All Forum Posts by: Steve Meyers

Steve Meyers has started 19 posts and replied 175 times.

Post: Buying out Siblings of Inheritance properties

Post: Buying out Siblings of Inheritance properties

- Real Estate Agent

- San Diego, CA

- Posts 190

- Votes 77

@Karim Baker what's your goal with the properties to sell them for top dollar or keep them as rentals or keep one as a primary and the other as a family rental? There are a lot of different options out there. If looking to sell one of them and the property is vacant you could use curbio. They upfront the costs of rehab and get paid back once they property sell from the proceeds. If you're looking to owner occupy one of them then a 203k loan might be a good way to go. That's the FHA loan product for rehabs there is also the homestyle reno loan which is the conventional loan product.

As for the family rental property see if you can negotiate some type of seller financing terms for that one where you can still cash flow on the property without having to raise the rents, it sounds like there is a very small loan amount left on it so that would probably be your best option if your family members want to stay and keep renting the property.

Post: Introduction of a newbie

Post: Introduction of a newbie

- Real Estate Agent

- San Diego, CA

- Posts 190

- Votes 77

@Joseph Thompson welcome to the community. I'm also an investor as well as FT agent here in San Diego. I'm an end buyer but also have an extensive cash buyers list too if it's not a fit for me. Let me know if there's anything I can do to help you in your RE journey

Post: Finding/skip tracing absentee elderly owner

Post: Finding/skip tracing absentee elderly owner

- Real Estate Agent

- San Diego, CA

- Posts 190

- Votes 77

@Edward Badal I would recommend using a site like truepeoplesearch.com it's free and pretty accurate, it also allows you to track down the possible known associates of the owner and their contact numbers.

Buying a burnt house is usually going to be a tear down the framing isn't structural enough to keep. I'm very well connected here in San Diego to investors who take on these projects if you wanted to team up and JV on this deal I'd be happy to help you out. I wouldn't worry too much about the family members not wanting to sell most of the time they just don't know what to do and need some guidance. I doubt they are going to want to keep the house especially if it's damaged from fire. Hope that helps

Post: New to BP and first time investor

Post: New to BP and first time investor

- Real Estate Agent

- San Diego, CA

- Posts 190

- Votes 77

@Tyler Torres I would recommend following these guys on instagram they do a lot of investing in the midwest and could help you decide which area you want to invest in. @tcruznc @investwithace @investarters

San Diego is definitely a hard market for both cash flow and competition and hard for newbie investors, good luck on your journey!

Post: How to finance an ADU?

Post: How to finance an ADU?

- Real Estate Agent

- San Diego, CA

- Posts 190

- Votes 77

@David Yee my advice would be to look into Multitasker. I got introduced to them at an ADU meetup recently in Solana Beach and was impressed with all they have to offer and they do financing for ADUs. https://gomultitaskr.com/adu-f...

Post: San Diego Homes Prices & Inventory Supply - January 2022 to January 2023

Post: San Diego Homes Prices & Inventory Supply - January 2022 to January 2023

- Real Estate Agent

- San Diego, CA

- Posts 190

- Votes 77

Hi All,

With Q2 of 2023 well under way, I wanted to recap what we saw in April now that market stats for last month are available.

In April we saw 1,312 single family detached homes for sale roughly an 8% decrease from the 1,431 availble inventory in March. We also saw a decrease in the number of condos/townhomes available for sale down from 803 in March to 696 in April about a 13% decrease in inventory.

Buyer demand continues to remain strong in most areas of the county and mutiple offers are still happening as well. We saw a 99.7% list price to sales price for single family detached homes in April and 100.3% list price to sales price for condos/townhomes in April. In layman's terms sellers were getting either their listing price or over the listing price last month for their property.

If you are interested in knowing stats for a certain area or zip code just respond back to this email and I would be happy to send you some market stats on it!

New Listings for Detached Single Family Residences

-In April we saw 1,312 new listings for single family detached homes hit the market. Down about 8% from the 1,431 we saw in March. The increase in supply we saw from February to March quickly got erased with the 8% decrease in suppy from March to April.

New Listings for Condos/Townhomes

-We also saw a decrease in the number of condos/townhomes available for sale down from 803 in March to 696 in April about a 13% decrease in inventory.

Pending (Under Contract) for Detached Single Family Residences

We saw 1,291 single family detached homes go under contract in April. There were a total of 1,312 new houses listed for sale in April. 98% of homes listed in April went under contract in that same month.

Pending (Under Contract) for Condos/Townhomes

We saw 729 condos/townhomes go under contract in April. There were a total of 696 new condos/townhomes listed for sale in April. Meaning all the condos/townhomes that were listed in April went under contract and the additional 33 condos/townhomes were carry over listings from March.

