All Forum Posts by: Jon Schwartz

Jon Schwartz has started 37 posts and replied 926 times.

Post: Buying a Condo to later turn into a rental property

Post: Buying a Condo to later turn into a rental property

- Realtor

- Los Angeles, CA

- Posts 952

- Votes 1,153

@Anthony Holloway, good morning!

Just some initial thoughts as I get my first cup of coffee in me...

Your eventual refinance will be at 75% LTV tops, so any equity you're able to pull out will have to be beyond that. Have you looked at the numbers? I'd be happy to create some hypotheticals a little later this morning.

I’d say the make-or-break element of this plan is your ability to quickly build up equity in the condo. So you’d have to buy an eyesore of a condo — not on the exterior, but on the interior. You’d have to find a condo that’s dated and ugly and selling for much less than other condos in the building have. So you’d be executing a live-in flip to force the equity build.

Another possible route is to buy a 2-bed and rent out room #2. In this scenario, you’d want to buy at the top end of your budget (with enough set aside for a few months of vacancy if such should happen) so that the principal pay down is bigger. You’d still need to run the numbers on this and see exactly how many principal has been paid down in a few years.

Buying for equity growth isn’t a bad plan in LA, but with a relatively short timeline and a condo, you’ll have to be really exacting in your strategy.

Post: What would you do? (in-laws trying to support w/home purchase)

Post: What would you do? (in-laws trying to support w/home purchase)

- Realtor

- Los Angeles, CA

- Posts 952

- Votes 1,153

Originally posted by @Gracie Brown:

This is hopefully not as complicated as it might sound, but was wondering if any of the great minds on this forum have thoughts on best strategy for current situation.

My husband's parents are fortunate enough to own two properties:

House #1: A bungalow a few blocks from the beach in Venice Beach, CA - purchased for basically nothing in the 80s, own outright, probably worth about $1.2 million (guessing).

House #2: A 3bed 2 bath amazing view house with guest house in Topanga, CA - purchased for basically nothing in the 80s, has a 350k mortgage on it, probably worth about $2 million.

(both have extremely low tax basis)

My husband parents are also incredible generous, and were looking into way to help us and his sister purchase properties, without having to wait for the trust to be divided upon their death (knock on wood, not for a long while!).

The first idea was to 1031 the Venice house, giving each child enough to pay ~$500k or so down on a house.

Pros: higher payout

Cons: they have an existing tenant whom they are collecting $4k/mo from that they would lose, each sibling is looking for completely different things, so the timeline of the 1031 is scary in this real estate market, the house would be out of the trust.

The second idea was to take a loan on one (or both?) properties, giving each child just enough for a down payment, essentially (a few hundred grand).

Pros: both houses left in trust, quicker (?), simpler (?)

Cons: less $$, the loans on the properties would increase, would have to pay the loan (likely with the rental income from property #1)

Is there a better option that we just don't know about? I have been on this forum for a minute, but in practice, I don't know what the best way to go about this is. I thought this would be a great place to get any creative ideas that may be out there that we are unaware of. Is there a different way to use the equity in each home without overcomplicating?

I'm dying to know where there is headed!

Post: Paint for condo getting ready to sell

Post: Paint for condo getting ready to sell

- Realtor

- Los Angeles, CA

- Posts 952

- Votes 1,153

Post: Paint for condo getting ready to sell

Post: Paint for condo getting ready to sell

- Realtor

- Los Angeles, CA

- Posts 952

- Votes 1,153

Originally posted by @Shawn S.:

I have 1bd/1bath condo in Los Angeles that I purchased before I discovered BP. This was my former primary residence and the numbers don’t pencil out that favorably to make it a rental. So I plan to take my equity elsewhere. My question is what color should I paint the interior before selling it.

1. I’m planning on keeping the ceilings white and the baseboards white.

2. There are custom interior doors that are dark green and I plan to keep those as is or should I paint them?

3. Should I just paint the entire interior white to keep things simple and cheap or will a two tone be better? If so which colors?

4. Any recommendations for a painter in Los Angeles?

Thank you!!

A suggestion from the peanut gallery for your walls:

https://www.homedepot.com/p/BE...

Silverdrop is an very light grey/off white that goes great with white trim.

Good luck!

