All Forum Posts by: Eric Fernwood

Eric Fernwood has started 64 posts and replied 792 times.

Post: Biggest Mistake in Real Estate

Post: Biggest Mistake in Real Estate

- Realtor

- Las Vegas, NV

- Posts 823

- Votes 1,574

Hello @Ethan Hanes,

Good question. There is a reason 90% of the world’s millionaires made their money through real estate. Real estate investing is relatively simple and secure. However, some people still fail. I have witnessed many and listed below a few reasons that had the biggest impact.

Do Nothing

Doing nothing is the most common cause of failure. For some, it is the desire to find a “perfect” property. Others spend years looking for the right book or seminar to give them the “secret” to success. Spoiler alert! There are no perfect properties and no “secrets” in real estate investing.

Buying in a Bad Location

As long as you buy in a location where prices and rents increase faster than the inflation rate, all but the worst mistakes will be corrected over time through appreciation, inflation, and rent increases. If you buy in a location where rents and prices are not increasing faster than the inflation rate, your inflation-adjusted income will continuously decline. In this case, you can do nothing to turn the situation around other than sell the property.

Not Working with an Investment Team

If you needed surgery, you would not start medical school. Also, not just any doctor will do. You want a surgeon specializing in the surgery you need, not a general practitioner. The same is true with real estate investing. You cannot learn what you need to know in 1 or 50 seminars, books, or podcasts. The information all these sources provide is general knowledge. Real estate is local. Only by working with a local experienced real estate Investment Team that already has all the skills and resources will you maximize your investment dollars.

Selling Winners and Keeping Losers

I was talking to someone about a 1031 exchange. To my surprise, they wanted to keep their loser properties and exchange their winners. Sadly, this is not uncommon. There is even a name for it, the “Disposition Effect.” Investors will sell winners and marvel at their profits but hold onto losers hoping they will “come back.” Following this approach, you almost guarantee a losing portfolio of properties over time. Everyone makes mistakes. Sell the under-performers and buy winners.

If you make any of the above mistakes, your success odds are greatly reduced.

Post: QOTW: If you've bought a property in 2022, how did you find it?

Post: QOTW: If you've bought a property in 2022, how did you find it?

- Realtor

- Las Vegas, NV

- Posts 823

- Votes 1,574

We still find good passive income properties; we average closing five properties each month in 2022. However, good investment properties are always few and far between.

Only about 0.4% of all available properties meet our requirements. We find these properties using the data mining software we developed. The data mining software only selects properties that meet our target tenant pool segment's housing characteristics (property type, configuration, location, and rent range). All properties of interest must then pass a rigorous validation process, including estimated renovation cost and risk.

In 2017 we standardized almost all renovation components and costs. Due to standardization, we can quickly estimate renovation costs using software we developed. Knowing renovation cost enables us to make offers based on the probable total acquisition cost.

The entire process, from candidate property through validation and estimating renovation cost, is typically completed within 24 hours of the property coming on the market. Good properties usually go under contract within three days (it was less than 24 hours in Q1 2022). We usually only get about one out of every seven offers because we have to get the property at the right price and terms.

Our processes and software are the result of 15 years of continual process and software improvement. The two founders are engineers, and we approached real estate investing as an engineering problem. So, everything is a documented, repeatable process. The process we followed is illustrated below.

In short, our software and processes (still evolving) enable us to continue finding, closing, and renovating five or more properties each month.

Post: Would you purchase strictly for cash flow?

Post: Would you purchase strictly for cash flow?

- Realtor

- Las Vegas, NV

- Posts 823

- Votes 1,574

Hello @Lane Kawaoka,

You brought up a great topic, turnkey. I am occasionally asked about turnkey vs. working with an investment team.

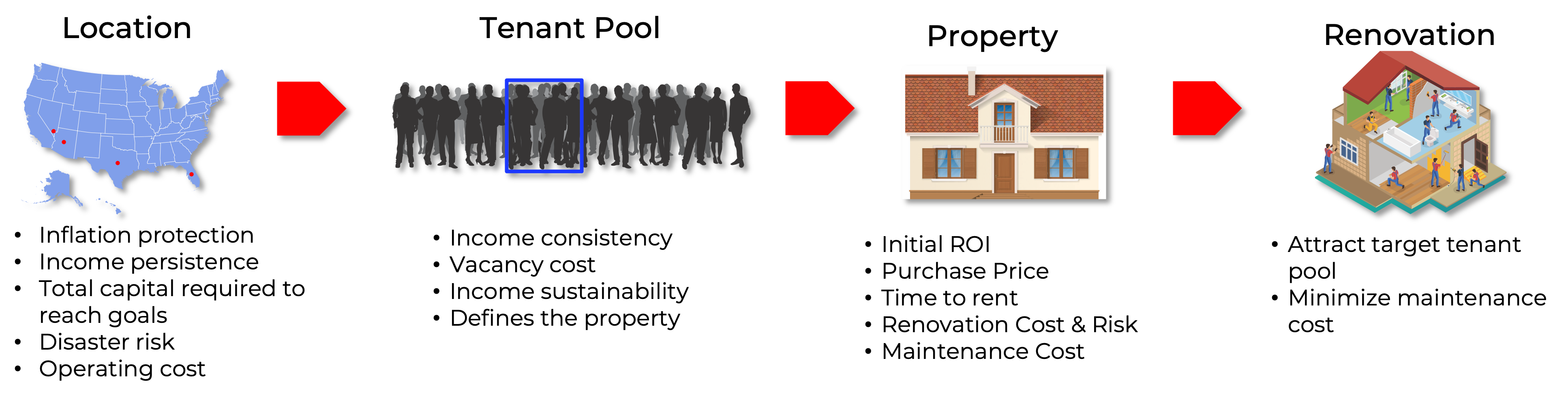

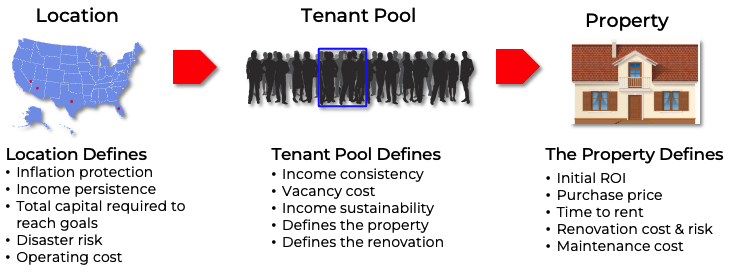

Turnkey is a purchase method and nothing more. Buying turnkey does not reduce your due diligence. The most important decision you will make is the location, not the property. Select the investment location based on factors including:

- Rent growth and appreciation rate vs. the inflation rate.