Closed Sales for Detached Single Family Residences

A total of 1,182 homes were sold in April. ***(Not all homes that go under contract in that month will close that same month)***

Closed Sales for Condos/Townhomes

A total of 694 condos/townhomes were sold in April. ***(Not all condos/townhomes that go under contract in that month will close that same month)***

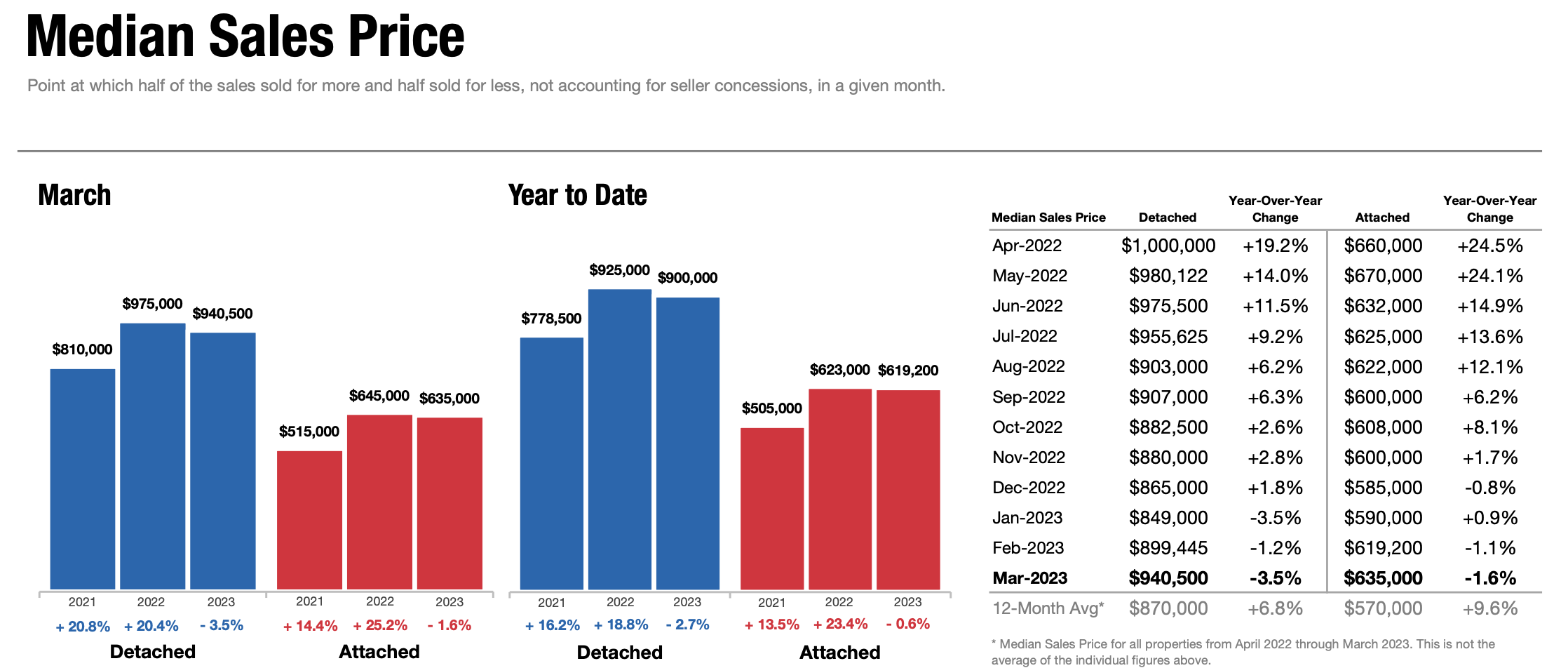

Median Sales Price for Detached Single Family Residences from Jan-April

January Median Sales Price: $849,000

February Median Sales Price: $900,000

March Median Sales Price: $940,500

April Median Sales Price: $952,600 (Up $103,600 since January)

Median Sales Price for Condos/Townhomes from Jan-April

January Median Sales Price: $590,000

February Median Sales Price: $616,000

March Median Sales Price: $635,000

April Median Sales Price: $640,000 (Up $50,000 since January)

Today's Mortgage Rates

Post: What is a good amount to save to prepare for first Real Estate Investment?

Post: What is a good amount to save to prepare for first Real Estate Investment?

- Real Estate Agent

- San Diego, CA

- Posts 190

- Votes 77

@Zarrin M. San Diego is a tough market in general to cash flow in for an investment property, it's definitely still possible just harder to find those gems. I wouldn't waste the time trying to save up 20% down for an investment that will take forever for most people and the market can change a lot by the time you're ready.. With FHA the property needs to pass a self sufficiency test which basically means that 75% of the rents must cover the mortgage amount, which I have yet to find here in San Diego because a lot of the time these mutli units have tenants in them that have been paying well under market rents. The lenders won't use short term rental income either so it will need to go off the current rents or if vacant the current market rents which typically still don't cover the 75% of the mortage I've found especially now with higher interest rates.