Post: PLEASE HELP: Buying First Home

Post: PLEASE HELP: Buying First Home

- Realtor

- Los Angeles, CA

- Posts 952

- Votes 1,153

Originally posted by @Diana Camacho:

@JonSchwarts Thanks so much for your reply and I am appreciative of your willingness to help. The office is in Glendale and I live in Avocado Heights, near La Puente and Hacienda Heights. Pre pandemic, my commute was anywhere from 50 min to 1:10 hrs. It's not ideal but the average commute in LA. I have been looking for places in Azusa (looks like they have a lot of new construction), West Covina, Covina, Hacienda Heights, Rowland Heights, Montebello, and Whittier. I have looked in the cities west of the 605 but the closer they get to DT, the more expensive everything gets. I have also considered looking in Dimond Bar, Glendora, and Walnut. These are farther from work but they are nicer cities.

I am having a hard time determining what cities will be the best investment because I have seen the prices in cities like El Monte go up dramatically and they are not the safest or nicest.

Diana,

To answer your last question first, home prices go up when demand goes up -- ie, when more people want to live in a place. And that's not necessarily because the place has become any safer or nicer. I lived in Echo Park from 2009 to 2019 and watched home prices skyrocket (I remember the first $1M sale, then the first $2M sale) while the neighborhood became marginally safer and nicer.

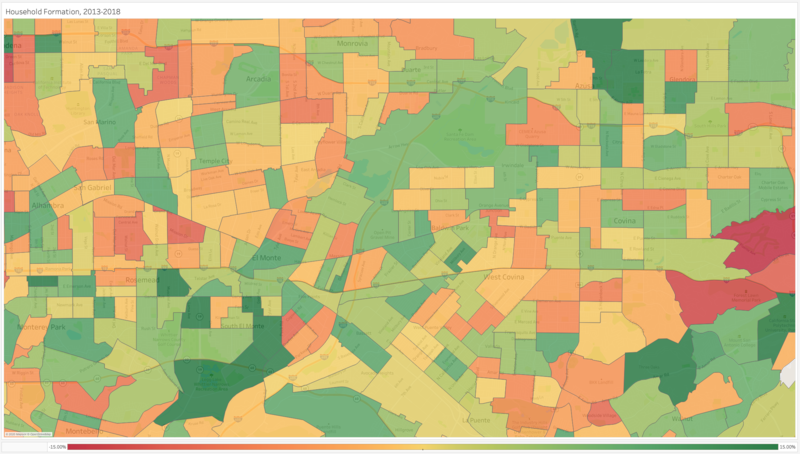

Here's a map of household formation form 2013-2018 (that's the most recent data the Census Bureau has published) in the area you're considering:

As you can see, El Monte is very green!

I guess my question for you is: how much of an investor do you want to be with this purchase? Looking around at what's on the market now, I'm surmising you're comfortable with a purchase around $400K. For that amount, you could buy a larger, move-in ready condo in a nice area an hour from Glendale. OR, you could buy a condo that's smaller or needs a renovation closer to work. OR, you could buy a condo in an up-and-coming neighborhood that isn't necessary "nice," but it appreciating well.

I'm seeing some inexpensive listings in Downtown LA and Westlake, which is just west of Downtown. Obviously, these are areas people are leaving because of COVID -- so they're probably a great buy right now!

And check out this listing. This is interesting for two reasons. One, it's in Mount Washington, which is definitely a gentrifying area and solid for investment. Because the neighborhood is still attracting lots of young people, this condo will convert in a great rental when you move out. And two, this is a TIC listing, which is a new kind of condo alternative. TIC stands for "tenants in common," and a lot of developers are converting courtyard apartment buildings into TICs. You and the owners of the other bungalows together own the entire parcel. I'd need to dig up the details again, and there are special requirements regarding financing, but it's an interested option.

Anyway, those are some wild suggestions. I come back to you with the question: how much of an investor do you really want to be with this purchase?

Also, how many bedrooms do you require?

Best,

Jon

Post: Salesperson exam/license CA

Post: Salesperson exam/license CA

- Realtor

- Los Angeles, CA

- Posts 952

- Votes 1,153

Originally posted by @Sam Shueh:

No broker will even want to chat with you until you pass the test.

That's not true. I've already spoken with two.

Post: Entering the exciting world of real estate in Los Angeles

Post: Entering the exciting world of real estate in Los Angeles

- Realtor

- Los Angeles, CA

- Posts 952

- Votes 1,153

Originally posted by @Pushkar Mulay:

Hello BP,

My name is Pushkar and I am currently living in Los Angeles. I am a recent MBA graduate and my day job is in technology product management. While I was a student, I became really interested in real estate based off of a couple of real estate finance courses I took. I am looking to learn about real estate strategies in the multifamily and short-term rental space.