- Population size

- Population growth

- Crime

- Disaster risk

- Operational costs

Once you’ve selected the location, the next decision is which tenant pool to target. Every property is only desirable to a narrow tenant pool segment. Choose a tenant pool segment that will provide a reliable income stream (in good times and bad) and only buy properties that the tenant pool segment is willing and able to rent. Once you select your tenant pool segment, all decisions about the property characteristics are defined. Your target tenant pool defines the location, property type, configuration, rent range, and more.

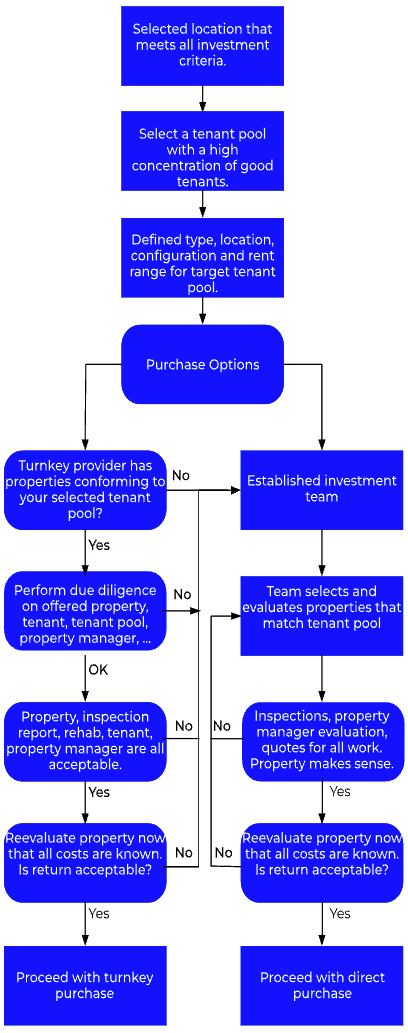

Once you know the characteristics of the properties you want, the next step is deciding how to purchase the property. Two options are direct or turnkey. As an engineer, I believe in processes, not feelings and guesses. So, I put together the following decision tree to help decide which purchase method was best for meeting your goals.

Other considerations

Turnkey Convenience Fee

Turnkey properties will always be more expensive than direct purchases, resulting in a lower return. Turnkey providers must charge enough to cover a renovation, carrying costs, marketing expenses, tenant acquisition, and profit. These costs are in addition to the actual property cost. Below is a diagram illustrating the cost difference between direct vs. turnkey. The difference between a direct purchase and buying turnkey is the "convenience fee.”

Note that while you pay more with turnkey, you will save time. That is the main advantage of buying turnkey.

Property Condition

Most turnkey providers put their money into cosmetics, not systems. Painting, carpet, and light fixtures are low-cost items compared to termites, roof, plumbing, wood rot, electrical, HVAC, and foundation issues. For example, during the inspection of a flipped property, we learned that the plumbing system needed replacement; the flipper just patched over the leaks. A typical cost to re-plumb a house is $10,000 to $20,000. The paint, carpet, and everything else probably cost under $5,000.

I have also heard that some turnkeys do not allow independent property inspectors. Unless I know the actual property condition, how do I know the actual cost? Never buy a property without an independent inspection.

Property Management

One of the selling points for turnkeys is that they manage the property after the sale. The flip side is that you cannot use a different property manager, even if you are dissatisfied with their property manager's performance. While Yelp (and similar) reviews are problematic, read the turnkey's property manager's reviews. One large turnkey property manager has a 1.5 stars rating. Such a poor-performing property manager will result in more frequent tenant turns, which generates more income for the property manager (lease-up fees).

Another claimed advantage of the property manager is their internal maintenance staff. Internal maintenance staffs are an inherent conflict of interest. Property managers make more money on repairs than they do on rent collections. I do not want my maintenance costs to be the property manager's profit center.

If You Decide on Turnkey

I recommend the following as a condition of purchase.

- The right to have an inspection by an independent licensed property inspector.

- A list of all repairs made by the turnkey. You need to know which items (from the inspection report) still need to be corrected. Get a quote for all these repairs, so you know how much the property will cost you, including repairs.

- Get independent rental and sales comps for the property. Compare this to what the turnkey states.

- Get copies of their management and leasing agreement and read them. For example, I've seen terms requiring you to sell the property through the turnkey at a very high commission rate.

- You must have the right to choose the property manager. You want a property manager that works for you, not the turnkey. I have heard that you do not have that option with most turnkeys. Property management is a significant residual income for the turnkey.

- Results from any code inspections. In some locations, the house must pass specific codes to get a certificate of occupancy.

- All disclosures that the property's prior owner provided to the turnkey.

- A written statement from the property manager with specifics on the time and cost to evict a non-paying tenant.

If you obtain all the above, buying turnkey or direct becomes a simple time vs. return decision.

Post: Timing the market. Wait or buy?

Post: Timing the market. Wait or buy?

- Realtor

- Las Vegas, NV

- Posts 823

- Votes 1,574

Hello @Adriaan Sierra,

Real estate investing is a long-term proposition. Market timing is difficult, at best. You have the additional issue of inflation and rising interest rates. Waiting only makes sense if one or both of the following occurs:

- Interest rates drop significantly. Until inflation declines to the Feds target rate, I only see interest rates rising.

