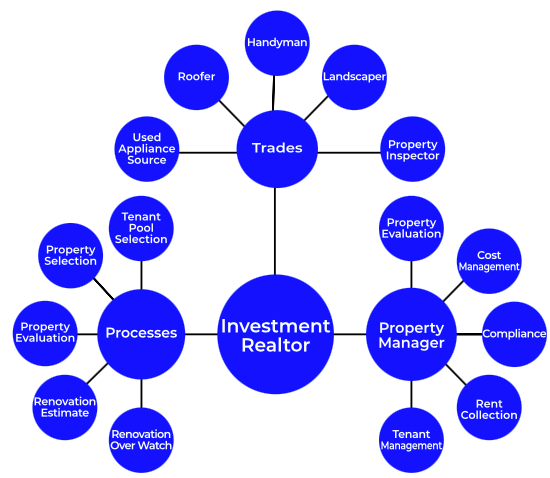

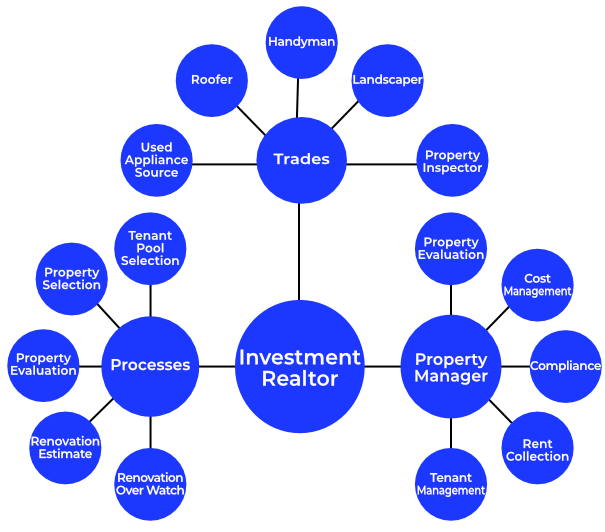

If you needed surgery, you would not start medical school. Also, not just any doctor will do. You want a surgeon specializing in the kind of surgery you need, not a general practitioner. The same is true with real estate investing. Why re-invent the wheel? Work with an investment team that already has the skills and a proven track record of finding, qualifying, renovating, and managing properties. A good investment team costs you nothing and will minimize your time, risk, and money. If you try to do everything yourself, it will cost you more, require far more time, and the odds of success are much lower. (Note that turnkeys are not an investment team. Turnkeys sell packaged properties at a premium price to maximize their profits, not yours.) Also, an investor-friendly Realtor is not an investment Realtor. Investor-friendly Realtors do not have the resources and team you need. Below are the skills investment Realtors and their team provide. Do not spend the time, money, and effort to duplicate what an experienced investment team already provides. Instead, find a good investment Realtor who already has everything you need to succeed.

Note, when you work with an investment team, you are the CEO. You do need a basic understanding of real estate investing but not all the gritty details. Let your investment team do all this for you.

Summary

Real estate is the simplest and most reliable path to financial independence. If you buy good properties in good locations, real estate provides a reliable, inflation compensating, passive income stream you will not out live. Do not fall for short term returns and magic ratios. Work with an investment team to develop a long term strategy.

Post: Feedback on Turkey- Memphis Investment Properties company

Post: Feedback on Turkey- Memphis Investment Properties company

- Realtor

- Las Vegas, NV

- Posts 820

- Votes 1,572

Hello @Mina Skoutelakis,

Turnkey is a purchase method, nothing more. Buying turnkey does not reduce your due diligence effort.

Location

Start by selecting an investment location. The location is the most important investment decision you will make. Select a location that meets all the following criteria.

- Appreciation - The number one location selection criteria is appreciation. Inflation constantly erodes buying power; each year, it costs more to buy the same set of goods. If you buy in a location where pre-COVID prices and rents increased faster than the current inflation rate, you will continue to have the funds you need. If not, the initial cash flow will be the highest you will ever receive, and you will have a continuously declining standard of living.

