All Forum Posts by: Jon Schwartz

Jon Schwartz has started 37 posts and replied 926 times.

Post: New Investor Starting out

Post: New Investor Starting out

- Realtor

- Los Angeles, CA

- Posts 952

- Votes 1,153

Originally posted by @Toby Kay:

Hello everyone,

My name is Toby and I am thrilled to be apart of a community of like-minded individuals with the same goals of financial freedom and overall success. I'm in my junior year at the University of Miami studying business and film. While the majority of my classes have been online, I have found time more recently in my day to get into real estate investing.

I recently finished reading The Guide on Rental Property Investing and have a hunger to procure my very first investment property. House Hacking and the BRRR strategy seem like great time tested plays in wealth building. Now I know what you're thinking, "Ah, kid reads one book and thinks he's a real estate guru" and well... I'm trying to get there at least. By joining this forum I'm hoping to network further, extend my financial/real estate literacy, and be well on my way to purchasing my first property.

I'm originally from Los Angeles but would like to start investing outside of California due to taxes and the oversaturated market

If anyone has any tips on getting started, life advice, or information regarding the Florida real estate market (specifically in miami) I would love to network! Agent recommendations and areas to look at in Miami are welcome too!

I would love also any further book recommendations or other sources on educating myself. Currently, I'm reading "Rich Dad Poor Dad" and will begin reading Gary Kelley's "The Millionaire Real Estate Investor".

As my father has would always tell me, "You buy knowledge once and you own it for a lifetime"

Toby, just want to chime in to say that CA has some of the lowest property taxes and the worst undersupply in the country. I don't know if your reasons for staying away are sound...

Best,

Jon

Post: ADU Worth the Investment?

Post: ADU Worth the Investment?

- Realtor

- Los Angeles, CA

- Posts 952

- Votes 1,153

Originally posted by @Ray Martinez:

Hey there BP Community,

I'm in the early stages of constructing an ADU and I've just been offered an opportunity for a job in AZ. (I'm currently in CA)

If I continue with the construction of the ADU, will I get the investment back if say I have it for at most 12 months?

Will the resale recoup the investment?

I'm constructing a 1 Bedroom/1 Bath 360 Sq Ft Garage Conversion in San Fernando Valley.

Thanks everyone!

Ray,

The ADU will make sense if you hold the property as a rental, but not if you sell the property in the near term.

ADU's aren't valued as traditional additions because they don't add square footage to the original house. Instead, they're valued as an amenity, like a swimming pool or wooden porch. Most appraisers these days are valuing ADUs at $40K-$50K, which is less than you're paying to build it, I'm sure. So don't expect to recoup your costs in a sale.

However, if you keep the home and rent out the ADU separately from the main house, you'll be getting an excellent ROI. What's a 1/1 rent for in your area? $1500/month? If you building an ADU for $100K and it generates gross rent of $18K/year, you're probably looking at a net return of $15K/year or 15%. That's AMAZING in LA!

So if you're planning to sell in the next year, stop construction. If you're planning to hold for a couple of years, keep building.

Good luck!

Best,

Jon

Post: Duplex House Hack Cash Flow Question

Post: Duplex House Hack Cash Flow Question

- Realtor

- Los Angeles, CA

- Posts 952

- Votes 1,153

Who's telling you your plan isn't possible? It seems totally reasonable to me. If the numbers work, it should work fine: refinance out of one FHA loan in order to acquire another.

Do you have a listing for the kind of duplex you want to buy? I'd be happy to run a listing through my spreadsheet, but I need the actual numbers!

Best,

Jon

Post: Residing in CA, LLC in WY, Syndication in TX - Challenges?

Post: Residing in CA, LLC in WY, Syndication in TX - Challenges?

- Realtor

- Los Angeles, CA

- Posts 952

- Votes 1,153

Originally posted by @Allen S.:

Look up “Anderson Advisors”... the tax and asset protection structures they recommend are set up very similar to this. You shouldn’t have to pay the $800 franchise fee to CA if all of the pertinent entities exist and do business outside of CA. PM me if you want me to put you in touch with our business advisor at Anderson. I have been very pleased with their services so far...

Allen, you should familiarize yourself with CA tax regulations before pontificating on them!

Best,

Jon

Post: Residing in CA, LLC in WY, Syndication in TX - Challenges?

Post: Residing in CA, LLC in WY, Syndication in TX - Challenges?