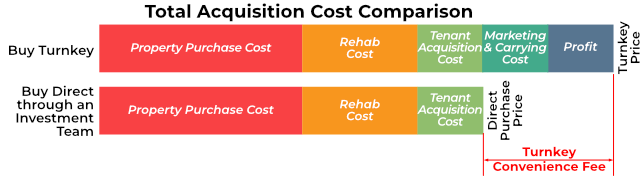

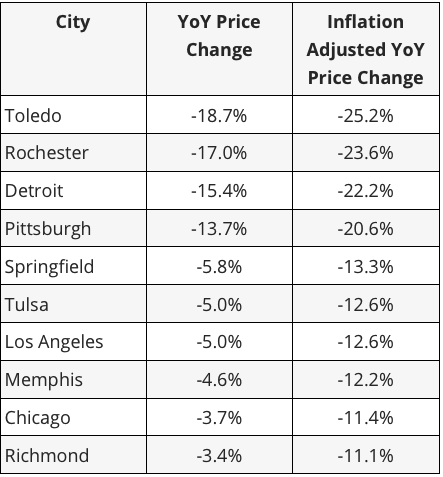

- Prices drop significantly. In many places where prices rose during COVID are falling today. Some examples are below (from realtor.com for SFHs). Also, it is not just the price decrease but the price decrease compounded with the effects of inflation. See the table below for ten cities (among many) where prices are falling.

All of these cities had COVID-driven price increases; the market drivers were unchanged from before COVID. The major economic impact of COVID on real estate is declining. So I question whether buying in any of the cities above ever made sense if your goal was a dependable passive income. So we are on the same page, my definition of a dependable passive income is below.

- Inflation Adapting - Your rental income increases faster than inflation, so you have the additional dollars you need to maintain the same lifestyle.

- Income Reliability - You continuously receive income with minimal interruptions in good and bad economic times.

I could go into details, but here I will only mention inflation adapting.

Inflation Adapting

Inflation continuously erodes the buying power of the dollar. Every time you go to the grocery store, buying the same basket of goods takes more and more dollars. If your rent is not rising as fast or faster than inflation, you will not have the additional dollars to maintain your standard of living. How can a passive income be dependable if the buying power does not keep pace with inflation?

I talked to someone who was not concerned about inflation because their rents rose on average 2% per year. What is happening to their buying power over time? See the table below.

So, even if the rent increases 2% annually, when inflation is 8%, at the end of year 5, your buying power declined by 32%.

Summary

Waiting does not make sense if your goal is dependable passive income. And choose a location that meets the following criteria:

- Prices and rents are increasing faster than inflation.

- Tenants are likely to stay employed today and in the future. Unless new employers are moving into the location, creating jobs that pay similar wages and require similar skills, in the next 10 to 15 years, all the jobs your tenant pool has today will be gone. What will remain are lower-paying service sector jobs. When their income falls, so will your rents (in buying power).

- Buy in a location where both local and state populations are increasing. Population growth is an excellent indicator of the overall economic health of the location. If the population of the state or location is falling or static, the area is in decline, and investing there would be a bad decision.

- Low crime is critical. When companies look for locations to set up new operations, a key consideration is the crime rate; companies do not invest in high-crime locations. If the location you are considering is on Neighborhood Scout’s list of the 100 most dangerous US cities, just don’t do it.

Adriaan, I do not believe prices will fall much if you select a location that meets all the above requirements. So, now is the time to buy so you can ride rent growth and appreciation to a dependable passive income before rising interest rates make them unaffordable.

Post: Would you purchase strictly for cash flow?

Post: Would you purchase strictly for cash flow?

- Realtor

- Las Vegas, NV

- Posts 823

- Votes 1,574

Hello @Erika Geoffrey,

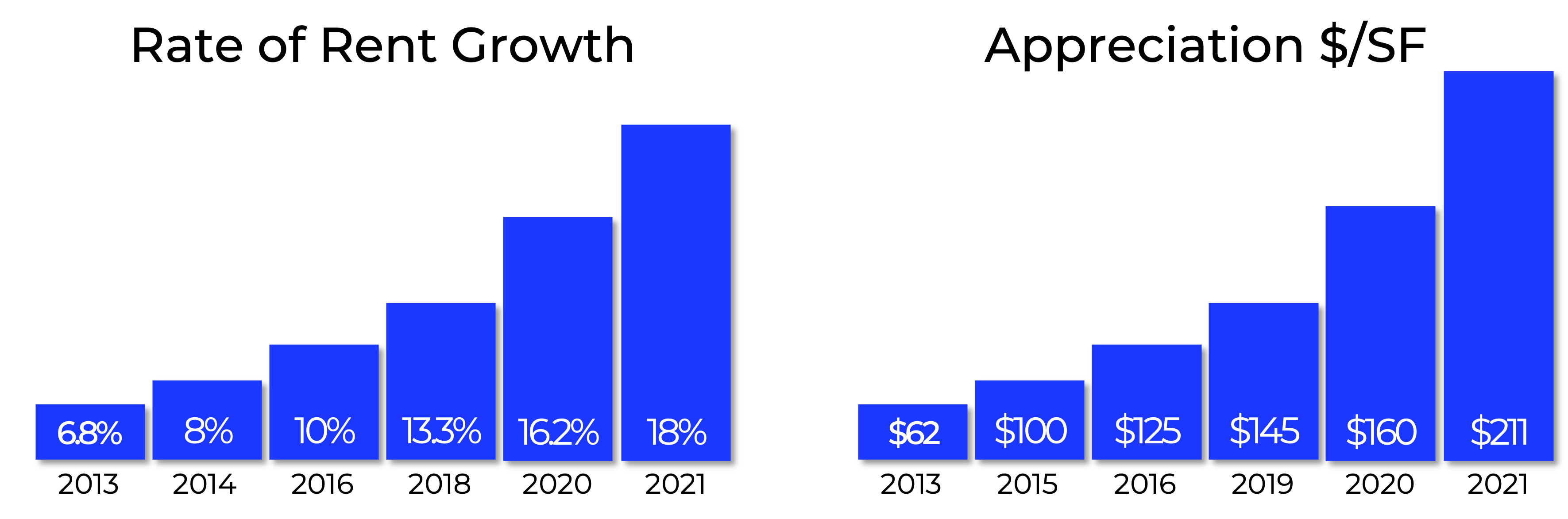

It depends on the location. We are in Las Vegas, and below are the stats for our target tenant pool and the properties they rent.