My recommendation would be to find a single family house to house hack with and rent out some of the rooms or you can get a duplex and rent out the other side doing STR or MTR (short term rentals or mid term rentals). There is also Padsplit which is a newer site that is similar to air bnb and let's you rent out by room rather than an entire house and is cheaper than air bnb I'm told. Hope that helps, feel free to message me if you want to chat about more creative options.

Post: First Time Managing a Rental - Wheres the best place to Market my Rental?

Post: First Time Managing a Rental - Wheres the best place to Market my Rental?

- Real Estate Agent

- San Diego, CA

- Posts 190

- Votes 77

@Erick Armando Gonzalez I've had good luck with Turbo tenant it puts it out to all the sites for you and it's free. https://www.turbotenant.com/

Post: San Diego Homes Prices & Inventory Supply - January 2022 to January 2023

Post: San Diego Homes Prices & Inventory Supply - January 2022 to January 2023

- Real Estate Agent

- San Diego, CA

- Posts 190

- Votes 77

With Q1 of 2023 behind us and the first month of Q2 beginning it will be interesting to see if more homes start to hit the market as we enter into Spring.

To recap our active for sale inventory from February to March we saw an increase in the number of single family detached homes available for sale.

March saw 1,431 single family detached homes for sale roughly a 22% increase from the 1,174 available in February. We also saw an increase in the number of condos/townhomes available for sale up 17% in March.

Buyer demand has remained steady and the introduction of the Cal HFA shared appreciation program has generated a lot of new buyer demand as well.

If you are interested in know more stats about a certain zip code or area send me an email and I'd be happy to send you some stats on it.

New Listings for Detached Single Family Residences

-Inventory is starting to increase this year but we are still down considerably compared to March of 2022 where the number of single family detached homes for sale was 2,568 compared to 1,431 from this past March about a 44% difference in supply.

New Listings for Condos/Townhomes

-Condo/Townhomes are also still down considerably compared to March 2022's supply of 1,268 active listings for sale compared to 803 from this past month about a 37% difference in supply.

Pending (Under Contract) for Detached Single Family Residences

We saw 1,351 single family detached homes go under contract in March. There were a total of 1,431 new houses listed for sale in March. To put that in prospective 94% of these went under contract in March.

Pending (Under Contract) for Condos/Townhomes

We saw 799 condos/townhomes go under contract in March. There were a total of 803 new condos/townhomes listed for sale in March. To put that into prospective 99.5% of these went under contract in March.

Closed Sales for Detached Single Family Residences

A total of 1,330 homes were sold in March. ***(Not all homes that go under contract in that month will close that same month)***

Closed Sales for Condos/Townhomes

A total of 759 condos/townhomes were sold in March. ***(Not all condos/townhomes that go under contract in that month will close that same month)***

Median Sales Price for Detached Single Family Residences

January Median Sales Price: $849K

February Median Sales Price: $900K

March Median Sales Price: $940,500

Median Sales Price for Condos/Townhomes

January Median Sales Price: $590K

February Median Sales Price: $616K

March Median Sales Price: $635K

Today's Mortgage Rates

Post: San Diego. Is this a good deal for a flip

Post: San Diego. Is this a good deal for a flip

- Real Estate Agent

- San Diego, CA

- Posts 190

- Votes 77

Here are some line items you can use to make your own sheet. This is an outline of what I used for my first one. Obviously there will be other items that come up but it's a good outline to start.

| Address |

| Purchase Price |

| Down Payment (20% if HM) |

| Loan Amount |

| Rehab Cost Est |

| Interest Rate |

| # Holding Months |

| Homeowner's Insurance Policy |

| Origination Fee |

| Document Fee |

| HOA Fee if applicable |

| Property Taxes |

| Title - Lender Title Insurance |

| Title - Owner's Title Insurance |

| Title - Binder Fee - Buy Side |

| Title - Binder Fee - Sell Side |

| Title Messenger Fees |

| Recording Grant Deed - Buy Side |

| Recording Trust Deed - Buy Side |

| Recording Fee - Sell Side |

| Statement Fee - Sell Side |

| Escrow Fee - Buy Side |

| Escrow Fee - Sell Side |

| Sub Escrow Fee - Buy Side |

| Sub Escrow Fee - Sell Side |

| Loan Doc Signing Service |

| Monthly Int Only Payment |

| NHD Report $99 |

| Utilities (Electric, water etc) |

| Owner's Title Insurance |

| Transfer Tax - Sell Side |

| HOA Docs Order if applicable |

| Home Warranty $500 |

| Agent Commissions (4-5% of sale price) |

| Wire Fee $25 per wire |

| Filed Articles of Incorp for LLC (if creating a new LLC) |

| ARV # |

| Minus Down Payment Back (20% if HM) |

| Minus Rehab Cost |

| Minus Holding Costs, HM Fees |

| Minus Realtor Commissions (4-5%) |

| Net Profit |