You may have noticed that I use rent increase and appreciation interchangeably. The reason is that appreciation and rents are tied together. If prices increase (appreciation), rent will follow, but with a 2 to 10-year lag depending on the market. What is happening with property prices before COVID is an excellent indicator of what will happen with rents in the future.

- Population Size - Greater than 1 million. Small towns may rely too much on a single business or market segment.

- Population Growth - If people are moving into a location, many things have to be right. Never invest in any location where the population is stagnant or declining.

- Crime - People and companies will not move to locations perceived as dangerous. One source of cities to avoid is Neighborhood Scout's 100 most dangerous cities. Avoid any city on this list.

- Disaster Risk - Some parts of the country are more prone to natural disasters. The best indicator for natural disaster probability is homeowners insurance cost. I would avoid states with high insurance rates. Note, even if insurance pays for all the damage your property suffers, you still lose. When a significant disaster occurs, people and jobs move to locations where they can make money today. The location may take years to recover, or it may never recover. ValuePenguin is a good source for the relative cost of insurance by state.

- Operational Costs - Costs like property taxes, insurance cost, state income taxes, regulatory costs (ex: time and cost to evict), inspections, rent control, etc., have a tremendous impact on your return. Select a location with relatively low operational costs. Operational costs are a direct hit on profitability.

If you select a location that meets all the above criteria, you are off to a good start. The next step is to decide what to buy. It is not as simple as buying a property that looks like a good investment. When you buy a property, you also select many things that you cannot change in the future. See the diagram below.

As shown in the diagram, the property defines the tenant pool. The vacancy cost differences between tenant pools can be huge. For example, there are three major tenant pool segments in Las Vegas. Below is an illustration showing the annual vacancy cost for each.

Determine the tenant pool you want to target by interviewing multiple local property managers. The best tenant pool will have a high concentration of "good" tenants. I define a good tenant as someone who:

- Has stable employment in a market segment that is very likely to be stable or improve over time.

- Has a financial history that shows they are stable and pay all their bills on schedule.

- Does not engage in illegal activities while on the property

- Does not cause problems with neighbors

- Takes care of the property

- Stays for many years

Once you know the tenant pool you want to target, you can then define the property characteristics this tenant pool is willing and able to rent. Below is the least you need to know.

- Type: Condo, high rise, single-family, etc.

- Configuration: For example, 2,000SF, two bedrooms, three-car garage, large back yard, single-story, two stories, etc.

- Location - Where your target tenant pool wants to live.

- Price - You must profitability rent the property within the target tenant pool's rent range.

- Wants - Tenant pool specific property features. For example, bars on the first-floor windows might be very important for one tenant pool. For another tenant pool, it might be granite kitchen counters.

Now that you know what kind of the properties you want to buy, the next step is to decide on a purchase method.

Turnkey vs. Investment team

Turnkey

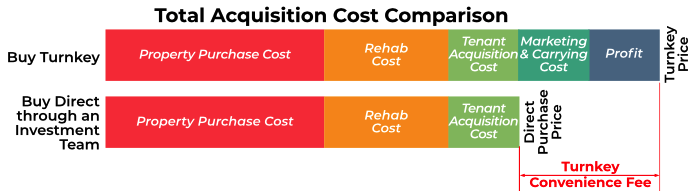

In general, turnkey properties will always be more expensive than a direct purchase, which results in a lower return and lower equity. Turnkey providers must charge enough to cover renovation, carrying costs, marketing expenses, tenant acquisition, and profit. These costs are in addition to the actual property acquisition cost. Below is a diagram illustrating the cost difference between direct vs. turnkey. The difference between a direct purchase and buying turnkey is what I call the "convenience fee."

Note that even though you pay more with turnkey and have a lower return and equity, you save time. Convenience is the main value of buying turnkey.

Investment Team

An investment team has all the skills you need to acquire investment properties including the following.

