All Forum Posts by: Ron Gallagher

Ron Gallagher has started 11 posts and replied 191 times.

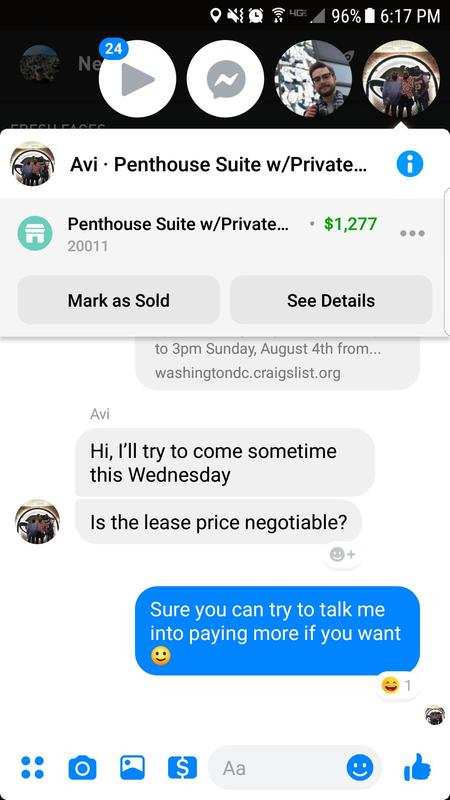

Post: Tenant Applicants say the dumbest things

Post: Tenant Applicants say the dumbest things

- Investor

- Washington, DC

- Posts 198

- Votes 323

Post: How can I buy property for $10,000 down?

Post: How can I buy property for $10,000 down?

- Investor

- Washington, DC

- Posts 198

- Votes 323

Originally posted by @Michael Ealy:

One thing that others have not covered here is get a Business line of credit. If you have a 720 credit score, good job and very little credit card balances, you can qualify for a $40,000 (or more) BLOC.

I want a BLOC! Which lenders do you use for your BLOC?

Post: Where are you buying for cashflowing properties today?

Post: Where are you buying for cashflowing properties today?

- Investor

- Washington, DC

- Posts 198

- Votes 323

Originally posted by @David Friedman:

San Bernardino, CA. My favorite place.

I just picked up 6 units for $550,000 and they all rent for $1,000 each. Anybody that says you can't achieve the 1% rule in California isn't trying hard enough.

I am also getting close to the 1% rule in the Washington DC metro area. All the properties that I have purchased in the last couple of years almost meet the 1% rule, which is a similar price to rent ratio that I am seeing for turnkey properties in cash flowing markets, so I feel pretty good about getting those cash flow numbers in DC that you would expect to find in the midwest and still being able to benefit from the appreciation the DC market provides.

Post: Any tips for moving refrigerators purchased second hand?

Post: Any tips for moving refrigerators purchased second hand?

- Investor

- Washington, DC

- Posts 198

- Votes 323

Home Depot usually will rent you a truck for around $20 an hour. In the past when I have need to move bulky items I just rent the Home Depot truck for an hour or two.

Post: Washington DC's New Airbnb Law

Post: Washington DC's New Airbnb Law

- Investor

- Washington, DC

- Posts 198

- Votes 323

Thank you @Tom Gimer you just potentially doubled my future rental income!

Post: Washington DC's New Airbnb Law

Post: Washington DC's New Airbnb Law

- Investor

- Washington, DC

- Posts 198

- Votes 323

I know that DC's new airbnb law allows you to rent out a room or the basement of your primary residence without restriction if you are also present (not on vacation or away from the property), but can I rent out more than one bedroom in my primary residence on airbnb all at the same time?

In other words, under the new law, can a person have multiple listings on airbnb for the same address? I have read the airbnb bill online and I don't see where this scenario is addressed. Does anyone with more knowledge of the law have any insight into this?

Post: Advice needed for a newbie cash buyer

Post: Advice needed for a newbie cash buyer

- Investor

- Washington, DC

- Posts 198

- Votes 323

You can get a no-docs mortgage these days but the interest rate will be 7%+ and you'll probably have to pay 2 points, but getting a mortgage is not out of the question.

Post: Rental Property on Main Street

Post: Rental Property on Main Street

- Investor

- Washington, DC

- Posts 198

- Votes 323

Awesome... did you have to pay a bunch for flood insurance?

Post: What happens to rents during a recession?

Post: What happens to rents during a recession?

- Investor

- Washington, DC

- Posts 198

- Votes 323

I will also add that people moved to DC during the recession because they were looking for secure government jobs. The government isn't going out of business and isn't getting any smaller so that's another reason to invest in DC if you are worried about a recession. I was a DC landlord during the great recession and if you plotted a graph of my DC rents during the last 15 years you would see no dip in my rental income, rather you would see a gradual upward trend as I have been able to increase the rent on my DC rentals a little bit each year whether there was a recession or not.

Now of course my property values took a dip during the 2008 recession but since I didn't sell it really had no impact on my rental business. I can't think of a city that is more recession proof then DC is for buy and hold rentals. My biggest fear when investing in DC isn't a great recession, but rather if a terrorist attack wiped out my rental properties. Luckily some of the insurance policies I have do include a rider for terrorism.

Post: What do you name each of your rental properties?

Post: What do you name each of your rental properties?

- Investor

- Washington, DC

- Posts 198

- Votes 323

Street name or neighborhood.

To answer how I keep track of the different properties- I use cozy.co where I can track all the incoming rent payments for each property/unit, add an expense for a particular property, and export a spreadsheet based on property or unit within that property.