The stats are only for the properties we target, not the overall Las Vegas market. Our client's rental incomes continue to increase in buying power, even considering inflation.

Rent growth in 2021 (for our target segment) was 18%. However, you can not increase a tenant's rent by 18% in one year. I did a study, and most rent increases ranged between 8% and 12% per year.

Las Vegas is a unique city for several reasons.

- Las Vegas is a small island of privately owned land in an ocean of federally owned land. See the time-lapse below. People come to Las Vegas and see the vast open desert around Las Vegas and assume that there is infinite land for expansion. Not true. 85% of the entire state of Nevada is federally owned. Clark County (the Las Vegas metro area) is 87.5% federally owned. So, there is little land left for development. The land is expensive. In good areas, raw land costs over $1M/Acre or $1M/hectare.

- Rapid economic growth - Today, there are over 26,000 open jobs. And, there are $22B projects under construction, which will create thousands of additional jobs.

- A population growing at a sustainable rate (2.5% to 3%), limited land for expansion, and good-paying jobs will keep Las Vegas rents and prices increasing for the foreseeable future.

- Other factors will continue Las Vegas’ growth for the foreseeable future that I will not go into here.

A question I frequently get concerns income reliability - the connection between jobs and tourism. I was living in New York City when I decided to move to Las Vegas and to build a business focused on investors and dependable passive income streams. Once I selected Las Vegas, I spent almost three months studying tenant pool demographics. The result of my studies was selecting a narrow tenant pool segment. This tenant pool has performed exceptionally well in good times and bad. Below are our 15-year results.

- 2008 crash - Zero decline in rent and zero vacancies.

- COVID - Almost no impact

- Eviction moratorium - No impact

- Our average tenant stay is over five years.

- We’ve had only five evictions in the last 15 years.

- 2022 YoY (July) result: rent increase 11%, appreciation 26%

My point is that location is your most important investment decision, not the property. As long as you buy in a location where rents and prices increase faster than the inflation rate, appreciation and rent increases will correct all but the worst mistakes. However, if you buy in a location where prices and rents increase below the inflation rate, you can do nothing to turn the situation around after the fact.

I assume you are from Canada. Based on a quick Wikipedia search, you might need to look at metro areas of 800,000 or more. There are things to be considered when you buy in a high-appreciation location.

-

Property prices in high-appreciation locations are more expensive than in areas with low appreciation rates.

-

Just because you buy in a high-appreciation location does not guarantee that the property you select will perform. You must choose a tenant pool with a high concentration of “good” tenants. I define a good tenant as someone who:

- Has stable employment in a market segment that is very likely to be stable or improve over time

- Has a credit history with which you can evaluate the likelihood that they will perform

- Pays all the rent on schedule

- Takes care of the property

- Does not cause problems with neighbors

- Does not engage in illegal activities while on the property

- Stays for many years

Good tenants are the exception, not the norm. Good tenants are the result of:

- Targeting the right tenant pool.

- Select properties that your target tenant pool is willing and able to rent.

- A skilled property manager.

Your target tenant pool defines everything. The property type, location, configuration, and rent range. The tenant pool also defines the renovation items. Below is the process I followed.

If there are any questions about the above process, please feel free to ask.

I should have clarified that my 1M mark refers to the metro area, not just a city jurisdiction. @Erika Geoffrey @Jonathan R McLaughlin

Post: Out of State Investing - Please share the good, the bad, the ugly

Post: Out of State Investing - Please share the good, the bad, the ugly

- Realtor

- Las Vegas, NV

- Posts 823

- Votes 1,574

Hello @Tasha Barnes,

Good question. In this post, I will provide my opinion on remote investing and selecting a good investment location.

Investment Location Selection

Location is the most important investment location you will make, not the property. If your goal is a dependable passive income stream, the most important location selection criteria is that rents and prices keep pace with inflation. As long as you buy in a location where rents and prices increase faster than the inflation rate, appreciation and rent increases will correct all but the worst mistakes. However, if you buy in a location where prices and rents increase below the inflation rate, your only option will be to continuously lower your standard of living.

I talked to someone who was not concerned about inflation because their rents rose on average 2% per year. What is happening to their buying power over time? See the table below.

So, even if the rent increases 2% annually, when inflation is 8%, at the end of year 5, your buying power declined by 32%.

Remote Investing

If you needed surgery, would you sign up for medical school? Of course not. Successful real estate investing requires expert advisors; you can learn what you need to know by taking classes or reading books. So, whether you decide to invest in your neighborhood or across the country, you need to find a good investment team. If you have a good investment team, the location does not matter.

For example, we've delivered over 450 investment properties. Of the 150+ investors we've worked with, only 10 to 12 were local; all the rest live in other states or other countries. Does remote investing work? Over 90% of our clients buy two properties from us, and over 80% buy three or more properties. So we know our process works and our clients are happy.

Start your search for a good investment team by finding an investment realtor. However, even in a large metro area, there may be only one or at most two investment realtors. Knowing the difference between a residential realtor (or an “investor friendly realtor”) and an investment realtor is important.

- Residential Realtors enable people to buy or sell homes. The process is simple. Homebuyers select properties they want to see, and the Residential Realtor provides access. Once a property is selected, the Residential Realtor facilitates the offer and the closing process. A residential realtor usually provides no services beyond those needed for home buyers.

- Investment realtors sell passive income streams, not residences. Investment realtors must understand finance, market trends, ROI, tenant pools, and more. Investment realtors provide a wide range of services, including property selection and evaluation. Plus, Investment Realtors are always part of a team. Only a team can provide all the skills and resources required to maximize your investment dollars.