Most of the services will be low cost and some will be free to you as the buyer. Working with an investment team will increase your return and initial equity, but it will take more of you time.

Turnkey Considerations

Below are two of the concerns I have heard from people who purchased turnkey.

Property Condition

Most turnkey providers put all their money into cosmetics, not systems. Painting, carpet, and light fixtures are small cost items compared to termites, roof, plumbing, wood rot, electrical, HVAC, and foundation issues. For example, during a recent inspection of a flipped property, we learned that the plumbing system was shot and the flipper patched over leaks. Estimated cost to re-plumb the house,$10,000. In comparison, the paint and carpet and everything else probably cost under$5,000.

I have also heard that some turnkeys do not provide an independent inspection report or even allow the property to be inspected. Unless you know the property's actual condition, how do you know the actual acquisition cost? Never buy a property without an independent property inspection. Also, do not use a property inspector recommended by the turnkey company.

Property Management

One of the selling points for turnkeys is that they manage the property after the sale. The flip side is that you cannot use a different property manager, even if you are dissatisfied with their property manager's performance. Read the turnkey's property manager's reviews. One large turnkey's property manager has a rating of 1.5 stars based on a large number of reviews. Such a poor-performing property manager will result in more frequent tenant turns, generating more income for the property manager and lower returns for you.

If You Decide on Turnkey

I recommend the following as a condition of a turnkey purchase.

- The right to have the property inspected by an independent licensed property inspector of your choosing.

- A list of all repairs made by the turnkey to the property - you need to know which items (from the inspection report) still need to be corrected. Get a quote for all the needed repairs so you know how much the property actually costs.

- Get independent rental and sales comps for the property. This will enable you to compare market rent and property value vs. what the turnkey is stating.

- Get copies of their management and leasing agreement and read them. For example, I've seen management agreement terms requiring you to sell the property through them at a very high commission rate. This may not seem important today but will be very important in the future when you decide to sell.

- You must have the right to choose the property manager. You want a property manager that works for you, not the turnkey. From what I have heard, you do not have that option with most turnkeys. Property management and maintenance is where turnkeys derive a lot of their income.

- You will receive all disclosures provided by the prior owner of the property to the turnkey. In some locations, the seller must provide detailed disclosures on the condition of the property.

- A written statement from the property manager with specifics on the time and cost to evict a non-paying tenant. Then, confirm what they state with multiple sources.

If you obtain all the above, buying turnkey or direct becomes a simple time saved vs. return decision.

Post: Las Vegas Market - Best Investment Areas

Post: Las Vegas Market - Best Investment Areas

- Realtor

- Las Vegas, NV

- Posts 820

- Votes 1,572

Hello @Sarah Hoffer,

Good questions. We've worked with several house hackers and have some considerations.

- All multi-family properties in Las Vegas are in high-crime distressed areas, and I do not recommend any of these properties.

- With house hacking, you need to be aware of homeowner associations. All associations that I know of prohibit house hacking (subdividing a unit). So, avoid properties within associations.

- You will want to select a property with four or more bedrooms and baths. However, the number of baths must be proportional to bedrooms. The number of baths must not be less than bedrooms - 1. So, if you have a four-bedroom property, you must have at least three bathrooms.

- Be aware of the renovation materials. LVP performs exceptionally well. Also, be aware of the paints. Never paint walls with flat paint. If you like, reach out to me and I can provide you with the paints and colors that we use on our rental properties.

- You will likely put locks on the bedroom doors. We use Kwikset Smart Key locks because you can easily rekey them yourself. If you use standard locks, it will cost $55 or more per rekey, a waste of money, and an inconvenience.

- While your initial need for the property is house hacking, you may want to make it a long-term rental in the future. So, you need to be very aware of your tenant pool. For example, the tenant pool we target has an average stay of over five years. The 2008 crash and COVID had no impact on our target tenant pool. We've had five evictions in the last 15 years.