- Realtor

- Los Angeles, CA

- Posts 952

- Votes 1,153

Originally posted by @Jay P.:

I'm a resident of CA and I plan to invest in a syndication in Texas along with a friend of mine. I talked to a few lawyers and the recommendation was to create an LLC in WY with both of us as members and invest in the syndication through the LLC. A few questions though.

1. Once I register the LLC, how do I get a WY address to create a business bank account? Neither of us reside in WY or TX.

2. It seems like I would still have to pay the $800 annual fee to CA for the LLC as long as I reside in CA even if the LLC is incorporated out of state and holds investments outside CA. Is there a way to circumvent this?

3. I'm told the syndication would generate a K1 for our LLC and then the LLC would have to generate two separate K1s for each of the members. Is this a straightforward process?

Thanks,

Jay

Jay,

This is really complicated, and there's no reason for it.

If you and your friend are investing in the syndication as limited partners, you already have limited liability in the investment. That means that your liability does not extend any further than the capital you invest. At worst, you'll lose all of your money, but nobody can come after your home or other assets. If you're creating the WY LCC for asset protection, you're creating it needlessly.

And why are you and your friend forming an entity to invest together? Is it because there's a minimum investment amount? Don't worry; syndicators will take money from anybody who qualifies! Just explain that you two are investing together or not at all. Is there some other reason?

Best,

Jon

Post: First time home buyer: Investment property

Post: First time home buyer: Investment property

- Realtor

- Los Angeles, CA

- Posts 952

- Votes 1,153

@Spenser Hachey, you’ll most likely have to put down 25% for a non-owner-occupied property.

Good luck!

Post: Anybody have experience adding a unit or building an ADU in LA

Post: Anybody have experience adding a unit or building an ADU in LA

- Realtor

- Los Angeles, CA

- Posts 952

- Votes 1,153

Originally posted by @Daniel Krantz:

@Jon Schwartz thanks for the input! So have you built an ADU at a rental?

Also call @Yosef Peretz. He's a new friend in LA.

I have not built an ADU at a rental, but I've looked into it. Are you converting a structure or building from scratch? Do you have any questions that could be answered here?

Post: Tenants moving out while behind on rent

Post: Tenants moving out while behind on rent

- Realtor

- Los Angeles, CA

- Posts 952

- Votes 1,153

Originally posted by @David Boden:

We have a 6-plex we've owned for just over a year. All units are under market value in Los Angeles.

One unit has been giving us trouble and have been late on rent since before the pandemic and we were looking to begin eviction proceedings right as the moratorium was put in place.

We were considering doing a cash-for-keys option if they didn't pay rent on time this month and we've already waived all the late fees for the last months (per the County). When we wrote on the 1st to ask if they intended to make any payments in September, they wrote --

Hello how are you guys doing ? Thanks for helping us in the best way possible any small gesture has been a huge help. Thing is that due to all this COVID my moms husband lost his job. So we are going to be leaving back to our hometown Sacramento. Thank you for everyThing/ and your patience, sorry for the late notice. Take care god bless and good luck.

We are at a loss for how to proceed. They didn't give us a move-out date. We are owed roughly $3,500 in back rent payment. We haven't done an inspection (they've had a cat for the last 3 months in a building that doesn't allow pets).

We are looking for advice on how to respond, how to phrase that they aren't entitled to getting their security deposit back and what we can do about the rent. Rent has been coming from the tenants' son who works at a fast-food chain that lost his shifts. Thanks, all!

David,

Google "AB 3088." It was just passed by the state legislature. Rent unpaid during COVID can now be sought through small claims court. Not that you're likely to recover if you tenants are deadbeats, but that's a plus for landlords!

You're entitled to use the security deposit for repairs and unpaid rent (I'm 90% sure, but you should check with Santa Monica ordinance). You're not required to inform your tenants that they won't be getting their deposit back..

I'd be totally reasonable and above-board with your response. Ask them when they'll be vacating and let them know how much rent you are owed. Don't bring up the deposit; if they ask, tell them you'll return everything minus repair costs and rent owed.

Are the tenants unstable? What's the risk that they'll trash your place before leaving if you have a bad interaction?

In the grand scheme of things, I'd consider $3500 a small cost to get rid of a deadbeat tenant!

Best,

Jon

Post: Anybody have experience adding a unit or building an ADU in LA

Post: Anybody have experience adding a unit or building an ADU in LA

- Realtor

- Los Angeles, CA

- Posts 952

- Votes 1,153

Originally posted by @Daniel Krantz:

Hi Los Angeles investors!

