All Forum Posts by: Jerry K.

Jerry K. has started 51 posts and replied 683 times.

Post: Arizona Tax Lien advice

Post: Arizona Tax Lien advice

- Specialist

- Phoenix, AZ

- Posts 697

- Votes 624

@Steve Burt I knew I had a video I made about Real Auctions adding bidder data. The link is below. I also now realize that you can see the bidder distribution for previous years on Real Auction. I show that in the beginning of the video.

I'm putting together my strategy for the 2020 Arizona auctions coming up starting January 10th for Yavapai county.

Here is the link to the video I made in 2016 about the bidder data: Real Auction adds Bidder data 2016

Post: Arizona Tax Lien advice

Post: Arizona Tax Lien advice

- Specialist

- Phoenix, AZ

- Posts 697

- Votes 624

Post: Arizona Tax Lien advice

Post: Arizona Tax Lien advice

- Specialist

- Phoenix, AZ

- Posts 697

- Votes 624

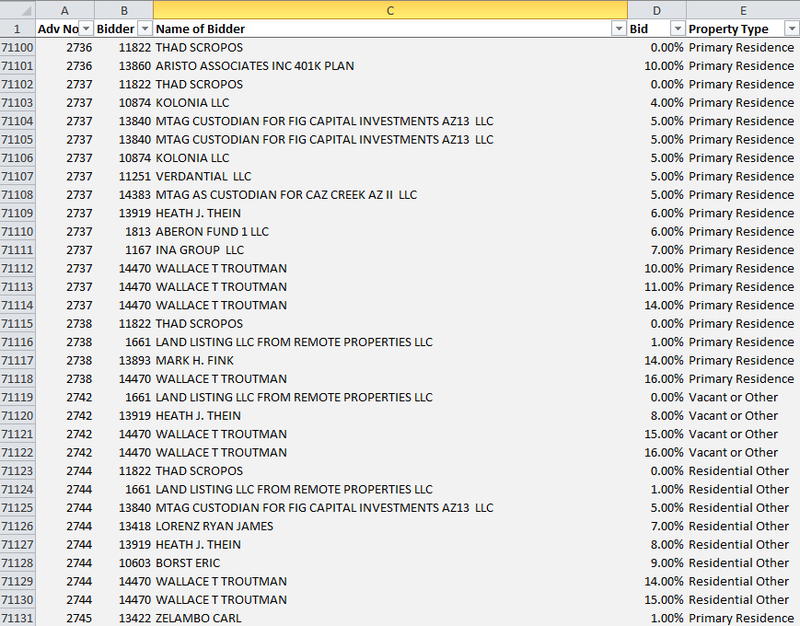

@Steve Burt Real Auctions does show the distributions of bidders. I just checked the site for Yavapai and I see they already deleted the distributions from last year's results in preparing for the 2020 auction in February. I grab the data and enhance it with the name of the bidder (if I have it) and the type of property. A screen capture is below. The ADV column is for each tax lien. (Click on the image to make it larger)

Post: Arizona Tax Lien advice

Post: Arizona Tax Lien advice

- Specialist

- Phoenix, AZ

- Posts 697

- Votes 624

@Aaron Perez I usually invest in Yavapai county and Coconino counties. I also invest in Pinal county to the south of Maricopa (Phoenix).

Post: Arizona Tax Lien advice

Post: Arizona Tax Lien advice

- Specialist

- Phoenix, AZ

- Posts 697

- Votes 624

@Aaron Perez - I do tax liens on vacant land in northern AZ. I do it mainly for the interest rate - not the property. Take a look at some of my blog articles on how I work at the link to the BP blog below.

Post: Billboard Investment Rents

Post: Billboard Investment Rents

- Specialist

- Phoenix, AZ

- Posts 697

- Votes 624

@Bruce Lynn Frank Rolfe was just featured on BP podcast #339. He spent the first part of his career building and buying billboards. He now invests in mobile home parks, But he has a fantastic ebook on billboard ground lease negotiating. I occasionally come across billboards in my tax lien investing as well and I needed a good resource on billboard ground lease negotiating.

The others are correct - you need to see if there is a ground lease already recorded and know the terms. Does it stay in effect when the property transfers title or not? If not, you can renegotiate a new lease.

Post: Beginner Tax Lien Questions

Post: Beginner Tax Lien Questions

- Specialist

- Phoenix, AZ

- Posts 697

- Votes 624

@Juan Santos What state is this example in? It does happen on rare occasions that I've heard. I've seen many examples where people either misread what they owe, or switch a couple of numbers on their check used to pay the taxes, etc. and they don't pay the full amount by accident. You're right, a small amount owed will usually get paid once the owner finds out.

There also are cases where the owner doesn't understand they owe the small amount and doesn't understand the process. They either had somebody who helped them in the past or they have become incapacitated in some way so that they can't handle their finances anymore and thus the real estate goes into tax foreclosure.

The property can be part of an estate that the heirs don't want to deal with and just will let it go. There are a number of reasons it happens. You are right, it doesn't make sense, but it can happen. Usually not on anything of much value.

Post: Beginner Tax Lien Questions

Post: Beginner Tax Lien Questions

- Specialist

- Phoenix, AZ

- Posts 697

- Votes 624

@Juan Santos Your scenario does vary. If the bidding type includes a premium, you need to learn the statutes/rules to see if the premium is paid back (sometimes yes, sometimes no) and if the premium earns interest (sometimes yes, sometimes no).

In general, you'll find the statutes either favor the homeowner or they favor the investor. If homeowner, then they have rules like premiums not being repaid, long redemption periods, low rates, difficult foreclosure procedures. If they favor investors then it's shorter redemption periods, no premiums or premiums that earn interest and are paid pack, etc.

There is a lot to read and understand before investing in liens/certificates/deeds.

Post: Flip in an Over 55 Community

Post: Flip in an Over 55 Community

- Specialist

- Phoenix, AZ

- Posts 697

- Votes 624

Nice job! Were than any issues other than one owner being at least 55? Like exterior color restrictions, landscaping standards, noise and work times, etc.

When I think of over 55 communities (and yes, I'm over 55) I think of nosy neighbors and ridiculous HOA restrictions. An 80+ guy sitting on his porch yelling at a 62 year old guy, "Hey punk, keep your dog off my lawn!"

Post: AZ Tax Lien Foreclosure

Post: AZ Tax Lien Foreclosure

- Specialist

- Phoenix, AZ

- Posts 697

- Votes 624

@David Ramos I buy tax liens in AZ. Great state but the long 3 year redemption makes it tough to plan paying sub taxes (if needed - some counties are changing so you don't have to pay subsequent years taxes to keep your lien in force).

When you complete that 3rd full year from the date of your original tax lien, then you need to send a certified letter to the owners and other lien holders (mortgage, mechanic liens, etc.) of your intent to foreclose. They have 30 days to respond/pay off the lien and interest.

If nobody pays the lien, then you can begin a judicial foreclosure ($1,800k - $2,500k are typical fees when using a lawyer). That can take several months - vacant land is usually a shorter term than if there is an improvement on the property.

The owner/lien holders can still redeem in that time foreclosure time frame. In most counties, they have to pay the lien, interest and your attorney fees. The one fee they don't have to pay is the cost of the "intent to foreclose" letter.

This has been my experience anyway. Others on BP have talked about foreclosing without a lawyer, but for me, it's too easy to miss something that needs to be completed/filed and each county can have some slight differences in how they want something done for foreclosure. I use a lawyer.

Would love to hear some of the details on your lien purchase.