- Always have room mates sign a lease that clearly states when money is due and the result of being late. Also, duties, like keeping the kitchen clean, where to park cars, etc.

- Do not buy weird properties; stick with one or two-story homes.

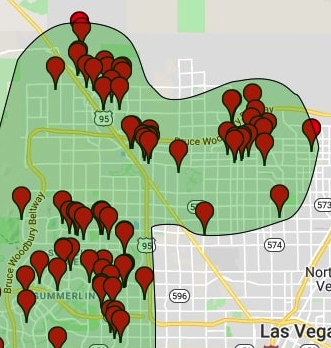

- Below is a map of some of our client's properties from 2018, which should give you an idea of where our clients own properties in the northern part of the Las Vegas metro.

Post: Methods of looking for good deals in greater Seattle areas

Post: Methods of looking for good deals in greater Seattle areas

- Realtor

- Las Vegas, NV

- Posts 820

- Votes 1,572

Hello @Xiaolong Yin,

There may not be any multi-family properties that generate the cash flow and return you are seeking in Seattle. There are none in Las Vegas. But, be aware that there is a significant difference between paper and actual returns.

A few years ago, we studied vacancy costs for the three major tenant pool segments in Las Vegas. The results are shown in the table below.

For example, suppose I owned a C Class 4-plex generating an 8% return. I will assume that the property costs $400,000. If I ignore debt service, management, maintenance, etc., the annual paper rent would be $32,000/Yr or 8% cash/cash. If I subtract vacancy cost (4 x $3,200), the net rent reduces to $19,200/Yr, or a 4.8%. Also, consider maintenance costs. With a 4-plex, you have 4 water heaters, toilets, appliances, HVAC, etc.

Properties are not islands. When you buy a property, you also lock in multiple other costs, regulations, and more, as shown below.

When you buy a property in Seattle, you also buy the regulatory environment. Seattle has a pro-tenant, anti-landlord regulatory environment. For example:

- The Seattle City Council passed the bills last month. The first requires landlords to give six months’ notice of any rent increase, up from the current two months. The second requires landlords to pay certain tenants relocation assistance if the landlord raises the rent by 10% or more and the tenant moves out.

- Mayor Durkan Announces January 15, 2022 Extension of Eviction Moratorium and Continuation of Additional COVID-Related Protections

- On Thursday, the Washington State Supreme Court ruled in favor of a Seattle law that requires landlords to rent on a first-come, first-served basis. It’s called the “first-in-time” rule.

All of these regulatory costs reduce your profitability. I am aware of these costs and regulations because we have had multiple clients use 1031s to sell their Seattle properties and buy in Las Vegas, which is landlord-friendly.

In summary, when you are evaluating a property, do not rely on the paper return. Determine vacancy cost, the cost of regulations, and much more for your property and tenant pool, and include all these costs in your calculations. You will be surprised at the difference between paper and probable return. The best place to get such cost information is to interview multiple local property managers with a significant population of units under management similar to what you are considering.

Post: How do YOU Screen for your Markets (specifically out of state)

Post: How do YOU Screen for your Markets (specifically out of state)

- Realtor

- Las Vegas, NV

- Posts 820

- Votes 1,572

Hello @Isaiah J Aragon,

I applaud your methodical process. I went through the same exercise 15 years ago and knowing what I know now may be able to help you narrow down your search. I approached location selection based on metro areas, not states.

Location

I recommend selecting a location that meets all the following criteria.

- Appreciation - The number one location selection criteria is appreciation. Inflation constantly erodes buying power; each year, it costs more to buy the same set of goods. If you buy in a location where pre-COVID prices and rents increased faster than the current inflation rate, you will continue to have the funds you need. If not, the initial cash flow will be the highest you will ever receive, and you will have a continuously declining standard of living.

You may have noticed that I use rent increase and appreciation interchangeably. The reason is that appreciation and rents are tied together. If prices increase (appreciation), rent will follow, but with a 2 to 10-year lag depending on the market. What is happening with property prices today is an excellent indicator of what will happen with rents in the future.