I'm looking at a multifamily property right now, but the deal hinges on my ability to add another unit to the property. Does anybody here have experience adding an ADU or another permitted unit to a property in Los Angeles?

Best,

Daniel

Daniel,

I recommend you google "Los Angeles ADU designer" and call the results to ask questions. ADUs are big business are here, so these folks will be happy to impress a potential client.

Best,

Jon

Post: Duplex House Hack Cash Flow Question

Post: Duplex House Hack Cash Flow Question

- Realtor

- Los Angeles, CA

- Posts 952

- Votes 1,153

Originally posted by @Dave McCulley:

I am looking to get out of my current SFH and into a duplex to house hack. I know cash flow is very important and getting the best deal is the most important thing.

If I break even of have to pay a little in mortgage by renting out one side and house hacking the other all while building equity in it, is this not a good idea since it's not cash flowing yet?

I want to get into duplex owning, but as far as living in one, I don't want to be in a class C neighborhood and would have to pay more.

Anyone have any expertise in this area?

Dave, at the risk of ruffling @James Bradin's feathers, I'm going to tell you not to listen to his advice.

Firstly, all real estate is local, and the same is true of real estate investing. I live and invest in Los Angeles, so my metrics a totally different than James's and will be different from what works for you. Don't chase the 1% rule into a D-class neighborhood! Don't walk away from a good opportunity because it's cashflow neutral and not $200/door.

Right now, I'm househacking a beautiful, historical duplex in Hancock Park, a pretty ritzy neighborhood in LA. It doesn't cashflow, but I'm paying net about half what my tenants' pay (and I have the better unit!), and the financial advantages don't stop there.

So let's look at the different ways that househacking a duplex benefits you financially:

Firstly, there's the reduced cost of living. Even in a high-price city like LA, househacking a duplex is cheaper than renting a comparable apartment or owning a house down the block. Some markets have price points that allow a househacked duplex to cashflow; some don't. Regardless, your housing cost is likely to be cut in half or more. That's awesome!

Secondly, there's the principal paydown. This is the not-talk-about-enough magic of househacking. Let's say your mortgage cost is $1500/month and you can rent the other unit for $1000/month. Your tenant is paying 2/3 of the mortgage, but all of the principal paydown is going onto YOUR balance sheet. Even month, your net worth increases by the amount of principal that gets paid down.

Thirdly, appreciation adds up -- though this is really dependent on where you live. In LA, appreciation is a powerful wealth-building force. In most Midwest markets, not so much (though of course there are exceptions!).

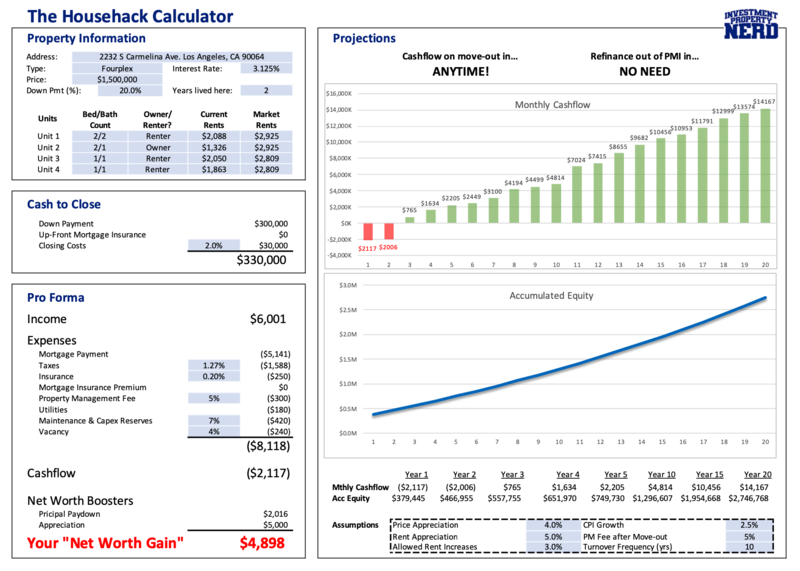

I'm a bit of a nerd for househacking, so I put together a spreadsheet to quickly analyze a househacked multifamily. Here's an example with a fourplex in LA that a friend is considering:

I'd love to run the spreadsheet for an out-of-state market that doesn't have rent control or much appreciation and see how that changes the longterm projection. You game to find a listing in your local market so we can run it through the spreadsheet?

Best,

Jon