All Forum Posts by: Lee Ripma

Lee Ripma has started 13 posts and replied 2032 times.

Post: Anyone used Rent to Retirement

Post: Anyone used Rent to Retirement

- Rental Property Investor

- Prairie Village, KS

- Posts 2,098

- Votes 2,365

@Jason Dirks - just make sure vet the locations you’re investing in. The TK stock sold by rent to retirement in the KC market is in very rough areas. Just go in eyes wide open to what you’re buying. If you want some ideas on how to vet remote locations feel free to PM me.

Post: RE investor / agents in CA - what is the best flat fee brokerage?

Post: RE investor / agents in CA - what is the best flat fee brokerage?

- Rental Property Investor

- Prairie Village, KS

- Posts 2,098

- Votes 2,365

I switched over their dual agency policy. I used the in house TC which was maybe another 400 per transaction. It was easy, if you need any help on forms not a good choice. If you're cool 100% doing your own thing then it totally works. United Realty is way more responsive if you have a question or need anything. They also charge more but it's all a trade off between what you need and what you pay. If you're MLS only then you'll need to buy your own zip forms.

Post: Analyzing property with rent control

Post: Analyzing property with rent control

- Rental Property Investor

- Prairie Village, KS

- Posts 2,098

- Votes 2,365

Sounds like you have some experience but your next moves are uncertain. You’ve got resources so not sure why you’d be spending your own time driving for dollars. I always say look at your goal, then figure out how to get there. Goal currently: buy cash flow positive RE, wealth accumulation, and financial freedom. I’d say that’s too broad. What’s one project you could do in the next 3 months that would get you closer to that? What resources do you currently have to get you closer to your goals?

Post: RE investor / agents in CA - what is the best flat fee brokerage?

Post: RE investor / agents in CA - what is the best flat fee brokerage?

- Rental Property Investor

- Prairie Village, KS

- Posts 2,098

- Votes 2,365

REebroker with MLS only access. That's what I did when I started. Then I became more active and switched to the local United realty group. Most brokerages want you to work as an agent. REebroker is likely your best choice.

Post: Market Option for 2021

Post: Market Option for 2021

- Rental Property Investor

- Prairie Village, KS

- Posts 2,098

- Votes 2,365

@Noah Spiegel - I’m still a fan of out of state investing. Be careful who you listen to when folks say there are no deals to be had. Is it harder than 2011, yes, is it impossible to buy in a growing affordable market with meat on the bone, not at all. I’m doing it, many others on this site are doing it. I’ll send you some resources for a data driven approach to picking a market and vetting deals.

Post: Skip Tracing a second time for missing data?

Post: Skip Tracing a second time for missing data?

- Rental Property Investor

- Prairie Village, KS

- Posts 2,098

- Votes 2,365

I would just try it and compare. I double skip trace sometimes.

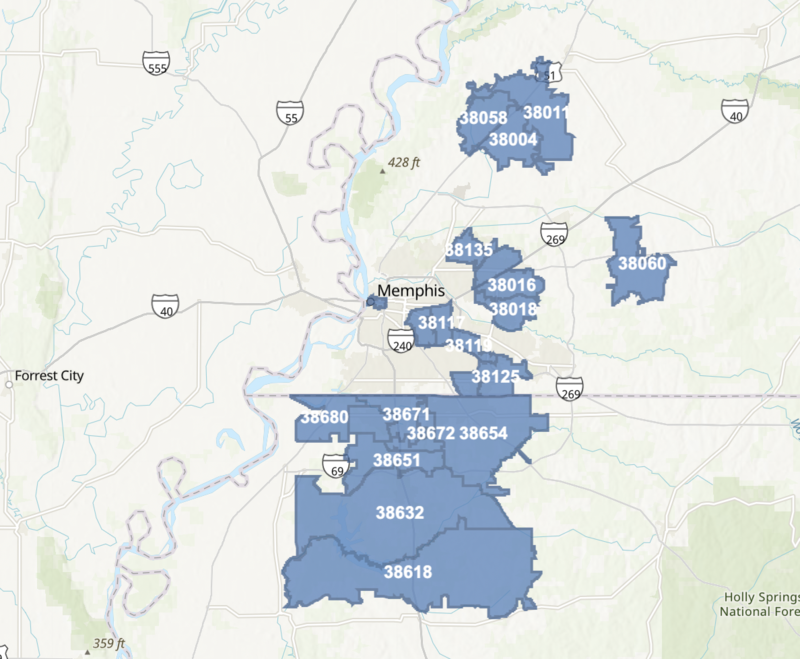

Post: OOS Investor Interested in Memphis Looking for Feedback

Post: OOS Investor Interested in Memphis Looking for Feedback

- Rental Property Investor

- Prairie Village, KS

- Posts 2,098

- Votes 2,365

Post: How’s the St.Jospeh, MO market??

Post: How’s the St.Jospeh, MO market??

- Rental Property Investor

- Prairie Village, KS

- Posts 2,098

- Votes 2,365

I'm an investor in the KC market and I wouldn't buy in St Joe. It's small town with a lot of old cheap houses. It's hayday is long past, that used to be where the crossing of the Missouri river was. Well now there are lots of other bridges so no one needs to go there anymore. You can get cash flow because the prices are so low. However, the housing stock is very old and the houses are all from the turn of the century. Rents are low and population growth is non-existent.

Kansas City has great growth but St. Joe won't really benefit from all that growth because there is a whole lot of land in the surrounding area (unlike CA). My advice, pay higher prices to be in the path of progress in KC. I'm happy to suggest some areas. If you want lower price points checkout Grandview and Belton, KC suburbs. For a bit more you can get into Blue Springs, Lee's Summit, and Grain Valley. There are lots of great submarkets in KC but St. Joe isn't one of them!

Post: Best Ways to Analyze Your Market

Post: Best Ways to Analyze Your Market

- Rental Property Investor

- Prairie Village, KS

- Posts 2,098

- Votes 2,365

I’ve got very specific ideas about this, feel free to DM for details!

location insights can be hard, I run the DISCERN method on all potential locations.

Post: ListSource or PropStream?

Post: ListSource or PropStream?

- Rental Property Investor

- Prairie Village, KS

- Posts 2,098

- Votes 2,365

Depends on the type of property you’re looking for. I’ve found list source to be low quality for MF at least in Missouri.