- Population Size - Greater than 1 million. Small towns may rely too much on a single business or market segment.

- Population Growth - If people are moving into a location, many things have to be right. Never invest in any location where the population is stagnant or declining.

- Crime - People and companies will not move to locations perceived as dangerous.

- Operational Costs - Costs like property taxes, insurance cost, state income taxes, regulatory costs (ex: time and cost to evict), inspections, rent control, etc., have a tremendous impact on your return. Select a location with relatively low operational costs. Operational costs are a direct hit on profitability.

- Disaster Risk - Some parts of the country are more prone to natural disasters. The best indicator for natural disaster probability is homeowners insurance cost. I would avoid states with high insurance rates. Note, even if insurance pays for all the damage your property suffers, you still lose. When a significant disaster occurs, people and jobs move to locations where they can make money today. The location may take years to recover, or it may never recover. ValuePenguin is a good source for the relative cost of insurance by state.

I recommend you apply the above filters in the following order, from quickest to most time-consuming.

- Population size. - Wikipedia.com

- Disaster Risk - Homeowners insurance cost. Landlord insurance is 10% to 20% higher than homeowners, but there are good state-by-state comparisons for homeowners insurance. - valuepenguin.com

- Crime - One source of cities to avoid is Neighborhood Scout's 100 most dangerous cities. Avoid any city on this list.

- Population growth - Wikipedia.com

- Operational Costs - Your approach to eliminate blue states is good. I know of no blue state with reasonable operational costs. Another filter is property tax rates. For example, Texas has no state income tax, but it does have high property tax rates.

- Appreciation - Pre-COVID. Zillow research is the best option I know. Look at zipcode pre-COVID appreciation rates, not metro averages.

At this point, you should have a small set of potential cities. The next thing you need to be successful is a good investment team.

Investment Team

If you needed surgery, you would not start medical school. Also, not just any doctor will do. You want a surgeon specializing in the kind of surgery you need, not a general practitioner. The same is true with real estate investing. You want to work with an investment team that already has the skills and contacts. Good investment teams are hard to find. Start with an investment Realtor (not an "investor-friendly" Realtor). Know that even in a large metro area, there is likely only one or at most two investment Realtors. While finding an investment Realtor may take time, the cost, risk, and time savings will be worth it. See the image below for the range of skills you need to succeed.

If you select a city that conforms to all the criteria I listed and found a good local investment team, you should do well.

Post: How to invest a considerable amount in RE

Post: How to invest a considerable amount in RE

- Realtor

- Las Vegas, NV

- Posts 820

- Votes 1,572

Hello @Yosef Itav,

In my opinion, if a property cannot generate a positive cash flow on day one and have a high appreciation rate, you need to look somewhere else. I have never understood buying an investment property and operating at a loss.

Location

When you are considering an investment location, select a location that meets all the following criteria.

- Appreciation - The number one location selection criteria is appreciation. Inflation constantly erodes buying power; each year, it costs more to buy the same set of goods. If you buy in a location where pre-COVID prices and rents increased faster than the current inflation rate, you will continue to have the funds you need. If not, the initial cash flow will be the highest you will ever receive, and you will have a continuously declining standard of living.

You may have noticed that I use rent increase and appreciation interchangeably. The reason is that appreciation and rents are tied together. If prices increase (appreciation), rent will follow, but with a 2 to 10-year lag depending on the market. What is happening with property prices today is an excellent indicator of what will happen with rents in the future.

- Population Size - Greater than 1 million. Small towns may rely too much on a single business or market segment.

- Population Growth - If people are moving into a location, many things have to be right. Never invest in any location where the population is stagnant or declining.

- Crime - People and companies will not move to locations perceived as dangerous. One source of cities to avoid is Neighborhood Scout's 100 most dangerous cities. Avoid any city on this list.