Start your search for an investment realtor by talking to property managers, cruise real estate investing sites, seek out local investors, Google search, etc. Once you have a list of candidates, you need to determine whether any have the skills, experience, processes, contacts, and team members you need. To simplify the task, I put together the diagram below. Start at the top and ask each question, noting their answers. If they cannot answer any question satisfactorily, go to the next candidate.

If a candidate passes all the above, they know what they are doing. What if you cannot find an investment realtor? Then you either have to provide everything yourself, or look in another location.

I am frequently asked, “Why not start with a property manager?” In any large metro area, there could be 100 or more property managers. It's a much larger pool to evaluate. However, none of the property managers I've worked with over the last 15 years understands selecting and evaluating investment properties. Property managers are experts at selecting tenants and complying with all the regulations for managing properties. But they are not investment realtors.

Summary

The most important decision you will make is the investment location, not the property. The most important selection criteria are that rents and prices keep pace with inflation. Once you select a location, the next step is to find an investment realtor. An investment realtor is always part of an investment team. Once you have a good investment team, work with them to find good properties.

Post: Would you purchase strictly for cash flow?

Post: Would you purchase strictly for cash flow?

- Realtor

- Las Vegas, NV

- Posts 823

- Votes 1,574

Hello @Erika Geoffrey,

What you should buy depends on your goals. If your goal is a dependable passive income, then no. There are multiple reasons I do not recommend small towns and buying just for cash flow, but the biggest reason is inflation.

Inflation continuously erodes the buying power of the dollar. Every time you go to the grocery store, buying the same basket of goods takes more and more dollars. If your rent is not rising as fast or faster than inflation, you will not have the additional dollars to maintain your standard of living.

For example, if inflation continues at 8%, how many dollars will you need to buy the same basket of goods in five or ten years? See the table below. The table shows how many dollars you will need each year to have the same buying power as $100 today.

I talked to someone who was not concerned about inflation because their rents rose on average 2% per year. What is happening to their buying power over time? See the table below.

So, even if the rent increases 2% annually, when inflation is 8%, at the end of year 5, your buying power declined by 32%.

Jobs are another factor to consider. A rental property is no better than the jobs around it. Small towns tend to be too dependent on a single business sector or company. And, it is not just the jobs the tenant has today. The average life of a company is ten years. The average life of an S&P 500 company is only 18 years. Every job your tenant pool has today will likely go away over the next 10 to 15 years. Unless new employers are moving into the location and creating similar paying jobs requiring similar skills, the only jobs available will be lower-paying service-sector jobs. If your tenant pool's income declines, so will your rent.

Also, cities derive most of their operating income from property and sales taxes. Property prices and sales tax revenue decline if the median income declines. When the city's revenue falls, they have no option but to reduce spending on schools, public safety, road repair, etc. As city services decline, crime follows. No one wants to live in a high-crime location with declining services. Those with sufficient income will move to a more desirable location. The people remaining will, on average, have lower incomes. Thus, the city receives less revenue and cuts more services. This is a financial death spiral from which few declining cities have recovered.

My Recommendations

Only buy in cities with a population of at least 1 million. Real estate investing is a long-term business. Smaller towns are unlikely to attract new employers and have limited ability to weather financial storms. Long term, few small cities will do well. Also, only buy where appreciation and rents increase faster than the inflation rate. If not, your first month's rent will be the highest amount you will ever receive.

Post: Problems with my property Management

Post: Problems with my property Management

- Realtor

- Las Vegas, NV

- Posts 823

- Votes 1,574

Hello @Adam Galal,

While I have little to add to what others said about your current situation, I can offer some guidance to help you select a good property manager down the road. Before I talk about the process I’ve successfully followed, I will discuss the value of a property manager.

Many people believe the only value of a property manager is just collecting the rent. A good property manager provides far more value. Below are examples of what a good property manager provides.

Property Manager Contributions

Local knowledge - Real estate is local, not national. Databases and websites provide general information on a location but not the hyper-local knowledge you need to evaluate the location. The property manager is your one-stop source for the local information you need, such as:

- Tenant and landlord regulations including time and cost to evict

- Best rental areas for a given tenant pool.

- Rental trends.

- Best tenant pools for reliable income. The right tenant pool is critical.

- Referrals such as an investment Realtor, handyman, contractors, etc.

Property Selection and Evaluation - Once you find a potential property, you need to know things such as:

- Rent - What is the after-renovation rent range for a given property? Your offer price and initial return are dependent on getting this right. No website or software can match the skills of a good property manager.

- Time to rent - A property might generate an excellent rate of return, but what if it takes six months to rent the property and the average tenant stay is only two years? This property would be a disaster to own. There is no database with this sort of tenant pool specific information.

- Renovation items - Renovation is tenant pool specific. There is no source other than the property manager for this knowledge. Without the right renovations, your property will take longer to rent, rent for less than full market value, or may not even target the right tenant pool.

Execution - This is another phase where the property manager provides value. Below are some examples:

- Marketing - Only an experienced property manager will know the best channel(s) for your target tenant pool.

- Tenant selection - Tenant selection is the most important skill the property manager provides. You only make money if the property is continuously occupied by someone that pays all the rent on schedule, takes care of the property, and stays for many years. Only a good property manager can select such tenants.

- Compliance - There are multiple federal, state, county, and city ordinances concerning rental properties. A violation of any of these regulations can result in fines and legal costs. A good property manager is a member of NARPAM or a similar organization, so they always have the latest regulatory information.

- Lease agreement - The lease agreement is the number one tool for controlling tenant behavior, protecting the property, collecting the rent, and protecting you from litigation. Property managers use regulation-compliant lease agreements, not a generic form from a stationery store. They also know how and when to enforce the lease terms with the tenant.

- Rent collection - This goes without saying, but it may not be as simple as you expect. Some tenant pools will pay online, others by credit card and others in cash through a local 7-11 store. The payment collection method must match the tenant pool demographic.