Separately, I have also started working on an internet-of-things (IoT) project that helps enforce hand hygiene in public restrooms and would love to get some feedback from the community here. It would be greatly appreciated if someone could please share the right sub-forum where I can post about it.

Looking forward to participating in some wonderful real estate discussions soon!

Welcome, Pushkar! LA is an exciting, dense, diverse market. There's a lot to do here!

I'm a buy-and-hold multifamily investor and a househacker. I really like LA for its strong appreciation and low cap rates. Cashflow isn't stellar here, but equity growth and wealth creation is! I dig those.

What strategies have caught your interest?

Best,

Jon

Post: PLEASE HELP: Buying First Home

Post: PLEASE HELP: Buying First Home

- Realtor

- Los Angeles, CA

- Posts 952

- Votes 1,153

Originally posted by @Diana Camacho:

Hi there, I am planning on buying my first home. I live in SoCal and although the interest rates are very low the market here is very competitive. Everything is selling quickly and for a higher price than listed. I would love to get into real estate investing but I am not too sure how to approach it considering the high cost of loving here.

The areas I am looking for to buy will put me at a 1 hr. commute from work (the closer to LA, the more expensive everything gets). I am thinking of buying a condo, I can't afford a home without the need of major renovations or having a 1:30+ hrs commute when I go back to work on-site. I know condos are harder to sell and they don't typically give you the best return for your money but it seems like the best option at the moment.

I plan on buying a condo, living there for a few years, sell or rent, and then buy a home and hopefully an investment property. How should I determine what are the best cities to buy this first property in? I am considering areas in decent cities but there are also nicer/cheaper areas getting farther away that would add 30 min to my commute. How can I determine if enduring a longer commute it's worth it? A lot of the areas closer to LA have been gentrified and the prices have gone up a lot but the cities are still not the nicest. Not sure how to determine if the closer cities I am considering will follow the same pattern.

I have a good credit score (750+) and I have ~$30K for downpayment and closing costs. What steps and considerations would you all recommend? Is this a good approach or would you suggest I consider something else?

Thanks!

Diana,

With you savings and good credit, I think it's entirely possible to find a condo within a decent drive to your workplace in Los Angeles.

Your timeline is also very good! People are selling their condos in droves right now and moving out to the burbs. It's a great time to buy. And personally, I think this trend will revert back to the norm after we get past the current health crisis. So, 2-3 years down the line, right when you're thinking of selling or renting your condo, I bet demand for urban living will be back where it was six months ago.

In my mind, the piece to get right is neighborhood. I love studying and mapping LA submarkets. I'd love to help!

So the first question is: where's work? Where are you commuting to everyday? All else being equal, it'd be ideal to keep your drive under 30 minutes!

All the best,

Jon

Post: How can I market my room to rent a room quicker

Post: How can I market my room to rent a room quicker

- Realtor

- Los Angeles, CA

- Posts 952

- Votes 1,153

@David Minaya, I definitely recommend Facebook Marketplace.

To find rent comps, you’re best off looking at Craigslist and seeing what other bedrooms in your area are renting for. Rentometer, Zillow, Zumper, etc. estimate rents for apartments, not individual bedrooms. If you’re basing your asking price on what Rentometer says a one-bedroom apartment rents for in your area, you’re asking for too much! That might explain the lack of interest.

Good luck!

Post: House hacking in HCOL

Post: House hacking in HCOL

- Realtor

- Los Angeles, CA

- Posts 952

- Votes 1,153

Originally posted by @Taylor Alseth:

Hey everyone!

So I am looking to move to Calgary, Alberta within next two-three years. I am definitely looking to purchase my first home and house hack it. Real estate is very expensive in Calgary. I am looking for general advice for house hacking in HCOL areas. Any advice that would be helpful?

Taylor, I'm househacking a duplex about four blocks from this SFR listing:

https://www.redfin.com/CA/Los-Angeles/201-S-Plymouth-Blvd-90004/home/7096031

So, definitely a HCOL!

My biggest piece of advice would be to look at the holistic value of your purchase. Don't expect cashflow, but do expect to live for less than your neighbors and watch your equity grow.

To get specific, my tenants pay $4975/month for the downstairs unit. We live upstairs in a nicer unit, and our monthly outlay is about $4000. So already we're ahead for this neighborhood. On top of that, I'm getting about $2100/month in principal paydown -- so my "net net" monthly cost is more like $1900. And my duplex is appreciating at the same nice clip as all the SFRs surrounding me! I feel like I've cheated my way into this beautiful neighborhood!

Good luck!

Best,

Jon