- Disaster Risk - Some parts of the country are more prone to natural disasters. The best indicator for natural disaster probability is homeowners insurance cost. I would avoid states with high insurance rates. Note, even if insurance pays for all the damage your property suffers, you still lose. When a significant disaster occurs, people and jobs move to locations where they can make money today. The location may take years to recover, or it may never recover. ValuePenguin is a good source for the relative cost of insurance by state.

- Operational Costs - Costs like property taxes, insurance cost, state income taxes, regulatory costs (ex: time and cost to evict), inspections, rent control, etc., have a tremendous impact on your return. Select a location with relatively low operational costs. Operational costs are a direct hit on profitability.

Once you narrow your selection choices, look for a good investment team.

Investment Team

If you needed surgery, you would not start medical school. Also, not just any doctor will do. You want a surgeon specializing in the kind of surgery you need, not a general practitioner. The same is true with real estate investing. You want to work with an investment team that already has the skills and contacts. Good investment teams are hard to find. Start with an investment Realtor (not an "investment-friendly" Realtor). Know that even in a large metro area, there is likely only one or at most two investment Realtors. While finding an investment Realtor may take time, the cost, risk, and time savings will be worth it. See the image below for the range of skills you need to succeed.

Yosef, if you select a location that matches the criteria I listed and have a good investment team, you should do well.

Property Type

The property type (condo, single-family, multi-family, etc.) does not matter. You are buying a reliable income stream, not a specific property type. Select a property based on current and future cash flow and appreciation, whatever type of property that turns out to be. I sell residential and commercial, and I prefer residential investments for the following reasons.

Residential:

- Value is driven by market demand.

- 30 year, fixed-rate financing.

- When you sell, you have two potential buyers: home buyers and investors.

- Very stable income, people always need a place to live.

- Simple to evaluate

Commercial:

- Difficult to evaluate. Typical commercial property due diligence is 90 days for a reason. Also, in 15 years, I have never seen an investor sell a performing asset. I start my evaluation assuming the property is losing money, and I have never been wrong. The most common reasons for a property to lose money are deferred maintenance and or tenant issues.

- Commercial financing - The normal commercial lending sources offer 5 or 7-year term, 20-year amortization, 40% down, prime plus 2% to 4%, and 1% to 5% closing costs. This is expensive financing plus it exposes you to interest rate risk every 5 or 7 years when you have to refinance the property. @John Orthman, I see in your spreadsheet you used 25% down 3.20% interest rate for a 10-unit building, I would love to get in touch with your lender.

- Commercial real estate is very cyclical, so you need to be aware of the current state of the commercial market. For example, five years ago, there was only one self-storage near me. Now there are six and another one under construction. I bet no one will make money on self-storage until the local area population expands significantly. The same is true for warehouses near me.

- The CAP rate largely determines the value of a commercial property. If your rents are not increasing, your property value is not increasing.

Yosef, I hope this helps.

Post: What are good BRRR markets for new investors?

Post: What are good BRRR markets for new investors?

- Realtor

- Las Vegas, NV

- Posts 820

- Votes 1,572

Hello @Toan Dang,

Markets with high appreciation are best for BRRRR. You might think low-cost fix and refinance properties are your best option, but that is not the case. You can pull cash out only once with a low-cost fix and refinance. In a high-appreciation market, you could refinance and pull cash out multiple times over the life of the property. Also, when evaluating markets, ignore the COVID madness times; locations that have been flat for years started appreciating; look at the appreciation rate over the ten years before COVID.

I put together the following table to show the advantage of appreciation vs. cash flow over five years. While this is an oversimplified example (based on a 25% down $400,000 property), you can see the advantage of an appreciating market. We and our clients refinanced and pulled cash out using a refi multiple times.

A common statement I get from people concerning appreciating markets is that you cannot count on appreciation continuing. Not true (except for the boom and bust times. For example, the run-up to the 2008 crash of Las Vegas). Appreciation (or lack of appreciation) is a symptom of long-term underlying economic conditions like job quality and quantity, location desirability, population growth, etc. And, like a large cargo ship, markets have tremendous momentum and do not change quickly. For example, is there a two or ten-year method to transform Detroit into a highly desirable location to live in? No. I see no possibility Detroit will reverse its decline.