- Control maintenance costs - A good property manager will control your maintenance costs. They know which vendors to use and sources to buy from. Also, they know how to control tenants who turn in excessive repair requests.

I could continue, but I trust you see the value that a good property manager provides is well beyond just collecting the rent. In the next section, I will describe the process for finding a good property manager.

How to Vet a Good Property Manager

Below are the steps I follow when I am evaluating potential property managers.

Make a List of What You Need

The first step is to list what characteristics your property manager must have. For example, suppose you plan to purchase one or more single-family properties on the southwest and southeast side of the city. Knowing this much enables you to eliminate property management companies with few properties in this area, ones that focus on apartments or commercial properties. Also, most property managers focus on a certain class of properties. A property manager with many B and A Class properties under management may not know how to manage C Class properties.

Searching for Prospective Property Managers

There are many potential sources, and each has pros and cons. Below are a few.

Search Engines

If you Google something like "Las Vegas Nevada property management," you will get many hits. Too many to be practical. With Google or any other search engine, ranking is more of a popularity/marketing contest than any measure of quality or service. In short, I do not believe a search engine will enable you to narrow the number of property managers to a reasonable level in larger metro areas. However, a search engine might be a great starting point in a smaller city. All you can do is try it.

Contacts

Read message boards on sites like BiggerPockets or other real estate investment sites and connect with people who already have properties under management in your area. The recommendation you receive should be a reasonable starting point. Important: just because someone tells you that XXX is a great management company does not mean they will be a great management company for you. Your needs or location may be different.

Property Manager Websites

Once you have property manager candidates, check their website. You may be able to eliminate many due to their service area, their focus on different types of properties, etc. Select the best 5 or 10 property managers for further evaluation. Next, it's time to make some phone calls.

Initial Phone Screen and Questions

The primary goal of the initial phone screen is to get a feel for the property manager and their company. Before you make the first call, have your questions (no more than 10) ready. Below are the types of questions I would ask during the initial phone screen:

- “How long have you been managing properties full time?” (No part-timers)

- “How many properties are you currently managing?”

- “What is your mix of property types?” (single-family, condos, commercial, etc.)

- “What geographical area(s) do you service?”

- “Do you have a staff? Please tell me about them. How many are full-time?”

- “If you were buying your first property, what type would you buy? How much should I expect to pay? Where should I look for these properties?”

Second Interview Questions

Once you narrow your list to 2-3 choices, make a list of questions that will enable you to determine if there is a good match between your needs and their services and skills. Below are some example questions grouped by topic. Contact me if you'd like a complete list of property manager interview questions we've built up over the years.

General Questions

- “What is your mix of properties?” You want a property manager who primarily manages the same type of properties you are buying.

- “Who are your typical tenants, and where are they employed?” You want to know which industries to determine how stable their jobs are and their market segment.

- “What is the average length of time your tenants stay in a property?”

- “What is your typical time-to-rent?”

Contracts

The contract is your protection and can help keep costs low. Get a copy and read the contracts.

- Property management agreement

- Rental agreement - Pay particular attention to what costs the tenant is responsible for and what the landlord is responsible for.

Fees

- “What is your startup fee?”

- “What percentage of collected rent do you charge?”

- “Do you charge a lease renewal fee?”

- “Are there other fees?”

Maintenance

- “How do tenants contact you for maintenance issues?” They should have a 24-hour answering service and a member of the property managers team on call.

- “How do you handle tenants that request multiple frivolous repairs?”

- “Do you have an in-house maintenance staff?” If they answer yes, I would probably end the call. You can not afford an in-house maintenance staff. For most property managers, maintenance is where they make the most money, not collecting rent. I never want my maintenance expenses to be their financial advantage. The property managers we work with all outsource repairs to independent companies.

- Ask, “Under what conditions do you contact me for prior approval before you make the repair?” Usually, this will be $200 to $300. Above this amount, I would become cautious.

Renovation

- “Will you manage the initial renovation?” Very few will do this.

- “Typically, what is the cost to turn a property between tenants, and how long does it take?”

Rent/Rentals

- “How do you estimate the rental rate for properties?”

- “How do you estimate time-to-rent?”

- "If I am considering a property, will you provide estimated rent and time-to-rent based on the MLS data plus a video or photos?"

- “How do you collect the rent, and on what day of the month?” (Is the property manager set up to handle automatic payments, credit cards, 7-11, and checks? The method that matters depends on your target tenant pool.)

How Do You Market to Find Prospective Tenants?

- “Where/how do you market properties?” Where they market your property should match your target tenant pool.

Tenant Screening

The most important duty of any property manager is to keep your property filled with good tenants. In my experience, good tenants are the exception, not the norm.

- “What is your process for screening tenants?”

- “What are the top 5 things you look for in an application?”

- “What regulations govern tenant screening.”

Physical Visit

If you cannot visit the property manager's office in person, ask them to give you a video tour of their office.

- Is the office neat and orderly?

- Is the staff busy or sitting around doing little?

- Ask for a demo of the software they use to track maintenance requests and rent collection, and generate monthly statements.

In Conclusion

Most property managers I've met are mediocre rent collectors and service dispatchers. You must find the (very) few that can provide the services and skills essential to your success. These are not easy to find. Hopefully, the process I described in this article will help you find a good one.

Post: QOTW: what’s the average cost per sqft to rehab?

Post: QOTW: what’s the average cost per sqft to rehab?

- Realtor

- Las Vegas, NV

- Posts 823

- Votes 1,574

Great question - Renovation is where things frequently go bad. I will share how we determine what to renovate and some lessons from completing over 400 renovations. To clarify, I will only discuss renovations for rental properties, not renovations in general.

Before you start, clarify your goals

Why do you renovate a property? There are five reasons to renovate a property:

- Attract the right tenant pool

- Increased rent

- Decreased time to rent

- Increased tenant stay

- Reduced maintenance cost

Notice that I said “the right tenant pool.” Each tenant pool segment has different things they consider important. For example, one tenant segment may see bars on the first-floor windows as essential. Another may value granting kitchen counters. If you want to know more about tenant pools and their importance, please contact me.

Only Renovate to Your Target Tenant Pool

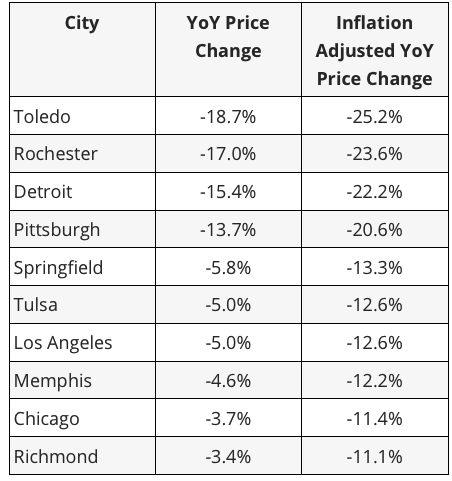

Assuming that you have identified your tenant pool, you need to transform their critical and desired housing characteristics into a physical property description, as illustrated below.

Create your property description based on your target tenant pool segment. This means that the properties you buy will be the ones your target tenant pool is willing and able to rent. Again, feel free to contact me if you are not familiar with any of these concepts.

Part of what attracts tenants to a specific property is meeting their "wants," which may be separate from their needs. As I mentioned, "wants" are unique to each tenant pool. So what you will renovate is defined by the tenant pool segment, not you. Your “style” or tastes do not matter; only what the target tenant pool cares about matters.

The property partially meets tenant pool "wants" and others through renovation. Properties that meet your tenant pool's broadest range of wants will get the most traffic and rent the fastest and for the highest rent. The right renovation will increase your cash flow and reduce maintenance costs.

What to Renovate?

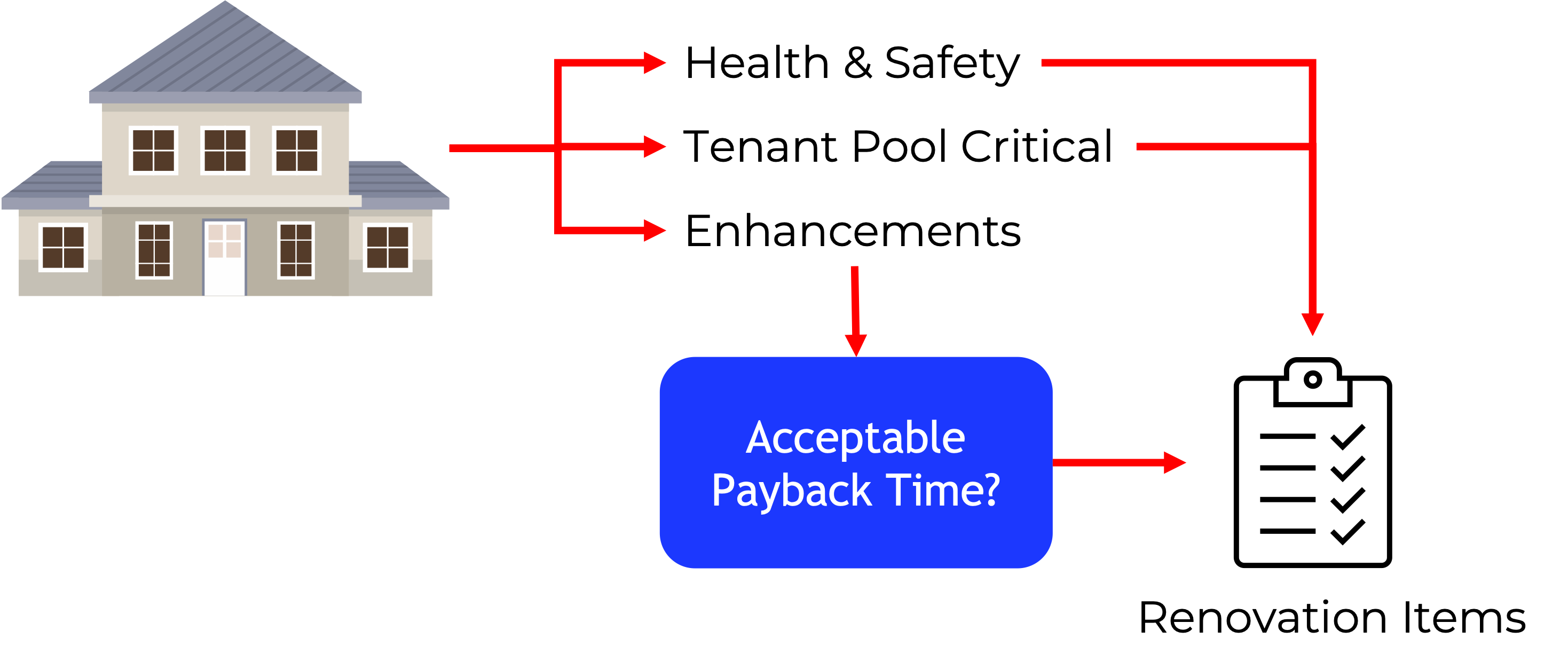

We determine what to renovate by comparing the current property condition vs. the "ideal condition" for our target tenant pool. The difference becomes our initial renovation list. We always do all health and safety-related items, plus items required to attract our tenant pool. Beyond that, every item (replace the carpets, the kitchen faucet, etc.) must be cost-justified. If the item doesn't pay for itself in an acceptable period, we do not do it. See the image below.

If you follow the above method, there is not much subjectivity; your target tenant pool tells you what you need to renovate. It then becomes cost-justifying items beyond the minimum, which is straightforward.

What does a typical renovation cost? There is no typical cost. In the last 15 years, our renovation costs ranged between $500 and $55,000. Every property is different.

Renovation Considerations

We’ve learned a lot of lessons completing over 400 renovations. Some of the takeaways are listed below.

- Do not be trendy - For example, the current “in” color might be grey, but how will it look in ten years? We use a light tan for the walls and an off-white for trim, doors, and cabinets. We’ve used the same color scheme for the last 15 years.