So, what can you count on? If you buy in a declining market (any market where appreciation and rent increase are below the inflation rate), your cash flow and home value will decline. Also, if you buy in an appreciating market, your cash flow and value will appreciate.

What is the actual impact of buying in a declining market? People purchase properties for passive income they can rely upon to have a better life. However, inflation is constantly eroding the buying power of money. So, unless rents are increasing at or above the inflation rate, the quantity of goods you will be able to purchase will decrease over time, as will your standard of living. Could you have rent growth and still have declining buying power? Yes. See the chart below.

For example, if the rent starts at $1,500/Mo and increases 4% per year, you've lost 12% in buying power after five years (at the current inflation rate). If rents increase 2% per year, you've lost 57% in buying power after ten years. Inflation is why you should only buy properties in a location where rents and prices are increasing at or above the inflation rate.

Toan, I hope this helps.

Post: Buying a condo a good option for rental?

Post: Buying a condo a good option for rental?

- Realtor

- Las Vegas, NV

- Posts 820

- Votes 1,572

Hello Wesley,

Condos have issues for investors. In this post, I will cover a few.

Length of Tenant StayCondos attract a transient tenant pool that only stays on average about two years. (In comparison, the tenant pool we target stays on average five years.) And, under non-COVID conditions, the average time-to-rent for condos is about two months. The result is a vacancy cost of about $2,000/Yr for condos. This is a huge unplanned annual expense. For the tenant pool we target, the annual vacancy cost is about $400.

Condo Association FeesMonthly HOA for many condos exceeds $200/Mo. High HOA fees eat into your profitability. In some cases, once you take vacancy cost and association fees into account, it may not be possible to make an acceptable profit.

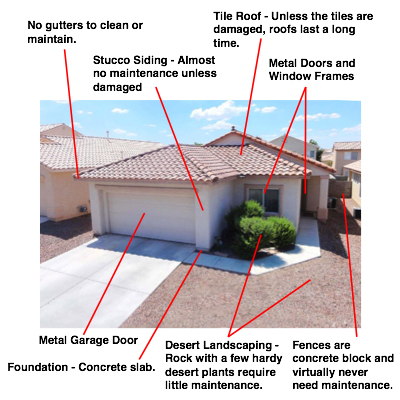

Maintenance CostSome people choose condos due to the perception of low maintenance costs. Due to the construction materials required in Las Vegas (Mojave Desert), there is little difference in maintenance costs between condos and single-family homes. See the image below.

Financing

Financing

Condo financing is limited for investors. Please check with your lender, but investment financing may not be available for the specific condo you are considering. You may have the cash to purchase the property, but this limits potential buyers in the future.

Appreciation and RentCondos have not performed as well as single-family homes when it comes to appreciation and rent increases. Due to COVID madness, all properties are performing well today, but the market will return to "normal" conditions.

Condo AlternativesIf you are looking for a lower-cost property than single-family, a few townhome complexes have performed well. However, this is a very small set of communities; most townhouse communities do not perform well for various reasons.

Another advantage of townhomes is financing. Townhomes have the same financing options as single-family homes.

Wesley, I hope this helps.

Post: Who should I know? Where should I buy?

Post: Who should I know? Where should I buy?

- Realtor

- Las Vegas, NV

- Posts 820

- Votes 1,572

Hello Thomas,

There is always a strong tendency to invest where you feel comfortable. However, this does not mean it is a good investment location. Fortunately, there are objective criteria you can use to evaluate a location, which is illustrated below.

Details on each of the process steps.

- Appreciation - The number one location selection criteria is appreciation. Inflation constantly erodes buying power; each year, it costs more to buy the same set of goods. If you buy in a location where pre-COVID prices and rents increased faster than the current inflation rate, you will continue to have the funds you need. If not, the initial cash flow will be the highest you will ever receive, and you will have a continuously declining standard of living.