- Use durable materials - On a renovation several years ago, we purchased carpet from a big box store. The carpet looked good and seemed to wear well. After a couple of years, the carpet on the stairs was damaged and had to be replaced. We went to the same big box store and purchased the same part number. When the carpet was installed, there was a noticeable color difference between the new and existing carpet. We ended up replacing all the existing carpets. We now use commercial-grade nylon carpets. There is no color variance over time with the commercial carpet, so we can replace high-wear areas, which blends with the existing carpet.

- Your tastes do not matter - This will not be your home; you're not going to live there. What you like or do not like is irrelevant. Make the house desirable to your target tenant pool. Listen to your investment team.

- Contractors & handymen - Finding and managing contractors and handymen can be a nightmare. Some considerations:

- Price is no indication of quality or timeliness.

- Everything in writing - Start date, duration, paint brand & colors, materials included, permits as needed, etc. Every line item will have a separate cost.

- Verify that they are licensed and provide proof of insurance.

- Fixed price – No matter how low the hourly rate, you can not afford to pay hourly. It will never get done if you pay by the hour.

- There will be unexpected expenses. Always include a pad in all renovation estimates. For us (in Las Vegas), it is common to have $200 to $300 in unplanned expenses on a ~$20,000 job.

- It will take longer than expected.

- CRITICAL - Unless you have a local person with construction experience to walk the property at least every other day, the job will take longer, cost more, and have poorer quality.

If you have questions, please post them, and I will try to answer them.

Post: Newbie from CA looking in Las Vegas

Post: Newbie from CA looking in Las Vegas

- Realtor

- Las Vegas, NV

- Posts 823

- Votes 1,574

Great comments on this thread. Thought I would add my thoughts.

A frequent mistake I see is that people combine different kinds of items and then calculate the average. A good example is real estate. The demographic of a person who buys a $1 million home is different than a person who buys a $300,000 home. A mistake would be combining all home sales and then taking the average. Below is an example.

Based on the average, home prices fell by 3%! In reality, million-dollar home prices fell, and $300,000 home prices rose. This is an example of why statistics can be very misleading if you average apples and oranges.

As an example of segment specific results vs metro averages, for the last 15 years, we've targeted a specific tenant pool, and the properties they are ready, willing, and able to rent. Below are 13-month rental statistics for this segment; it does not include properties outside of this segment or other types of properties like townhomes, condos, high rises, etc.

Rental Months of Supply by Month

In July, there was a small increase in average daily availability (units). However, there was still only 1 month of supply. Demand is still greater than supply. Pre-Covid it was 2-3 months.

Rentals $/SqFt by Month

There is virtually no change between June and July. I expect a small decrease in August due to fewer people moving.

Rentals List to Contract Days by Month

As you can see, in July, the median days on the market increased from 15 to 17 days. Pre-Covid, our segment's median time to rent was about 30 days. So you could say that the market has cooled some. But it's like being in a room where it was 150°, and the temperature drops to 130°, it's still hot. So, we do not see any change inconsistent with past seasonal trends.

Rental Closing by Month

There was an increase in closings between June and July. However, I expect the number of closings to drop in August due to school starting back up.

You cannot average all properties together and get anything meaningful. You have to look at specific segments of the market. The segment we target has been performing well for many years and we don’t see that changing in the foreseeable future. So whether it is a good time to invest in Las Vegas or anywhere else depends on a combination of the location, tenant pool, and the property.

There's another factor at play in Las Vegas and other locations. As prices and interest rates rise, fewer people can afford to purchase homes. Their only alternative is to rent. Historically, increasing prices and high-interest rates increased rents and rental demand.

Another consideration is the unique nature of Las Vegas. 87.5% of Clark County is federal land. 85% of the entire state is federal land. Las Vegas is a small area of private land in an ocean of federal land. There is not a lot of undeveloped land left in Clark County (the Las Vegas metro area). See the time-lapse below.

If you come to Las Vegas, you will see vast open areas and not realize almost all of it is federal land. So, in the long run, I see prices and rents will rise due to the increase in population, the creation of new jobs, and the land shortage combined.

On the water situation, some clarification.

Colorado River water is divided between 7 states, and Nevada is one of these states. If you would like to read a summary of the 1922 agreement, here is a link to the Wikipedia article.

Is Las Vegas water supply secure in the short term? Yes. Below is a quote from this article.

However, if the water falls significantly, the Hoover dam will not generate as much electricity. Fortunately, Las Vegas is one of the only major cities in the US with dual electric power sources: Hoover dam and California. I suspect that if we end up buying more power from California, our utility bills may increase.

What is the long-term water situation? Below is an article I wrote on the water situation.

Around 1890, research showed that the water supply would limit the LA population to a maximum of about 400,000 people. Everyone agreed; end of the story. Then William Mulholland, head of the LA water district, proposed building the Los Angeles Aqueduct. A 233-mile-long system to move water from Owens Valley to the San Fernando Valley. Today, the Los Angeles Aqueduct supplies a lot of LA’s water.

About 15 years ago, a study estimated the cost to build a pipe from Las Vegas to a location in Northern Nevada where there is sufficient water at about $2B. However, whether the cost is $2B, $4B, or $20B does not matter. The Resorts World Casino alone cost over $7B to build. No one will shut down a trillion-dollar business (Las Vegas) for a few billion dollars.

One of our clients works for the local water company. I asked him about water usage in the Las Vegas valley and learned that about 80% of the total water consumed is for irrigation in private homes, mostly watering grass. When the water situation gets sufficiently dire, the water company will increase prices, and the lawns will disappear. Grass in the Mojave Desert makes no sense.

What do others think? We have a lot of major projects under construction in Las Vegas; the total is over $22B. All these companies did their homework on the water supply and other potential issues before committing so much money. I trust their research.

In summary, in the short term, there may need to be a change in Las Vegas residential landscaping to reduce water consumption (lawns, etc.). Long term, the money, water source, and the necessary skills are readily available, so I am not worried about the short or long-term water supply of Las Vegas.