You may have noticed that I use rent increase and appreciation interchangeably. The reason is that appreciation and rents are tied together. If prices increase (appreciation), rent will follow, but with a 2 to 10-year lag depending on the market. What is happening with property prices today is an excellent indicator of what will happen with rents in the future.

- Population Size - Greater than 1 million. Small towns may rely too much on a single business or market segment.

- Population Growth - If people are moving into a location, many things have to be right. I would not invest in any location where the population is stagnant or declining.

- Crime - People and companies will not move to locations perceived as dangerous. One source of cities to avoid is Neighborhood Scout's 100 most dangerous cities. Avoid any city on this list.

- Disaster Risk - Some parts of the country are more prone to natural disasters. The best indicator for natural disaster probability is homeowners insurance cost. I would avoid states with high insurance rates. Note, even if insurance pays for all the damage your property suffers, you still lose. When a significant disaster occurs, people and jobs move to locations where they can make money today. The location may take years to recover, or it may never recover. ValuePenguin is a good source for the relative cost of insurance by state.

- Operational Costs - Costs like property taxes, insurance cost, state income taxes, regulatory costs (ex: time and cost to evict, rent caps, rent control, certificates of occupancy), inspections, rent control, etc., have a tremendous impact on your return. Select a location with relatively low operational costs. Operational costs are a direct hit on profitability.

Thomas, as long as you select a location which meets all of the above criteria, you should do well.

Post: How to expand past 2 properties?

Post: How to expand past 2 properties?

- Realtor

- Las Vegas, NV

- Posts 820

- Votes 1,572

Hello Andrew,

Congratulations on a great start!

I do not know the Cincinnati market, so I cannot offer any specific recommendations. However, I will comment on hard money loans and expanding your portfolio.

Hard Money Loans

My experience with hard money loans is that they are expensive and short-term. They are not a substitute for long-term financing. The last hard money loan a client did was prime +5%, 3% loan origination fee, 25% to 40% down, 6 to 18 months term, interest-only, amortized of 20 years. After that, the full loan amount is due, so you would need to get long-term financing anyway. I see a limited advantage to using hard money unless you need short-term money to buy and renovate a property before getting long-term financing.

Growing Your Portfolio

I have found that if you invest in a high appreciation market it can help expand your portfolio faster. That is what I personally experienced in the Las Vegas market. To illustrate this point I put together a simple model comparing five-year investable cash accumulation for a high cash flow market vs. a high appreciation market. To keep the model simple, I made the following assumptions.

- High appreciation market - appreciates at 7% annually, but has zero cash flow.

- High cash flow market - 7% cash/cash return but zero rent growth and zero appreciation.

- Combined state and federal income tax rate is 30%.

- Purchase price: $400,000.

- Down: 25%

- Acquisition cost: $100,000 (25% X $400,000)

- No inflation

- No rent increases

- In the high cash flow market you accumulate all rental income.

- No loan costs

- No closing costs

- No renovation costs

- No vacancies

- No maintenance cost

- No management expenses

- No principal pay down

As you can see, at the end of 5 years you will have a lot more investable cash from the high appreciation property than the high cash flow property, which you can use to purchase more properties. In reality, rents will rise in a high appreciation market which will give you more investable cash.

Appreciation and Rent

Appreciation is much like the spots you see on your skin if you have measles. The spots are not the virus. The spots are a symptom of the virus. The same is true with appreciation. Where you find rapid appreciation you will find a growing population, significant job creation, and a generally desirable place to live. Under these conditions, both property prices and rents will increase. There are studies showing that property prices and rents are connected. However, property prices typically lead rents by 2 to 10 years, depending on the market. So, if you see significant appreciation today you can reasonably expect to have significant rent increases in the future. My point is that if you buy in a market for appreciation, your rents will rise as the property prices rise. It is not all appreciation or all cash flow.

Andrew, I hope this helps.